Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

by the way for us short term speculators, if you have any slv, pslv etc, you may want to consider a move to CEF.

people are scared out of it because it has silver??? It is down nearly as much as SLV, and PSLV. yet it is only 54% silver.

So you would be selling silver to buy gold at a discount. If you have paper gold, you could sell that to keep your gold/silver

ratio the same.

Announcement

Collapse

No announcement yet.

Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Collapse

X

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

ZIRP exactly. if you're in mm, t's etc, you can watch your money get nicked on a daily basis due to rising costs.

If mm were paying 4-5%, I probably would have liquidated the entire postion, and I would also have pared down my oil holdings. I just threw 27 out their because its roughly the 200MDA. Looking at a multi-year chart, and long average 20 looks about right. However, things generally do not go straight up and straight down forever. Hoping for a reversal here so I get called out.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

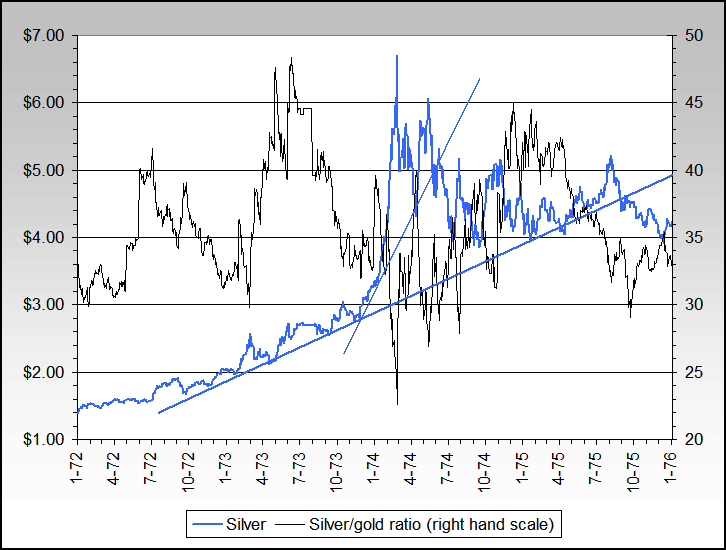

Random chart thoughts... ;-)

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

SLV appears that it will hit EJ's $20 forecast ... in two weeks!Originally posted by charliebrown View PostSLV dosen't go all the way

to 27 or so.

This thing has no bottom now and same for oil.

At some point it will be a buy and I will buy back. We are all short-term speculators afterall due to ZIRP right?

Leave a comment:

-

1921 silver before and after

When EJ was doing his research in early April before making his final decision on April 29, one of the sources he referenced was eBay. Here is a screen shot of a 1921 Morgan dollar for sale on eBay on April 20.

Here is a screen shot of a similar coin for sale on eBay, in better condition, today.

Meanwhile, the dealer buy price has fallen from 37 times faces to 20 times face.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

First I want to thank EJ on announcing his thoughts.

I had been selling paper silver, once it broke $45.00. However I was just trimming my over-extended position each week.

On Monday, I sold all of my sterling silver to Apmex for roughly 38.00 (They pay 80% of spot for sterling)

I also sold a big chunk of my over-allocation of silver I sold pslv at 21.xx.

Today I sold 1/3 of my hedged position (SLV with May 35 call written on it). I'm not selling anymore.

If it goes to 20, I'm riding it the rest of the way down. 20 is about my average cost. My allocation is now under

5%. Now if we have a bounce here, I'm would be willing to sell more into it. If we stay over $35.00 before

May expiration, I will be called out, and I will have an opportunity to reduce my postion again.

Buying my May 35s today, cost me $2.00 in premium. But I won't be really surprised if SLV dosen't go all the way

to 27 or so.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

EJ has made a great call short-term at least, time will tell about the long term.

Now the bottom might be in, just exactly about now, in this correction, if silver holds above 35.25 (futures), and what if it makes new highs after this?

I found this interesting:

Ben Davies - Silver Criticality, Why Silver Might Crash?

http://kingworldnews.com/kingworldne...ght_Crash.html

Perspective in markets is everything. The rate of acceleration is not consistent with the precursory signatures for a crash to end this market. It is, though, a mini-version of this. The big parabola is yet to come.Last edited by cobben; May 05, 2011, 01:24 PM.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

You're still glossing over the fact that EJ did not call the year long rally after the low on March 2009 - something which I believe EJ has said was a missed opportunity.Originally posted by metalmanwrong. here's the history for you newcomers.

Again, this doesn't detract from the body of excellence which already exists, but equally detracts from the image of infallibility you are portraying.

Equally EJ has clearly stated that he did not believe the US government would blow another bubble after the collapse of the Y2K Internet stock bubble, which wound up being wrong as evidenced by the real estate bubble of 2003-2006.

In both cases, my respect for EJ and grown because of the willingness to admit fallibility and to examine the reasons for the missed opportunity.

Boosterism in contrast is of far less benefit.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

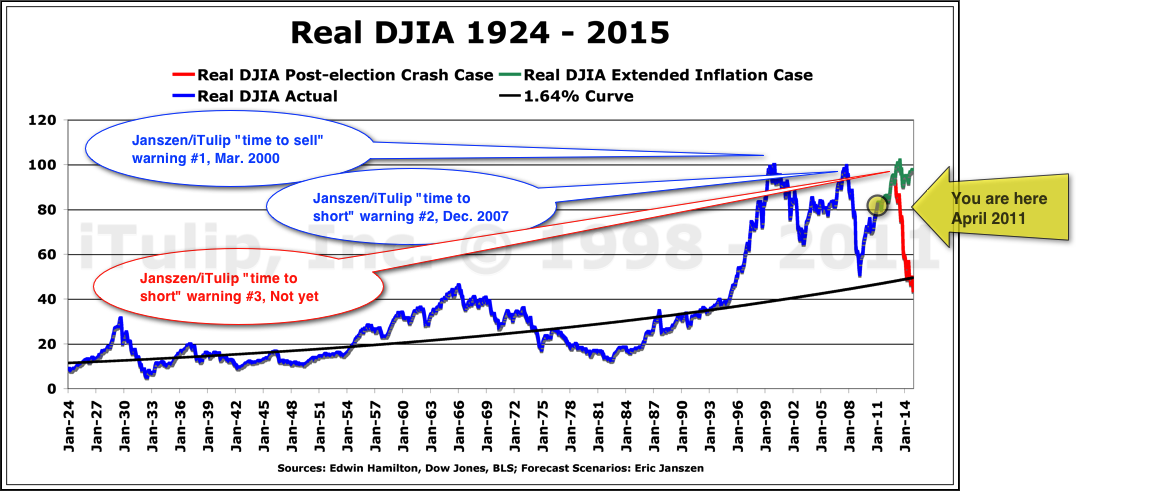

wrong. here's the history for you newcomers.Originally posted by c1ue View PostBut let's be honest: while I appreciate and respect EJ's capabilities and record, his call to sell in 2007 was right as much as his failure to buy in March of 2008 was wrong.

ej only tells us trades he makes for himself.

ej's been out of stocks since the real (adjusted for inflation) top in mar 2000.

he put profits from stock sales into long tbonds & gold... the portfolio outperformed everything since.

he didn't get back into stocks in 2008 cause he didn't get out in 2007. he shorted stocks end of 2007... the title 'time at last to short the market'

he sold silver fri after holding 10 yrs... the title 'time to sell'

get it?

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Whatever.Originally posted by metalmanbs... a single & definite 'time to sell now' & 'the price will crash' from ej after 10 yrs of silence = jesse's unactionable & repeated warnings that the price got too high too fast & we'll see a correction some day but don't sell, it'll be a temporary setback? sheesh.

this is like ej's dec. 2007 'time to short stocks... market's gonna fall 40% in 2008' but compressed into 2 weeks. the call let you dodge a 25% loss... if you were listening. if he gets it right in the other direction, the bottom ~20, that's a 2 fer.

Besides my own sell, I know of 3 other people - who don't even own physical Ag - who either put money into an investment account to short Ag via ZSL or directly shorted Ag because of the bubbly nature of the rise.

As someone who is not a iTulip Select member and had no idea on the sell call, my own action in selling Ag - albeit slightly early as is my historical pattern - itself is an indication that there were clear reasons for thinking Ag was due for a fall.

This doesn't detract from EJ's call, but to say it was unique is wrong.

As for Jesse - he has been a consistent 'pro' PM person for the entire year plus I've been watching. For him to say that silver is looking bubbly is a significant change in basic position, and thus is actionable. It would be like Alex Jones saying the OBL story line by the US government is believable: a significant departure from norm.

You also fail to understand that my commentary on EJ's projection of Ag's fall is in fact a compliment.

EJ isn't perfect - there have been failed calls as well as imprecision in the details of even correct calls.

This is in no way a criticism; there are so many factors behind any attempt to give precise timing and price level details that any success at all is far above noise level.

But let's be honest: while I appreciate and respect EJ's capabilities and record, his call to sell in 2007 was right as much as his failure to buy in March of 2008 was wrong.

He isn't perfect - no one is - and attacking anyone who merely doesn't think EJ is perfect is hardly conducive to rationale discourse.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Originally posted by metalman View Postbs... a single & definite 'time to sell now' & 'the price will crash' from ej after 10 yrs of silence = jesse's unactionable & repeated warnings that the price got too high too fast & we'll see a correction some day but don't sell, it'll be a temporary setback? sheesh.

this is like ej's dec. 2007 'time to short stocks... market's gonna fall 40% in 2008' but compressed into 2 weeks. the call let you dodge a 25% loss... if you were listening. if he gets it right in the other direction, the bottom ~20, that's a 2 fer.

EJ and Jesse comparisons are apples and oranges. EJ is not a short term trader.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

bs... a single & definite 'time to sell now' & 'the price will crash' from ej after 10 yrs of silence = jesse's unactionable & repeated warnings that the price got too high too fast & we'll see a correction some day but don't sell, it'll be a temporary setback? sheesh.Originally posted by c1ue View PostThe sell call was great, but then again, EJ was not the only one to point out the bubbly nature of silver as of Friday, April 29, 2011.

Jesse noted this, and I myself dumped a 971 oz Ag bar on 4/22.

In fact, what I was noting was that a fall under $20 is far more actionable than a call that Ag was about to fall - especially given the 4th margin increase by CFTC as well as the unquestionably parabolic nature of the rise.

this is like ej's dec. 2007 'time to short stocks... market's gonna fall 40% in 2008' but compressed into 2 weeks. the call let you dodge a 25% loss... if you were listening. if he gets it right in the other direction, the bottom ~20, that's a 2 fer.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Most of the public jumped on the CNBC bandwagon or listened to some newsletter telling them to buy silver. These are the people that are being shaken out of the market- it is a herd mentality.Originally posted by Kadriana View PostThe shop owner thinks this is a temporary blip and it will start going back up soon. I guess we'll have to wait and see.

In all seriousness, the more bad news about silver, like "silver plunges" in headlines the lower the public opinion. This will be one of three indicators to get back into silver if you are underweight. On this site you have diligent investors who don't react rather follow long term trends as EJ. The Gold/silver ratio definitely favors gold as a good next move. Consider GTU over GLD if you can.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

EJ wrote that if he were to invest in silver again, it would not be 1921 silver dollars, though he enjoyed owning them. Is that just because paper silver investments have become available and are preferable, or does he have another physical form in mind?

FRED wrote: "Some day you all will undrestand the mechanism of iTulip's remarkable record" Ooooo- such a tease! :-)

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

My husband stopped at the coin shop yesterday to check things out and talk to the owner. A lot of people were in the store selling the silver and the shop owner was buying all he could $1 below spot for junk. Not sure about SE's or bullion. The shop owner thinks this is a temporary blip and it will start going back up soon. I guess we'll have to wait and see. I'm relatively young, at least for this board I believe, so I probably won't be selling our small amount of physical any time soon. I don't have that large of a % of my worth in silver so it just seems like too much work to sell and then try and buy later on. I am glad for the couple of puts we have which makes this dip a little less upsetting.

Leave a comment:

Leave a comment: