I haven't looked at this in a while, but did so today.

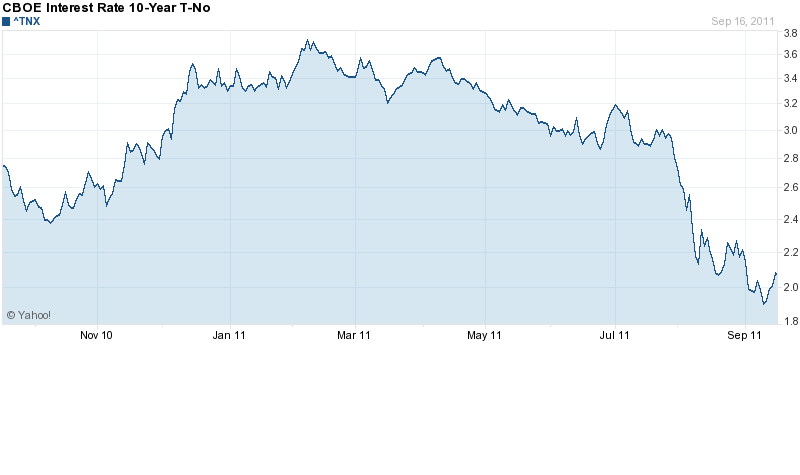

What's interesting is the January 2011 to June 2011 trend (or lack thereof):

For FY 2011 up until July, the total of Treasuries sold is a net of only $26.6 billion.

According to SIFMA: www.sifma.org/govtforecast3q2011/

Net issuance for Q1 and Q2 was a total of $399.93 billion, with another $362 billion net issuance for Q3 2011.

This means the foreign purchases of net Treasury issuance is now under 10% (under 7% in fact, maybe as low as 5%)

Looking further - there is also a shift from short term Treasury bills to longer/long term Treasury bonds, but clearly this shift is isolated to the few nations that are actually buying: principally the UK and Japan.

Of course some will probably argue that this is a short term 7 month anomaly due to Russia, Luxembourg, Caribbean banking centers, and Hong Kong all dumping Treasuries like mad.

What's interesting is the January 2011 to June 2011 trend (or lack thereof):

| Jul | Jun | Month | May | Apr | Mar | Feb | Jan | FY 2011 | Dec | Nov | Oct | Sep | Aug | Jul | |

| Country | 2011 | 2011 | Change | 2011 | 2011 | 2011 | 2011 | 2011 | Change | 2010 | 2010 | 2010 | 2010 | 2010 | 2010 |

| China, Mainland | 1173.5 | 1165.5 | 8 | 1159.8 | 1152.5 | 1144.9 | 1154.1 | 1154.7 | 18.8 | 1160.1 | 1164.1 | 1175.3 | 1151.9 | 1136.8 | 1115.1 |

| Japan | 914.8 | 911 | 3.8 | 912.4 | 906.9 | 907.9 | 890.3 | 885.9 | 28.9 | 882.3 | 875.9 | 873.6 | 860.8 | 832.5 | 817.3 |

| United Kingdom 2/ | 352.5 | 347.8 | 4.7 | 345.1 | 332.5 | 324.6 | 295.7 | 278.1 | 74.4 | 270.4 | 242.5 | 209 | 190.5 | 181 | 107.2 |

| Oil Exporters 3/ | 234.3 | 229.6 | 4.7 | 229.9 | 221.5 | 222.3 | 218.8 | 215.5 | 18.8 | 211.9 | 204.3 | 207.8 | 215.4 | 211.7 | 209.3 |

| Brazil | 210 | 207.1 | 2.9 | 211.4 | 206.9 | 193.5 | 194.3 | 197.6 | 12.4 | 186.1 | 189.8 | 183 | 181 | 170.5 | 167.7 |

| Taiwan | 154.3 | 153.4 | 0.9 | 153.4 | 154.5 | 156.1 | 155.9 | 157.2 | -2.9 | 155.1 | 154.4 | 154.5 | 153.3 | 153.4 | 153.8 |

| Carib Bnkng Ctrs 4/ | 124.5 | 141.7 | -17.2 | 149.7 | 138.4 | 155.2 | 169.8 | 166.9 | -42.4 | 168.4 | 158.8 | 146.3 | 157.8 | 172.8 | 164.3 |

| Hong Kong | 111.9 | 118.4 | -6.5 | 121.9 | 122.4 | 122.1 | 124.6 | 128.1 | -16.2 | 134.2 | 134.9 | 135.2 | 131.9 | 133.9 | 131.2 |

| Switzerland | 108.4 | 108 | 0.4 | 108 | 106.1 | 109.7 | 109.6 | 107.4 | 1 | 106.8 | 106.8 | 107.6 | 110 | 113 | 111.8 |

| Russia | 100.2 | 109.8 | -9.6 | 115.2 | 125.4 | 127.8 | 130.5 | 139.3 | -39.1 | 151 | 167.3 | 176.3 | 173.3 | 173.7 | 175.7 |

| Canada | 83.4 | 81.4 | 2 | 87.8 | 85 | 90.4 | 90 | 84.3 | -0.9 | 75.3 | 75.6 | 66.1 | 56.5 | 44.9 | 43 |

| Thailand | 65.2 | 62.6 | 2.6 | 59.8 | 60.7 | 57.1 | 57.6 | 56.5 | 8.7 | 52 | 52.2 | 52.7 | 50.4 | 47.3 | 40.8 |

| Singapore | 62.9 | 61.7 | 1.2 | 57.5 | 60.3 | 55.7 | 66.7 | 57.8 | 5.1 | 72.9 | 62.2 | 66.4 | 56.7 | 55.4 | 55.3 |

| Luxembourg | 61.4 | 69 | -7.6 | 68.1 | 78.4 | 81.1 | 81 | 83 | -21.6 | 86.4 | 81.9 | 78.5 | 86.1 | 79 | 98.9 |

| Germany | 61.4 | 62 | -0.6 | 61.2 | 61.3 | 59.8 | 58.3 | 61.1 | 0.3 | 60.5 | 58.6 | 58.2 | 57.9 | 56.8 | 55.3 |

| Turkey | 41.9 | 41.9 | 0 | 39.3 | 37.9 | 36.2 | 34.3 | 32.9 | 9 | 28.9 | 29.1 | 27.8 | 27.8 | 29.7 | 26.7 |

| India | 37.9 | 38.9 | -1 | 41 | 42.1 | 39.8 | 40.3 | 40.6 | -2.7 | 40.5 | 39.7 | 40.1 | 40 | 37.9 | 38.4 |

| Ireland | 34.3 | 36.1 | -1.8 | 33.5 | 40.2 | 44 | 42 | 44.4 | -10.1 | 45.8 | 50 | 48.9 | 51.5 | 49.5 | 51.1 |

| Belgium | 31.3 | 33.6 | -2.3 | 31.4 | 31.6 | 32.2 | 32 | 32.1 | -0.8 | 33.2 | 33.4 | 33.4 | 33.8 | 51.9 | 34.3 |

| Korea, South | 29.4 | 29.9 | -0.5 | 32.5 | 30.8 | 32.5 | 31.2 | 31.9 | -2.5 | 36.2 | 39.8 | 39.4 | 38.7 | 39.9 | 37.6 |

| Poland | 29.3 | 28.5 | 0.8 | 27.9 | 27.4 | 28.4 | 27.3 | 26.3 | 3 | 25.5 | 27.2 | 28.8 | 28.4 | 26.6 | 24.8 |

| Mexico | 29.1 | 29.2 | -0.1 | 27.7 | 26.7 | 28.1 | 34.6 | 34.4 | -5.3 | 33.6 | 32.6 | 34.8 | 36.9 | 36.2 | 33.5 |

| Philippines | 24.7 | 22.6 | 2.1 | 23.6 | 23.9 | 23.4 | 22.7 | 22.8 | 1.9 | 20.1 | 19.2 | 18.5 | 18.5 | 19.3 | 20.3 |

| Italy | 24.3 | 23.7 | 0.6 | 25.4 | 24.8 | 24.2 | 24.3 | 24.6 | -0.3 | 23.7 | 23.6 | 23.7 | 24.1 | 23.6 | 23.2 |

| Netherlands | 23.1 | 23.4 | -0.3 | 23.7 | 23.6 | 25.1 | 24.9 | 25.4 | -2.3 | 22.7 | 22.1 | 22 | 23.1 | 25.1 | 24.2 |

| France | 22.5 | 22.4 | 0.1 | 23.6 | 20.3 | 17.7 | 30.2 | 30.2 | -7.7 | 15 | 20.1 | 23.5 | 23.3 | 26.1 | 19.8 |

| Sweden | 21.3 | 21.3 | 0 | 20.9 | 21.4 | 21.3 | 17.7 | 17 | 4.3 | 16.8 | 15.2 | 16.1 | 15.4 | 16.8 | 17.7 |

| Colombia | 20 | 20.1 | -0.1 | 19.9 | 19.8 | 20.2 | 20.1 | 19.8 | 0.2 | 20.2 | 20.3 | 16.7 | 16.3 | 16.5 | 16.4 |

| Chile | 18 | 18.4 | -0.4 | 18.9 | 18.6 | 16.7 | 16 | 15 | 3 | 13.9 | 13.4 | 13.4 | 13 | 13 | 13.1 |

| Norway | 17.6 | 20.4 | -2.8 | 21.1 | 21.1 | 21.4 | 20.8 | 19.4 | -1.8 | 19.6 | 19 | 18 | 18.1 | 17.5 | 16.3 |

| Israel | 17.2 | 18.3 | -1.1 | 19.1 | 19.3 | 18.9 | 19.8 | 19.9 | -2.7 | 20.6 | 20.5 | 17.9 | 17.6 | 16.3 | 17.9 |

| Malaysia | 13.2 | 12 | 1.2 | 12.7 | 12.2 | 11.2 | 11.3 | 11.3 | 1.9 | 11.5 | 11.7 | 11.6 | 11.5 | 11.7 | 11.7 |

| Australia | 13.1 | 13.9 | -0.8 | 12.3 | 13.1 | 10.3 | 12.6 | 14.7 | -1.6 | 14.9 | 14.9 | 15.7 | 18 | 15.5 | 19.2 |

| All Other | 210.8 | 212.1 | -1.3 | 215.7 | 218.7 | 216.3 | 212.7 | 215.4 | -4.6 | 219.2 | 230.5 | 232.1 | 234.8 | 236 | 232.6 |

| Grand Total | 4478 | 4495.6 | -17.6 | 4511.5 | 4486.3 | 4476.2 | 4472.1 | 4451.4 | 26.6 | 4435.6 | 4411.4 | 4373.1 | 4324.2 | 4272 | 4125.5 |

| Of which: | |||||||||||||||

| For. Official | 3237 | 3238.9 | -1.9 | 3240.6 | 3217.6 | 3182.9 | 3193 | 3184 | 53 | 3189.3 | 3212.4 | 3227.9 | 3192.7 | 3142.7 | 3098.8 |

| Treasury Bills | 391.7 | 407.5 | -15.8 | 422.9 | 421.5 | 414.9 | 432.4 | 438.9 | -47.2 | 462.3 | 499.2 | 531.3 | 495.4 | 486.9 | 473.5 |

| T-Bonds & Notes | 2845.3 | 2831.4 | 13.9 | 2817.7 | 2796.1 | 2768 | 2760.6 | 2745.1 | 100.2 | 2727 | 2713.2 | 2696.6 | 2697.3 | 2655.9 | 2625.3 |

According to SIFMA: www.sifma.org/govtforecast3q2011/

Net issuance for Q1 and Q2 was a total of $399.93 billion, with another $362 billion net issuance for Q3 2011.

This means the foreign purchases of net Treasury issuance is now under 10% (under 7% in fact, maybe as low as 5%)

Looking further - there is also a shift from short term Treasury bills to longer/long term Treasury bonds, but clearly this shift is isolated to the few nations that are actually buying: principally the UK and Japan.

Of course some will probably argue that this is a short term 7 month anomaly due to Russia, Luxembourg, Caribbean banking centers, and Hong Kong all dumping Treasuries like mad.

Comment