Risk Tsunami Over?

We're still officially on vacation but thought we'd drop in with a report to note the ho-hum news of the day that Four Major Banks Borrow From Fed and Mortgage Job Losses Surpass 40,000. The 145 point DOW crash up was welcomed today in the context of short term treasury and muni yield sea level not moving much compared to the tsunami type moves of 100% over a few days that we've seen recently.

Whew! What a relief!

The analogy I offered some time ago to explain both the circumstances we were experiencing then and what was likely coming was that the recent ultra low risk premium period, which Grantham noted as an inverted risk curve, is like the period before a tsunami when the ocean is sucked away from shore. For investors who don't understand risk tsunamis it was a time to run down to what was previously the ocean floor and pick up the fish flopping there. Easy fishing in the hot sun. For anyone who understood what the inverted risk curve held in store, it was a time to head for higher ground.

We were on another Goldman client call this AM. The topic: what is the meaning of the credit market contagion to money market funds and muni bonds? They took an hour to carefully and cogently make the case that the credit market correction is technical, not fundamental. I'll write it up in further detail for subscribers tomorrow but in summary they said everything will soon return to normal–unless (here's the out) the housing market pushes the US economy into recession.

They remarked on the yield on short term treasuries changing by a factor of two in a few days, an unheard of rate of change. Munis decoupled from treasuries–highly unusual–but in the past few days things have at least stopped getting worse. We were contacted by a firm in NYC today that is in the secondary CDO market who indicated that the market appears to be starting to function again. So, more evidence of at least a bounce in confidence.

From here there are two possibilities. Either the risk tsunami has already come in and drown all the poor souls it was going to drown, or it's still pouring into the system and causing damage that no one sees or understands yet. Time will tell. We will continue to collect evidence and report our conclusions, we hope in time for the information to be useful.

On the question is Wall Street getting bailed out or not, Allan Sloan, Fortune senior editor-at-large, weighs in with Why does Wall Street always get bailed out?

Wall Street loves to talk about letting financial markets weed out the weak. But when the Street itself gets in trouble, it sticks out its little tin cup, asking for help. And gets it.

The subprime-mortgage-market meltdown is a classic example of the way small fry get devoured, but the whales of Wall Street get rescued. Here's the deal: People with crummy credit who took out mortgages are being allowed to fail in record numbers. The mortgage companies that made those loans are being allowed to fail.

The Street itself? It's bailout city. Even before the Fed made a symbolic half-point cut in the discount rate, it and other central banks from Switzerland to Singapore were trying to rescue the Street by injecting hundreds of billions of dollars into the financial markets and announcing they will put up more, if needed.

Hello? If you believe in markets - which I do - this rescue is especially galling, because Wall Street enabled this mess in the first place. How so? By happily sucking up hundreds of billions of dollars' worth of suspect mortgages from marginal U.S. borrowers-and begging mortgage makers to create more of them. The Street sliced and diced this financial toxic waste into a variety of esoteric securities, making a nice markup when it sold them and generating a continuing stream of profits when it made markets in them.

Oh, the irony. Oh, the corruption. Voters might confront the source of the problem in the next election, but I won't hold my breath. The subprime-mortgage-market meltdown is a classic example of the way small fry get devoured, but the whales of Wall Street get rescued. Here's the deal: People with crummy credit who took out mortgages are being allowed to fail in record numbers. The mortgage companies that made those loans are being allowed to fail.

The Street itself? It's bailout city. Even before the Fed made a symbolic half-point cut in the discount rate, it and other central banks from Switzerland to Singapore were trying to rescue the Street by injecting hundreds of billions of dollars into the financial markets and announcing they will put up more, if needed.

Hello? If you believe in markets - which I do - this rescue is especially galling, because Wall Street enabled this mess in the first place. How so? By happily sucking up hundreds of billions of dollars' worth of suspect mortgages from marginal U.S. borrowers-and begging mortgage makers to create more of them. The Street sliced and diced this financial toxic waste into a variety of esoteric securities, making a nice markup when it sold them and generating a continuing stream of profits when it made markets in them.

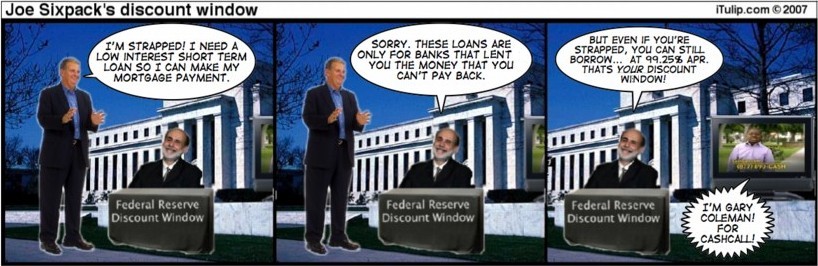

Meanwhile, if you're strapped for cash, you can always tap the consumer's retail "discount" window.

Comment