Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Personally I would wait. I don't see silver (an industrial metal) doing well if the stock market (which helps finance the industry) goes under, which seems to be on the horizon for 2014

Announcement

Collapse

No announcement yet.

Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Collapse

X

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

2011... EJ gives the sell call on the very day silver peaked at $49. 2 years later, silver is about $19 (Feb 3, 2014.) Is it "Time at last to buy silver again?" While the bears are calling for $14-$15 silver, a lot of traders are getting interested in silver again... in EJ's latest article he expects gold to close around $1,400-$1,500 for 2014... with a gold to silver ratio of almost 65 (it was about 27 when EJ sold) what are EJ's thoughts? Thank you!

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

I bought my precious metals in 2008 - 25% silver75% gold

I am up a little over 100% on my gold and 240% on my silver to date and I am happy with the trade and glad I did not sell on the call.

Probably one of EJ's less popular calls, I and many others here made the argument that the short fundemental supply was a different animal and should not be viewed solely through the bubble prisim and should be seen as more like peak cheap oil -Time will decide who was right.

In any event I have 2X'ed my wealth since joining in 2008 from Itulip so I have no complaints, sometimes you have to go on your gut understanding of things and not rely on others.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Thank you very much, EJ. Excellent link, now bookmarked.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Silver may reach $100 if gold reaches $5,000.Originally posted by shiny! View PostEJ, while the price of gold:silver is approximately 1:50, I've read that the actual physical G:S ratio is more like 1:16. Do you agree with the claims that miners have essentially reached "peak silver", or is that a myth to support the pump-and-dump scheme?

What are the long-term prospects for silver as an industrial commodity, i.e. how do you perceive supply and demand over the next 10-20 years?

And do you still expect silver to hit $100-$180 in a blow-off top?

Until the day silver is burned as fuel and lost into the atmosphere forever as fossil fuels are there will be no peak silver or peak any kind of metal. Silver is recycled at 50%, lead at 80%, and steel at 88%. As prices rise with PCO, so shall recycling.

As for the industrial, jewelry, investor and other sources of demand for silver, I recommend you reference only reputable sources.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

There was an article about this today:Originally posted by Polish_Silver View PostI have often wondered about this. Gold is best for central banks, who want to stabilize currencies, post collateral for international loans, etc.

Are you thinking the "inflation blow off" will result in a barter system, or that people will want to store wealth in silver coins instead of paper bills? Silver might well be the "metal of choice" in that situation, since even a 1/10oz gold coin will be too valuable for most transactions.

But what kind of scenario will cause silver to "hugely outperform gold"? It seems like Hyperinflation, radical currency devaluation, or sustained high inflation, or the fear them.

In favor of that idea, I have seen any number of articles from "prominent economists" calling for inflation or negative real rates, to encourage individuals and institutions to spend the money they have. As though saving for the future is unpatriotic.

This so called "paradox of thrift" should be thoroughly debunked by some one.

Slowly falling prices are beneficial, unless the economy has high debt levels.

http://fofoa.blogspot.fr/2012/11/reg...1998-2001.html

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

EJ, while the price of gold:silver is approximately 1:50, I've read that the actual physical G:S ratio is more like 1:16. Do you agree with the claims that miners have essentially reached "peak silver", or is that a myth to support the pump-and-dump scheme?Originally posted by EJ View PostI recall JK and others also made a decision at the time to trade silver, a commodity that was the subject of a pump-and-dump operation by the usual suspects, for the only commodity that is also an international reserve currency, gold. A perfectly reasonable move.

What are the long-term prospects for silver as an industrial commodity, i.e. how do you perceive supply and demand over the next 10-20 years?

And do you still expect silver to hit $100-$180 in a blow-off top?

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

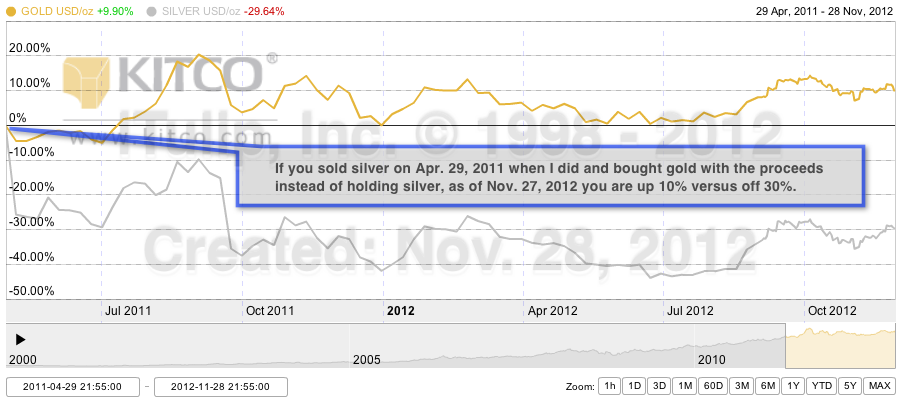

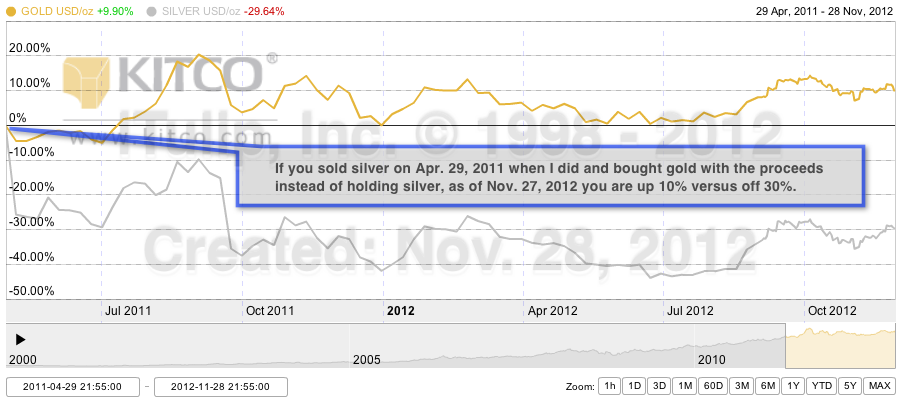

I recall JK and others also made a decision at the time to trade silver, a commodity that was the subject of a pump-and-dump operation by the usual suspects, for the only commodity that is also an international reserve currency, gold. A perfectly reasonable move.Originally posted by rogermexico View PostIt's true that one could have done better than the 10% gold has gone up, but I look at the swap from silver to gold in 24 hours as one trade, and the move out of silver and back in as requiring two trades and two calls- calling a top in silver and then calling a subsequent bottom in silver... So in addition to gold being the sounder long term holding (fourth currency) I am really pretty happy with the incremental 10% gained vs leaving silver proceeds in cash..

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

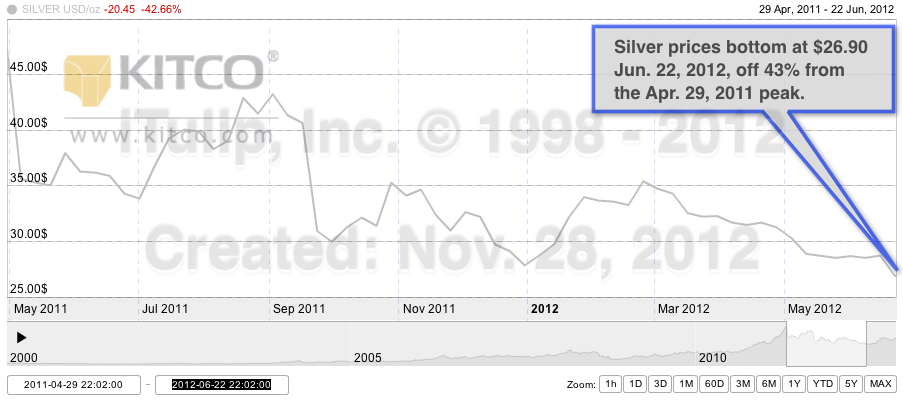

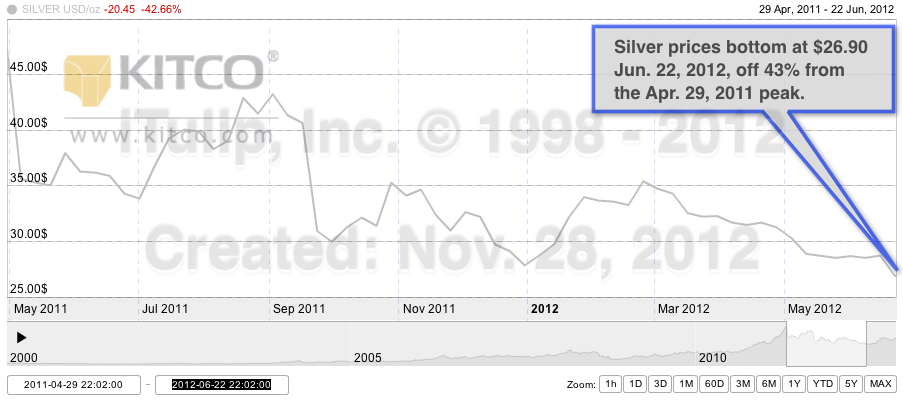

It's true that one could have done better than the 10% gold has gone up, but I look at the swap from silver to gold in 24 hours as one trade, and the move out of silver and back in as requiring two trades and two calls- calling a top in silver and then calling a subsequent bottom in silver... So in addition to gold being the sounder long term holding (fourth currency) I am really pretty happy with the incremental 10% gained vs leaving silver proceeds in cash..Originally posted by EJ View PostThat decision worked out like this:

If you hung on you saw silver prices fall 43%

If you re-purchased silver exactly at the bottom you have experienced a 27% gain.

Not bad, but what's the total upside versus downside risk at $34.20 in 2012 versus 4.25 in 2001?

We can say the same for gold. We hold gold not for capital gain but for insurance against IMS crisis, that is, for the same reason that Russia, China, Argentina and dozens of other countries have been buying it.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

That decision worked out like this:Originally posted by rogermexico View PostI also rolled all my silver, bought at 14.00 and sold at 47.50, into gold at around $1500. That's worked out reasonably well.

If you hung on you saw silver prices fall 43%

If you re-purchased silver exactly at the bottom you have experienced a 27% gain.

Not bad, but what's the total upside versus downside risk at $34.20 in 2012 versus 4.25 in 2001?

We can say the same for gold. We hold gold not for capital gain but for insurance against IMS crisis, that is, for the same reason that Russia, China, Argentina and dozens of other countries have been buying it.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

I was reading the % number off the Kitco chart that Kitco calculated. I could have used 1000% but then the question arises, Why is my number 1000% and Kitco's 628%? For the sake of the argument I'm making, it was a large return and won't be as large again.Originally posted by DRumsfeld2000 View PostEJ "Answer: The silver play was for a 628% gain from $4.25 to $48.50 between 2001 to 2011. It won't be repeated.''

Am I being stupid here as I write early in the morning, but is this not a gain of over 1,000%?

Leave a comment:

-

Re: Undervalued assets: Nearing Extinction?

That's fine for Buffet and Lynch who can hire an army of analysts to pour over the financials and industry details of hundred's of companies to narrow your search to a dozen or so. Then you visit the company and meet management, get the tour, and learn more about the company first hand. You get this access because you have millions of dollars to invest. When the news of your investment is made public and is widely followed because you are a public figure who writes op eds in the Wall Street Journal and otherwise participates in the "debate" on the markets and the economy, including a heavy dose of gold bashing, guess what happens to the price of the stock you invested in? That's right. It goes up.Originally posted by Polish_Silver View PostBuffet and Peter Lynch used to talk about finding undervalued stocks, and recommend it

for everyone. But with more people using the internet, and more money in 401k's, perhaps there are fewer undervalued stocks. Information flows more freely. Buffet is not making most of his money on a "buy and hold" strategy in recent years, but on arbitrage deals.

Your average retail stock investor can't do any of this. The performance of a portfolio of individual stocks purchased over time by a retail investor using all of the online tools that every other retail investor has is rarely better than the performance of a stock index and usually worse.

I met Grantham in November 2008 at the time he asserted that the market bottomed. The market proceeded to to drop another 13% into March. He called another bottom then. That's the bottom he refers to when he claims to have correctly noted the financial crisis market bottom.Grantham is also on the prowl for undervalued assets. He is a macro thinker, so his findings are of interest to bugs and I-tulipers. Doesn't he claim it is difficult to find good investments?

I've met Shiller and Karl Case, too. I prefer the FHFA's old All-Transactions House Price Index over the newer Case-Shiller index. The media uses the Case-Shiller indexes when talking up the housing market, not the more established All-Transactions index. A comparison between the two indexes suggests the reason why: the FHSA index does't make for much debate about the state of the housing market.Shiller's opinion is that we are not much better off than people 3000 years ago trying to increase the size of their goat herd, or have more children to take care of them.

Not so. We have discussed two. Both are energy related. One is a widely hated and derided dirty energy source that is under-produced and the other is the subject of a media frenzy and is being over-produced. There are also under-priced private equity plays, although these are few and far between and not available to all members. We're always looking.I doubt there is any scalable asset undervalued to the extent gold was in 2000.

Agree on the hard to find part. It takes discipline. Let me give you an example.There may be a myriad of smaller ones you could invest in, but I think there are not enough around for all the investors who want even 6% real returns.

I worked as Entrepreneur-in-Residence for Venetia Kontogouris, Managing Director Trident Capital, for six months. She'd come up to Boston from Westport, Conn. for meetings I'd set up with start-ups. She'd get up at 5AM to be in a meeting in Boston by 7AM. We'd have one meeting after another until 8PM then knock off for a working dinner to review notes. We'd do this for days on end. This was a normal day for her. Her motto, spend 99% of your time hunting, then 1% pouncing. Her personal IRR was 66% last I checked, three times the industry average.

The boys at Eastham Capital take the same approach to deals. They turn down something like 95% of the deals they look at. I assume members who invested in Eastham Capital Fund II are pleased with the results.

So we keep doing what we do: hunt for the underpriced thing and, on rare occasion when we find it, pounce.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

I also rolled all my silver, bought at 14.00 and sold at 47.50, into gold at around $1500. That's worked out reasonably well.Originally posted by shiny! View PostIn addition to watching the gold:silver ratio as an indicator of inflation, you can also use this ratio to increase your holdings of either metal without spending any money. Example:

When silver was under-priced and the G:S ratio was high, I bought silver, from the 90's when it was $4.50, then again starting in 2007-2009 or so, when the ratio eventually climbed to 1:80. One ounce of gold was equal to 80 ounces of silver.

At the time EJ made his "sell silver" call, the G:S ratio was 1:33, IIRC. I traded most of my silver for gold.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

In addition to watching the gold:silver ratio as an indicator of inflation, you can also use this ratio to increase your holdings of either metal without spending any money. Example:

When silver was under-priced and the G:S ratio was high, I bought silver, from the 90's when it was $4.50, then again starting in 2007-2009 or so, when the ratio eventually climbed to 1:80. One ounce of gold was equal to 80 ounces of silver.

At the time EJ made his "sell silver" call, the G:S ratio was 1:33, IIRC. I traded most of my silver for gold. Ended up with twice as much gold for my original dollar outlay as I would have had if I'd bought gold originally. If the ratio ever expands again dramatically, I might trade some of the gold for silver again, then trade back when and if the ratio shrinks substantially.

Trade opportunities like this don't come along often, but when they do you can use them to significantly increase your holdings.

I think it's a good idea to keep at least some silver- not that we're going all Mad Max, but I do recall the gas shortages in the 70's, with gas station owners giving preference to people who could pay with silver dimes and quarters. It never hurts to have insurance.

Leave a comment:

-

Re: Catch a falling silver knife - Notes on EJ's April 29 silver sell call

Some combination of paper gold, cash and T-bills (not notes) would be my suggestion. Mix to suit risk tolerance.Originally posted by vinoveri View PostI for one would be much obliged for suggestion on where to keep one's dry powder in a ZIRP environment with real inflation.

The worry for loss of purchasing power of wealth can hinder patience and cause one to invest unwisely.

What would you recommend as a non-cash highly liquid means of storing powder?

thanks

Leave a comment:

Leave a comment: