There was little financial sunshine in the proposed California budget released on Monday. As we have stated before the only way that California was going to start fixing its budget was with cuts and higher taxes. Short of a massive boom throughout the state there has been no magical business sector like technology or real estate that suddenly filled the state coffers. The preliminary budget looks to cut $12.5 billion in spending and seeks to maintain current revenues with a likely ballot measure that will hit in June. There are large implications here and housing is simply one facet of this multi-dimensional puzzle. I find it hard how anyone can view the current California financial environment and somehow think home prices will go up. It defies reason and ultimately home prices will come down in many inflated housing areas that somehow think that the massive state fiscal problems will not impact their tiny city island. Ironically lower home prices will bode well for the majority of the economy since it will free up more disposable income for spending on other goods. First let us look at the California budget and where revenues come from.

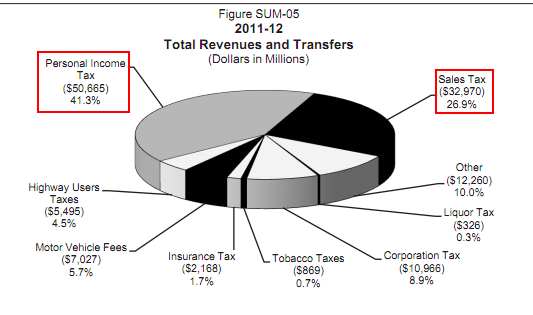

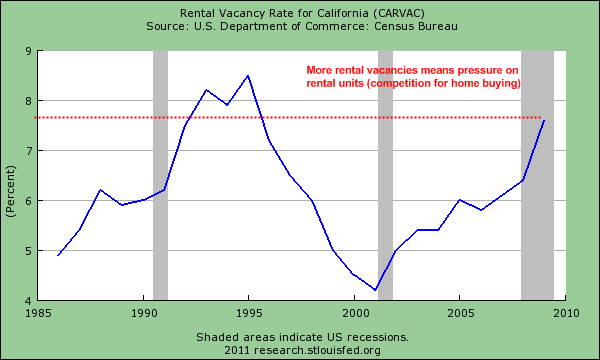

Chart #1 – California Budget

The current state government is coming to terms that we are not going to have any surge in revenues any time soon. So that leaves two options on the table; if we want to keep government as status quo then funding for spending will have to come from somewhere (i.e., taxes). If the people for example vote down the ballot measures in June you can expect more layoffs at the state level. Now in healthier times this probably would not impact the state economy much but right now unemployment is so incredibly high in the state that these are both painful decisions to make. If you look at the above chart you clearly see that over 41 percent of state revenues come from the personal income tax. Now logically you can figure out on your own that with less people working and many working in lower paying jobs that this line item will shrink (and it has).

The second largest line item is from the sales tax. This area accounts for over 26 percent of state revenues. Again in the current financial environment spending has also come down especially with the HELOC machine shutting off in California. These two items make up the bulk of revenues and completely rely on the health of the overall economy.

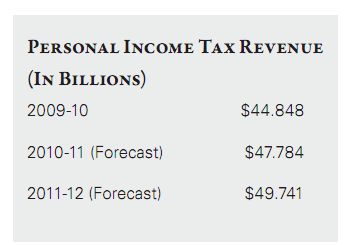

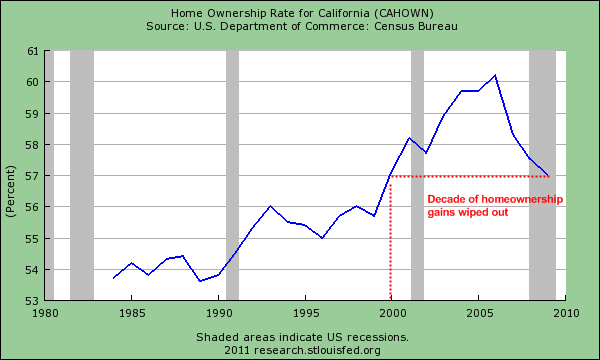

Chart #2 – Personal Income Tax

The above projections have always been much too optimistic and that is why California has always faced reoccurring budget shortfalls. Each year serves as a baseline and rarely allows for any variance in terms of facing a contraction. Now if the state is hauling in money then problems can be plastered over and the tech and real estate bubbles provided this cover for many years. That cover is no longer available.

So you have to wonder where this money is going to come from. You can cut but is there any appetite for additional taxes? We will find out in June when it is put to a vote. Either way much of this does not bode well for the housing market. How can this be seen as positive? If taxes go up then that means less money to spend and if more cuts are made, you shrink an already small pool of home buyers. Basically there are no easy options on the table.

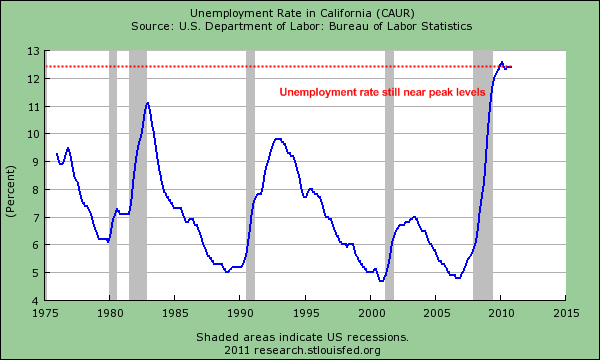

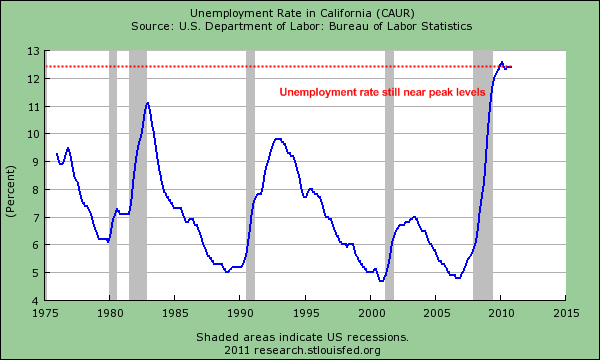

Chart #3 – Unemployment Rate

I’m amazed how little coverage has been given to the California employment market. California is in the midst of the highest unemployment rate since the Great Depression but rarely do you see anyone talking about this. This isn’t some kind of monthly aberration but the unemployment rate has shot off the charts since 2007.

If we really look at the overall depth of this problem, it is much worse. The unemployment and underemployment rate is up to a startling 23 percent. Given the incredible amount of shadow inventory in the state it is very clear that many people massively over extended their budget and really had no ability to pay for their home.

Some of this stuff is leaking out into the anecdotal economy in odd ways. I have seen on many occasions BMWs or Lexus SUVs pulling up to recycling centers with giant black plastic bags of recycled cans and bottles. Now I’m all for recycling but the lines have grown and many wait it out for a long time to cash out. I can assure you that in 2005 and 2006 there was no way you would have seen this. Given the above data things are much worse than people are letting on. Only in California will you see someone in a leased $80,000 car and a studio apartment in a bad part of town.

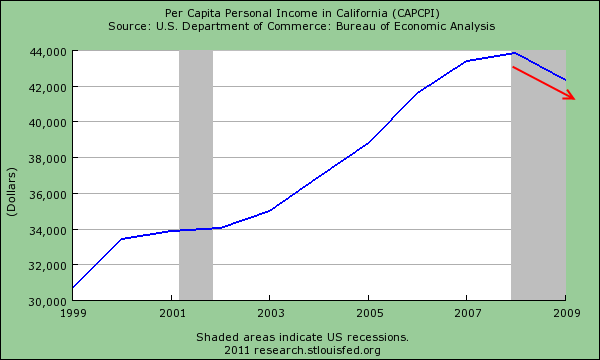

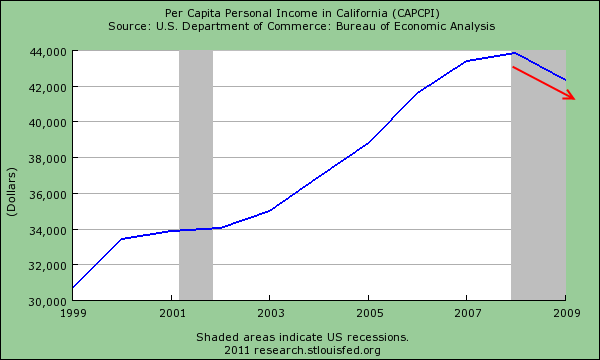

Chart #4 – Per Capita Income

Per capita income has fallen steadily since the recession hit. The latest Census data shows this trend in nominal terms. The above is probably one of the bigger reasons why home prices will continue to fall. If incomes are falling it is likely that home prices will fall as well. The only way home prices go up in this market is bringing back high leverage toxic loans. So far the market seems to have little appetite for being suckered into another giant make believe Ponzi scheme.

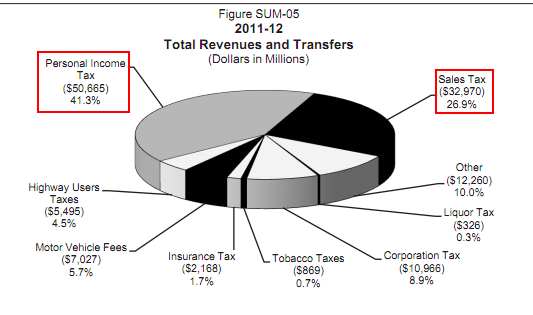

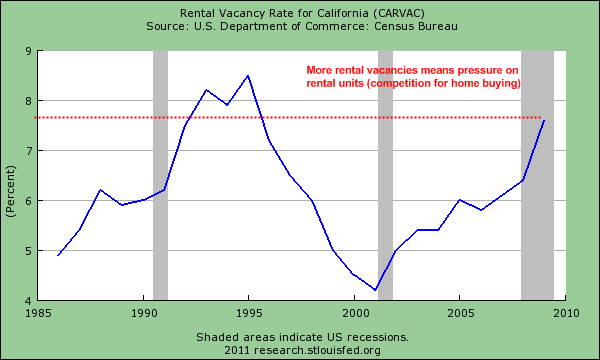

Chart #5 – Rental Vacancy Rate

If it isn’t obvious to you already renting in California is a solid alternative to buying. With the rental vacancy rate at decade highs there are many options for potential renters in this market. The fact that the vacancy rate is high means there are more incentives out there in terms of lower rental prices or more locations so this adds pressure to those on the fence between buying and leasing. As long as certain markets remain inflated inventory will continue to stack up until a slow correction evens out the price discrepancies.

Many younger Californians are also moving back home simply because of the job market. This has actually shrunk the demand for new household formation. More added pressure to the already large amount of inventory lingering. As we have seen in the Inland Empire or Las Vegas low home prices can cause a surge in buying behavior but price reductions have to be substantial.

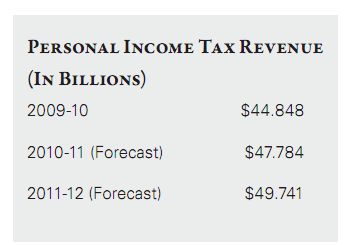

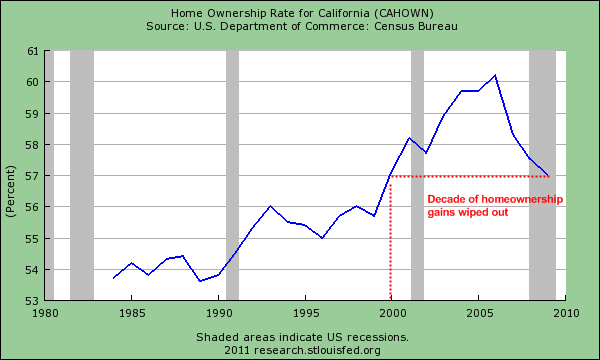

Chart #6 – Homeownership Rate

You know all that homeownership gain we had in the last decade? Well we can pretty much wipe it away for California. We are now back to homeownership levels of 2000 and this is likely to decrease even further given the backlog of distressed properties. Having a high homeownership rate without having a solid and robust economy is like having a nice car shell but having no engine. What is the point? You need something that can actually move and sustain the vehicle in motion (work) and keep it running (a paycheck).

It is a weird feeling looking at the above charts. What was really gained in the last decade in terms of economic progress? Are we better off? If we look at the above in aggregate it seems like we were living in a video game where the ultimate goal was to jump into the McMansion and score a HELOC by refinancing as many times before time ran out. Entire industries were built basically revolving around housing obsession. I remember talking to people who pulled money out of their homes on a yearly ritual as if it were no different than Thanksgiving or Independence Day. It was financial madness. And here we are today with looming deficits as far as the eye can see.

Until we see sustainable and good job growth housing prices will keep going lower. Why in the world will they move up? It defies logic. Many still have a hard time coming to terms that much of all housing price gains in California over the last decade were largely because of a bubble. Strip out the bubble gains and what are you left with?

http://www.doctorhousingbubble.com/c...-state-budget/

Chart #1 – California Budget

The current state government is coming to terms that we are not going to have any surge in revenues any time soon. So that leaves two options on the table; if we want to keep government as status quo then funding for spending will have to come from somewhere (i.e., taxes). If the people for example vote down the ballot measures in June you can expect more layoffs at the state level. Now in healthier times this probably would not impact the state economy much but right now unemployment is so incredibly high in the state that these are both painful decisions to make. If you look at the above chart you clearly see that over 41 percent of state revenues come from the personal income tax. Now logically you can figure out on your own that with less people working and many working in lower paying jobs that this line item will shrink (and it has).

The second largest line item is from the sales tax. This area accounts for over 26 percent of state revenues. Again in the current financial environment spending has also come down especially with the HELOC machine shutting off in California. These two items make up the bulk of revenues and completely rely on the health of the overall economy.

Chart #2 – Personal Income Tax

The above projections have always been much too optimistic and that is why California has always faced reoccurring budget shortfalls. Each year serves as a baseline and rarely allows for any variance in terms of facing a contraction. Now if the state is hauling in money then problems can be plastered over and the tech and real estate bubbles provided this cover for many years. That cover is no longer available.

So you have to wonder where this money is going to come from. You can cut but is there any appetite for additional taxes? We will find out in June when it is put to a vote. Either way much of this does not bode well for the housing market. How can this be seen as positive? If taxes go up then that means less money to spend and if more cuts are made, you shrink an already small pool of home buyers. Basically there are no easy options on the table.

Chart #3 – Unemployment Rate

I’m amazed how little coverage has been given to the California employment market. California is in the midst of the highest unemployment rate since the Great Depression but rarely do you see anyone talking about this. This isn’t some kind of monthly aberration but the unemployment rate has shot off the charts since 2007.

If we really look at the overall depth of this problem, it is much worse. The unemployment and underemployment rate is up to a startling 23 percent. Given the incredible amount of shadow inventory in the state it is very clear that many people massively over extended their budget and really had no ability to pay for their home.

Some of this stuff is leaking out into the anecdotal economy in odd ways. I have seen on many occasions BMWs or Lexus SUVs pulling up to recycling centers with giant black plastic bags of recycled cans and bottles. Now I’m all for recycling but the lines have grown and many wait it out for a long time to cash out. I can assure you that in 2005 and 2006 there was no way you would have seen this. Given the above data things are much worse than people are letting on. Only in California will you see someone in a leased $80,000 car and a studio apartment in a bad part of town.

Chart #4 – Per Capita Income

Per capita income has fallen steadily since the recession hit. The latest Census data shows this trend in nominal terms. The above is probably one of the bigger reasons why home prices will continue to fall. If incomes are falling it is likely that home prices will fall as well. The only way home prices go up in this market is bringing back high leverage toxic loans. So far the market seems to have little appetite for being suckered into another giant make believe Ponzi scheme.

Chart #5 – Rental Vacancy Rate

If it isn’t obvious to you already renting in California is a solid alternative to buying. With the rental vacancy rate at decade highs there are many options for potential renters in this market. The fact that the vacancy rate is high means there are more incentives out there in terms of lower rental prices or more locations so this adds pressure to those on the fence between buying and leasing. As long as certain markets remain inflated inventory will continue to stack up until a slow correction evens out the price discrepancies.

Many younger Californians are also moving back home simply because of the job market. This has actually shrunk the demand for new household formation. More added pressure to the already large amount of inventory lingering. As we have seen in the Inland Empire or Las Vegas low home prices can cause a surge in buying behavior but price reductions have to be substantial.

Chart #6 – Homeownership Rate

You know all that homeownership gain we had in the last decade? Well we can pretty much wipe it away for California. We are now back to homeownership levels of 2000 and this is likely to decrease even further given the backlog of distressed properties. Having a high homeownership rate without having a solid and robust economy is like having a nice car shell but having no engine. What is the point? You need something that can actually move and sustain the vehicle in motion (work) and keep it running (a paycheck).

It is a weird feeling looking at the above charts. What was really gained in the last decade in terms of economic progress? Are we better off? If we look at the above in aggregate it seems like we were living in a video game where the ultimate goal was to jump into the McMansion and score a HELOC by refinancing as many times before time ran out. Entire industries were built basically revolving around housing obsession. I remember talking to people who pulled money out of their homes on a yearly ritual as if it were no different than Thanksgiving or Independence Day. It was financial madness. And here we are today with looming deficits as far as the eye can see.

Until we see sustainable and good job growth housing prices will keep going lower. Why in the world will they move up? It defies logic. Many still have a hard time coming to terms that much of all housing price gains in California over the last decade were largely because of a bubble. Strip out the bubble gains and what are you left with?

http://www.doctorhousingbubble.com/c...-state-budget/

Ahhh , so he was doing a good job but just couldn't keep going. Poor bugger.

Ahhh , so he was doing a good job but just couldn't keep going. Poor bugger.

Comment