Originally posted by GRG55

View Post

A rapid private debt binge is nearly over, Macquarie says.

February 19, 2016 — 12:54 PM MST

Canada has entered the very late innings of its super-charged private sector credit cycle, one that has completely decoupled from that of its largest trading partner, according to Macquarie Analyst David Doyle.

"Canada’s private sector nonfinancial debt to GDP ratio (includes household debt and non-financial business debt) has skyrocketed since 2005, rising by over 60 percentage points," he wrote. "This is a greater magnitude of increase than occurred for the forty years prior (1965 to 2005)."

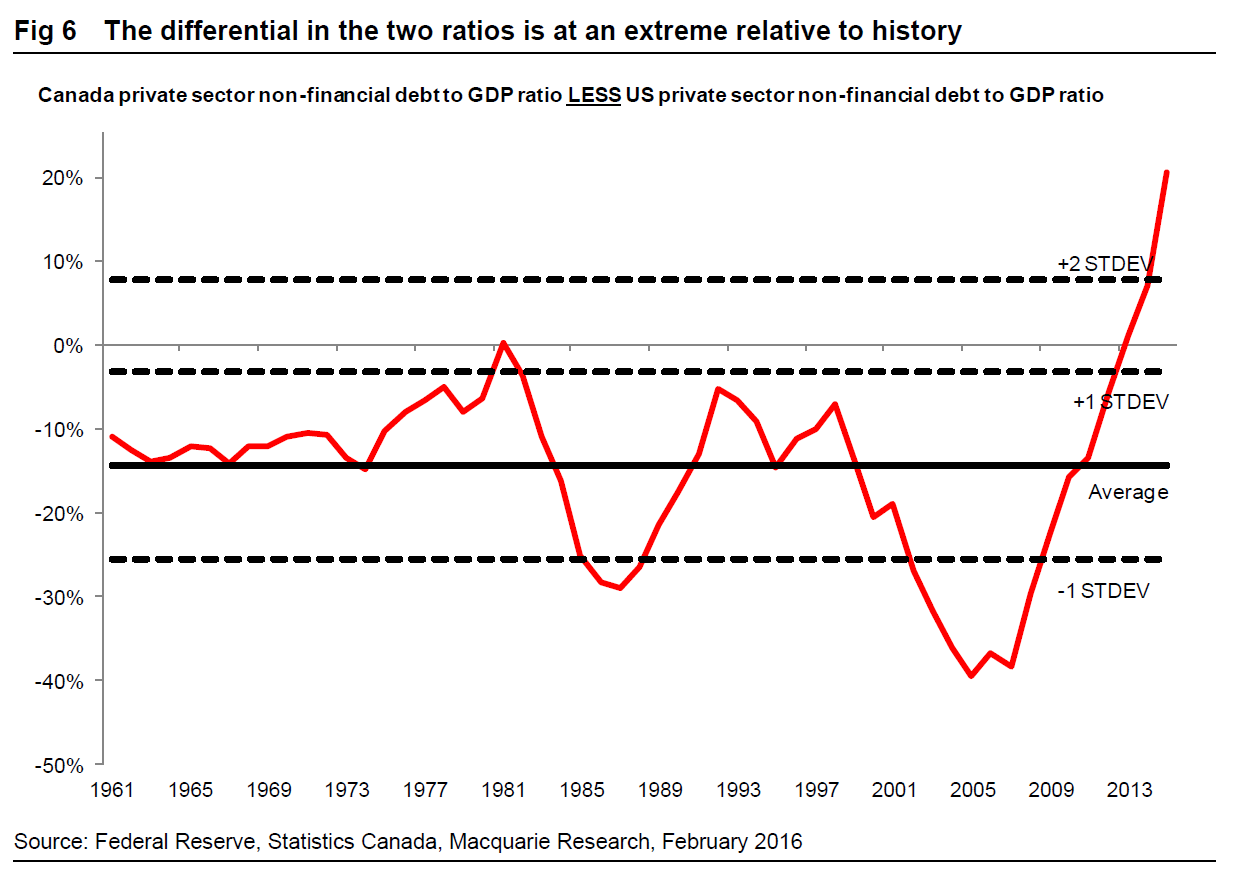

As a result of this prolonged binge, Canada's private sector non-financial debt-to-GDP exceeds the comparable U.S. ratio by its highest level on record:

"Canada’s private sector nonfinancial debt to GDP ratio (includes household debt and non-financial business debt) has skyrocketed since 2005, rising by over 60 percentage points," he wrote. "This is a greater magnitude of increase than occurred for the forty years prior (1965 to 2005)."

As a result of this prolonged binge, Canada's private sector non-financial debt-to-GDP exceeds the comparable U.S. ratio by its highest level on record:

In the wake of the credit crisis through 2015, the U.S. economy experienced a painful deleveraging, with the ratio of private sector debt-to-GDP falling by an average of 2 percentage points per year. Meanwhile, Canada's credit cycle kicked into overdrive, with private sector debt-to-GDP rising nearly 5 percentage points each year...

Leave a comment: