"This new normal is not just simply about slower growth but also the increasing sophistication and linkages between different economic and financial factors and asset classes," they write. "In turn, a wider group of asset classes now requires policy support to ensure the smooth functioning of the financial system. This explains why policy is becoming more experimental — entering uncharted territory requires new thinking."

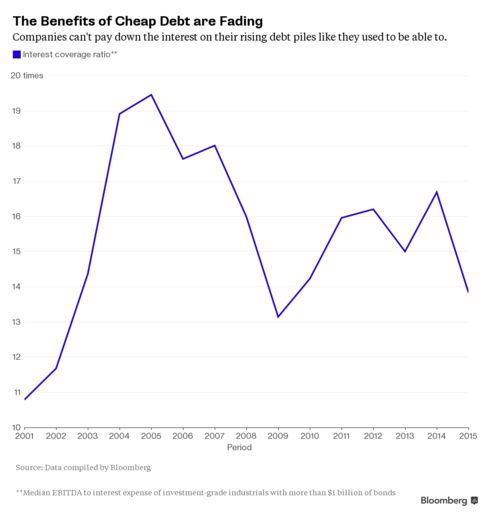

kind of like the policy support that cushioned the shanghai market? it's hard to figure which bond market crashes first- american energy corporates or chinese corporates. but i suppose the damage will be "contained."

edit: this post of mine, and one i just wrote in another thread about cdo's reappearing has suddenly sparked a new thought for me. for some time i've been wondering: "where is the bubble?" it seemed like the bubble was everywhere, but nowhere in particular. then i started thinking that the bond market, pushing into negative interest rates, was the central bubble. but i couldn't figure out how it would burst. now i see an analogy: cdo's of subprime mortgages were the first instruments to blow up in '07 - they were junk to the junk power, so of course the spark that went first, but was not contained. now we have chinese corporate debt and american energy-based corporate debt, and probably other classes of corporate debt beyond my knowledge, that are teetering. the spark won't be in the treasury market. the spark will be in the junkiest kind of corporate debt, or cdo's of corporate debt, or leveraged funds of corporate debt, i.e. junk to the junk power. i expect another "flight to quantity" as bill fleckenstein described the move to treasuries last time around. but i don't know when.

Leave a comment: