Re: Peak cheap oil....

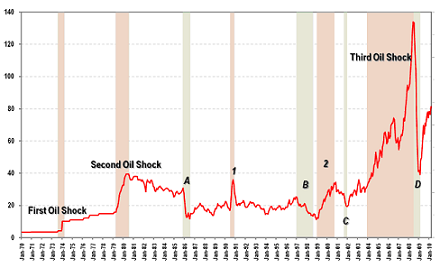

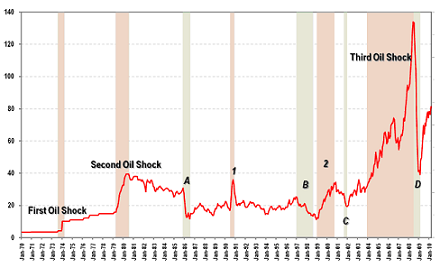

really? here's ej's pco chart/forecast from May 2008...

here's what went down...

look darn trade able to me.

here's an opposing view...

'For a dictatorship running an oil producing country, the more oil you consume at home to pay off your opposition, the less oil you have for export, the higher oil prices go even when you are operating at maximum production, the more power domestic and international political [power] you have. The West's backing of dictators worked before the Peak Cheap Oil era, but the global oligarchy has a narrow window of opportunity to get them out of power before the Peak Cheap Oil Producer/Consumer Feedback Loop makes them too powerful to manage. '

http://www.itulip.com/forums/showthr...g-Eric-Janszen

thx. when do you plan to get out? why?

Originally posted by dropthatcash

View Post

here's what went down...

look darn trade able to me.

Right now most traders are working under the assumption that the BRIC nations will only continue to use more oil. This model doesn't conform with the U.S. hyper inflation theory. A weaker dollar will destroy their exports and impede growth in these nations. It will also destroy oil consumption here as limited wealth will require consumers to start using fossil fuels like the irreplaceable gift they are.

'For a dictatorship running an oil producing country, the more oil you consume at home to pay off your opposition, the less oil you have for export, the higher oil prices go even when you are operating at maximum production, the more power domestic and international political [power] you have. The West's backing of dictators worked before the Peak Cheap Oil era, but the global oligarchy has a narrow window of opportunity to get them out of power before the Peak Cheap Oil Producer/Consumer Feedback Loop makes them too powerful to manage. '

http://www.itulip.com/forums/showthr...g-Eric-Janszen

Before this happens I still expect a further rally in metals and fuels as easy money (hence growth) is still flooding the system. Even stocks continue to act very bullish. I went long at 7000 on the DOW and my number one pick then was Ford at $2 (no longer a good investment at these prices).

true peak oil itself occurred in 1853 when the first commercial oil well was drilled. We've been draining the worlds tank ever since and usage has increased nearly every year since but those two facts alone would have never made you a penny and from an investment standpoint the concept 'cheap peak oil' is far to ambiguous to be traded. Just ask Jim Rodger and T Boone Pickens whom rode oil all the way up and down from $50 to $150 to $50 and made and lost a fortune. Timing is crucial. If you don't have timing your gambling.

true peak oil itself occurred in 1853 when the first commercial oil well was drilled. We've been draining the worlds tank ever since and usage has increased nearly every year since but those two facts alone would have never made you a penny and from an investment standpoint the concept 'cheap peak oil' is far to ambiguous to be traded. Just ask Jim Rodger and T Boone Pickens whom rode oil all the way up and down from $50 to $150 to $50 and made and lost a fortune. Timing is crucial. If you don't have timing your gambling.

Comment