http://politicalcorrection.org/factcheck/201110140001

Facts Show Private Lenders Who Were Not Subject To CRA, Not Government-Backed Ones Who Were, Drove The Subprime Mortgage Market

Private Firms, Not Fannie And Freddie, Dominated The Subprime Mortgage Market

2007: The Collapse Of The Housing Bubble And Widespread Defaults On Subprime Loans Triggered A Banking Crisis That Led To A Massive Recession. From Slate: "The only near consensus is on the question of what triggered the not-quite-a-depression. In 2007, the housing bubble burst, leading to a high rate of defaults on subprime mortgages. Exposure to bad mortgages doomed Bear Stearns in March 2008, then led to a banking crisis that fall. A global recession became inevitable once the government decided not to rescue Lehman Bros. from default in September 2008. Lehman's was the biggest bankruptcy in history, and it led promptly to a powerful economic contraction. Somewhere around here, agreement ends." [Slate, 1/9/10, emphasis added]

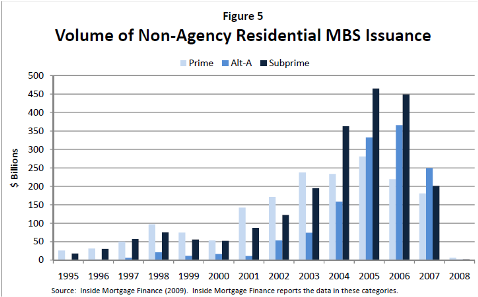

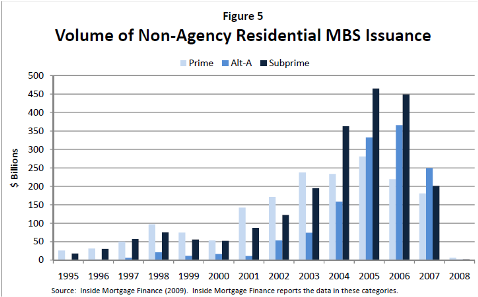

The Subprime Market Surged From 2004 To 2006. As reported by McClatchy: "Subprime lending offered high-cost loans to the weakest borrowers during the housing boom that lasted from 2001 to 2007. Subprime lending was at its height from 2004 to 2006." [McClatchy, 10/12/08]

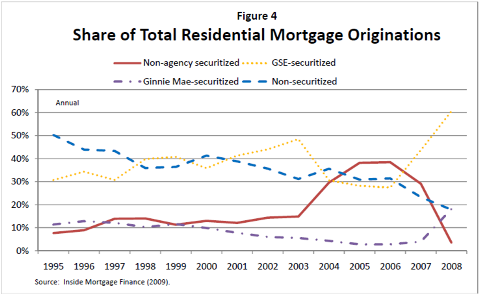

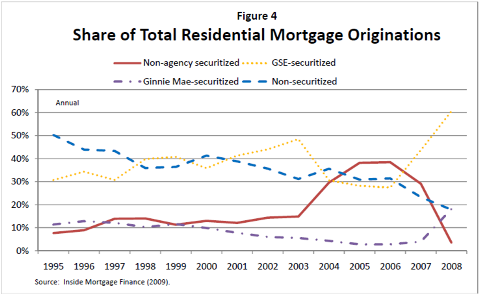

From 2004 To 2006, Fannie And Freddie's Share Of Subprime Market Fell From Almost Half To Just Under One-Quarter. As reported by McClatchy: "But these loans, and those to low- and moderate-income families represent a small portion of overall lending. And at the height of the housing boom in 2005 and 2006, Republicans and their party's standard bearer, President Bush, didn't criticize any sort of lending, frequently boasting that they were presiding over the highest-ever rates of U.S. homeownership. Between 2004 and 2006, when subprime lending was exploding, Fannie and Freddie went from holding a high of 48 percent of the subprime loans that were sold into the secondary market to holding about 24 percent, according to data from Inside Mortgage Finance, a specialty publication." [McClatchy, 10/12/08, emphasis added]

2006: Private Firms Issued About Six Out Of Every Seven Subprime Mortgages. As reported by McClatchy:

Fannie And Freddie Don't Issue Loans, But Buy Them From Private Banks So Banks Can Continue Lending. As reported by McClatchy: "Conservative critics claim that the Clinton administration pushed Fannie Mae and Freddie Mac to make home ownership more available to riskier borrowers with little concern for their ability to pay the mortgages. [...] Fannie, the Federal National Mortgage Association, and Freddie, the Federal Home Loan Mortgage Corp., don't lend money, to minorities or anyone else, however. They purchase loans from the private lenders who actually underwrite the loans. It's a process called securitization, and by passing on the loans, banks have more capital on hand so they can lend even more." [McClatchy, 10/12/08, emphasis added]

The CRA Didn't Apply To The Private Firms That Inflated The Subprime Bubble

Conservatives Blame The Community Reinvestment Act Of 1977 (CRA) For The Subprime Boom Of The Early 2000s. From former Director of the U.S. Treasury's Office of Thrift Supervision Ellen Seidman:

"Only One-Third Of All CRA Loans" Were Subprime, And Default Rate Was Low. As reported by McClatchy:

Krugman: As Private Involvement In Subprime Loans Surged, Fannie And Freddie Were "Sidelined." From Nobel Prize-winning economist Paul Krugman of the New York Times:

Deregulation Of Financial Markets And GOP-Appointed Absentee Regulators Paved The Way For The Subprime Bubble To Cause A Broad Collapse

Deregulation

Financial Fraud Expert Bill Black: Presidents Reagan, Bush, Clinton, And Bush All Aided Deregulation Of Financial Markets Over 30-Year Period. According to fraud expert Bill Black: "Thirty years ago Ronald Reagan was President. Reagan famously claimed that government was always the problem. He was a zealous supporter of deregulation. He appointed regulatory leaders he believed were strong supporters of desupervision. His Vice President, George Herbert Walker Bush, chaired the administration's financial deregulation task force. President Clinton strongly supported financial deregulation. His principal economic advisors, Robert Rubin and Larry Summers, were eager financial deregulators. His Vice President, Al Gore, lead the 'reinventing government' movement that spread the rot of desupervision. Banking regulators were instructed to refer to banks as their 'customers.'" [Benzinga.com, 2/7/11]

1999: Gramm-Leach-Bliley Act Integrated Commercial & Investment Banks, Making The System Less Sound. As reported by Newsweek:

Then-Senator Phil Gramm "Inserted A Key Provision Into The 2000 Commodity Futures Modernization Act That Exempted...Derivatives Such As Credit Default Swaps From Regulation." As reported by Time: "As chairman of the Senate Banking Committee from 1995 through 2000, Gramm was Washington's most prominent and outspoken champion of financial deregulation. He played the leading role in writing and pushing through Congress the 1999 repeal of the Depression-era Glass-Steagall Act that separated commercial banks from Wall Street, and he inserted a key provision into the 2000 Commodity Futures Modernization Act that exempted over-the-counter derivatives such as credit-default swaps from regulation by the Commodity Futures Trading Commission (CFTC)." [Time, 1/24/09]

"Credit Default Swaps" Are A Form Of Insurance For Investors Against Default. From a Huffington Post blog post by Fiscal Strategies Group President David Paul:

President Bush Appointed An SEC Chief Who Believed Government Was "A Service Industry" Rather Than A Strict Regulator. According to fraud expert Bill Black: "George W. Bush was an ardent anti-regulator. He appointed the nation's leading anti-regulators to run the regulatory agencies. Bush appointed Harvey Pitt, for example, to run the SEC because he was the leading opponent of vigorous securities regulation and effective accounting. On October 16, 2001, Enron announce[d] massive losses and accounting restatements. On October 22, 2001, SEC Chairman Pitt addressed the AICPA Governing Council (his former client) and bemoaned the fact that the SEC had not always been a 'kinder and gentler' place for accountants. He called accountants the SEC's 'partners.' (The FBI would later call the Mortgage Bankers Association - the trade association of the mortgage fraud perps - its partner against mortgage fraud.) Pitt blamed the SEC staff for purportedly intimidating accountants and refusing to listen to them. He explained his guiding rule: 'I am committed to the principle that government is and must be a service industry.'" [Benzinga.com, 2/7/11]

SEC Historian: Regulators Had A "Trust The Market" Philosophy. As reported by the Los Angeles Times: "The change in leadership at the SEC is an opportunity to reverse years of a failed 'trust the market' philosophy permeating the agency, said Joel Seligman, an SEC historian. Although SEC division chiefs normally don't depart with an outgoing chairman, Seligman said the new chief should replace them." [Los Angeles Times, 12/18/08]

Former Fed Chairman Alan Greenspan Now Says He Was Wrong To Oppose Regulation Of Derivatives. As reported by the New York Times:

Bush's Pick To Run The Federal Reserve Said In 2005 That Derivatives Did Not Need Regulation Because Traders Were "Very Sophisticated." As reported by Pro Publica:

"Financial Crisis Inquiry Commission" Expert Panel Found Wall Street Recklessness Caused The Crisis

Right-wing interests, chiefly the U.S. Chamber of Commerce, have claimed the FCIC's report is biased. Political Correction debunked those claims when the report was released. Read our full fact check of that claim.

Bipartisan Financial Crisis Inquiry Commission Found The Financial Crisis Was Avoidable, Caused By Recklessness On Wall Street. From the Huffington Post: "In a report released today, the Financial Crisis Inquiry Commission found that 'reckless' Wall Street firms, an abundance of cheap credit and 'weak' federal regulators caused the crisis. 'This financial crisis could have been avoided. Let us be clear,' chairman Phil Angelides said at the Washington press conference marking the official release of the report. 'The record is replete with evidence of failures. None of what happened was an act of God.' Former California treasurer Angelides confirmed that the bipartisan panel appointed by Congress to investigate the financial crisis concluded that several financial industry figures appear to have broken the law and has referred multiple cases to state or federal authorities for potential prosecution. The report also revealed that Goldman Sachs collected $2.9 billion from the American International Group as payout on a speculative trade it placed for the benefit of its own account, receiving the bulk of those funds after AIG received an enormous taxpayer rescue, according to the FCIC." [Huffington Post, 1/27/11]

All Four Republican Commissioners Of The Financial Crisis Inquiry Commission Voted To Ban Words Like "Wall Street" And "Shadow Banking" From The Report On The Financial Crisis. As the Huffington Post reported: "During a private commission meeting last week, all four Republicans voted in favor of banning the phrases 'Wall Street' and 'shadow banking' and the words 'interconnection" and 'deregulation' from the panel's final report, according to a person familiar with the matter and confirmed by Brooksley E. Born, one of the six commissioners who voted against the proposal." [Huffington Post, 12/15/10]

Republican Commissioners Voted To Ban The Word "Deregulation" From Financial Crisis Inquiry Commission Findings. As reported by Accounting Today: "The four Republican members decided last week to release their own nine-page version of the report, entitled 'Financial Crisis Primer,' through a think tank called the American Action Forum. In the process, they also have effectively disowned the 'final' version of the report that the Democratic-led commission now plans to release in January. They are concerned that the final report will end up putting the blame on Wall Street for the financial crisis, whereas they believe the blame should be placed instead on government-sponsored housing agencies like Fannie Mae and Freddie Mac, and the affordable housing goals of the Clinton and second Bush administrations. The Republican commission members even voted in private to ban phrases like 'Wall Street,' 'shadow banking,' 'interconnection,' 'deregulation,' 'magic,' and 'alchemy' from the final report." [Accounting Today, 12/21/10, emphasis added]

[back to top]

Author Of Top Book On Financial Crisis Says There Is No Evidence For Blaming Either The CRA Or Fannie And Freddie

"Bailout Nation" By Barry Ritholtz Was Named Among The "Best Business Books To Make Sense Of [The] Financial Crisis" By USA Today. [USA Today, 12/24/09]

Ritholtz Blames Deregulation, Weakened SEC Funding, And Wall Street Practices, But "Could Find No Evidence That [The CRA Was] A Cause Or Even A Minor Factor." From Barry Ritholtz, who wrote the book Bailout Nation about the housing bubble and ensuing financial crisis:

Private Firms, Not Fannie And Freddie, Dominated The Subprime Mortgage Market

2007: The Collapse Of The Housing Bubble And Widespread Defaults On Subprime Loans Triggered A Banking Crisis That Led To A Massive Recession. From Slate: "The only near consensus is on the question of what triggered the not-quite-a-depression. In 2007, the housing bubble burst, leading to a high rate of defaults on subprime mortgages. Exposure to bad mortgages doomed Bear Stearns in March 2008, then led to a banking crisis that fall. A global recession became inevitable once the government decided not to rescue Lehman Bros. from default in September 2008. Lehman's was the biggest bankruptcy in history, and it led promptly to a powerful economic contraction. Somewhere around here, agreement ends." [Slate, 1/9/10, emphasis added]

The Subprime Market Surged From 2004 To 2006. As reported by McClatchy: "Subprime lending offered high-cost loans to the weakest borrowers during the housing boom that lasted from 2001 to 2007. Subprime lending was at its height from 2004 to 2006." [McClatchy, 10/12/08]

From 2004 To 2006, Fannie And Freddie's Share Of Subprime Market Fell From Almost Half To Just Under One-Quarter. As reported by McClatchy: "But these loans, and those to low- and moderate-income families represent a small portion of overall lending. And at the height of the housing boom in 2005 and 2006, Republicans and their party's standard bearer, President Bush, didn't criticize any sort of lending, frequently boasting that they were presiding over the highest-ever rates of U.S. homeownership. Between 2004 and 2006, when subprime lending was exploding, Fannie and Freddie went from holding a high of 48 percent of the subprime loans that were sold into the secondary market to holding about 24 percent, according to data from Inside Mortgage Finance, a specialty publication." [McClatchy, 10/12/08, emphasis added]

- Fannie And Freddie Faced Tougher Regulatory Standards Than The Private Firms. As reported by McClatchy: "One reason is that Fannie and Freddie were subject to tougher standards than many of the unregulated players in the private sector who weakened lending standards, most of whom have gone bankrupt or are now in deep trouble." [McClatchy, 10/12/08]

2006: Private Firms Issued About Six Out Of Every Seven Subprime Mortgages. As reported by McClatchy:

Federal Reserve Board data show that:

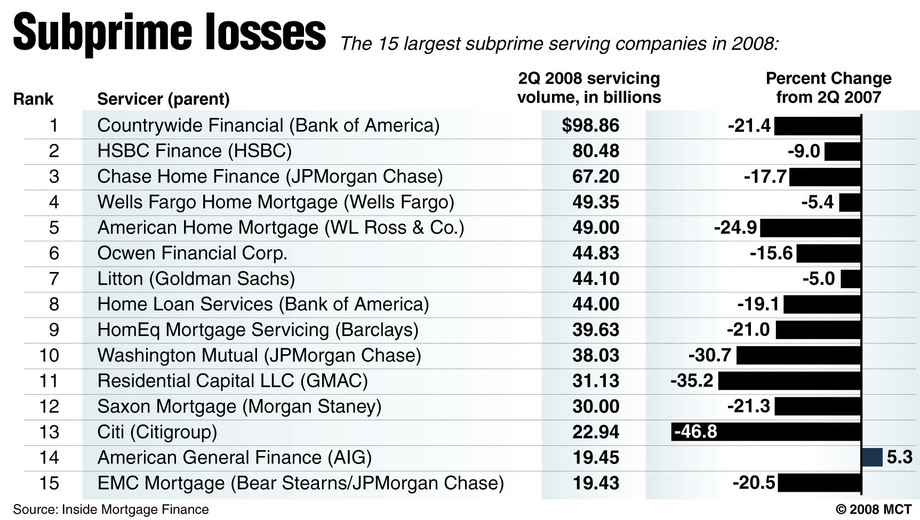

2008: The 15 Largest Subprime Servicers Were All Private Companies, Despite Large Drops In The Volume Of Their Subprime Business Compared To 2007. McClatchy prepared a graphic based on Inside Mortgage Finance data showing the 15 largest subprime service companies in 2008:"Conservative Campaign That Blames The Global Financial Crisis On A Government Push To Make House More Affordable" Is Disproved By The Data. As reported by McClatchy: "As the economy worsens and Election Day approaches, a conservative campaign that blames the global financial crisis on a government push to make housing more affordable to lower-class Americans has taken off on talk radio and e-mail. Commentators say that's what triggered the stock market meltdown and the freeze on credit. They've specifically targeted the mortgage finance giants Fannie Mae and Freddie Mac, which the federal government seized on Sept. 6, contending that lending to poor and minority Americans caused Fannie's and Freddie's financial problems. Federal housing data reveal that the charges aren't true, and that the private sector, not the government or government-backed companies, was behind the soaring subprime lending at the core of the crisis." [McClatchy, 10/12/08, emphasis added]- More than 84 percent of the subprime mortgages in 2006 were issued by private lending institutions.

- Private firms made nearly 83 percent of the subprime loans to low- and moderate-income borrowers that year.

- Only one of the top 25 subprime lenders in 2006 was directly subject to the housing law that's being lambasted by conservative critics. [McClatchy, 10/12/08, emphasis added]

Fannie And Freddie Don't Issue Loans, But Buy Them From Private Banks So Banks Can Continue Lending. As reported by McClatchy: "Conservative critics claim that the Clinton administration pushed Fannie Mae and Freddie Mac to make home ownership more available to riskier borrowers with little concern for their ability to pay the mortgages. [...] Fannie, the Federal National Mortgage Association, and Freddie, the Federal Home Loan Mortgage Corp., don't lend money, to minorities or anyone else, however. They purchase loans from the private lenders who actually underwrite the loans. It's a process called securitization, and by passing on the loans, banks have more capital on hand so they can lend even more." [McClatchy, 10/12/08, emphasis added]

The CRA Didn't Apply To The Private Firms That Inflated The Subprime Bubble

Conservatives Blame The Community Reinvestment Act Of 1977 (CRA) For The Subprime Boom Of The Early 2000s. From former Director of the U.S. Treasury's Office of Thrift Supervision Ellen Seidman:

It has lately become fashionable for conservative pundits (Larry Kudlow, George Will) and disgruntled ex-bankers (Vernon Hill, for example, in his March 7 American Banker editorial) to blame the current credit crisis on the Community Reinvestment Act. This is patent nonsense. The sub-prime debacle has many causes, including greed, lack of and ineffective regulation, failures of risk assessment and management, and misplaced optimism. But CRA is not to blame.

First, the timing is all wrong. CRA was enacted in 1977, its companion disclosure statute, the Home Mortgage Disclosure Act (HMDA) in 1975. While many of us warned against bad subprime lending before the turn of the millennium, the massive breakdown of underwriting and extension of risky products far down the income scale-without bothering to even check on income-was primarily a post-2003 phenomenon. To blame a statute enacted in 1977 for something that happened 25 years later takes a fair amount of chutzpah. [...]

Second, CRA does not either encourage or condone bad lending. Bank regulators were decrying bad subprime lending before the turn of the millennium (see Interagency Guidance on Subprime Lending), and warning the CRA-covered institutions we regulated that badly underwritten subprime products that ignored consumer protections were not acceptable. Lenders not subject to CRA did not receive similar warnings. [New America Foundation, 9/22/08, emphasis added]

The CRA Did Not Affect The Vast Majority Of Subprime Loans. From Businessweek: "The Community Reinvestment Act, passed in 1977, requires banks to lend in the low-income neighborhoods where they take deposits. Just the idea that a lending crisis created from 2004 to 2007 was caused by a 1977 law is silly. But it's even more ridiculous when you consider that most subprime loans were made by firms that aren't subject to the CRA. University of Michigan law professor Michael Barr testified back in February before the House Committee on Financial Services that 50% of subprime loans were made by mortgage service companies not subject comprehensive federal supervision and another 30% were made by affiliates of banks or thrifts which are not subject to routine supervision or examinations." [Businessweek, 9/29/08]First, the timing is all wrong. CRA was enacted in 1977, its companion disclosure statute, the Home Mortgage Disclosure Act (HMDA) in 1975. While many of us warned against bad subprime lending before the turn of the millennium, the massive breakdown of underwriting and extension of risky products far down the income scale-without bothering to even check on income-was primarily a post-2003 phenomenon. To blame a statute enacted in 1977 for something that happened 25 years later takes a fair amount of chutzpah. [...]

Second, CRA does not either encourage or condone bad lending. Bank regulators were decrying bad subprime lending before the turn of the millennium (see Interagency Guidance on Subprime Lending), and warning the CRA-covered institutions we regulated that badly underwritten subprime products that ignored consumer protections were not acceptable. Lenders not subject to CRA did not receive similar warnings. [New America Foundation, 9/22/08, emphasis added]

- Subprime Loans Performed "Quite Well" When Enforcement Of CRA "Was At Its Strongest In The 1990s," But The Bush Administration Weakened CRA Enforcement. From Businessweek: "Finally, keep in mind that the Bush administration has been weakening CRA enforcement and the law's reach since the day it took office. The CRA was at its strongest in the 1990s, under the Clinton administration, a period when subprime loans performed quite well. It was only after the Bush administration cut back on CRA enforcement that problems arose, a timing issue which should stop those blaming the law dead in their tracks. The Federal Reserve, too, did nothing but encourage the wild west of lending in recent years. It wasn't until the middle of 2007 that the Fed decided it was time to crack down on abusive pratices [sic] in the subprime lending market." [Businessweek, 9/29/08, emphasis added]

"Only One-Third Of All CRA Loans" Were Subprime, And Default Rate Was Low. As reported by McClatchy:

In a speech last March, Janet Yellen, the president of the Federal Reserve Bank of San Francisco, debunked the notion that the push for affordable housing created today's problems.

"Most of the loans made by depository institutions examined under the CRA have not been higher-priced loans," she said. "The CRA has increased the volume of responsible lending to low- and moderate-income households."

In a book on the sub-prime lending collapse published in June 2007, the late Federal Reserve Governor Ed Gramlich wrote that only one-third of all CRA loans had interest rates high enough to be considered sub-prime and that to the pleasant surprise of commercial banks there were low default rates. Banks that participated in CRA lending had found, he wrote, "that this new lending is good business." [McClatchy, 10/12/08, emphasis added]

Even Though They Weren't Subject To The CRA, "It Was The Lenders Themselves Who Were Pressing [Fannie And Freddie] To Buy These Loans." From Barry Ritholtz, who wrote the book Bailout Nation about the housing bubble and ensuing financial crisis: "It was the lenders themselves who were pressing the GSEs to buy these loans. The private sector lenders were pursuing this market due to fatter potential profits - not Fannie and Freddie. These facts don't stop the pundits; nor does an apparent lack of understanding of the actual causes of the housing boom/bust and the credit crisis. Their cognitive dissonance has also prevented them from acknowledging the role deregulation had in these events. [...] Only commercial banks and thrifts must follow CRA rules. The investment banks don't, nor did the now-bankrupt non-bank lenders such as New Century Financial Corp. and Ameriquest that underwrote most of the subprime loans. Mortgage brokers, who also weren't subject to federal regulation or the CRA, originated most of the subprime loans." [The Big Picture, 10/23/08, emphasis added]"Most of the loans made by depository institutions examined under the CRA have not been higher-priced loans," she said. "The CRA has increased the volume of responsible lending to low- and moderate-income households."

In a book on the sub-prime lending collapse published in June 2007, the late Federal Reserve Governor Ed Gramlich wrote that only one-third of all CRA loans had interest rates high enough to be considered sub-prime and that to the pleasant surprise of commercial banks there were low default rates. Banks that participated in CRA lending had found, he wrote, "that this new lending is good business." [McClatchy, 10/12/08, emphasis added]

Krugman: As Private Involvement In Subprime Loans Surged, Fannie And Freddie Were "Sidelined." From Nobel Prize-winning economist Paul Krugman of the New York Times:

Just to repeat the basic facts here:

1. The Community Reinvestment Act of 1977 was irrelevant to the subprime boom, which was overwhelmingly driven by loan originators not subject to the Act.

2. The housing bubble reached its point of maximum inflation in the middle years of the naughties:

Robert Shiller

Robert Shiller

3. During those same years, Fannie and Freddie were sidelined by Congressional pressure, and saw a sharp drop in their share of securitization:

FCIC

FCIC

while securitization by private players surged:

FCIC

FCIC

[New York Times, 6/3/10]

[back to top]1. The Community Reinvestment Act of 1977 was irrelevant to the subprime boom, which was overwhelmingly driven by loan originators not subject to the Act.

2. The housing bubble reached its point of maximum inflation in the middle years of the naughties:

Robert Shiller

Robert Shiller3. During those same years, Fannie and Freddie were sidelined by Congressional pressure, and saw a sharp drop in their share of securitization:

FCIC

FCICwhile securitization by private players surged:

FCIC

FCIC[New York Times, 6/3/10]

Deregulation Of Financial Markets And GOP-Appointed Absentee Regulators Paved The Way For The Subprime Bubble To Cause A Broad Collapse

Deregulation

Financial Fraud Expert Bill Black: Presidents Reagan, Bush, Clinton, And Bush All Aided Deregulation Of Financial Markets Over 30-Year Period. According to fraud expert Bill Black: "Thirty years ago Ronald Reagan was President. Reagan famously claimed that government was always the problem. He was a zealous supporter of deregulation. He appointed regulatory leaders he believed were strong supporters of desupervision. His Vice President, George Herbert Walker Bush, chaired the administration's financial deregulation task force. President Clinton strongly supported financial deregulation. His principal economic advisors, Robert Rubin and Larry Summers, were eager financial deregulators. His Vice President, Al Gore, lead the 'reinventing government' movement that spread the rot of desupervision. Banking regulators were instructed to refer to banks as their 'customers.'" [Benzinga.com, 2/7/11]

1999: Gramm-Leach-Bliley Act Integrated Commercial & Investment Banks, Making The System Less Sound. As reported by Newsweek:

Glass-Steagall was one of the many necessary measures taken by Franklin Delano Roosevelt and the Democratic Congress to deal with the Great Depression. Crudely speaking, in the 1920s commercial banks (the types that took deposits, made construction loans, etc.) recklessly plunged into the bull market, making margin loans, underwriting new issues and investment pools, and trading stocks. When the bubble popped in 1929, exposure to Wall Street helped drag down the commercial banks. In the absence of deposit insurance and other backstops, the results were devastating. Wall Street's failure helped destroy Main Street.

The policy response was to erect a wall between investment banking and commercial banking. It outlasted the Berlin Wall by a few decades. In the 1990s, as another bull market took hold, momentum built to overturn Glass-Steagall. Commercial banks were eager to get into high-margin businesses like underwriting hot tech stocks. Brokerage firms saw commercial banks, with their massive customer bases, as great distribution channels for stocks, mutual funds, and other financial products that they created. Generally speaking, the investment banks were the aggressors. In April 1998, Sandy Weill's Travelers, which owned Salomon Smith Barney, merged with Citicorp. The following year, Congress passed and President Clinton signed the Financial Services Modernization Act of 1999, known as the Gramm-Leach-Bliley Act. This law effectively deleted the prohibition on commercial banks owning investment banks and vice versa. [Newsweek, 9/15/08]

By Repealing Glass-Steagall, Gramm-Leach-Bliley Made "Too Big To Fail" Banks Possible. As reported by the Huffington Post: "On the 10th anniversary of Congress voting to repeal the law that had long separated Main Street commercial banking from Wall Street investment banking, current members of the body are talking about ways to potentially bring it back. A return to the Depression-era law -- known as Glass-Steagall -- is now being seriously discussed. Some leading economists and financial thinkers point to its repeal as a precipitator of the current crisis, because it enabled banks to become 'too big to fail.' [...] On November 5, 1999, when Congress passed the bill repealing Glass-Steagall, it was hailed as something that would provide the country with the "opportunity to dominate" the new century. The bill was the Gramm-Leach-Bliley Act of 1999, and it enabled banks to engage in the kind of activities that had been largely prohibited since the Great Depression." [Huffington Post, 11/5/09]The policy response was to erect a wall between investment banking and commercial banking. It outlasted the Berlin Wall by a few decades. In the 1990s, as another bull market took hold, momentum built to overturn Glass-Steagall. Commercial banks were eager to get into high-margin businesses like underwriting hot tech stocks. Brokerage firms saw commercial banks, with their massive customer bases, as great distribution channels for stocks, mutual funds, and other financial products that they created. Generally speaking, the investment banks were the aggressors. In April 1998, Sandy Weill's Travelers, which owned Salomon Smith Barney, merged with Citicorp. The following year, Congress passed and President Clinton signed the Financial Services Modernization Act of 1999, known as the Gramm-Leach-Bliley Act. This law effectively deleted the prohibition on commercial banks owning investment banks and vice versa. [Newsweek, 9/15/08]

Then-Senator Phil Gramm "Inserted A Key Provision Into The 2000 Commodity Futures Modernization Act That Exempted...Derivatives Such As Credit Default Swaps From Regulation." As reported by Time: "As chairman of the Senate Banking Committee from 1995 through 2000, Gramm was Washington's most prominent and outspoken champion of financial deregulation. He played the leading role in writing and pushing through Congress the 1999 repeal of the Depression-era Glass-Steagall Act that separated commercial banks from Wall Street, and he inserted a key provision into the 2000 Commodity Futures Modernization Act that exempted over-the-counter derivatives such as credit-default swaps from regulation by the Commodity Futures Trading Commission (CFTC)." [Time, 1/24/09]

- Financial Instruments Insulated Mortgage Originators And Securities Traders From The Risks Of The Loans They Made And Traded. From a Businessweek op-ed by business consultant Michael Watkins: "Securitization of mortgages into collateralized debt obligations (CDOs) decoupled mortgage originators (brokers and others) from the credit risks of the loans they were writing. At the same time, U.S. investment law shielded sellers of these securities from the legal consequences of fraud by originators. This introduced corrosive conflicts of interest into the system." [Businessweek, 12/17/07]

"Credit Default Swaps" Are A Form Of Insurance For Investors Against Default. From a Huffington Post blog post by Fiscal Strategies Group President David Paul:

In contrast, credit default swaps are financial products that allows for the transfer of the default risk related to owning a corporate bond from one party to another. For example, imagine that before the current market meltdown, CalPERS -- the large California public pension fund -- owned $100 million of IBM bonds, but wanted to insure against the risk of a bond default. CalPERS could accomplish this by negotiating a $100 million, five-year credit default swap with AIG -- which up until a month ago was a global, triple-A rated financial institution.

Under the terms of the swap, CalPERS would make an annual swap payment to AIG equal to -- for example -- 1% of the $100 million swap notional amount. In return, AIG would pay CalPERS the amount of any losses that CalPERS realized in the event of a default by IBM. For example, if IBM went bankrupt during the contract period, and bondholders were only repaid twenty cents on the dollar, AIG would pay CalPERS $80 million. And to secure AIG's obligations, the swap contract would require that if AIG were downgraded from triple-A level to below double-A, AIG would post collateral equal to 20% of the notional amount of the swap contract, or $20 million. [Huffington Post, 10/11/08]

Asleep-At-The-Wheel RegulatorsUnder the terms of the swap, CalPERS would make an annual swap payment to AIG equal to -- for example -- 1% of the $100 million swap notional amount. In return, AIG would pay CalPERS the amount of any losses that CalPERS realized in the event of a default by IBM. For example, if IBM went bankrupt during the contract period, and bondholders were only repaid twenty cents on the dollar, AIG would pay CalPERS $80 million. And to secure AIG's obligations, the swap contract would require that if AIG were downgraded from triple-A level to below double-A, AIG would post collateral equal to 20% of the notional amount of the swap contract, or $20 million. [Huffington Post, 10/11/08]

President Bush Appointed An SEC Chief Who Believed Government Was "A Service Industry" Rather Than A Strict Regulator. According to fraud expert Bill Black: "George W. Bush was an ardent anti-regulator. He appointed the nation's leading anti-regulators to run the regulatory agencies. Bush appointed Harvey Pitt, for example, to run the SEC because he was the leading opponent of vigorous securities regulation and effective accounting. On October 16, 2001, Enron announce[d] massive losses and accounting restatements. On October 22, 2001, SEC Chairman Pitt addressed the AICPA Governing Council (his former client) and bemoaned the fact that the SEC had not always been a 'kinder and gentler' place for accountants. He called accountants the SEC's 'partners.' (The FBI would later call the Mortgage Bankers Association - the trade association of the mortgage fraud perps - its partner against mortgage fraud.) Pitt blamed the SEC staff for purportedly intimidating accountants and refusing to listen to them. He explained his guiding rule: 'I am committed to the principle that government is and must be a service industry.'" [Benzinga.com, 2/7/11]

SEC Historian: Regulators Had A "Trust The Market" Philosophy. As reported by the Los Angeles Times: "The change in leadership at the SEC is an opportunity to reverse years of a failed 'trust the market' philosophy permeating the agency, said Joel Seligman, an SEC historian. Although SEC division chiefs normally don't depart with an outgoing chairman, Seligman said the new chief should replace them." [Los Angeles Times, 12/18/08]

Former Fed Chairman Alan Greenspan Now Says He Was Wrong To Oppose Regulation Of Derivatives. As reported by the New York Times:

[O]n Thursday, almost three years after stepping down as chairman of the Federal Reserve, a humbled Mr. Greenspan admitted that he had put too much faith in the self-correcting power of free markets and had failed to anticipate the self-destructive power of wanton mortgage lending.

"Those of us who have looked to the self-interest of lending institutions to protect shareholders' equity, myself included, are in a state of shocked disbelief," he told the House Committee on Oversight and Government Reform. [...]

On a day that brought more bad news about rising home foreclosures and slumping employment, Mr. Greenspan refused to accept blame for the crisis but acknowledged that his belief in deregulation had been shaken.

He noted that the immense and largely unregulated business of spreading financial risk widely, through the use of exotic financial instruments called derivatives, had gotten out of control and had added to the havoc of today's crisis. As far back as 1994, Mr. Greenspan staunchly and successfully opposed tougher regulation on derivatives.

But on Thursday, he agreed that the multitrillion-dollar market for credit default swaps, instruments originally created to insure bond investors against the risk of default, needed to be restrained.

"This modern risk-management paradigm held sway for decades," he said. "The whole intellectual edifice, however, collapsed in the summer of last year." [New York Times, 10/23/08, emphasis added]

Bush SEC Chief Cox Opposed Regulation Of Derivatives In The Mid '90s. As reported by Pro Publica: "Cox has long known about the pitfalls of poorly understood hedging instruments; as a Congressman, he represented Orange County, California, when it declared bankruptcy in 1994 after its investments in derivatives went badly awry. But at the time, he did not join calls to regulate them: 'I'm concerned that now anything called a derivative will be considered inherent evil in Congress,' Cox said, according to the Orange County Register. 'It is sort of like a fire hose: In the wrong hands, it is dangerous.' Did his opinion evolve by the time he was confirmed as SEC Chairman? You won't find any clues by looking at his Senate confirmation hearing of July 2005. That is because no senator asked him a question about the topic." [Pro Publica, 10/6/08, emphasis added]"Those of us who have looked to the self-interest of lending institutions to protect shareholders' equity, myself included, are in a state of shocked disbelief," he told the House Committee on Oversight and Government Reform. [...]

On a day that brought more bad news about rising home foreclosures and slumping employment, Mr. Greenspan refused to accept blame for the crisis but acknowledged that his belief in deregulation had been shaken.

He noted that the immense and largely unregulated business of spreading financial risk widely, through the use of exotic financial instruments called derivatives, had gotten out of control and had added to the havoc of today's crisis. As far back as 1994, Mr. Greenspan staunchly and successfully opposed tougher regulation on derivatives.

But on Thursday, he agreed that the multitrillion-dollar market for credit default swaps, instruments originally created to insure bond investors against the risk of default, needed to be restrained.

"This modern risk-management paradigm held sway for decades," he said. "The whole intellectual edifice, however, collapsed in the summer of last year." [New York Times, 10/23/08, emphasis added]

Bush's Pick To Run The Federal Reserve Said In 2005 That Derivatives Did Not Need Regulation Because Traders Were "Very Sophisticated." As reported by Pro Publica:

When former Sen. Paul Sarbanes asked [Federal Reserve Chairman Ben] Bernanke about derivatives at his November 2005 Senate confirmation hearing, Bernanke said he felt "sanguine" about these instruments, noting the sophistication of those who dealt with them. Sarbanes responded that this attitude toward derivatives and the hedge funds dealing in them could "come back to haunt you."

SARBANES: Warren Buffett has warned us that derivatives are time bombs, both for the parties that deal in them and the economic system. The Financial Times has said so far, there has been no explosion, but the risks of this fast growing market remain real. How do you respond to these concerns?

BERNANKE. I am more sanguine about derivatives than the position you have just suggested. I think, generally speaking, they are very valuable. They provide methods by which risks can be shared, sliced, and diced, and given to those most willing to bear them. They add, I believe, to the flexibility of the financial system in many different ways. With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly. [Pro Publica, 10/6/08, emphasis added]

Bush's Treasury Secretary Opposed Regulation Of Derivatives. As reported by Pro Publica: SARBANES: Warren Buffett has warned us that derivatives are time bombs, both for the parties that deal in them and the economic system. The Financial Times has said so far, there has been no explosion, but the risks of this fast growing market remain real. How do you respond to these concerns?

BERNANKE. I am more sanguine about derivatives than the position you have just suggested. I think, generally speaking, they are very valuable. They provide methods by which risks can be shared, sliced, and diced, and given to those most willing to bear them. They add, I believe, to the flexibility of the financial system in many different ways. With respect to their safety, derivatives, for the most part, are traded among very sophisticated financial institutions and individuals who have considerable incentive to understand them and to use them properly. [Pro Publica, 10/6/08, emphasis added]

In June, Treasury Secretary [Henry] Paulson told the Washington Post that in one of his first meetings with President Bush, he warned that the growing use of derivatives posed a fundamental risk to the market. If that is the case, he didn't say so publicly. In response to a written question by Sen. Mike Crapo (R-ID) submitted at the Treasury Secretary's Senate confirmation hearing in June 2006, Paulson said he was 'wary' of proposals to strengthen regulation of derivatives because of their importance in managing risk. [...]

PAULSON: I believe these proposals could have significant unintended consequences for the risk-management functions that the markets - whether over-the -counter or exchange-based - perform in our economy. It is my view that absent a clearly demonstrated need, we should be wary of major changes to the manner in which we regulate our derivatives markets. [Pro Publica, 10/6/08, emphasis added]

[back to top]PAULSON: I believe these proposals could have significant unintended consequences for the risk-management functions that the markets - whether over-the -counter or exchange-based - perform in our economy. It is my view that absent a clearly demonstrated need, we should be wary of major changes to the manner in which we regulate our derivatives markets. [Pro Publica, 10/6/08, emphasis added]

"Financial Crisis Inquiry Commission" Expert Panel Found Wall Street Recklessness Caused The Crisis

Right-wing interests, chiefly the U.S. Chamber of Commerce, have claimed the FCIC's report is biased. Political Correction debunked those claims when the report was released. Read our full fact check of that claim.

Bipartisan Financial Crisis Inquiry Commission Found The Financial Crisis Was Avoidable, Caused By Recklessness On Wall Street. From the Huffington Post: "In a report released today, the Financial Crisis Inquiry Commission found that 'reckless' Wall Street firms, an abundance of cheap credit and 'weak' federal regulators caused the crisis. 'This financial crisis could have been avoided. Let us be clear,' chairman Phil Angelides said at the Washington press conference marking the official release of the report. 'The record is replete with evidence of failures. None of what happened was an act of God.' Former California treasurer Angelides confirmed that the bipartisan panel appointed by Congress to investigate the financial crisis concluded that several financial industry figures appear to have broken the law and has referred multiple cases to state or federal authorities for potential prosecution. The report also revealed that Goldman Sachs collected $2.9 billion from the American International Group as payout on a speculative trade it placed for the benefit of its own account, receiving the bulk of those funds after AIG received an enormous taxpayer rescue, according to the FCIC." [Huffington Post, 1/27/11]

All Four Republican Commissioners Of The Financial Crisis Inquiry Commission Voted To Ban Words Like "Wall Street" And "Shadow Banking" From The Report On The Financial Crisis. As the Huffington Post reported: "During a private commission meeting last week, all four Republicans voted in favor of banning the phrases 'Wall Street' and 'shadow banking' and the words 'interconnection" and 'deregulation' from the panel's final report, according to a person familiar with the matter and confirmed by Brooksley E. Born, one of the six commissioners who voted against the proposal." [Huffington Post, 12/15/10]

- Terms Republicans Wanted To Ban Refer To Wall Street's Unsupervised, Risky, Interdependent Way Of Managing Housing-Related Financial Instruments Ahead Of Crisis. From the Huffington Post: "The shadow banking system refers to the part of the financial system in which investors and other nonbanks like hedge funds and investment firms provide credit to borrowers, as opposed to more traditional banks. Interconnection refers to the links that bind financial institutions to one another, like derivatives, borrowings, and investments. 'I certainly felt, and I think the majority of the commission felt, that deleting those phrases would impair the commissioners' ability to give a full and fair and understandable report to the American people about the causes of the financial crisis,' [commission member Brooksley] Born said." [Huffington Post,12/15/10]

Republican Commissioners Voted To Ban The Word "Deregulation" From Financial Crisis Inquiry Commission Findings. As reported by Accounting Today: "The four Republican members decided last week to release their own nine-page version of the report, entitled 'Financial Crisis Primer,' through a think tank called the American Action Forum. In the process, they also have effectively disowned the 'final' version of the report that the Democratic-led commission now plans to release in January. They are concerned that the final report will end up putting the blame on Wall Street for the financial crisis, whereas they believe the blame should be placed instead on government-sponsored housing agencies like Fannie Mae and Freddie Mac, and the affordable housing goals of the Clinton and second Bush administrations. The Republican commission members even voted in private to ban phrases like 'Wall Street,' 'shadow banking,' 'interconnection,' 'deregulation,' 'magic,' and 'alchemy' from the final report." [Accounting Today, 12/21/10, emphasis added]

[back to top]

Author Of Top Book On Financial Crisis Says There Is No Evidence For Blaming Either The CRA Or Fannie And Freddie

"Bailout Nation" By Barry Ritholtz Was Named Among The "Best Business Books To Make Sense Of [The] Financial Crisis" By USA Today. [USA Today, 12/24/09]

Ritholtz Blames Deregulation, Weakened SEC Funding, And Wall Street Practices, But "Could Find No Evidence That [The CRA Was] A Cause Or Even A Minor Factor." From Barry Ritholtz, who wrote the book Bailout Nation about the housing bubble and ensuing financial crisis:

When writing Bailout Nation, I tried to steer clear of partisan finger pointing. I kept the focus on what actually occurred, what could be proven mathematically. I blamed Democrats and Republicans - not equally, but in proportion to their actions, and what they did. Unsupported theories, tenuous connection, loose affiliations were not part of the analysis.

To be blameworthy, every legislative change, each regulatory failure, any corporate action had to manifest themselves in actual mathematical proof. This led me to ascertain the following 30 year sequence:

-Free market absolutism becomes the dominant intellectual thought.

-Deregulation of markets, investment houses, and banks becomes a broad goal: This led to Glass Steagall repeal, unfettering of Derivatives, Investing house leverage exemptions, and a new breed of unregulated non bank lenders.

-Legislative actions reduce or eliminate much of the regulatory oversight; SEC funding is weakened.

-Rates come down to absurd levels.

-Bond managers madly scramble for yield.

-Derivatives, non-bank lending, leverage, bank size, compensation levels all run away from prior levels.

-Wall Street securitizes whatever it can to satisfy the demand for higher yields.

-"Lend to securitize" nonbank mortgage writers sell enormous amounts of subprime loans to Wall Street for this purpose.

-To meet this huge demand, non bank lenders collapse lending standards (banks eventually follow), leading to a credit bubble.

-The Fed approves of this "innovation," ignores risks.

-Housing booms . . . then busts

-Credit freezes, the markets collapse, a new recession begins.

You will note that the CRA is not part of this sequence. I could find no evidence that they were a cause or even a minor factor. If they were, the housing bubbles would not have been in California or S. Florida or Las Vegas or Arizona - Harlem and South Philly and parts of Chicago and Washington DC would have been the focus of RE bubbles. [The Big Picture, 5/13/10, emphasis added]

Ritholtz: "I Have Called Them 'Phoney And Fraudy'" But "Even I Cannot Reconcile Reality With The Movement To" Blame The Crisis On Fannie And Freddie. From Barry Ritholtz' blog The Big Picture: "Nor do I blame Fannie and Freddie. Now understand, there is no love lost between myself and the GSEs. For years, I have called them 'Phoney and Fraudy.' Since George Bush and Hank Paulson nationalized them, I have accused the government of using these two as a backdoor bailout for banks - a hidden PPIP/TARP used to buy all the garbage mortgages that banks are desperate to get off their balance sheets. Longtime readers will recall we very publicly shorted Fannie based upon their fraudulent practices and horrific balance sheet when FNM's stock was in the $40s (it soon after collapsed). But even I cannot reconcile reality with the movement to place all of the world's troubles at the feet of the GSEs. Not, at least, according to the data." [The Big Picture, 5/13/10, emphasis added]

To be blameworthy, every legislative change, each regulatory failure, any corporate action had to manifest themselves in actual mathematical proof. This led me to ascertain the following 30 year sequence:

-Free market absolutism becomes the dominant intellectual thought.

-Deregulation of markets, investment houses, and banks becomes a broad goal: This led to Glass Steagall repeal, unfettering of Derivatives, Investing house leverage exemptions, and a new breed of unregulated non bank lenders.

-Legislative actions reduce or eliminate much of the regulatory oversight; SEC funding is weakened.

-Rates come down to absurd levels.

-Bond managers madly scramble for yield.

-Derivatives, non-bank lending, leverage, bank size, compensation levels all run away from prior levels.

-Wall Street securitizes whatever it can to satisfy the demand for higher yields.

-"Lend to securitize" nonbank mortgage writers sell enormous amounts of subprime loans to Wall Street for this purpose.

-To meet this huge demand, non bank lenders collapse lending standards (banks eventually follow), leading to a credit bubble.

-The Fed approves of this "innovation," ignores risks.

-Housing booms . . . then busts

-Credit freezes, the markets collapse, a new recession begins.

You will note that the CRA is not part of this sequence. I could find no evidence that they were a cause or even a minor factor. If they were, the housing bubbles would not have been in California or S. Florida or Las Vegas or Arizona - Harlem and South Philly and parts of Chicago and Washington DC would have been the focus of RE bubbles. [The Big Picture, 5/13/10, emphasis added]

[McClatchy,

[McClatchy,

Comment