Re: Next Wall Street surprise: More bad employment news

I read on FinancialSense.com that the employment numbers on manufacturing continued to plummet, but were somewhat contradicted by an increase in hourly payroll.

Now I may not be the sharpest tack in the toolshed, but doesn't increased uninemployment in a sector tend to lower wages as there are more workers available?

And why doesn't the media see this? I wonder when the total disconnect (gubment numbers vs. day-to-day experience) becomes apparent to the general public.

Announcement

Collapse

No announcement yet.

Next Wall Street surprise: More bad employment news

Collapse

X

-

Re: Next Wall Street surprise: More bad employment news

It's not just China that has a serious concern. Excerpts from two ArabianBusiness articles. (Kuwait had a history making mother-of-all-stock-market-bubbles back in 1980. After it burst it took the country years to get the economy sorted. Investment bankers and brokers still talk about it today.)Originally posted by touchring View PostInflation affects a chinese several times more than an American. Many Chinese families spend 1/4 to 1/2 (for poor) of their income on food. Imagine if food cost doubles! This is no laughing matter. The monks in Burma went out to the streets because of inflation, the Chinese government is very worried and watching... If inflation continues at the same rate, trouble may break out before the Beijing Olympics.

Saudi king demands inflation answers

by Reuters on Sunday, 07 October 2007

Saudi Arabia's King Abdullah has summoned the interior minister and provincial governors to explain rising inflation, which hit a seven-year high in August, Saudi media reported.

The king asked for "prompt reports" at the last weekly government meeting on Monday, Interior Minister Prince Nayef bin Abdul-Aziz said in remarks published on Thursday and Friday.

Inflation in August was 4.4% from a year earlier, driven mainly by a record 12.1% jump in rents and a 6.6% rise in prices of food products, according to data released this week.

The data raised pressure on the central bank which is torn between the need to contain prices and avoid appreciation of its dollar-pegged currency.

Inflation is rising across the Gulf Arab region. In May Kuwait broke ranks with its neighbours and dropped its peg to the dollar, saying the US currency's decline was making imports more expensive and fuelling inflation.

Kuwait unleashes anti-inflation policies

Kuwait said on Thursday it would clamp down on price gougers after lawmakers called on the government to take action against inflation fuelled by food and rent costs in the Gulf Arab state.

Trade & Industry Minister Falah Fahd al-Hajeri told reporters in parliament the government would increase price controls and take legal action against price gouging.

"We are ready to deal with parliament on this issue. We will intensify price controls and refer anybody who raises prices in an unjustified way to the prosecution," Hajeri said after a meeting of parliament's financial committee.

The government said last month it would investigate a jump in property prices after housing costs surged in July. On average, the value of real estate sales gained 67 percent in the first eight months of 2007, according to National Bank of Kuwait.Last edited by GRG55; October 07, 2007, 06:13 AM.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

Inflation affects a chinese several times more than an American. Many Chinese families spend 1/4 to 1/2 (for poor) of their income on food. Imagine if food cost doubles! This is no laughing matter. The monks in Burma went out to the streets because of inflation, the Chinese government is very worried and watching... If inflation continues at the same rate, trouble may break out before the Beijing Olympics.

Originally posted by EJ View Posthttp://www.itulip.com/forums/showthr...7184#post17184

I don' see why the Chinese don't just carve food and rent out of their CPI like we do.

Just kidding. Good point.

Also, combine all we've read about suppressed inflation data with this analysis by Dave Lewis and the elimination of M3 and even someone as skeptical of conspiracy theories as I am starts to see a system that allows inflation to build for a very long time before it has to be dealt with.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

EJ: Since Volker's summary beheading of the economy at the beginning of the 1980's, I do not recall a single example where the Administration and the Fed did not take the "short term economic reprieve" over a (potentially) superior long term outcome. What the Fed and other key FIRE economy participants are doing right now seems perfectly consistent with iTulip anticipations. Am I overlooking something?Originally posted by EJ View PostWe may have underestimated the willingness of the Fed and Congress to delay long term economic pain for a short term economic reprieve. These efforts may be able to delay recession, but not avoid it. Before calling a delay from the current quarter to, say, Q1 2008 we need to dig into other numbers besides the Labor Department's.

Even Ka-Poom theory suggests multiple long periods of inflation, interjected with comparatively brief periods of dis-inflation. Certainly the experience since WWII has been pretty relentless debasement of the purchasing power of the currency over the generations...Originally posted by EJ View PostI don' see why the Chinese don't just carve food and rent out of their CPI like we do.

Just kidding. Good point.

Also, combine all we've read about suppressed inflation data with this analysis by Dave Lewis and the elimination of M3 and even someone as skeptical of conspiracy theories as I am starts to see a system that allows inflation to build for a very long time before it has to be dealt with.Last edited by GRG55; October 06, 2007, 10:44 AM.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

Wouldn't take much engineering either. Certainly easier than finding a non-recessionary solution.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

Well if it is a deal with the GOP instead of the Democrats, then Bernanke really is a gamblin' man. :eek:Originally posted by Andreuccio View PostCould the Fed, perhaps, be trying to delay it long enough to get through the next election cycle? Is it possible the Fed's deal this time is not with a Clinton but with a Bush? Just a thought.

If he wants to be renominated for another term, certainly Bush won't be able to help, and likely neither will the GOP candidate.

The polls suggest it's going to be a Democrat president in the Oval Office when that decision next comes around. You would think Bernanke would be as smart as his predecessor and cater to a Clinton. I'm sure a little engineered recession about now would do wonders for her campaign.

Leave a comment:

-

Re: Payroll employment projection post-mortem

what happened just before the 2001 recession? a sudden "revision" of numbers. folks, it's garbage. a revision on this scale can only mean either that we are headed into recession very soon or are already in one.Originally posted by SSmith View PostWhy are the Labor Department reports on wages so often good, while the less frequent Census Bureau reports on wages are always grim? Or is my impression wrong?

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

Could the Fed, perhaps, be trying to delay it long enough to get through the next election cycle? Is it possible the Fed's deal this time is not with a Clinton but with a Bush? Just a thought.Originally posted by EJ View PostWe may have underestimated the willingness of the Fed and Congress to delay long term economic pain for a short term economic reprieve. These efforts may be able to delay recession, but not avoid it. Before calling a delay from the current quarter to, say, Q1 2008 we need to dig into other numbers besides the Labor Department's.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

http://www.itulip.com/forums/showthr...7184#post17184I don' see why the Chinese don't just carve food and rent out of their CPI like we do.Originally posted by touchring View PostIf not 1Q2008, definitely by end of 2008.

Even China will be in by trouble then, what's there left to drive global demand? Even as we speak, inflation is double digit in major chinese cities. Chinese businesses operate on very thin margins due to overcapacity, the cost is driving businessmen crazy - they are now cheating on everything to save even one or two cents on every product.

Asian economies are overheating very badly, costs soaring, you are looking at double digit increase in rent, food, cost in just the last 3 months or so! Yes, 3 mths, not even 1 year!

Just kidding. Good point.

Also, combine all we've read about suppressed inflation data with this analysis by Dave Lewis and the elimination of M3 and even someone as skeptical of conspiracy theories as I am starts to see a system that allows inflation to build for a very long time before it has to be dealt with.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

If not 1Q2008, definitely by end of 2008.

Even China will be in by trouble then, what's there left to drive global demand? Even as we speak, inflation is double digit in major chinese cities. Chinese businesses operate on very thin margins due to overcapacity, the cost is driving businessmen crazy - they are now cheating on everything to save even one or two cents on every product.

Asian economies are overheating very badly, costs soaring, you are looking at double digit increase in rent, food, cost in just the last 3 months or so! Yes, 3 mths, not even 1 year!

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

We may have underestimated the willingness of the Fed and Congress to delay long term economic pain for a short term economic reprieve. These efforts may be able to delay recession, but not avoid it. Before calling a delay from the current quarter to, say, Q1 2008 we need to dig into other numbers besides the Labor Department's.Originally posted by jk View Postemphasis added

ej, are you retracting your recession prediction? and if so, do you think it's possible we saw the bottom for equities on 8/16?

Leave a comment:

-

Re: Payroll employment projection post-mortem

Why are the Labor Department reports on wages so often good, while the less frequent Census Bureau reports on wages are always grim? Or is my impression wrong?

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

emphasis addedOriginally posted by ejAt 22 million, total government employment is now at parity with the goods producing sector.

There is little reason to believe that the Banana Republicization of America will not continue. As long as it does, the US may be able to avoid recession.

ej, are you retracting your recession prediction? and if so, do you think it's possible we saw the bottom for equities on 8/16?

Leave a comment:

-

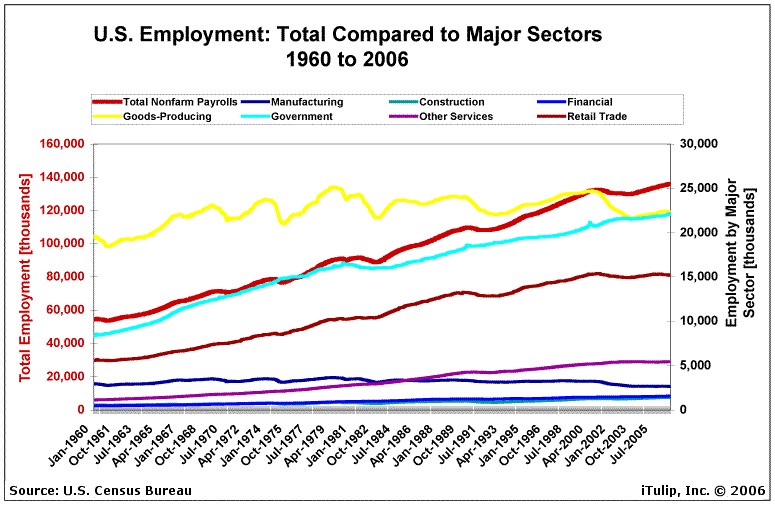

Payroll employment projection post-mortem

We dig into the Labor Department's numbers to see where all these jobs came from, but the fact is that our projection was wrong.

The good news: unemployment is only slightly up. The bad news: the Banana Republicization of America is proceeding apace.Payrolls Pick Up by 110,000 but Not Enough to Stop Jobless Rate From Rising to 4.7 PercentThe magic of a depreciating currency is working. Foreign investors are buying US stocks and other assets at fire sale prices. Tourism is up as visitors from Asia, Europe, Canada and all other countries whose currencies have appreciated against the US$ flock to visit the US for a cheap United Banana Republic States of America vacation, driving leisure and hospitality jobs within the service sector where most of the job growth occurred.

The new job market snapshot released by the Labor Department on Friday showed that employers boosted payrolls by 110,000, the most in one month since last May. In an encouraging note, the economy actually added 89,000 jobs in August. That marked an improvement from the net loss of 4,000 that the government first estimated.

To be sure, the ill effects of these problems are showing up at some companies. Construction firms cut 14,000 jobs in September, Factories slashed 18,000. Retailers got rid of just over 5,000 jobs. Financial services companies eliminated 14,000 slots.

However, gains in education and health services, professional services, leisure and hospitality, and in government work more than offset those losses, leading to a net gain in new jobs in September.

Like all banana republics, the government of the United Banana Republic States of America is employing more and more of its citizens as private sectors–especially the goods producing sector–of the economy shrink.

The payroll numbers today extend a trend that started with post 2000 stock market crash re-inflation policies. Of 140 million jobs in the US economy, approximately 50 million, or 36%, are in the goods producing, construction, and manufacturing sectors. The rest are in finance, retail, services, or government. At 22 million, total government employment is now at parity with the goods producing sector.

There is little reason to believe that the Banana Republicization of America will not continue. As long as it does, the US may be able to avoid recession.

But there is one fly in the tropical rum drink. Today's labor department report also showed: "Wages, meanwhile, rose solidly."

Suppression of wage increases has been the centerpiece of monetary and government policy to manage inflation in the Production/Consumption Economy since 1980. Given the difficulty in acquiring legitimate measures of actual inflation rates in the US economy, there is no way of telling whether these wage increases translate into increased purchasing power. Given the rise of oil and other commodity prices, it seems doubtful. In fact, it looks like the US is going full-bore banana republic, including wage and price inflation to maintain employment going into an election year.Last edited by FRED; October 05, 2007, 01:08 PM.

Leave a comment:

-

Re: Next Wall Street surprise: More bad employment news

Mmmmm. Yummy.Originally posted by Fred View PostThat's not a ash tray. Those are little bread sticks.

Leave a comment:

Leave a comment: