Originally posted by Polish_Silver

View Post

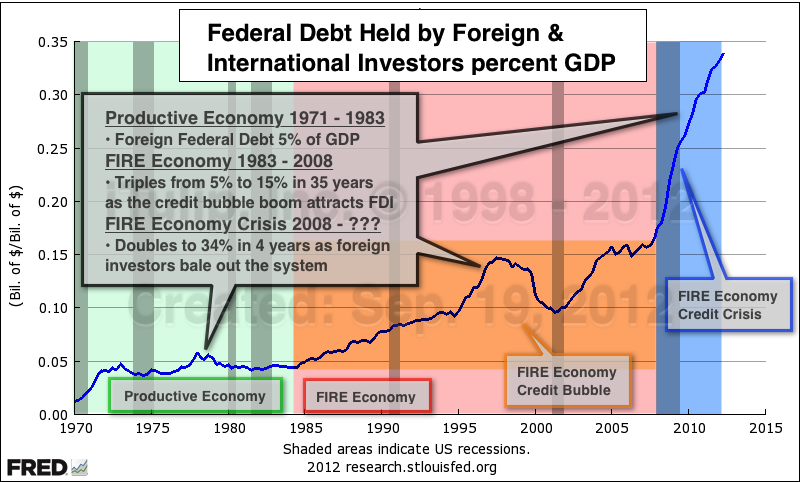

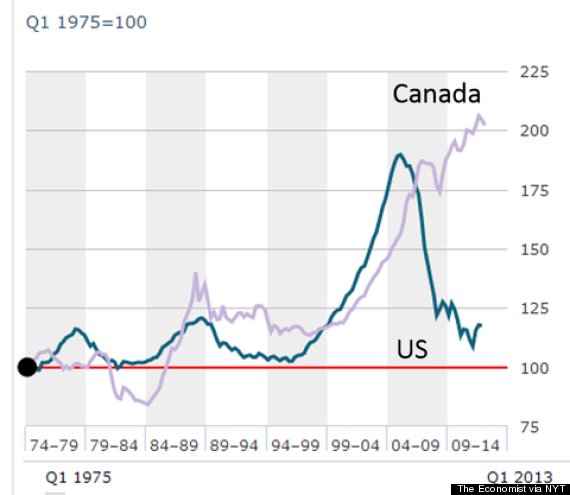

Here's a few charts below to amuse, the first of which I believe includes a form of the debt to income data you were inquiring about. Please note that mortgage interest on a principal residence is not deductible against other income in Canada, unlike the USA. Further, our mortgage market is quite different from the USA in that 30 year fixed mortgages and easily refinanced mortgages aren't available. Refinancing early usually involves heavy interest penalties, and mortgages generally have to be renegotiated at maximum 5 year intervals, so Canadian home buyers are generally more exposed to rising interest rates over the life of their indebtedness.

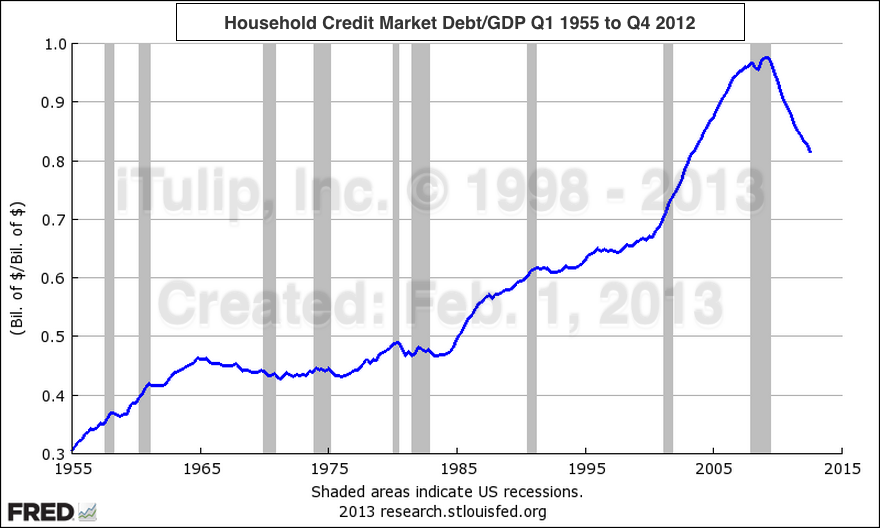

The second chart below shows Canadian Mortgage and Housing Corporation (CMHC) insured mortgages. CMHC is a federal government (e.g. Taxpayer) backed mortgage insurer. At present (1st Q 2013 data) it insures some CAD $560 Billion or about 62% of all home loans in Canada. Since CMHC insulates the banks who write the mortgages from losses there is a growing concern about potential loosening of credit standards. Although the Finance Minister won't use the phrase "housing bubble", the now acute concern about Canadian debt levels within the Finance Ministry and the Bank of Canada caused the government to announce that it was capping CMHC's balance sheet at a maximum of CAD $600 Billion. They know full well that in the event of a train wreck in the real estate market the taxpayers will have to bail out the banks both directly and via bailing out CMHC. Earlier this year the banking regulator designated all six major Canadian banks as "systemically important" - read: TBTF.

There is currently Cdn$960 Billion of real estate backed lending on the books of the major Canadian banks. The Cdn $400 Billion that isn't insured by CMHC is high-ratio mortgages that don't qualify for the insurance and Home Equity Lines of Credit (HELOCs) that also don't qualify. If there is a significant downturn in Canadian home prices it is these loans that have the potential to start the deleveraging cascade. That risk rises at the onset of the next Canadian recession (the economy is already slowing, unlike the USA) when reduced incomes will impair the ability to service these record household debt levels.

What I find most amazing is that almost everyone I speak to where I live in western Canada is completely convinced that real estate is the most secure "investment" they can make today. Most of them seem to have way too much of their net worth tied up in their expensive personal residences, and an extraordinary number also have second vacation homes on the lakes in B.C., at the ski resorts in the Canadian Rockies or Whistler, and most recently in places like Phoenix or Palm Springs. Mind boggling...

\\

Leave a comment: