Originally posted by coolhand

View Post

Some Economyths need to busted. Wal Mart clocked $264 Billion in US sales in 2012. The US economy was more than $15 Trillion.

From the Federal Reserve Bank of San Francisco (full study available at the link):

The U.S. Content of “Made in China”

Galina Hale and Bart Hobijn

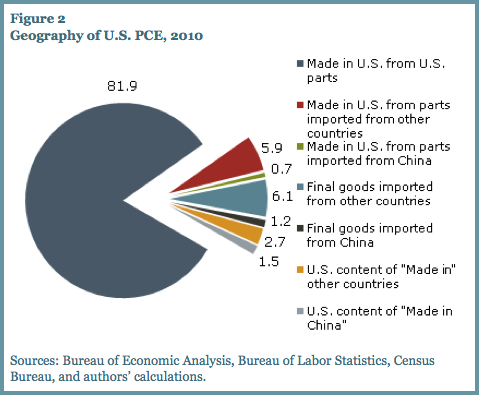

Goods and services from China accounted for only 2.7% of U.S. personal consumption expenditures in 2010, of which less than half reflected the actual costs of Chinese imports. The rest went to U.S. businesses and workers transporting, selling, and marketing goods carrying the “Made in China” label. Although the fraction is higher when the imported content of goods made in the United States is considered, Chinese imports still make up only a small share of total U.S. consumer spending. This suggests that Chinese inflation will have little direct effect on U.S. consumer prices.

Originally posted by coolhand

View Post

Leave a comment: