Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

YYYYEEESSSSSS...................

Enough of all this twoddle.............Mega require a bit of guide-ance on how to get a Hot Bitch & Fast car sort of a thing.......????

The Next Bubble will be?

I honesty don't know, but i bet that Goldman & J P Morgan are trying to "Magic" one up right now. I guess that Atomic power will from 2011 start to gather pace.

Mike

Announcement

Collapse

No announcement yet.

Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Collapse

X

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

you can always tell a fire economy economist but you can't tell him much...Originally posted by whitetower View PostI remember studying Eichengreen in my doctoral program in Intl Relations back in the mid-90s. He's in the camp of the Great-Depression-could-have-been-avoided-by-looser-money/credit-policies. The chief culprit for the Great Depression being "Great": lingering attachments to the gold standard.

He was also a bigwig advisor to the IMF in the late 90s if I recall. He's basically a monetarist, although sometimes it's hard to tell the difference between them and Keynesians in that they both want to throw money at the "problem" of recession.

(Check out this recent article by Eichengreen -- is he a monetarist or Keynesian?)

Going back to E.J.'s and iTulip's main point: there has never truly been "deflation" since the Great Depression, due to the influence of economists and international trade theorists like Eichengreen.

Bizarrely however, inflation/hyperinflation is essentially thought as a "normal" and welcome condition to these modern theories of political economy.

he's clearly identified by what he cannot see... asset price inflation (what bubble?)... only wage price inflation.

asset price inflation good, wage price inflation bad.

who benefits from one not the other?

pure politics.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

I remember studying Eichengreen in my doctoral program in Intl Relations back in the mid-90s. He's in the camp of the Great-Depression-could-have-been-avoided-by-looser-money/credit-policies. The chief culprit for the Great Depression being "Great": lingering attachments to the gold standard.

He was also a bigwig advisor to the IMF in the late 90s if I recall. He's basically a monetarist, although sometimes it's hard to tell the difference between them and Keynesians in that they both want to throw money at the "problem" of recession.

(Check out this recent article by Eichengreen -- is he a monetarist or Keynesian?)

Going back to E.J.'s and iTulip's main point: there has never truly been "deflation" since the Great Depression, due to the influence of economists and international trade theorists like Eichengreen.

Bizarrely however, inflation/hyperinflation is essentially thought as a "normal" and welcome condition to these modern theories of political economy.Last edited by whitetower; June 28, 2009, 03:00 AM.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

ok if i send your version to Barry Eichengreen & Kevin H. O’Rourke? i'd like to hear what they say.Originally posted by bart View PostAnd I did note that above as well as touched on it in The Great Depression parallels... busted thread:

...

Not only that, but using April 2008 is even further after the current stock market peak and current official recession start date (and in the other direction) that June 1929 is ahead of the actual start of the Great Depression.

It still seems quite misleading to me, and significantly skews all the charts.

How many have read that article and all the references and links to it on other sites, and don't realize that most of the charts are not aligned with either the start of the Great Depression or the current recession?

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Thanks for your work, bart! It is always great to have someone out there that helps to clarify or even dispel misinformation. And you have done a great job, from my perspective, since I have been here! :cool:Originally posted by bart View PostFair enough - that's three of you.

I won't bother to spend 4 hours on two charts next time to bring up a point here that my emails have shown that most don't understand and didn't get.

I'm not upset, just disappointed.

Keep it up, buddy. Your efforts are definitely appreciated here.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Thanks for the analysis EJ. It leads me to one question though. Who is going to war against who?

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

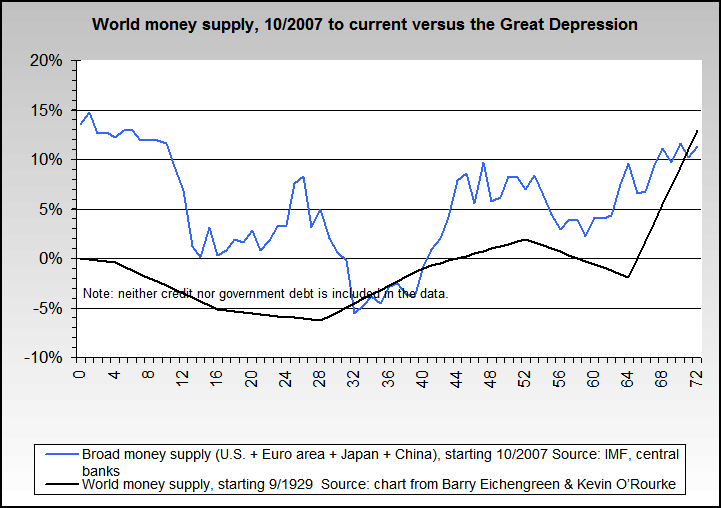

Bart, Thank you for the charts.Originally posted by bart View PostHere's the one on global money supply, which again is just plain wrong or misleading.

The one I just built:

The misleading or incorrect one:

I urge extreme caution for anyone trying to draw conclusions from those misleading or outright wrong charts.

I have to ask:

you seem to be making a MAJOR implication as to what it would MEAN if the start of the derpression is misaligned.

Could you please (for me, since I'm a simpleton) explicitly state what the implication is? It looks to be a big one, and I'm missing it, so I have to ask, because I want to CLEARLY UNDERSTAND what you are saying.

Thank you.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Points taken on the start dates for the data. However, we stand by the point that we make with the global money markets and fiscal spending charts and want to make sure that readers don't miss that point in the data minutia.Originally posted by bart View PostFair enough Jim. I believe that the facts clearly speak for themselves.

Making comparisons and conclusions about the Great Depression while not using the accepted start date, and also not using the current recession start date strikes me as less than wise.

Per my experience, the majority of regular folk who have looked at those charts whether here or at other sites don't even realize that the original writers are going way out there with basing the charts on industrial production peaks, and are drawing incorrect and potentially very costly conclusions.

In the first year of this debt deflation crisis versus in 1930 governments are spending vastly more money more quickly to try to spend their way out of one kind of trouble, and in our opinion into another kind of trouble. In the final quarter of 2008 and first quarter of 2009 alone governments spent $2.2 trillion on fiscal stimulus as GDP fell. This level of deficit spending dwarfs any that occurred during The Great Depression.

Global fiscal stimulus as a percent of GDP: China, Spain and the U.S. lead the pack

Global fiscal stimulus in dollars: China, the U.S., and Saudi Arabia lead the pack

At the same time, GDP is declining.

Global fiscal spending to GDP ratio today dwarfs 1930, and all of the data we have confirms this fact. It reflects a very different view toward deficit spending held by governments today that developed out of the Great Depression and WWII experience.

This response by governments was not exactly a surprise to iTulip readers, any more than was the economic crash that led governments to execute on their "spend your way out of economic depression" philosophy.

Without a doubt, the U.S. is leading the pack in the deficit spending area, as far as we know--if China's GDP numbers are to be believed.

Fiscal Deficit/GDP 1930 to 2009 (Goldman Sachs)

The focus of our analysis is on the U.S. and how its bet on fiscal stimulus is setting the economy up for a dire outcome if the stimulus fails and leaves the U.S. with gigantic debts and not enough cash flow to pay it off. One chart that went into the analysis but was not published with it should give readers pause. It backs up our assertion that the composition of U.S. foreign debt is becoming more precarious in the manner of Argentina in the late 2000.

Change in composition of debt to China, the USA's "IMF"

The same Goldman analysis that produced the chart above also forecasts the positive GDP impact of stimulus to peak in Q3 2009, which is one of the reasons we viewed the rally from March as a "first bounce." Note that Goldman expects the stimulus to begin to exert a negative impact on the economy in the final quarters of 2010.

Safe to say that is not going to happen--we'll get more stimulus spending before it does. :eek:

As for the global money supply, again the philosophy and practice today are quite different than in the early 1930s. Compare interest rates in major countries in 1930 versus today and you'll see what I mean. That said, it's not strictly relevant to our point; what matters is not the global money supply but the difficulty that the U.S. is having expanding broad money, as your excellent M3 chart shows.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

In the end, we all make our own investment decisions. The more good data the better. Where else but iTulip can someone present an alternative perspective of the data and make a strong, intellectually rigorous, case in defense of their position. That's why I read iTulip.Originally posted by jk View Posti, for one, found your charts and - even more so - the discussion here quite illuminating. you can't say Eichengreen and O'Rourke's charts were wrong, although you can - and did! - argue that they are misleading, and highlight that element of their construction that produced what you feel are misleading results.

more data is better.

Bart's perspective only adds to the strong presentation by EJ and the iTulip team.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Absolutely agree. No one spends more of their time trying to enlighten the rest of us as Bart. If I were Bart after spending all the time he does posting all the charts he does. I would kick back, put my feet up, and say "It's great to be the king."Originally posted by Tybee Island View PostBart:

I think your charts are superb and very enlightening. Thank you for taking the time to construct them.

Tybee

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Bart:

I think your charts are superb and very enlightening. Thank you for taking the time to construct them.

Tybee

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

i, for one, found your charts and - even more so - the discussion here quite illuminating. you can't say Eichengreen and O'Rourke's charts were wrong, although you can - and did! - argue that they are misleading, and highlight that element of their construction that produced what you feel are misleading results.Originally posted by bart View PostFair enough - that's three of you.

I won't bother to spend 4 hours on two charts next time to bring up a point here that my emails have shown that most don't understand and didn't get.

I'm not upset, just disappointed.

more data is better. i would also point out that the money supply charts are of different forms- yours a rate of change chart, theirs a chart of money supply size itself. you'd need to take the first derivative of their chart, then align the start dates to see if there's any difference at all. if so, that would mean that someone has wrong, or at least wrongly labeled data.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Originally posted by metalman View Postagree with your point, jim. am not convinced that eichengreen's and o'rourke's representations of the data are not valid.

Fair enough - that's three of you.

I won't bother to spend 4 hours on two charts next time to bring up a point here that my emails have shown that most don't understand and didn't get.

I'm not upset, just disappointed.Last edited by bart; June 27, 2009, 12:57 AM.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Fair enough Jim. I believe that the facts clearly speak for themselves.

Making comparisons and conclusions about the Great Depression while not using the accepted start date, and also not using the current recession start date strikes me as less than wise.

Per my experience, the majority of regular folk who have looked at those charts whether here or at other sites don't even realize that the original writers are going way out there with basing the charts on industrial production peaks, and are drawing incorrect and potentially very costly conclusions.

Leave a comment:

-

Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

agree with your point, jim. am not convinced that eichengreen's and o'rourke's representations of the data are not valid.Originally posted by Jim Nickerson View PostIt struck me that the Eichengreen and O'Rourke's point was to present their opinion of 1929 vs. recently based as they wrote, and as was quoted above, on "peaks in the world industrial production." I assume their data are correct, and that their graphs correctly reflect correct data.

Whether or that presentation agrees with the reality of 1929 vs. now as you perceive it, Bart, or as you think it is best displayed is not an argument that I believe will be sorted out on these pages. They wrote what they wrote on the basis of their qualifications in presenting the graphs. Unless you can disprove the correctness of their data, the reasonable thing appears to be to take their study for what it shows as a valid comparison.

Leave a comment:

Leave a comment: