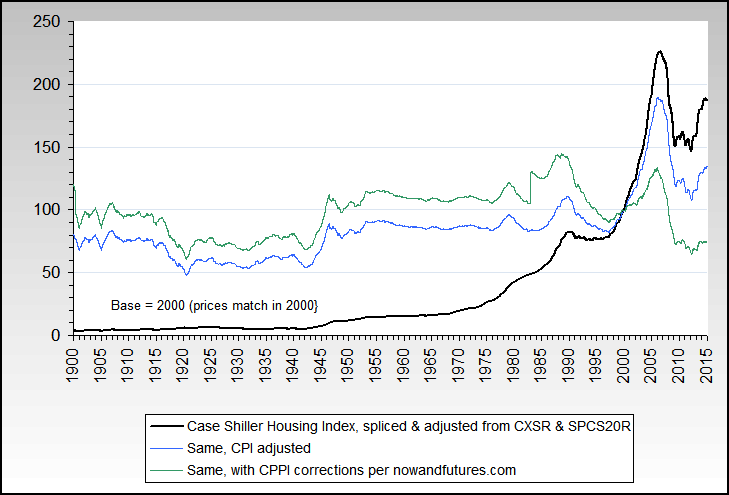

As someone always points out in discussions like these, houses today are larger than they were in the past (although there was a small decline in 2009, the latest data available). So the following chart shows ounces of gold to buy one square foot of the median home.

Although this gold ratio concept is a neat idea, and both charts suggest we are at or near historic low points, I believe there are other factors to consider. If you are at least relatively well-off, have every reason to believe you will continue to be, and intend to by a home to live in "forever", then using the gold ratio to determine timing is probably a reasonable approach.

For the rest of us, I think that house prices relative to incomes are more important. The following chart shows the ratio of median new home prices to median annual household income. Prior to 1944 I had to use average income data. One might think then that the ratio is too high in the early part of the 20th century, but as averages tend to be higher than medians, it may actually be understated.

At any rate, using this metric, homes have been getting progressively more expensive relative to incomes since the end of WW II. Despite a significant decline in nominal prices over the past few years, this ratio has hardly slowed down.

As a bonus of sorts, this chart also shows income expressed in ounces of gold. It is important to understand the dynamics of the dramatic increase and peak around 1970. After the war, the United States was the only major country left untouched. The industrial base built up for the war effort turned to consumer goods, and the nation prospered. Meanwhile, however, the US dollar gold price was still fixed at $35 until it was allowed to float in 1968. Incomes were rising during those years, roughly three times in nominal terms, but the gold price was flat. This over-exaggerates the increase. After gold was allowed to float, the price quickly climbed, and therefore the income ratio dropped.

Incomes measured in gold are near historic lows. Will they soon reverse? What if they don't, and what if you have to sell sooner than expected... who can afford to buy your house? 1945 was the most affordable time to buy a home in living memory. IMO, either home prices need to continue to drop significantly, or median incomes need to rise significantly (or some combination of the two) to make buying a home affordable.

Leave a comment: