It should be abundantly clear and obvious that the government and Wall Street want nothing more than to keep home prices inflated and are sticking out a giant middle finger to the majority of Americans. You might have missed the glorious news that our stunningly cunning Senate decided to reinstate the heightened loan limits for Fannie Mae, Freddie Mac, and the FHA (aka the entire stinking mortgage market). Of course the lobbying arms of the housing industry went gaga for this policy even though it keeps prices further inflated in bubble states like California and New York. Good job politicians, I’m sure the checks from the FIRE industry will come in just in time for the 2012 election! Since our politicians care so deeply about working Americans, they are also examining a push at giving residential visas to foreigners looking to buy at least $500,000 in real estate. Forget about the fact that the median home in the U.S. costs more like $170,000 to $180,000. Then we have the Federal Reserve artificially keeping mortgage rates at historic lows and you hit the trifecta of housing welfare for expensive bubble ridden states while the overall economy falters.

Ever notice how bipartisan hammering the savers is. Two party system my ass . . .

Senate sells out again to the FIRE industry

Showing that the Republicans and Democrats are largely two sides of the same soiled coin, the Senate went off the reservation and reinstated the higher loan limits:

Success of bailouts? How about $7 trillion in lost real estate equity and 3 million foreclosures

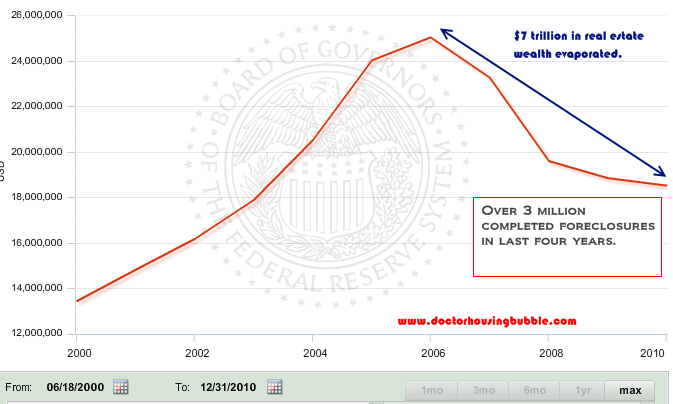

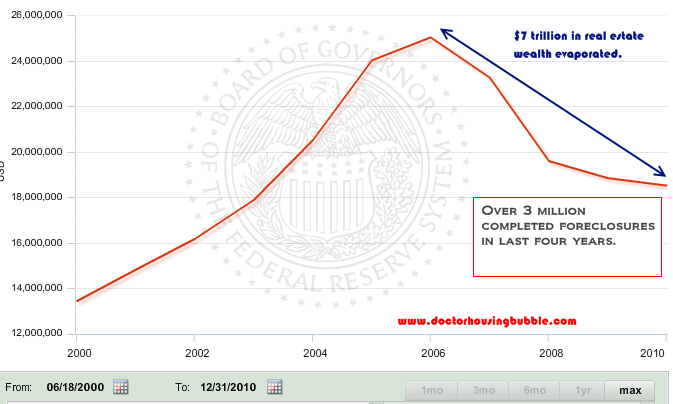

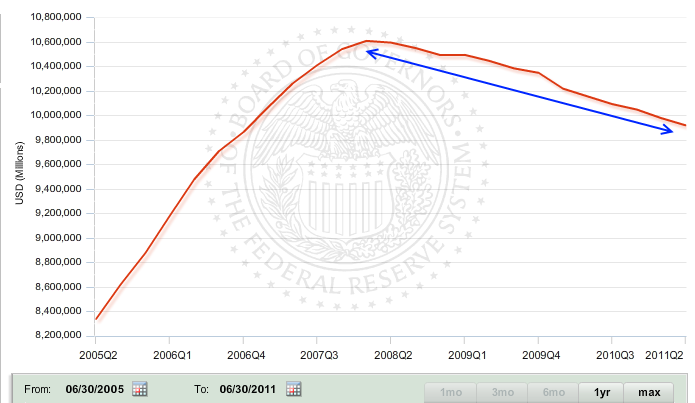

After trillions of dollars in bailouts this is what most home owners have to show for it:

Since the housing bubble popped some $7 trillion in real estate wealth has evaporated. Part of this is a reflection that many potential buyers can only afford lower priced homes but also a reflection of the bubble bursting. So why in the world are we passing higher loan limits of $729,750 when the typical household makes $50,000 a year in the U.S.? Never mind that tiny detail, since the crash hit over 3 million foreclosures have concluded and this is in spite of banks creating a shadow inventory of between 4 and 6 million properties. It is also the case that banks are dragging their feet on higher priced properties.

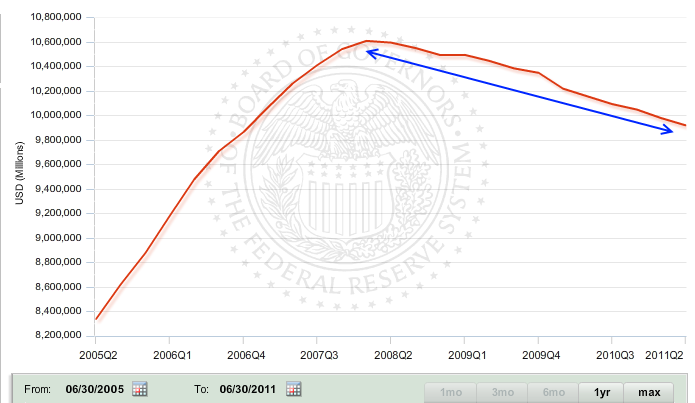

The pretending is going on with the mortgage side of the equation:

While the $7 trillion drop represents a fall of close to 30 percent from the peak in equity, mortgage debt has decline by roughly 5 percent. In other words the game of pretend continues.

More bi-partisan selling out for wealthy foreigners

Picture this, we are in the late 1800s and early 1900s and millions are immigrating through Ellis Island. The only difference is that we are now checking to see who is coming in with suitcases full of dollars. We have another bi-partisan sham job at hand here:

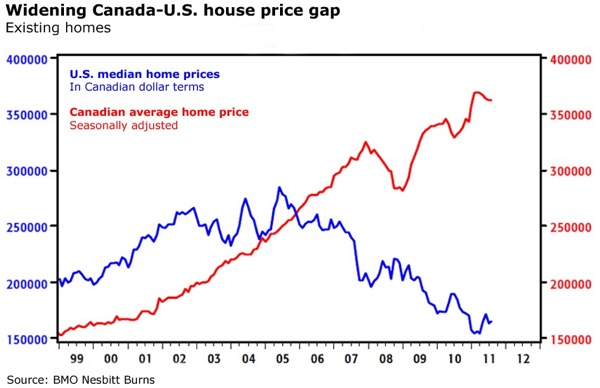

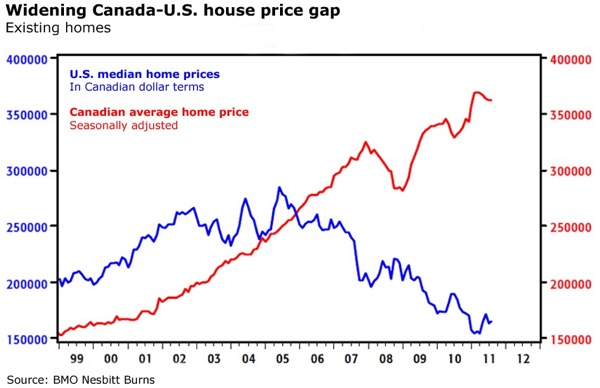

If you really want to see what happens when you do a boneheaded policy like this just look to our neighbors in the north:

Source: The Globe

Here is an interesting on the ground perspective in regards to purchases in Canada:

http://www.doctorhousingbubble.com/t...rates-lower-t/

Ever notice how bipartisan hammering the savers is. Two party system my ass . . .

Senate sells out again to the FIRE industry

Showing that the Republicans and Democrats are largely two sides of the same soiled coin, the Senate went off the reservation and reinstated the higher loan limits:

“(Housing Wire) The Senate voted 60-38 Thursday night to reinstall the elevated conforming loan limits on mortgages guaranteed by the government.

The higher limits expired Sept. 30. Sens. Johnny Isakson (R-Ga.) and Robert Menendez (D-N.J.) introduced an amendment to H.R. 2112, a minibus spending bill. The Senate approved the amendment Thursday, and the Senate will take up the full bill after the recess, according to Isakson’s office.”

Only recently the Federal Reserve, the same folks pumping up this bubble found that allowing the loan limit to drop would only impact 1.3 percent of all purchases! Do you really need any more information as to who the government is really working for? At this point, the financial industry has the government in a deep capture that is simply amazing. The fact that this was passed on a 60-38 vote margin shows how bought out the Senate really is.The higher limits expired Sept. 30. Sens. Johnny Isakson (R-Ga.) and Robert Menendez (D-N.J.) introduced an amendment to H.R. 2112, a minibus spending bill. The Senate approved the amendment Thursday, and the Senate will take up the full bill after the recess, according to Isakson’s office.”

Success of bailouts? How about $7 trillion in lost real estate equity and 3 million foreclosures

After trillions of dollars in bailouts this is what most home owners have to show for it:

Since the housing bubble popped some $7 trillion in real estate wealth has evaporated. Part of this is a reflection that many potential buyers can only afford lower priced homes but also a reflection of the bubble bursting. So why in the world are we passing higher loan limits of $729,750 when the typical household makes $50,000 a year in the U.S.? Never mind that tiny detail, since the crash hit over 3 million foreclosures have concluded and this is in spite of banks creating a shadow inventory of between 4 and 6 million properties. It is also the case that banks are dragging their feet on higher priced properties.

The pretending is going on with the mortgage side of the equation:

While the $7 trillion drop represents a fall of close to 30 percent from the peak in equity, mortgage debt has decline by roughly 5 percent. In other words the game of pretend continues.

More bi-partisan selling out for wealthy foreigners

Picture this, we are in the late 1800s and early 1900s and millions are immigrating through Ellis Island. The only difference is that we are now checking to see who is coming in with suitcases full of dollars. We have another bi-partisan sham job at hand here:

“Times Union — Sen. Chuck Schumer is proposing a bill that would grant three-year residential visas to foreign nationals who buy homes in the United States.

The Democratic New York senator describes his bill, which is co-sponsored by Sen. Mike Lee, a Republican from Utah, as a way to help the sluggish housing market by boosting demand. Foreign nationals would have to spend at least $500,000 on residential real estate, including at least $250,000 for a primary residence.

“Our housing market will never begin a true recovery as long as our housing stock so greatly exceeds demand,” Schumer said, adding that the effort “won’t cost the government a nickel.”

There would be plenty of demand if the government and banks wouldn’t keep prices artificially high! Instead of these sell outs working for their banking masters why don’t they sit the housing market on the shelf and focus on setting up an environment to create jobs instead of bowing down to their banking overlords? What utter nonsense and I seriously feel like we are in some Alice in Wonderland scenario. This will spur more speculation in bubble markets since I doubt there foreigners are going to flock to Cleveland or Detroit with their suitcases of cash. We have the TSA basically feeling up our citizens and for those with cash we are offering them a golden ticket? What in the world? This is such an absurd policy. What about being smarter and offering visas to scientists and innovators that can actually create jobs for other Americans? Instead we offering more financial shelters for those that can afford it and penalizing local households that will now need to contend with buckets of global money?The Democratic New York senator describes his bill, which is co-sponsored by Sen. Mike Lee, a Republican from Utah, as a way to help the sluggish housing market by boosting demand. Foreign nationals would have to spend at least $500,000 on residential real estate, including at least $250,000 for a primary residence.

“Our housing market will never begin a true recovery as long as our housing stock so greatly exceeds demand,” Schumer said, adding that the effort “won’t cost the government a nickel.”

If you really want to see what happens when you do a boneheaded policy like this just look to our neighbors in the north:

Source: The Globe

Here is an interesting on the ground perspective in regards to purchases in Canada:

“How many are rich foreigners? 20-25%

How many are poor foreigners (i.e. high ration financing)? Zero”

Can anyone from Canada comment on this? I’m curious to hear how this has played out with locals since it definitely looks to be in a bubble and given our sold out government, might also be part of our future.How many are poor foreigners (i.e. high ration financing)? Zero”

http://www.doctorhousingbubble.com/t...rates-lower-t/

Comment