Announcement

Collapse

No announcement yet.

Iceland considers the Canadian dollar over the Euro

Collapse

X

-

Re: Iceland considers the Canadian dollar over the Euro

so... uhh.... wow....

let me see if i got this one straight... (recalling the opening scenes in INSIDE JOB)

the country that essentially started the bowling ball (ice ball) rolling down the lane into the pins (banks in london, amsterdam) that subsequently turned a 'spare' into a 'strike' in manhattan?

now wants to ditch its failing (2nd time in 4 years) fiat and since the euro isnt lookin all that attractive???

and use the loonie?

guess truth really IS stranger than fiction...Originally posted by euobserverFor the opposition party which initially floated the idea last summer, the Canadian dollar could be more attractive than the single currency.

Polls say seven out of 10 Icelanders want to ditch the kroner. But the population is split between the euro and the Canadian dollar. Surveys also show that just 26 percent want to join the EU.

and... THEN

we're supposed to believe bernanke,geithner,dodd&frank that what went down in congress

the past couple years HAS 'FIXED' ANYTHING?

oh look!

here comes another one!

Last edited by lektrode; May 11, 2012, 10:18 PM.

-

Re: Iceland considers the Canadian dollar over the Euro

Earth to Iceland... Canada has practically no gold reserves! (#81 on the list). Over a dozen third world countries have more gold reserves than than Canada! Just saying...Last edited by Adeptus; May 12, 2012, 01:10 AM.Warning: Network Engineer talking economics!

Comment

-

Re: Iceland considers the Canadian dollar over the Euro

Why does it need gold reserves? It has oil.Originally posted by Adeptus View PostEarth to Iceland... Canada has practically no gold reserves! (#81 on the list). Over a dozen third world countries have more gold reserves than than Canada! Just saying...

Comment

-

Re: Iceland considers the Canadian dollar over the Euro

When should a country abandon its own money?

http://www.npr.org/blogs/money/2012/...-its-own-money

Comment

-

Re: Iceland considers the Canadian dollar over the Euro

I think Canada is one of the few countries that in the long term, at least for another couple of generations will be doing better than most. In great part due to its small population (1/10th of US) compared to its huge land mass (bigger than US), and the resources that come along with it such as Oil, gold mines and vast agricultural lands, this on top of getting 'free' military protection from the USA. My reference, while unstated, was in regards to both poom and a post-poom gold standard world. When poom comes (along with much higher interest rates and inflation), Canada is going to get hit hard. We can relatively easily argue that it's real estate bubble will finally crash, if it hadn't already by that time frame. Private debt is at all time historic highs, reaching north of 150%. Post poom, and assuming global currencies in part or in full going to be on some flavour of a gold standard, Canada would not likely survive that event very well either; and so, Iceland, if adopting the Loonie, would come along for another currency ride downwards.Originally posted by GRG55 View PostWhy does it need gold reserves? It has oil.

A few years later post poom/gold standard, yes Canada will do very well, possibly exceptionally well. But during the poom and post-poom, not so much IMO.

Canadian Private Debt Levels... Bank of Canada (Fed equivalent) jawboning with no action (yet).

Canadian Housing Bubble Rise: Vancouver, Toronto and Victoria (not listed - between Vancouver & Toronto), are seeing exceptional speculative rises that can not be supported by stagnant wages.

Household debt continues to climb, as desposible income in trending down - this in a low interest rate world. Imagine if inflation creeps in.

Canadian Inflation Rate (The lying CPI)... In a post-1971 fiat world with no long deflationary periods, inflation has nowhere to go but UP.

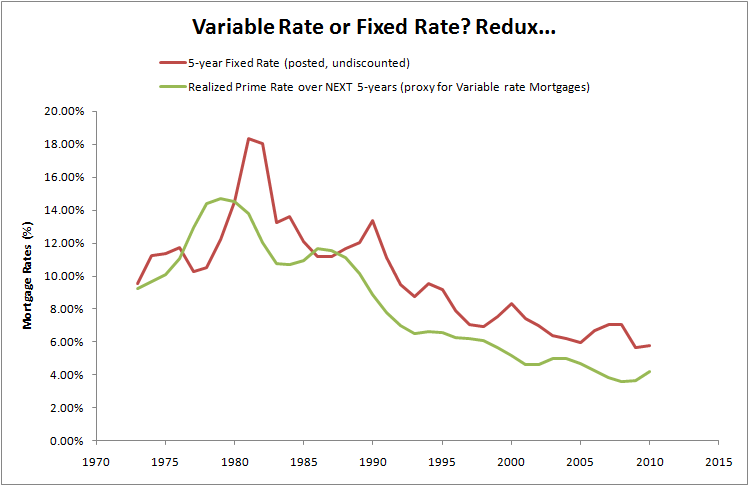

Mortgage Rates - Currently at all time lows, nowhere to go but UP.

PS. I live in CanadaLast edited by Adeptus; May 13, 2012, 03:15 PM.Warning: Network Engineer talking economics!

Comment

-

Re: Iceland considers the Canadian dollar over the Euro

Originally posted by Adeptus View PostI think Canada is one of the few countries that in the long term, at least for another couple of generations will be doing better than most. In great part due to its small population (1/10th of US) compared to its huge land mass (bigger than US), and the resources that come along with it such as Oil, gold mines and vast agricultural lands, this on top of getting 'free' military protection from the USA. My reference, while unstated, was in regards to both poom and a post-poom gold standard world. When poom comes (along with much higher interest rates and inflation), Canada is going to get hit hard. We can relatively easily argue that it's real estate bubble will finally crash, if it hadn't already by that time frame. Private debt is at all time historic highs, reaching north of 150%. Post poom, and assuming global currencies in part or in full going to be on some flavour of a gold standard, Canada would not likely survive that event very well either; and so, Iceland, if adopting the Loonie, would come along for another currency ride downwards.

A few years later post poom/gold standard, yes Canada will do very well, possibly exceptionally well. But during the poom and post-poom, not so much IMO.

....

......

...

(snip... all them great charts)

....

......

PS. I live in Canada

Nice job!

d`uude - yer almost as good as Fred/the Boss (EJ) with this kine stuff (not bad for an alchemy major)

kinda makes ya wonder if the icelandic econ people have thot this one all the thru, eh?

Comment

-

Re: Iceland considers the Canadian dollar over the Euro

http://news.nationalpost.com/2012/05...nadian-loonie/

If Iceland adopts the loonie, Greenland could soon follow: economist

To restart an icy economy and free its citizens from strict Soviet-style money controls, all Iceland needs is a single planeload of Canadian dollars, a pair of Iceland economists told a packed Bay Street conference room Monday afternoon.“It would fit nicely in a small plane, we just have to make sure it doesn’t get lost on the way,” said Heidar Gudjonsson, an investment manager and the chairman of Iceland’s Centre for Social and Economic Research.

Mr. Gudjonsson, along with University of Iceland finance professor Ársæll Valfells, were in Toronto on Tuesday to make the first pitch to a Canadian audience on a unorthodox proposal to to pull the debt-ridden Nordic state from recession by abandoning the Icelandic krona for the Canadian dollar.

Iceland was one of hardest hit by the 2008 financial collapse, rendering its currency effectively worthless. To prevent wealth from fleeing the country, Icelanders are on their fourth year of living under strict capital controls. International investment is banned, and when Mr. Gudjonsson left Reykjavik for Canada, he said he was only allowed to withdraw $2,570 for travel expenses. “The controls are stricter than they were in Eastern Europe under Communism,” said Mr. Gudjonsson.

Icelanders are united on the need to ditch the krona. However, the country’s reigning Social Democrats want the Euro, while the opposition Progressive Party has been pushing for the Canadian dollar since last summer. As resource economies, Canada and Iceland’s economic cycles are more likely to be in sync, loonie proponents argue. Also, Canada is home to about 200,000 people of Icelandic descent, more than anywhere else in the world. “I see that connection helping the public in Iceland accepting a new currency,” said Mr. Gudjonsson.

So far, the loonie appears to be winning. A March Gallup poll showed public approval for the loonie easily pulling ahead of the U.S. dollar, the euro and the Norwegian krone.

The mechanics of the swap would be the easy part. A party of Icelanders officials would simply fly to a Canadian bank and arrange a $300-million withdrawal. The final pile of multicoloured bills — no larger than two photocopiers — would then be shipped across the North Atlantic and loaded into ATMs and bank vaults over a weekend. (While there is far more than $300-million in the Icelandic money system, the country currently only has $300-million worth of krona coins and bills in circulation.)

Short of imposing its own Iceland-style currency controls, the Bank of Canada has no choice in the matter. “We will do it unilaterally without asking,” said Mr. Valfells. “It’s better to ask for forgiveness than permission.”

In the resource-rich Arctic, Mr. Gudjonsson said, a Canada-Iceland currency union could be the cornerstone of a Canadian-led polar juggernaut. With Iceland on the loonie, Greenland — which only recently declared independence from Denmark — could soon follow, he said.

“If you look at it from a strategic perspective, instead of one country at the Arctic Council using the Canadian dollar, you’d have three,” Mr. Gudjonsson.

Canada would also stand to make a tidy profit through seigniorage, the revenue a government earns by selling coins and bills into the money system. Per year, Iceland’s currency withdrawals could pull in “$15- to $20-million per year” for the Canadian government, said Mr. Gudjonsson.

Comment

Comment