Originally posted by Kadriana

View Post

Announcement

Collapse

No announcement yet.

Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Collapse

X

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

You can buy a proxy instead and then sell it once you can get hold of physical at the price you want.

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

I will probably buy some at $25 and alot at $20. Look forward to further discussion with you fine folks.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

The only problem is last time silver made it's lows in 2008, it was hard to get a hold of physical. There are a lot of people that are waiting to back up the truck. If people see the slightest hint of a shortage, I think they're all going to run for it. Apmex's SE's supply is already looking a bit sad.Originally posted by jiimbergin View PostWell, Bart says he sees it eventually at a minimum of 130, and even EJ says 100-180. If it gets to 20 as EJ says then buying at 20 will allow you to sell at 5X while gold going from 1500 to 5000 only sees a 3.33X, so for the more brave of us we should back up the truck at 20, or even 25

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Well, Bart says he sees it eventually at a minimum of 130, and even EJ says 100-180. If it gets to 20 as EJ says then buying at 20 will allow you to sell at 5X while gold going from 1500 to 5000 only sees a 3.33X, so for the more brave of us we should back up the truck at 20, or even 25Originally posted by flintlock View PostWhat happens to silver after the "asshanding"?

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

What happens to silver after the "asshanding"?

Leave a comment:

-

Re: 1921 silver before and after

I was going to say the same thing. 3 minutes to go in Ebay terms is an eternity!Originally posted by FrankL View Postif you want to use Ebay as support for one's arguments, be sure to at least use the settling price. Most price action happens in the last 30 seconds of trading on Ebay...

Leave a comment:

-

Re: 1921 silver before and after

if you want to use Ebay as support for one's arguments, be sure to at least use the settling price. Most price action happens in the last 30 seconds of trading on Ebay...Originally posted by FRED View PostWhen EJ was doing his research in early April before making his final decision on April 29, one of the sources he referenced was eBay. Here is a screen shot of a 1921 Morgan dollar for sale on eBay on April 20.

Here is a screen shot of a similar coin for sale on eBay, in better condition, today.

Meanwhile, the dealer buy price has fallen from 37 times faces to 20 times face.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

That may be, but you'll note that I was not one of them.Originally posted by metalmanej made an uncharacteristically harsh comment on apr 21 in ask ej in reaction to members who were arguing with him... 'Buy silver at $50 and enjoy your pump-and-dump asshanding by JP Morgan'

I haven't been on this silver bandwagon, nor have I been dissing the silver run.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

There is a video mentioning EJ on Max Keiser's website.

http://maxkeiser.com/2011/05/05/silv...when/#comments

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

QFT.Originally posted by c1ue View PostYou're still glossing over the fact that EJ did not call the year long rally after the low on March 2009 - something which I believe EJ has said was a missed opportunity.

Again, this doesn't detract from the body of excellence which already exists, but equally detracts from the image of infallibility you are portraying.

Equally EJ has clearly stated that he did not believe the US government would blow another bubble after the collapse of the Y2K Internet stock bubble, which wound up being wrong as evidenced by the real estate bubble of 2003-2006.

In both cases, my respect for EJ and grown because of the willingness to admit fallibility and to examine the reasons for the missed opportunity.

Boosterism in contrast is of far less benefit.

EJ does a really good job and is one of the very few people who actually seem to have a pretty good idea of what is going on and is willing to tell people what he is doing and why. He isn't perfect though and it is unreasonable to expect him to be.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

ej made an uncharacteristically harsh comment on apr 21 in ask ej in reaction to members who were arguing with him... 'Buy silver at $50 and enjoy your pump-and-dump asshanding by JP Morgan'Originally posted by c1ue View PostYou're still glossing over the fact that EJ did not call the year long rally after the low on March 2009 - something which I believe EJ has said was a missed opportunity.

Again, this doesn't detract from the body of excellence which already exists, but equally detracts from the image of infallibility you are portraying.

Equally EJ has clearly stated that he did not believe the US government would blow another bubble after the collapse of the Y2K Internet stock bubble, which wound up being wrong as evidenced by the real estate bubble of 2003-2006.

In both cases, my respect for EJ and grown because of the willingness to admit fallibility and to examine the reasons for the missed opportunity.

Boosterism in contrast is of far less benefit.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

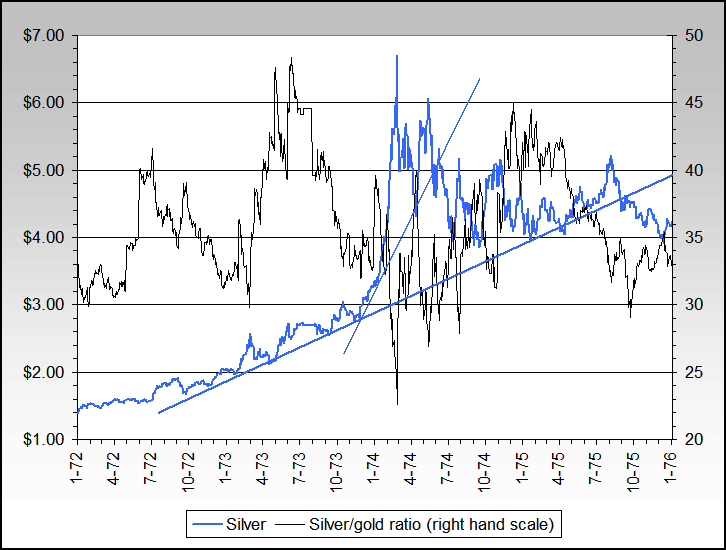

Originally posted by c1ue View PostA reprise of the '70s seems to imply a short term bottom of 33, and a longer term bottom (1 year) of 29.

It also seems to imply that 49.5 is the peak for the next 3 years or more...

Thoughts like that have crossed my mind, but "internet and new millennium years" are shorter... and I continue to dither about my large economy sized PM shorts.

Thought for the day:

http://www.nowandfutures.com/grins/eat_short.mp3 ;-)

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

A reprise of the '70s seems to imply a short term bottom of 33, and a longer term bottom (1 year) of 29.Originally posted by bartRandom chart thoughts... ;-)

It also seems to imply that 49.5 is the peak for the next 3 years or more...

Leave a comment:

Leave a comment: