Re: California Bubbly: Riding the Wave

dlt the dbl...

Announcement

Collapse

No announcement yet.

Yes Virginia...It's a Bubble...

Collapse

X

-

Re: California Bubbly: Riding the Wave

zippy-do-dah bunking . . . .For a house with 900423 beds that isn't too bad

Leave a comment:

-

Re: California Bubbly: Riding the Wave

For a house with 900423 beds that isn't too bad, but with only one bath I'd shower at the gym.

I know. Shame on me...

Though I would not make the same mistake Keynes made about WWI. He said the combatants would run out of money . He wasn't considering a foreign source like the US. China is propping up the California real estate market as we speak.

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

Originally posted by touchring View PostThe dollar has gone up more than 10% against almost all currencies in the last year or so. But the fall in imports is surprisingly large. This doesn't bode well for commodities exporting economies.

For those who are well traveled in China will know that China has a large consumer economy (the largest consumer of iron ore, cement, cellphones, television, etc) - although relatively small as compared to exports - so the steep fall in commodity prices more than offsets the fall in exports.

Except for oil, what is the US importing less of ?

Leave a comment:

-

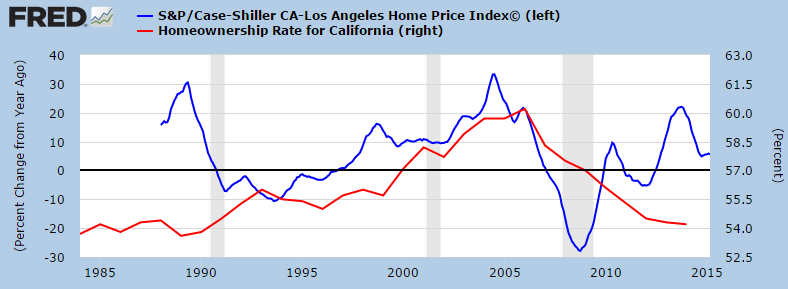

California Bubbly: Riding the Wave

One thing to understand about California housing is that boom and busts are central to the market. It is fascinating from a psychological standpoint that today, many think that California housing is a simple and safe bet. Casually, they forget the massive destruction that occurred only a few years ago and the echoes of the impact are still around: low inventory, massive Federal Reserve intervention, and a shift to investors buying homes. Looking to buy? Gear up for a sizable down payment and maximum leverage on a low interest rate. Also, it is easy to forget that 1,000,000+ Californians lost their homes via foreclosure and many today are still underwater even with the recent boom in home prices. Even with the trend to higher prices, people have the choice to buy or rent. Unlike stocks, most households have to make the analysis of buying or renting. In spite of rising prices and the meme that home values will only go up, the homeownership rate in California has plummeted. The state is seeing a wave of households opting to rent. This trend started in 2005, while home prices held a plateau up until 2007.

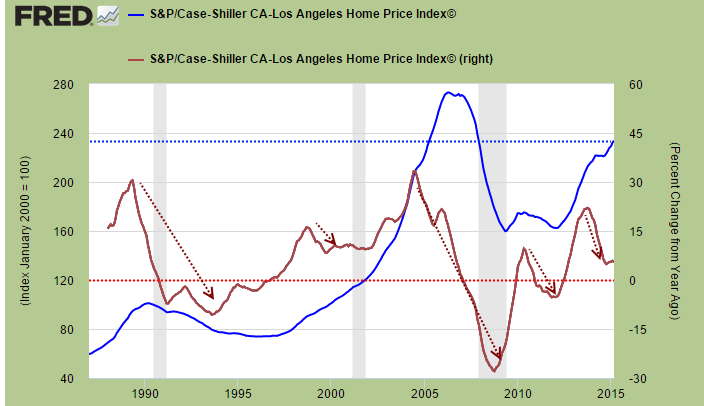

In housing, trends reverse slowly. Take a look at 30 years of housing data for the LA/OC markets.30 years of trends in the LA/OC marketThe boom and bust cycle is simply part of the California market. We’ve had a nice boom driven by investors and low inventory recently. But investors (those with big wallets) have pulled out dramatically early in 2014. Yet momentum is shifting but the question is, what will come about this change? People also forget that the stock market is on a six-year tear and California, especially the Bay Area has a deep connection between the two. Stocks are up and real estate follows. It is interesting to see that the stock market this year is also unsure of what it wants to do.It might be helpful to look at the Case-Shiller Index for the L.A. market. The index also pulls in OC data so it is a nice overview of a very big market. Here is data going back 30 years:

The blue line is the Case-Shiller Index with no adjustments. You can see the recent big bounce up. The red line shows momentum changes in the form of year-over-year changes. You can see that the trend is definitely heading lower. Of course, these changes happen over years. For those in the market looking at a $700,000 crap shack, you are really betting against the above chart. It is interesting that many in California will look at the stock market as some kind of risky proposition, even when placing a $50,000 bet. Yet some see no problem buying a $700,000 home requiring a $140,000 down payment to get down to a modest monthly mortgage payment. A small 10 percent correction (see chart above) would wipe out a nice chunk of change. Those going in with low down payments might be in a position where equity is at par (or below given selling costs).More to the point, price-to-income ratios are incredibly out of whack. It is interesting to see the justifications today for why prices are high. There is a reason why the LA/OC market is the most overpriced in terms of housing. Not New York. Not San Francisco. Not Chicago. It is the LA/OC region and you know why? Because relative to the other areas, incomes here are simply not that high. This is also a reason why we see more booms and busts here. Take New York City:

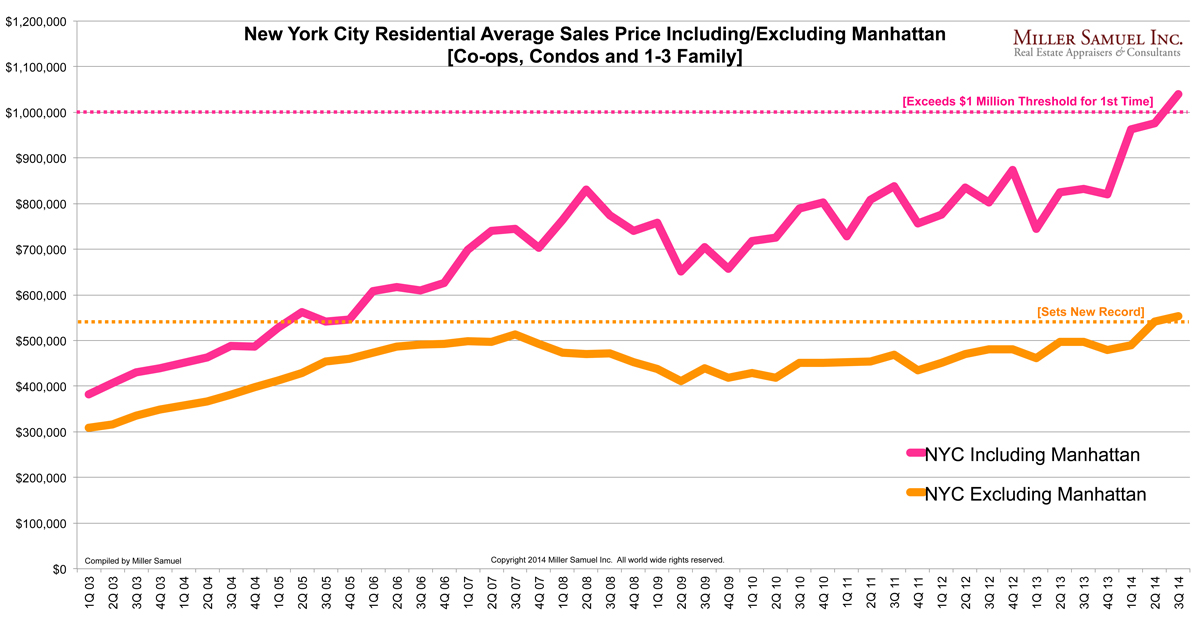

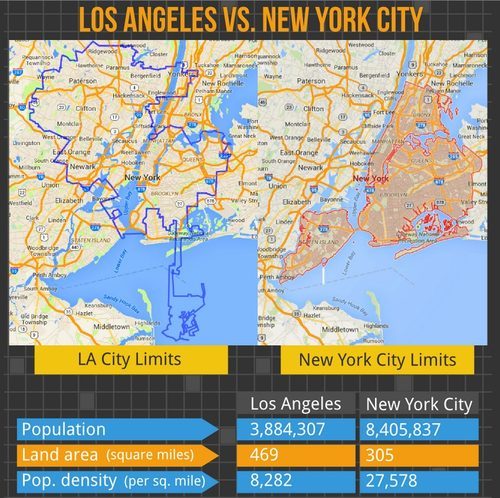

You notice how prices didn’t take a massive hit like the LA/OC area. You know why? Because unlike New York City, the LA/OC market is one giant urban sprawl that isn’t land locked. That is a massively important point to note. Also, incomes in NYC are simply better than in L.A. and Orange County. Forget about population density:

And that is merely for L.A. the city. L.A. County has 10,000,000 people and many are looking to buy in L.A. County cities, not L.A. With that said, the homeownership trend for California has been moving lower over the last decade:

Simply put, this means more renting households and fewer buyers. This young group of future buyers is unlikely to materialize, at least with current incomes. We’ve already highlighted that 2.3 million adult Californians are living at home with their parents. Wages are simply not keeping up with price gains or even rent increases. The last boom was driven by low Fed rates, hot investor money, and a lack of inventory (you notice how higher incomes or booming sales are not driving prices up).But if you want to buy, here is a nice and bright home in Highland Park:

6071 Roy St,Los Angeles, CA 900423 beds, 1 bath 1,231 square feetThis place sold for $90,000 in 1986 (the current tax assessment is $165,228). The current list price is $599,000 (in other words, $600,000). Just think, you’ll enjoy this bright colored home and you’ll have the privilege of paying property taxes 3.5 times higher than the current Prop 13 rate. This is a perfect hipster/Taco Tuesday home (make sure you get $120,000 for a nice down payment).

In 2011 the Zestimate on this place was $366,000. Now you “need” to pay $240,000 more but for what? So how do you justify a $240,000 (a 65% jump) price move in a mere 3 years. For the privilege of living in Highland Park. And they say real estate isn’t a speculative market. Look at the historical data here and you will find out that California is all about boom and bust. The LA/OC market is the epitome of this.

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

Originally posted by Southernguy View PostI don't quite understand if both times imports and exports are referred to in dollar terms.

If that is so prices may have a big part in it. Oil, natural gas and iron ore (to name the ones that come to my mind) have all of them fell in prices from last year. As for exports I don't know. Anyway, their economy seems to be growing much slower than before.

The dollar has gone up more than 10% against almost all currencies in the last year or so. But the fall in imports is surprisingly large. This doesn't bode well for commodities exporting economies.

For those who are well traveled in China will know that China has a large consumer economy (the largest consumer of iron ore, cement, cellphones, television, etc) - although relatively small as compared to exports - so the steep fall in commodity prices more than offsets the fall in exports.Last edited by touchring; June 10, 2015, 04:55 AM.

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

"Accordingly, the days of the Warren Buffet economy are indeed numbered."

Good....but what's the number: 100 1000 10000 or 1000000000?

That's the question nobody answers

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

Originally posted by don View PostThe Warren Buffet Economy——Why Its Days Are Numbered (Part 1) Finally, we have real median family income. Call it a round trip to nowhere over nearly three decades!....

in today’s dollars, Buffet started with $3.8 billion in 1987. Call his inflation-adjusted gain 19X then, and be done with it.

....

is THAT all there is?

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

The Warren Buffet Economy——Why Its Days Are Numbered (Part 1)

During the 27 years after Alan Greenspan became Fed chairman in August 1987, the balance sheet of the Fed exploded from $200 billion to $4.5 trillion. Call it 23X.

Let’s see what else happened over that 27 year span. Well, according to Forbes, Warren Buffet’s net worth was $2.1 billion back in 1987 and it is now $73 billion. Call that 35X.

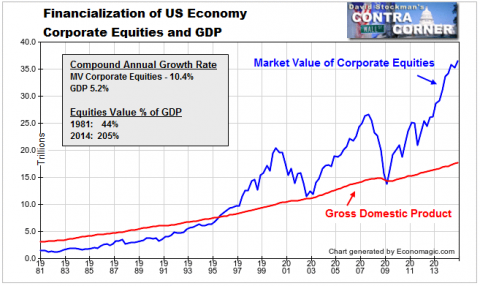

During those same years, the value of non-financial corporate equities rose from $2.6 trillion to $36.6 trillion. That’s on the hefty side, too—- about 14X.

When we move to the underlying economy that purportedly gave rise to these fabulous gains, the X-factor is not so generous. As shown above, nominal GDP rose from $5.0 trillion to $17.7 trillion during the same 27-year period. But that was only 3.5X

Next we have wage and salary compensation, which rose from $2.5 trillion to $7.5 trillion over the period. Make that 3.0X.

Then comes the median nominal income of US households. That measurement increased from $26K to $54K over the period. Call it 2.0X.

Digging deeper, we have the sum of aggregate labor hours supplied to the nonfarm economy. That metric of real work by real people rose from 185 billion to 235 billion during those same 27 years. Call it 1.27X.

Further down the Greenspan era rabbit hole, we have the average weekly wage of full-time workers in inflation adjusted dollars. That was $330 per week in 1987 and is currently $340 (1982=100). Call that 1.03X

Finally, we have real median family income. Call it a round trip to nowhere over nearly three decades!

OK, its not entirely fair to compare Warren Buffet’s 35.0X to the median household’s 0.0X. There is some “inflation” in the Oracle’s wealth tabulation, as reflected in the GDP deflator’s rise from 60 to 108 (2009 =100) during the period. So in today’s dollars, Buffet started with $3.8 billion in 1987. Call his inflation-adjusted gain 19X then, and be done with it.

And you can make the same adjustment to the market value of total non-financial equity. In 2014 dollars, today’s aggregate value of $36.7 trillion compares to $4.5 trillion back in 1987. Call it 8.0X.

Here’s the thing. Warren Buffet ain’t no 19X genius nor are investors as a whole 8X versions of the same. The real truth is that Alan Greenspan and his successors turned a whole generation of gamblers into the greatest lottery winners in recorded history.

That happened because the Fed grotesquely distorted and financialized the US economy in the name of Keynesian management of the purported “business cycle”. The most visible instrument of that misguided campaign, of course, was the Federal funds or money market rate, which has been pinned at the zero bound for the last 78 months.

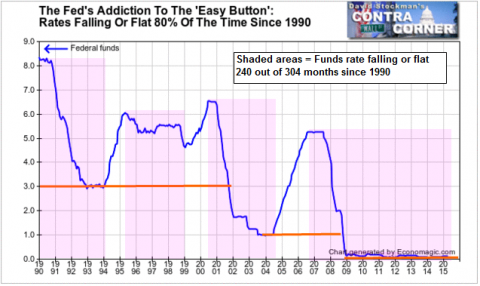

Not only did the Fed spend 27 years marching toward the zero bound, but in the process it has gotten addicted to it. During the last 300 months, it has either cut or kept flat the money market rate 80% of the time. And it has now been 108 months since it last raised interest rates by even 25 bps!

The simple truth is, the Fed has caused systematic, persistent and massive falsification of prices all along the yield curve and throughout all sectors of the financial market. The single most important price in all of capitalism is the money market rate of interest. It sets the cost of carry in all asset markets, and therefore indirectly fuels the bid for all debt, equity and derivative securities in the global financial system.

The Fed’s Addiction To The ‘Easy Button': Rates Falling Or Flat 80% Of The Time Since 1990 – Click to enlarge

Needless to say, when the cost of money is set at— and held at— zero in nominal terms, and driven deeply negative in after-inflation and after-tax terms, it becomes the mothers milk of speculation. Accordingly, it is neither a slightly lower trend rate of CPI inflation over the past 27 years nor an improvement in the art of central banking which has driven the core reference rate in the world financial markets—the 10-year US Treasury Note—–down by 80%.

Instead, the true agent of that decline is massive central bank intrusion into financial markets, wholesale manipulation of prices and fraudulent monetization of public debt and other securities. Just since 2006, the combined balance sheets of the world’s central banks have expanded from $6 trillion to $22 trillion, meaning that the scale of the implicit monetary fraud has been monumental.

Needless to say, the plunge of the world market’s core “cap rate” to what are false and unsustainably low levels caused two powerful distortions. In the DM economies like the US, it generated an enormous expansion of unproductive debt that funded fiscal expansion, household consumption and business financial engineering.

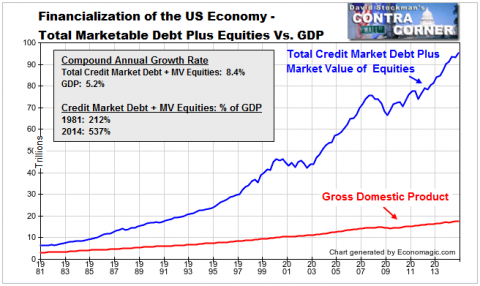

The result was a massive financialization of the economy that took the sum of business debt and market equity from about $12 trillion at the time of Greenspan’s arrival at the Eccles Building to $93 trillion today. Stated differently, the value of debt and equity securities mushroomed from about 2.4X GDP to 5.4X.

It was this massive financial bubble that begat paper wealth gains of 8X and 19X and even more.

Secondly, the worldwide central bank financial repression led by the Fed resulted in massive over-investment in fixed productive assets on a global basis, but especially in China and the EM. The impact was a one-time acceleration of global economic activity that temporarily inflated current income and further goosed the value of financial assets.

This central bank fueled boom will ultimately be paid for in the form of a prolonged deflationary contraction. Then, trillions of uneconomic assets will be written off, industrial sector profits will collapse and the great inflation of financial assets over the last 27 years will meet its day of reckoning.

On the morning after, of course, it will be asked why the central banks were permitted to engineer this fantastic financial and economic bubble. The short answer is that it was done so that monetary central planners could smooth and optimize the business cycle and save world capitalism from its purported tendency toward instability, underperformance and depressionary collapse.

As will be shown in Part 2, the whole case for this sweeping and unprecedented Keynesian demand management by the monetary authorities was a crock. Accordingly, the days of the Warren Buffet economy are indeed numbered.

David Stockman

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

iirc savings = investments.

the only way to have more consumption is to have relatively less investment. the only way to have relatively less investment is to have less saving. the only way to get the chinese saver to save less is to have more of a social safety net, which to my knowledge the chinese don't have much of. am i missing something here?

and is the chinese gov't doing anything towards securing pensions and health care, the 2 social goods which would allow chinese to relax their grip on their money. [gee, i sound like ben bernanke with this "savings glut" analysis!]

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

I don't quite understand if both times imports and exports are referred to in dollar terms.

If that is so prices may have a big part in it. Oil, natural gas and iron ore (to name the ones that come to my mind) have all of them fell in prices from last year. As for exports I don't know. Anyway, their economy seems to be growing much slower than before.

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

China trade shrinks again in latest sign of economic weaknessOriginally posted by GRG55 View PostLooks like they blinked. Again.

What a surprise

Even the much vaunted central planners in Beijing are having a wee difficulty restructuring the economy towards the ever elusive consumer.

...

The Associated Press

Published Monday, June 8, 2015 9:34AM EDT

HONG KONG -- Chinese imports and exports shrank again in May, the latest sign of sputtering growth in the world's second biggest economy that adds to pressure on Beijing to avoid a sharp slump.

Customs data released Monday showed that exports contracted 2.8 per cent from a year earlier to $1.17 trillion yuan ($189 billion).

Imports shrank 18.1 per cent to $803.3 billion yuan ($129 billion). For the first five months of the year, total imports and exports fell 7.8 per cent.

In dollar-denominated terms, exports shrank 2.5 per cent while imports tumbled 17.6 per cent, leaving a trade surplus of $59.49 billion, according to the customs data.

China's leaders are trying to steer the economy toward growth based on domestic spending and reduce its reliance on trade and investment.

The economy expanded 7 per cent in the first quarter, the slowest quarterly growth since the global financial crisis in 2008.

The poor trade data comes a week after an official index of activity in China's giant manufacturing industry remained subdued, with both export demand and employment shrinking.

Policymakers in Beijing have unleashed several rounds of stimulus, including cutting interest rates three times in six months and slashing reserve requirement ratios for banks to free up money for lending. Analysts say more measures will likely be needed if growth slows too abruptly.

Last edited by GRG55; June 08, 2015, 09:54 PM.

Leave a comment:

-

Never Saying the B Word

SAN FRANCISCO — It is a wild time in Silicon Valley. Two-year-old companies are valued in the billions, ramshackle homes are worth millions and hubris has reached the point where otherwise sane businesspeople muse about seceding from the United States.

But the tech industry’s venture capitalists — the financiers who bet on companies when they are little more than an idea — are going out of their way to avoid the one word that could describe what is happening around them.

Bubble.

“I guess it is a scary word because in some sense no one wants it to stop,” said Tomasz Tunguz, a partner at Redpoint Ventures. “And so if you utter it, do you pop it?”

A bubble, in the economic sense, is basically a period of excessive speculation in something, whether it is tulips, tech companies or houses. And it is a loaded, even fearful, term in the tech industry, because it reminds people of the 1990s dot-com bubble, when companies with little revenue and zero profits sold billions in stock to a naïve public.

In 2000, tech stocks crashed, venture capital dried up and many young companies were vaporized. Even today, with the technology industry on fire, venture capital investment remains below its 2000 peak.

“Anybody who lived through that will always wake up and see ghosts,” said Jerry Neumann, founder of Neu Venture Capital in New York.

Today, people see shades of 2000 in the enormous valuations assigned to private companies like Uber, the on-demand cab company, which is raising $1.5 billion at terms that deem the company worth $50 billion, and Slack, the corporate messaging service that is about a year old and valued at $2.8 billion in its latest funding round.

A few years ago private companies worth more than $1 billion were rare enough that venture capitalists called them “unicorns.” Today, there are 107, according to CB Insights, enough that venture capitalists had to create a second term — “decacorn” — for private companies like Uber and the data analysis company Palantir Technologies that are worth more than $10 billion.

Nobody doubts that many of tech’s unicorns are indeed real businesses and that some could be with us for decades. But because of low interest rates, tech companies are raising gobs of money from investors whose desperate need for returns has pushed them into riskier territory. Start-ups have begun attracting money from hedge and mutual funds that don’t usually invest in tech companies before they are public.

Valuations — and there is no real standard for determining how much a private company is worth — are inflating, leading some people to worry that investment decisions are being guided by something venture capitalists call FOMO — the fear of missing out.

In a recent analysis, Mr. Tunguz of Redpoint, who was in high school when the dot-com bubble burst, found that investors were paying twice as much for stakes in private technology companies as they were for those that were publicly traded.

He called it “a runaway train of late-stage fund-raising.” He also called it “a really weird time” and “a really hard environment to maintain financial discipline.”

The problem with the bubble question is nobody seems to agree on what exactly a bubble is. Robert Shiller, an economist whose work on stock prices earned him the 2013 Nobel Prize and who wrote the bubble book “Irrational Exuberance,”

defined speculative bubbles as “a psychological epidemic” in which people put reason aside and instead buy into a story.

“It’s a complicated social phenomenon that gets people into trouble, just like smoking too much and drinking too much,” Mr. Shiller said.

And no matter how hard people try to avoid them, bubbles happen again and again, from the Dutch tulip bubble of 1636, to the 1929 stock bubble that resulted in the Great Depression, to the housing bubble that buckled Wall Street in 2008.

Even the smartest get caught up. Isaac Newton, whose laws of motion and gravity arguably make him the most important scientist ever, bought into the South Sea Bubble of 1720. It was a bad bet on a company granted a monopoly on trade with South America by the British government. He reportedly said: “I can calculate the motions of the heavenly bodies, but not the madness of people.”

Bubbles seem obvious after the crash, of course. The problem is they are almost impossible to see in the present. Mr. Neumann admits he was caught in the dot-com bubble.

“I was a true believer in the Internet and all that,” he said.

So, do the staggering values of today’s private tech companies look like yet another bubble?

“If the question is, Are these valuations divorced from fundamentals? I think they are,” he said.

But that is not a bubble, he said. Rather, it is “an irrational pricing decision.”

Investors are happy to admit that this torrid pace of investment has started to worry them. But they still try to steer clear of the b-word, unless they are describing what Silicon Valley is not.

“There’s definitely some craziness and people overpaying” for stakes in companies, said Anand Sanwal, founder of CB Insights, an analytics firm focused on the venture capital industry. “But a bunch of bad decisions don’t necessarily mean we are in a bubble.”

Does George Zachary, a partner in the Menlo Park office of CRV, a venture capital firm, think we’re in a bubble? “I think we’re in a period of overvaluation and frothiness,” he said.

Sam Altman, president of Y Combinator, an incubator that invests in very young companies, has grown so tired of bubble talk that this month he countered it with a $100,000 “no bubble” bet.

The bet, which will be donated to charity, is based on several variables, including his prediction that the five most valuable unicorns, a list that includes Uber and Airbnb, the home rental service, will be worth more than $200 billion by 2020.

Of course, there is a difference between not thinking there is a bubble and not being concerned about how easy it has become for start-ups to raise money.

“Do I think companies are overvalued as a whole? No,” Mr. Altman said. “Do I think too much money can kill good companies? Yes. And that is an important difference.”

Some investors go so far to avoid the word bubble that they describe situations that sound quite a bit worse.

Take Charlie O’Donnell, founder of Brooklyn Bridge Ventures. His view is that when it becomes harder to raise money, companies that are funding losses with outside money will be forced to find profitability by cutting jobs and slowing expansion plans, Mr. O’Donnell said.

But that is not a bubble, he said. Rather, as he outlined in a recent blog post, that would be “the coming zombie start-up apocalypse.”

NYTimes

Leave a comment:

-

Re: Yes Virginia...It's a Bubble...

well, we know where it's all going, don't we?Originally posted by GRG55 View PostFrom the FT today:

Last updated: May 19, 2015 1:16 pm

Gabriel Wildau in Shanghai

Capital is flowing out of China at a record pace, sparking fears over financial stability and complicating efforts by the central bank to support a slowing economy with lower interest rates.

China ran a balance of payments deficit of $80bn in the first three months of the year, the largest quarterly net outflow on record, according to official data.

The outflows are all the more striking because China’s trade surplus remained strong over the period. As falling commodity prices slashed the country’s import bill, it recorded a $79bn current-account surplus — the largest in nearly five years.

But this was overwhelmed by outflows on the capital and financial accounts worth a record $159bn. The lure of China's surging stock market also failed to counter the outflow trend...

..."All things considered, [Beijing] would rather not have confidence-sensitive capital going out," said Tim Condon, head of Asia research for ING Financial Markets in Singapore.

By some measures, outflows have been continuing for more than a year. The central bank’s holdings of foreign assets have dropped for seven consecutive quarters — the longest run of declines on record.

But economists say that as yet, capital outflows have not accelerated to a level that would threaten the stability of the financial system...

...They also reflect recent reforms to loosen capital controls and cautiously encourage financial outflows through initiatives such as the Shanghai-Hong Kong Stock Connect, which allows mainland Chinese to invest in foreign equities...

...Nevertheless, capital outflows are complicating efforts by the People’s Bank of China to support the economy through monetary easing. For the past decade, central bank purchases of foreign exchange inflows were the main source of base money creation in China's banking system. Now, with outflows threatening to shrink the money supply, the central bank is turning to new mechanisms to expand it...

...“From the start of this year, capital inflows have been negative. We believe the key factor now restricting effective monetary easing is that the required reserve ratio remains at a high level,” said Liu Liu, macroeconomic analyst at China International Capital Corp.

In addition to RRR cuts, the central bank has slashed benchmark rates three times since November. But lower rates could exacerbate capital flight by making Chinese assets less attractive, especially in comparison to the US, where the Federal Reserve is expected to raise interest rates this year.

Forex traders say the PBoC has drawn down its foreign exchange reserves to head off depreciation of the renminbi. That explains why the exchange rate has been flat this year despite the record-setting outflows.

“As long as the renminbi remains broadly steady, domestic capital outflows are likely to be modest,” Standard Chartered analysts led by Beckly Liu wrote last week.

The PBoC’s signal to the market that it intends to hold the renminbi stable has helped prevent the trickle of outflows from becoming a flood.

.

.

.

.

.

.

.

.

.

.

.

.

vancouver real estate

Leave a comment:

Leave a comment: