A family bungalow in the Los Altos Hills

LOS ALTOS, Calif. — No need for tears, but the well-off are losing their master suites and saying goodbye to their wine cellars.

The housing bust that began among the working class in remote subdivisions and quickly progressed to the suburban middle class is striking the upper class in privileged enclaves like this one in Silicon Valley.

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

By contrast, homeowners with less lavish housing are much more likely to keep writing checks to their lender. About one in 12 mortgages below the million-dollar mark is delinquent.

CoreLogic data suggest that many of the well-to-do are purposely dumping their financially draining properties, just as they would any sour investment.

“The rich are different: they are more ruthless,” said Sam Khater, CoreLogic’s senior economist.

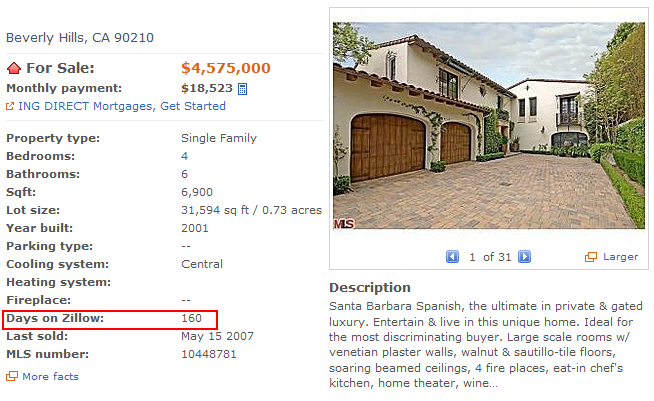

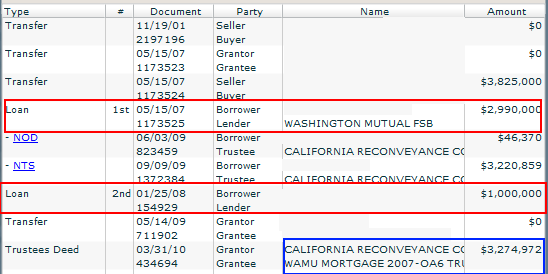

Five properties here in Los Altos were scheduled for foreclosure auctions in a recent issue of The Los Altos Town Crier, the weekly newspaper where local legal notices are posted. Four have unpaid mortgage debt of more than $1 million, with the highest amount $2.8 million.

Not so long ago, said Chris Redden, the paper’s advertising services director, “it was a surprise if we had one foreclosure a month.”

The sheriff in Cook County, Ill., is increasingly in demand to evict foreclosed owners in the upscale suburbs to the north and west of Chicago — like Wilmette, La Grange and Glencoe. The occupants are always gone by the time a deputy gets there, a spokesman said, but just barely.

In Las Vegas, Ken Lowman, a longtime agent for luxury properties, said four of the 11 sales he brokered in June were distressed properties.

“I’ve never seen the wealthy hit like this before,” Mr. Lowman said. “They made their plans based on the best of all possible scenarios — that their incomes would continue to grow, that real estate would never drop. Not many had a plan B.”

The defaulting owners, he said, often remain as long as they can. “They’re in denial,” he said. (actually, Denial had its name changed to Las Vegas years ago...)

Lenders are fearful that many of the 11 million or so homeowners who owe more than their house is worth will walk away from them, especially if the real estate market begins to weaken again. The so-called strategic defaults have become a matter of intense debate in recent months.

Fannie Mae and Freddie Mac, the two quasi-governmental mortgage finance companies that own most of the mortgages in America with a value of less than $500,000, are alternately pleading with distressed homeowners not to be bad citizens and brandishing a stick at them.

In a recent column on Freddie Mac’s Web site, the company’s executive vice president, Don Bisenius, acknowledged that walking away “might well be a good decision for certain borrowers” but argues that those who do it are trashing their communities.

The CoreLogic data suggest that the rich do not seem to have concerns about the civic good uppermost in their mind, especially when it comes to investment and second homes. Nor do they appear to be particularly worried about being sued by their lender or frozen out of future loans by Fannie Mae, possible consequences of default.

The delinquency rate on investment homes where the original mortgage was more than $1 million is now 23 percent. For cheaper investment homes, it is about 10 percent.

“I just decided to let it go, give it back to the bank, I just didn’t feel like it was a good investment.”The housing bust that began among the working class in remote subdivisions and quickly progressed to the suburban middle class is striking the upper class in privileged enclaves like this one in Silicon Valley.

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

By contrast, homeowners with less lavish housing are much more likely to keep writing checks to their lender. About one in 12 mortgages below the million-dollar mark is delinquent.

CoreLogic data suggest that many of the well-to-do are purposely dumping their financially draining properties, just as they would any sour investment.

“The rich are different: they are more ruthless,” said Sam Khater, CoreLogic’s senior economist.

Five properties here in Los Altos were scheduled for foreclosure auctions in a recent issue of The Los Altos Town Crier, the weekly newspaper where local legal notices are posted. Four have unpaid mortgage debt of more than $1 million, with the highest amount $2.8 million.

Not so long ago, said Chris Redden, the paper’s advertising services director, “it was a surprise if we had one foreclosure a month.”

The sheriff in Cook County, Ill., is increasingly in demand to evict foreclosed owners in the upscale suburbs to the north and west of Chicago — like Wilmette, La Grange and Glencoe. The occupants are always gone by the time a deputy gets there, a spokesman said, but just barely.

In Las Vegas, Ken Lowman, a longtime agent for luxury properties, said four of the 11 sales he brokered in June were distressed properties.

“I’ve never seen the wealthy hit like this before,” Mr. Lowman said. “They made their plans based on the best of all possible scenarios — that their incomes would continue to grow, that real estate would never drop. Not many had a plan B.”

The defaulting owners, he said, often remain as long as they can. “They’re in denial,” he said. (actually, Denial had its name changed to Las Vegas years ago...)

Lenders are fearful that many of the 11 million or so homeowners who owe more than their house is worth will walk away from them, especially if the real estate market begins to weaken again. The so-called strategic defaults have become a matter of intense debate in recent months.

Fannie Mae and Freddie Mac, the two quasi-governmental mortgage finance companies that own most of the mortgages in America with a value of less than $500,000, are alternately pleading with distressed homeowners not to be bad citizens and brandishing a stick at them.

In a recent column on Freddie Mac’s Web site, the company’s executive vice president, Don Bisenius, acknowledged that walking away “might well be a good decision for certain borrowers” but argues that those who do it are trashing their communities.

The CoreLogic data suggest that the rich do not seem to have concerns about the civic good uppermost in their mind, especially when it comes to investment and second homes. Nor do they appear to be particularly worried about being sued by their lender or frozen out of future loans by Fannie Mae, possible consequences of default.

The delinquency rate on investment homes where the original mortgage was more than $1 million is now 23 percent. For cheaper investment homes, it is about 10 percent.

With second homes, the delinquency rate for both types of owners was rising in concert until the stock market crashed in September 2008. That sent the percentage of troubled million-dollar loans spiraling up much faster than the smaller loans.

“Those with high net worth have other resources to lean on if they get in trouble,” said Mr. Khater, the analyst. “If they’re going delinquent faster than anyone else, that tells me they are doing so willingly.”

The rich and successful often come naturally to this sort of attitude, said Brent T. White, a law professor at the University of Arizona who has studied strategic defaults.

“They may be less susceptible to the shame and fear-mongering used by the government and the mortgage banking industry to keep underwater homeowners from acting in their financial best interest,” Mr. White said.

In the middle of a workday, one troubled homeowner here leaned over his laptop at the kitchen table, trying to maneuver his way out from under his debt and figure out the next big thing.

His five-bedroom house, drained of hundreds of thousands of dollars of equity over the last 13 years, is scheduled for auction July 20. Nine months ago, after his latest business (he has had several) failed in what he called “the global meltdown,” the man, a technology entrepreneur, said he quit making his $9,000 monthly payments.

“I’m going to be downsizing,” he said.

The man spoke on the condition of anonymity because, he said, he did not want his current problems to interfere with his coming reinvention. “I’m a businessman,” he explained. “I have to be upbeat.”

Comment