Originally posted by FRED

View Post

Announcement

Collapse

No announcement yet.

You're not going to believe this: Inflation/deflation debate still alive?

Collapse

X

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

That wasn't it, FRED, it was a simpler graph that required almost no thinking to grasp its point--right down my line so to speak. Your's does make the same point but not as simply. I'll look again for it.

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

That wasn't it, FRED, it was a simpler graph that required almost no thinking to grasp its point--right down my line so to speak.Originally posted by FRED View PostYou may have seen it on this web site called "iTulip.com" in a graph included in an old article called "Idiot's guide to investing in gold."

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

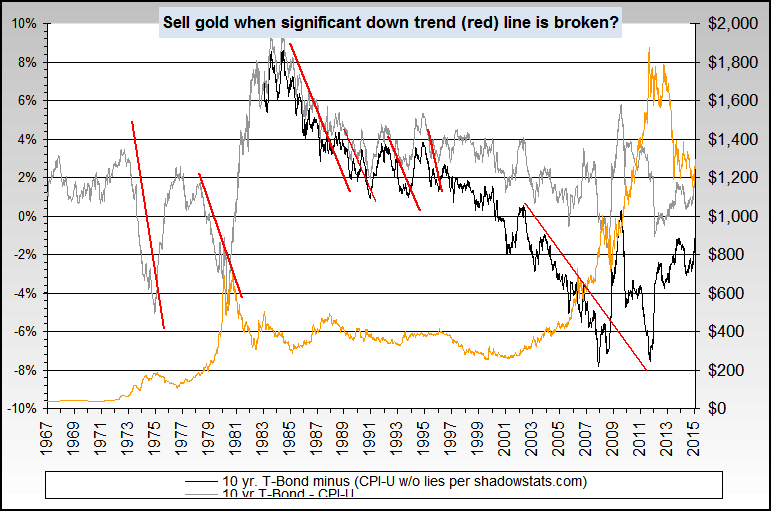

You may have seen it on this web site called "iTulip.com" in a graph included in an old article called "Idiot's guide to investing in gold."Originally posted by Jim Nickerson View PostI should have posted a nice graph I saw a few days back (forget where) that showed the best gains for gold are when real interest rates are negative.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Originally posted by GRG55 View PostIs it really a conundrum? Or is it that the real rate of interest is more important to the price behaviour of gold than the nominal rate?

I should have posted a nice graph I saw a few days back (forget where) that showed the best gains for gold are when real interest rates are negative.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Good point GRG55, they were certainly negative in the 70's as they are now but in the great depression when Homestake mining was quintupling while rates were going down I'm pretty sure real rates were positive. Default was the issue then.Originally posted by GRG55 View PostIs it really a conundrum? Or is it that the real rate of interest is more important to the price behaviour of gold than the nominal rate?

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Is it really a conundrum? Or is it that the real rate of interest is more important to the price behaviour of gold than the nominal rate?Originally posted by Charles Mackay View PostFinally had time to run the chart. The Green line is 30yr interest rates and the blue line is the POG. For the entire 13 year bull market it's about as tight as a correlation as you're going to get in markets. The inverse correlation that we've been getting since 2001 is a, cough cough, ... conundrum.

Or is it? During the great depression we also had falling interest rates and rising POG!

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Finally had time to run the chart. The Green line is 30yr interest rates and the blue line is the POG. For the entire 13 year bull market it's about as tight as a correlation as you're going to get in markets. The inverse correlation that we've been getting since 2001 is a, cough cough, ... conundrum.Originally posted by Charles Mackay View Postjimmy3 and Fred, aren't you both making an assumption that isn't born out in the historical record? Interest rates rose for the entire 13 year gold bull market from 1967 to 1980.

Or is it? During the great depression we also had falling interest rates and rising POG!

Leave a comment:

-

Guest repliedRe: You're not going to believe this: Inflation/deflation debate still alive?

Guest repliedRe: You're not going to believe this: Inflation/deflation debate still alive?

Bill - in amongst the fear each one of us now probably feels for our personal outcomes in the next decade, we occasionally also can feel a pang of sadness for what our country is turning into. This article about the US going hat in hand to Moscow to cringe for additional funds certainly qualifies in that category for Americans.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Perhaps a quibble, but I'd rather see that stated as "if the Fed raises rates so that they start to go truly towards the positive on a net basis".Originally posted by FRED View PostObviously if the Fed raises rates, PMs will fall.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

jimmy3 and Fred, aren't you both making an assumption that isn't born out in the historical record? Interest rates rose for the entire 13 year gold bull market from 1967 to 1980.Originally posted by FRED View PostObviously if the Fed raises rates, PMs will fall. Are deflationistas seriously expecting the Fed to commit fast political suicide by hiking rates during a credit crunch when it can die by slow, politically more expedient inflationary suicide instead?

That is the essence of Ka-Poom Theory, that governments always prefer slow suicide with the potential for recovery within the term of the current administration over the fast suicide with no chance of recovery.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Avoiding sudden death is a time honoured tradition at the Fed; something the deflatinists prefer to overlook apparently...Originally posted by FRED View PostObviously if the Fed raises rates, PMs will fall. Are deflationistas seriously expecting the Fed to commit fast political suicide by hiking rates during a credit crunch when it can die by slow, politically more expedient inflationary suicide instead?

That is the essence of Ka-Poom Theory, that governments always prefer slow suicide with the potential for recovery within the term of the current administration over the fast suicide with no chance of recovery.That is why there has never been any serious danger of a Fed rate hike in present circumstances, and little danger of any sustained rate hike from the ECB either. History rhymes..."Booms, it must be noted, are not stopped until after they have started. And after they have started the action will always look, as it did to the frightened men in the Federal Reserve Board in February 1929, like a decision in favour of immediate as against ultimate death. As we have seen, the immediate death not only has the disadvantage of being immediate but of identifying the executioner."

--John Kenneth Galbraith, "The Great Crash 1929"--

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Please do, then I won't have to worry so much when I loan people my only copy!!!Originally posted by Rajiv View PostI will get "Dying of Money" from the library and put up the pdf if you are interested in it.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Now getting so bad countries ask for help.Originally posted by Lukester View PostSo I hope with the above I have convinced you at least that something new and hyperinflationary in nature is going on with oil prices.

It is now getting so bad that the state and local governments are starting to appeal to the Federal government for help:

http://www.imf.org/external/pubs/ft/...NEW070108A.htm

Now where is that IMF, SWF manager?NEW IMF STUDY

Price Surge Driving Some Countries Close to Tipping Point—IMF

IMF Survey online

July 1, 2008- Food and oil price surge hurting poorest countries the most

- IMF study shows some countries at a tipping point

- Strauss-Kahn calls for broad cooperative approach

The impact of surging oil and food prices is being felt globally but is most acute for import-dependent poor and middle-income countries confronted by balance of payments problems, higher inflation, and worsening poverty, a new IMF study warns.

Analyzing the macroeconomic policy challenges arising from the price surges, the study argues that many governments will have to adjust policies in response to the price shock while the international community will need to do its share to address this global problem.

In advanced countries higher food and fuel prices are reducing people's living standards and making it more difficult for governments and central banks to support growth while containing inflation.

It also stands ready to help with balance-of-payments support, and has already provided additional financial assistance to seven low-income countries through the concessional Poverty Reduction and Growth Facility. It is also streamlining the Exogenous Shocks Facility to make it more useful to IMF members, and stands ready to provide support for middle-income countries through Stand-By Arrangements.

found him

http://en.rian.ru/business/20080630/112615283.html

MOSCOW, June 30 (RIA Novosti) - The United States intends to set favorable conditions for investment, including from Russia, the U.S. treasury secretary said Monday in Moscow. At a meeting with the Russian prime minister, Henry Paulson told Vladimir Putin that the U.S. welcomed investment, including from state sources, and would do everything to make sure the investment flows continue.

Paulson said investing in the U.S. should be attractive to Russia's "sovereign fund", but Putin told him Russia does not yet have a sovereign investment fund, although the authorities are ready to consider setting up one.

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Please do, I'd love to host it on my site and read it (instead of scanning a copy) too. I gather that it's public domain now?Originally posted by Rajiv View PostI will get "Dying of Money" from the library and put up the pdf if you are interested in it.

Yes, Martin is definitely one of the "very best people" who actually is very far from it, and not a favorite person of mine.Originally posted by Rajiv View PostThere was a very illuminating article at Elaine Supkis' site

Martin Jr And The Destruction Of Gold Peg

Martin Armstrong had many "interesting" things to say about him and what he did and did not do in the '20s that helped create the mess and also the Great Depression in his downloadable "The Greatest Bull Market In History".

Leave a comment:

-

Re: You're not going to believe this: Inflation/deflation debate still alive?

Originally posted by Charles Mackay View PostOK, but what about these foreign investment numbers in the U.S. being discontinued?

http://worldnetdaily.com/index.php?f...w&pageId=66694

... there's always at least one of youyr type in a crowd. :cool:

... there's always at least one of youyr type in a crowd. :cool:

I was actually the one who referred Jerome Corsi (the author of that article) to John Williams after he interviewed me about my M3 reconstruction (that was published much earlier than John's ;) ).

And on the BEA ceasing publication and that web page recap, I was under the impression that it was still going. I'm also unaware of any other significant data or reports being dropped. Perhaps they've learned a lesson from the public outcry and of course from cantankerous folk like John Williams and others who are now publishing M3.

Leave a comment:

Leave a comment: