Re: The deflation case: caught, gutted, poached and eaten

Fred, EJ, other people smarter than me...

Is there any way Bernake would be prevented from pulling out all the stops to inflate this problem away? In other words, is it possible that he could decide to go full out per the (in)famous Helicopter speech, but be stopped by others?

Announcement

Collapse

No announcement yet.

The deflation case: caught, gutted, poached and eaten

Collapse

X

-

Re: The deflation case: caught, gutted, poached and eaten

Hear, hear.Originally posted by billThe Feds new open "lets talk to the people policy" is not by accident it was planned as a tool to be more involved as they cranked up of the control lever. The feds years of monetary expansion were well planned and to think they don’t have a plan to control the aftermath of such monetary expansion would be naive.

The feds main objective will be to keep the liquidity flowing, thus dollar tanks, inflation continues, public is strapped with debt and no savings, credit harder to obtain, job loss and a country with no savings and little industry. What’s next? LIQUADATION at some point of pain.

Maybe the fed can partnership with government and purchase assets to reflate their value.

Maybe a good partnership match would be the Feds open transparent policy with SWF since SWF need all the transparency support they can get. We can call it “Print and Repudiation Inc.”.

I second Bill's statement - Bernanke is fully channeling Burns right now.

Cut 'til you drop.

0.5% at next meeting.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

The Feds new open "lets talk to the people policy" is not by accident it was planned as a tool to be more involved as they cranked up of the control lever. The feds years of monetary expansion were well planned and to think they don’t have a plan to control the aftermath of such monetary expansion would be naive.

The feds main objective will be to keep the liquidity flowing, thus dollar tanks, inflation continues, public is strapped with debt and no savings, credit harder to obtain, job loss and a country with no savings and little industry. What’s next? LIQUADATION at some point of pain.

Maybe the fed can partnership with government and purchase assets to reflate their value.

Maybe a good partnership match would be the Feds open transparent policy with SWF since SWF need all the transparency support they can get. We can call it “Print and Repudiation Inc.”.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

The Fed just looks out on a limb now. Marc Faber, in the Bloomberg interview you recently posted, agrees with your sentiments about the FOMC and Bernanke ("He will destroy the Dollar")Originally posted by Jim Nickerson View PostNice substantive post, GRG, I think if the equity markets were to be much lower--say have taken out the November lows--in 12 days, then the Fed will cut probably 0.5% as that is the last number I read somewhere the Fed futures were indicating. The FOMC is spineless in my opinion and is unwilling to allow the needed medicine to be taken by the economy. If the market were to substantially rally from here, who knows, they might not do anything.

However, Finster posted an item (on his "stagflation" thread) yesterday from a Fedhead speaking in London that caught my attention. Maybe it was the inflation-sensitive European audience he was catering to, but said Fedhead acknowledged that maybe, just maybe, a slowing economy and slowing inflation may not go hand-in-hand. This sort of hint gets my sensors tingling. Gold, silver, oil and grains on the verge of going parabolic don't do anything to calm the nerves either. ;)

Judging by the change in tone of commentators (very few now trying to sugarcoat it), this credit crisis now out in the open for all to see. Is there anyone on the face of the earth, even Hank Paulson, that believes that monolines desperate to raise capital deserve the AAA ratings the agencies continue to accord them? Anyone?

Wow. What an Orwellian world... :pLast edited by GRG55; March 06, 2008, 10:59 AM.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

Well consider a dying patient with a fatal disease, how much might this country spend to keep it going, if the country were a doctor? Perhaps it is a depression that is most needed to allow all the craziness that has occurred to be corrected and a new footing established. Ain't nothing in this country really going to change until is it hog-tied and forced to take its medicine without consideration for the subsequent pain of having done so, but only that do I think will start things to get truly better.Originally posted by FRED View PostApplication of the same medicine that caused two major recessions and repaired the economy in the early 1980s will lead to a depression today. The most significant difference between today versus 1980 is that the majority of US households have negative net worth vs sufficient savings to weather a lengthy recession.

The median US household has enough savings net of liabilities at current rates to support 18 weeks of cash flow vs 30 just eight years ago.

Such fragile balance sheets mean US households are in no state to experience the medicine that is needed to manage inflation fueled by a declining currency.

It is a dire conundrum.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

Application of the same medicine that caused two major recessions and repaired the economy in the early 1980s will lead to a depression today. The most significant difference between today versus 1980 is that the majority of US households have negative net worth vs sufficient savings to weather a lengthy recession.Originally posted by Jim Nickerson View PostNice substantive post, GRG, I think if the equity markets were to be much lower--say have taken out the November lows--in 12 days, then the Fed will cut probably 0.5% as that is the last number I read somewhere the Fed futures were indicating. The FOMC is spineless in my opinion and is unwilling to allow the needed medicine to be taken by the economy. If the market were to substantially rally from here, who knows, they might not do anything.

The median US household has enough savings net of liabilities at current rates to support 18 weeks of cash flow vs 30 just eight years ago.

Such fragile balance sheets mean US households are in no state to experience the medicine that is needed to manage inflation fueled by a declining currency.

It is a dire conundrum.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

Nice substantive post, GRG, I think if the equity markets were to be much lower--say have taken out the November lows--in 12 days, then the Fed will cut probably 0.5% as that is the last number I read somewhere the Fed futures were indicating. The FOMC is spineless in my opinion and is unwilling to allow the needed medicine to be taken by the economy. If the market were to substantially rally from here, who knows, they might not do anything.Originally posted by GRG55 View PostNo kidding. Look at this...

N.Z. Dollar Rises After Bollard Says Rate to Remain at RecordBy Emma O'Brien and Ron HaruiMarch 6 (Bloomberg) -- New Zealand's dollar advanced after the central bank said the nation's benchmark interest rate will remain at a record high.The local dollar gained after Reserve Bank of New Zealand Governor Alan Bollard kept borrowing costs unchanged at 8.25 percent, saying that inflation will ensure rates stay at ``current levels for a significant time.'' New Zealand's debt has attracted investors because the rate is the highest after Iceland's among economies rated Aaa.And this...``Inflation is the dominant problem so cuts are a very, very long way off,'' said Brendan O'Donovan, chief economist at Westpac Banking Corp. in Wellington. ``The interest-rate differential is going to stay wide so that's supportive of the currency.''

Australian Dollar Gains as Prices of Commodity Exports IncreaseBy Chris Young and Ron HaruiMarch 6 (Bloomberg) -- The Australian dollar gained as prices of commodities the nation exports such as gold increased, boosting the outlook for the nation's economic growth...And this......The Australian dollar's status as a favorite of so-called carry trades was enhanced yesterday when the central bank raised its benchmark interest rate to a 12-year high of 7.25 percent...

BOE Keeps Benchmark Interest Rate Unchanged at 5.25%By Jennifer RyanMarch 6 (Bloomberg) -- The Bank of England kept its benchmark interest rate unchanged as accelerating inflation prevented policy makers from cutting borrowing costs to shore up economic growth.The nine-member Monetary Policy Committee, led by Governor Mervyn King, kept the bank rate at 5.25 percent, as predicted by 59 of 60 economists in a Bloomberg News survey. One forecast a quarter-point reduction. The central bank reduced the benchmark in December and February.And this...Surveys this week showed factories and service companies raised prices at the fastest pace on record last month, and the central bank predicts inflation may accelerate above 3 percent this year. That makes it harder for policy makers to cut interest rates to protect the economy as house prices fall. Home values slipped 0.3 percent in February, HBOS Plc said today...

China Has Room to Raise Rates, Governor Zhou SaysBy Li YanpingMarch 6 (Bloomberg) -- China's central bank Governor Zhou Xiaochuan said he'll consider raising interest rates to tame the fastest inflation in 11 years.``There is still room for further interest-rate increases,'' Zhou said today at the annual meeting of China's legislature in Beijing. Any decision is complicated by the U.S. Federal Reserve cuts to borrowing costs and the government's goal of increasing consumer spending, he said.So the question is still...Does the Fed decide to draw a line in the sand and arrest, at least temporarily, the fall in the US$ and knock the economy and commodities on the head?China's Premier Wen Jiabao said yesterday curbing inflation is his top priority. Zhou, who's raised the benchmark one-year lending rate to a nine-year high of 7.47 percent, needs to cool prices without triggering a sharp slowing of the world's fourth- largest economy.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

That's what keeps us up at night. On the other hand, from the front page of today's Wall Street Journal:Originally posted by GRG55 View PostNo kidding. Look at this...N.Z. Dollar Rises After Bollard Says Rate to Remain at RecordBy Emma O'Brien and Ron HaruiMarch 6 (Bloomberg) -- New Zealand's dollar advanced after the central bank said the nation's benchmark interest rate will remain at a record high.The local dollar gained after Reserve Bank of New Zealand Governor Alan Bollard kept borrowing costs unchanged at 8.25 percent, saying that inflation will ensure rates stay at ``current levels for a significant time.'' New Zealand's debt has attracted investors because the rate is the highest after Iceland's among economies rated Aaa.And this...``Inflation is the dominant problem so cuts are a very, very long way off,'' said Brendan O'Donovan, chief economist at Westpac Banking Corp. in Wellington. ``The interest-rate differential is going to stay wide so that's supportive of the currency.''Australian Dollar Gains as Prices of Commodity Exports IncreaseBy Chris Young and Ron HaruiMarch 6 (Bloomberg) -- The Australian dollar gained as prices of commodities the nation exports such as gold increased, boosting the outlook for the nation's economic growth...And this......The Australian dollar's status as a favorite of so-called carry trades was enhanced yesterday when the central bank raised its benchmark interest rate to a 12-year high of 7.25 percent...BOE Keeps Benchmark Interest Rate Unchanged at 5.25%By Jennifer RyanMarch 6 (Bloomberg) -- The Bank of England kept its benchmark interest rate unchanged as accelerating inflation prevented policy makers from cutting borrowing costs to shore up economic growth.The nine-member Monetary Policy Committee, led by Governor Mervyn King, kept the bank rate at 5.25 percent, as predicted by 59 of 60 economists in a Bloomberg News survey. One forecast a quarter-point reduction. The central bank reduced the benchmark in December and February.And this...Surveys this week showed factories and service companies raised prices at the fastest pace on record last month, and the central bank predicts inflation may accelerate above 3 percent this year. That makes it harder for policy makers to cut interest rates to protect the economy as house prices fall. Home values slipped 0.3 percent in February, HBOS Plc said today...

So the question is still...Does the Fed decide to draw a line in the sand and arrest, at least temporarily, the fall in the US$ and knock the economy and commodities on the head?China Has Room to Raise Rates, Governor Zhou SaysBy Li YanpingMarch 6 (Bloomberg) -- China's central bank Governor Zhou Xiaochuan said he'll consider raising interest rates to tame the fastest inflation in 11 years.``There is still room for further interest-rate increases,'' Zhou said today at the annual meeting of China's legislature in Beijing. Any decision is complicated by the U.S. Federal Reserve cuts to borrowing costs and the government's goal of increasing consumer spending, he said.China's Premier Wen Jiabao said yesterday curbing inflation is his top priority. Zhou, who's raised the benchmark one-year lending rate to a nine-year high of 7.47 percent, needs to cool prices without triggering a sharp slowing of the world's fourth- largest economy.Liquidation Fears Squeeze StocksThe Bank of Japan in 1990 and the Fed in the early 1930s tried to raise interest rates during credit contractions to protect the currency. Didn't work out well.

Stocks fell as missed margin calls compounded fears of securities liquidation and the dollar hit fresh lows against the euro. Oil prices eased after climbing close to $106 a barrel. 10:16 a.m.

Carlyle Adds to Fears of Forced Sales

Carlyle Capital added to worries about forced liquidations of residential mortgage-backed securities after failing to meet margin calls on its $21.7 billion portfolio. 7:33 a.m.

New Spasm Jolts Credit Markets

Despite repeated doses of medicine from central banks, short-term lending markets around the world are struggling again. The renewed turmoil marks the latest fallout from the deflation of U.S. housing values and the subprime-mortgage crisis.

We need to see signs that the credit crisis is not spreading and deepening before worrying too much about the Fed changing direction.

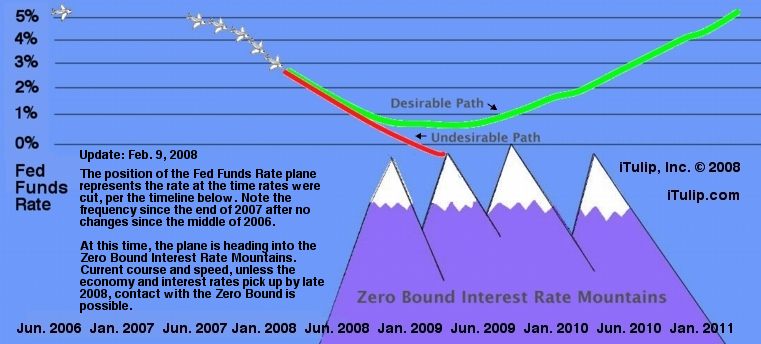

Fed will maintain course and speed toward zero until the credit crisis clears.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

No kidding. Look at this...Originally posted by FRED View PostThe Wall Street Journal put it well yesterday saying the Fed's policy has been as a man showning up at the black tie dinner in a Halloween costume.

N.Z. Dollar Rises After Bollard Says Rate to Remain at RecordBy Emma O'Brien and Ron HaruiMarch 6 (Bloomberg) -- New Zealand's dollar advanced after the central bank said the nation's benchmark interest rate will remain at a record high.The local dollar gained after Reserve Bank of New Zealand Governor Alan Bollard kept borrowing costs unchanged at 8.25 percent, saying that inflation will ensure rates stay at ``current levels for a significant time.'' New Zealand's debt has attracted investors because the rate is the highest after Iceland's among economies rated Aaa.And this...``Inflation is the dominant problem so cuts are a very, very long way off,'' said Brendan O'Donovan, chief economist at Westpac Banking Corp. in Wellington. ``The interest-rate differential is going to stay wide so that's supportive of the currency.''

Australian Dollar Gains as Prices of Commodity Exports IncreaseBy Chris Young and Ron HaruiMarch 6 (Bloomberg) -- The Australian dollar gained as prices of commodities the nation exports such as gold increased, boosting the outlook for the nation's economic growth...And this......The Australian dollar's status as a favorite of so-called carry trades was enhanced yesterday when the central bank raised its benchmark interest rate to a 12-year high of 7.25 percent...

BOE Keeps Benchmark Interest Rate Unchanged at 5.25%By Jennifer RyanMarch 6 (Bloomberg) -- The Bank of England kept its benchmark interest rate unchanged as accelerating inflation prevented policy makers from cutting borrowing costs to shore up economic growth.The nine-member Monetary Policy Committee, led by Governor Mervyn King, kept the bank rate at 5.25 percent, as predicted by 59 of 60 economists in a Bloomberg News survey. One forecast a quarter-point reduction. The central bank reduced the benchmark in December and February.And this...Surveys this week showed factories and service companies raised prices at the fastest pace on record last month, and the central bank predicts inflation may accelerate above 3 percent this year. That makes it harder for policy makers to cut interest rates to protect the economy as house prices fall. Home values slipped 0.3 percent in February, HBOS Plc said today...

So the question is still...Does the Fed decide to draw a line in the sand and arrest, at least temporarily, the fall in the US$ and knock the economy and commodities on the head?China Has Room to Raise Rates, Governor Zhou Says

By Li YanpingMarch 6 (Bloomberg) -- China's central bank Governor Zhou Xiaochuan said he'll consider raising interest rates to tame the fastest inflation in 11 years.

``There is still room for further interest-rate increases,'' Zhou said today at the annual meeting of China's legislature in Beijing. Any decision is complicated by the U.S. Federal Reserve cuts to borrowing costs and the government's goal of increasing consumer spending, he said.

China's Premier Wen Jiabao said yesterday curbing inflation is his top priority. Zhou, who's raised the benchmark one-year lending rate to a nine-year high of 7.47 percent, needs to cool prices without triggering a sharp slowing of the world's fourth- largest economy.

Last edited by GRG55; March 06, 2008, 10:05 AM.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

The Wall Street Journal put it well yesterday saying the Fed's policy has been as a man showning up at the black tie dinner in a Halloween costume.Originally posted by GRG55 View PostWhat happens if the ECB doesn't play ball?

Trichet's press conference today left me with the impression, from his tone not so much his words, that the ECB intends to hold the line on interest rate cuts. He made it very, very clear, answering several similar questions from different reporters, that the ECB does NOT have a dual mandate and that it's only mandate is price stability. At one point he made a pointed and deliberate contrast between his situation and the Federal Reserve Board dual mandate ("The ECB has a single needle compass...").

Emphasis mine...

Trichet Says Anchoring Inflation Is Highest Priority

By Brian Swint

March 6 (Bloomberg) -- European Central Bank President Jean- Claude Trichet said policy makers are focused on keeping expectations about future price increases in check.

``The firm anchoring of medium- to long-term inflation expectations is of the highest priority to the Governing Council,'' Trichet said at a press conference in Frankfurt today after the ECB kept its key rate at 4 percent. ``The current monetary policy stance will contribute to achieving'' this goal.

Record oil prices, higher credit costs and the euro's 17 percent gain against the dollar in the past year are slowing economic growth in the 15-nation euro region. At the same time, inflation is running at 3.2 percent, the fastest pace since the euro's debut in 1999.

``Uncertainty resulting from financial turmoil remains high,'' Trichet said. ``The economic fundamentals are sound. We emphasize that maintaining price stability over the medium term is our prime objective.''

The 21-member rate-setting council was unanimous in leaving interest rates unchanged today, Trichet told reporters. When asked if investors' expectations for lower interest rates were misplaced, he said: ``We're not underwriting the present future- market interest rates.''

The ECB today revised up its inflation forecasts to 2.9 percent from 2.5 percent for 2008 and said inflation will stay above the 2 percent ceiling in 2009, Trichet said.

The bank also cut its predictions for growth to 1.7 percent for this year and 1.8 percent for 2009, compared with a December forecast of 2 percent and 2.1 percent.

http://www.bloomberg.com/apps/news?p...Crc&refer=home

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

What happens if the ECB doesn't play ball?Originally posted by FRED View PostThe deflation case: caught, gutted, poached and eaten

Oh, no! Not the Inflation vs Deflation debate again!

by Eric Janszen

The Fed’s greatest challenge is that the need to create an inflationary firebreak between crashing asset prices and the real economy has become so obvious that Wall Street money managers are starting to pile into the inflation bet en masse...

Trichet's press conference today left me with the impression, from his tone not so much his words, that the ECB intends to hold the line on interest rate cuts. He made it very, very clear, answering several similar questions from different reporters, that the ECB does NOT have a dual mandate and that it's only mandate is price stability. At one point he made a pointed and deliberate contrast between his situation and the Federal Reserve Board dual mandate ("The ECB has a single needle compass...").

Emphasis mine...

Trichet Says Anchoring Inflation Is Highest Priority

By Brian SwintMarch 6 (Bloomberg) -- European Central Bank President Jean- Claude Trichet said policy makers are focused on keeping expectations about future price increases in check.

``The firm anchoring of medium- to long-term inflation expectations is of the highest priority to the Governing Council,'' Trichet said at a press conference in Frankfurt today after the ECB kept its key rate at 4 percent. ``The current monetary policy stance will contribute to achieving'' this goal.

Record oil prices, higher credit costs and the euro's 17 percent gain against the dollar in the past year are slowing economic growth in the 15-nation euro region. At the same time, inflation is running at 3.2 percent, the fastest pace since the euro's debut in 1999.

``Uncertainty resulting from financial turmoil remains high,'' Trichet said. ``The economic fundamentals are sound. We emphasize that maintaining price stability over the medium term is our prime objective.''

The 21-member rate-setting council was unanimous in leaving interest rates unchanged today, Trichet told reporters. When asked if investors' expectations for lower interest rates were misplaced, he said: ``We're not underwriting the present future- market interest rates.''

The ECB today revised up its inflation forecasts to 2.9 percent from 2.5 percent for 2008 and said inflation will stay above the 2 percent ceiling in 2009, Trichet said.

The bank also cut its predictions for growth to 1.7 percent for this year and 1.8 percent for 2009, compared with a December forecast of 2 percent and 2.1 percent.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

Long neglected industries are having their moment in the sun. It won't last forever, but it will last much longer than most Wall St. analysts expect.

Agreed. It's fun to watch the incredulous talking heads on CNBC rail against the rising gold price. They just want to close their eyes to reality and wish the FIRE economy back to its glory days.

Leave a comment:

-

Re: The deflation case: caught, gutted, poached and eaten

Fred,

I believe # 3 is the answer.

Isn't the dictionary definition of inflation simply an increase in the money supply resulting in the loss of value of the currency?

Throw in the traditional definition of too many dollars (from around the world) chasing too few goods and you get inflation here at home despite the average wage earner in the US not getting raises.

Greenspan used to say that increasing productivity held down inflation but that model only works with things like technology especially when that industry was nascent. It's harder to squeeze productivity out of commodities when you are faced with peak production problems. The law of diminishing returns forces inflation, especially when aggravated by soaring worldwide demandLast edited by BiscayneSunrise; March 06, 2008, 02:49 AM.

Leave a comment:

-

Re: Oil Industry Wages

I worked in oil idustry from 70's to my recent retirement. I remember the 70's oil boom in Houston well. It was a great time, jobs aplenty, rising wages, and a booming local economy.

And a lot of oil industry equipment manufacture was done in Houston at that time, so lots of those type jobs too.

The easiest way to describe the current Houston economy is probably better than the most of the U.S., but far from booming, nothing remotely like the 1970's.

Reason, I believe, is what I saw firsthand and have heard from many friends. Many of the bigger oil companies have off-shored big chunks of their non-Upstream activities in the last 10 years. And by that I mean, Information Technology, Accounting, Financial analysis, Procurement, Payables, Receivables, etc. I've even heard of an oil company that now processes and supports its U.S. payroll and benefits activities from South America, etc., etc.

So jobs for back office and Downstream activities are not booming and wages consequently are not going up in any significant way.

Upstream (Exploration and Production), though, is another story. Salaries in Upstream are going up as oil companies compete for engineers and others who can find oil or help get it out of the ground or deepwater.

Also, there is no boom in oil equipment manufacturing here. There doesn't seem to be much of that left in Houston.

Leave a comment:

Leave a comment: