Originally posted by thriftyandboringinohio

View Post

An "insider" from RS-resources recommended Pt to me and I bought 20 oz. I have poor knowlege of his track record though. First time working

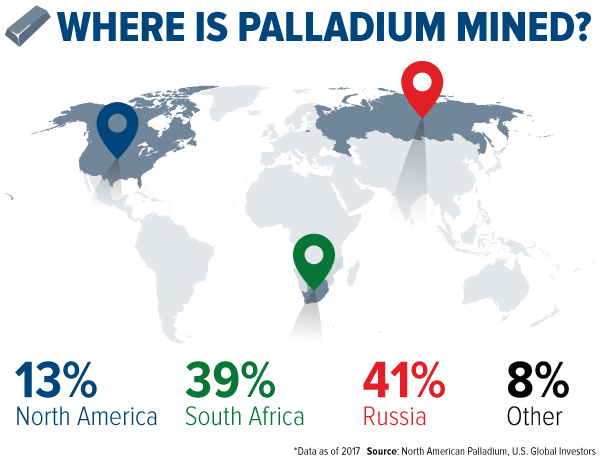

with him. Pd is not rising because of inflation. Inflation drives gold, not so much Pd.

Leave a comment: