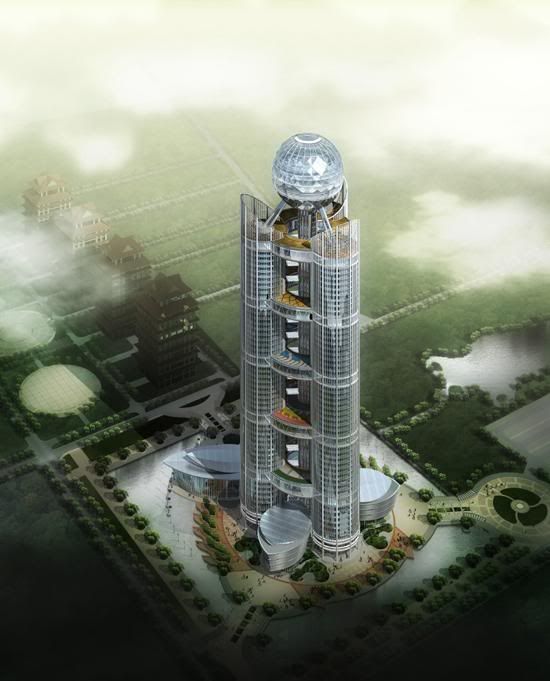

2009's Most Active Global Real Estate Markets

http://www.cnbc.com/id/35676535?slide=1

china $156 billion

hk $9 billion

UK $39 billion

USA $38 billion

Japan $19 billion

Germany $14 billion

France $10 billion

South Korea $10 billion

Australia $7 billion

Taiwan $5 billion

http://www.cnbc.com/id/35676535?slide=1

china $156 billion

hk $9 billion

UK $39 billion

USA $38 billion

Japan $19 billion

Germany $14 billion

France $10 billion

South Korea $10 billion

Australia $7 billion

Taiwan $5 billion

Comment