Originally posted by astonas

View Post

Announcement

Collapse

No announcement yet.

The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Collapse

X

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

The weekly data from 1986-2013 provided me with 1,458 observations. A quick way to see if there is serial correlation (a bad thing) is by looking at the Durbin-Watson statistic. Considering it was within the acceptable thresholds of 1.4 - 2.6 (1.95) I would assume conducting the Granger causality test would be appropriate.

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Just to be clear, I wasn't referring to stocks or any other commodities, or to the kind of futures analysis the Gorton paper does. (And sorry for my typo on the name "Granger", btw., doubly so if that caused this confusion.Originally posted by patrikkorda View PostDear astonas,

Thank you for bringing this up. I may end up conducting Ganger Causality analysis. However, some years ago I read Hot Commodities by Jim Rogers where he alluded to this working paper which shows that (1) stocks and commodities are negatively correlated and (2) commodity bull markets tend to last 18 years on average. While I do feel that EJ is absolutely correct in his assertion that gold has a special place at the core of the IMS, I wouldn't be surprised if other commodities tend follow oil just as well as does gold.

The Granger Causality test simply makes a considerably stronger assertion about the relationship between two time series than a mere correlation function does. It doesn't necessarily relate any additional series to the initial two.

Rather than merely stating that two numerical values "move together", it allows one to indicate which is likely to be the driver of the relationship, and which the follower. In other words: "Does the price of oil drive the price of gold, is it the other way around, or do both simply move (on average) simultaneously, perhaps due to some other cause, like international political events?" The reason a dense information set is required is that the data needs to be analyzed for offsets on the order of (and preferably smaller than) the time it takes for the effects in one marketplace to propagate to the other. Since I'm not certain that there is a time frame that is obvious as the characteristic response time, I was really asking if you think, after having pored over the data for a while in writing your paper, that the weekly data set you used is conducive to conducting a Granger Analysis.

I know that the only way to be sure is to run the computation on increasingly dense sets until there is no longer a discernible frequency effect, but that can take a lot of time, and sometimes one can get an intuition after spending enough time working with a data set for a publication. What is your intuition on the weekly data? Is it worth trying a Granger run, or would you guess more frequent data is likely to be required?

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

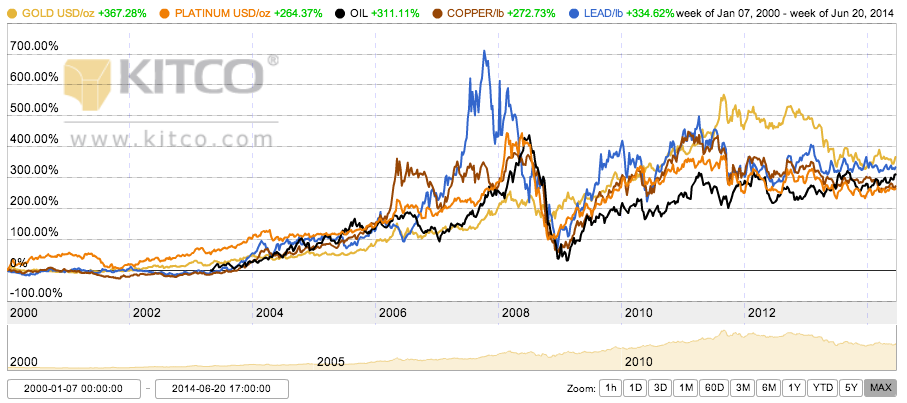

Careful not to confuse correlation with causation. No question gold and commodity prices correlate over long periods, but gold's dual role as a commodity and an international currency on FX account at central banks makes gold demand and price dynamics unlike commodity demand and price dynamics.Originally posted by patrikkorda View PostI was under the impression that commodity prices in general fell adjusted for inflation from 1980-2000 and have in general risen since adjusted for inflation. Glancing at a chart of a handful of commodities since 2000 seems to show that they do in fact tend to move in the same direction. Perhaps even more interesting is the fact that lead outperformed gold leading up to the financial crisis, something Rogers predicted in the aforementioned book. While the demand dynamics for every individual commodity might be different (e.g. lead went up because the Chinese started buying cars) the ultimate reason seems to be PCO.

GAGFO explains the demand and price mechanisms that produce the correlation between gold and oil prices, that is, how and why gold and oil correlate over long periods, and how this has changed since the end of the convertibility of foreign USD reserves to US Treasury gold.

Inflation is not a prime factor but a secondary factor of oil and gold price correlation. This can be observed by comparing inflation conditions for the period of the start of PCO in 1999 and the rise in oil and gold prices since, a period of historically low inflation, as compared to the 1970s high inflation period. The prime factor is USD currency risk. GAGFO defines the factors of USD depreciation risk as it relates to oil prices and central bank policy.

Gold, oil, and select commodity metals from PCO start to June 2014. Oil outperformed gold as an investment until

the start of the end of the AFC recession in 2009. Then factors of USD currency depreciation risk caused gold prices to

rise ahead of oil prices. These factors receded in mid-2011 but are starting to increase again.

FYI, I interviewed Rogers for that book in 2006. His commodity boom thesis revolved around demand from China. He understands monetary policy as "printing money" or not.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

I was under the impression that commodity prices in general fell adjusted for inflation from 1980-2000 and have in general risen since adjusted for inflation. Glancing at a chart of a handful of commodities since 2000 seems to show that they do in fact tend to move in the same direction. Perhaps even more interesting is the fact that lead outperformed gold leading up to the financial crisis, something Rogers predicted in the aforementioned book. While the demand dynamics for every individual commodity might be different (e.g. lead went up because the Chinese started buying cars) the ultimate reason seems to be PCO.Originally posted by EJ View PostCommodities have not and will not correlate to oil as gold does because gold is not only a commodity it is also a reserve currency.

Gold is the only reserve currency that central banks hold on FX account that is not a national currency.

We have analyzed central bank purchases of net oil producers and consumers with respect to gold and USD reserve accumulations, capital flows, net external debt, and other factors and have a model that we think is predictive with respect to gold prices for a range of future oil price scenarios. For example if the global oil price rises to $200 this implies a gold price of $2400 to $4000 depending on how quickly the price oil change occurs. By purchasing gold central banks can increase the exchange rate value of the gold they already hold to hedge USD depreciation risk that rises with an increased oil price for a range of reasons including an increased oil import trade deficit and increased budget deficit to offset the recessionary impact of rising oil prices. For obvious reasons the model will remain proprietary.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Commodities have not and will not correlate to oil as gold does because gold is not only a commodity it is also a reserve currency.Originally posted by patrikkorda View PostDear astonas,

Thank you for bringing this up. I may end up conducting Ganger Causality analysis. However, some years ago I read Hot Commodities by Jim Rogers where he alluded to this working paper which shows that (1) stocks and commodities are negatively correlated and (2) commodity bull markets tend to last 18 years on average. While I do feel that EJ is absolutely correct in his assertion that gold has a special place at the core of the IMS, I wouldn't be surprised if other commodities tend follow oil just as well as does gold.

Gold is the only reserve currency that central banks hold on FX account that is not a national currency.

We have analyzed central bank purchases of net oil producers and consumers with respect to gold and USD reserve accumulations, capital flows, net external debt, and other factors and have a model that we think is predictive with respect to gold prices for a range of future oil price scenarios. For example if the global oil price rises to $200 this implies a gold price of $2400 to $4000 depending on how quickly the price oil change occurs. By purchasing gold central banks can increase the exchange rate value of the gold they already hold to hedge USD depreciation risk that rises with an increased oil price for a range of reasons including an increased oil import trade deficit and increased budget deficit to offset the recessionary impact of rising oil prices. For obvious reasons the model will remain proprietary.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Dear astonas,Originally posted by astonas View PostThank you for sharing your research, Patrik!

I was wondering if the data set you used is sufficiently dense to also conduct a Ganger Causality analysis? This could lend additional numerical support to the iTulip thesis.

Thank you for bringing this up. I may end up conducting Ganger Causality analysis. However, some years ago I read Hot Commodities by Jim Rogers where he alluded to this working paper which shows that (1) stocks and commodities are negatively correlated and (2) commodity bull markets tend to last 18 years on average. While I do feel that EJ is absolutely correct in his assertion that gold has a special place at the core of the IMS, I wouldn't be surprised if other commodities tend follow oil just as well as does gold.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Thank you for sharing your research, Patrik!Originally posted by patrikkorda View PostI did some statistical work on this last year. From 1986-2013, the correlation comes out to .86 and the R2 is .73. Attaching my paper.

I was wondering if the data set you used is sufficiently dense to also conduct a Ganger Causality analysis? This could lend additional numerical support to the iTulip thesis.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Patrik, thanks for publishing your paper here. If you and/or EJ could take a few minutes to explain your definition of "highly correlated" I would appreciate it. I'm obviously looking at this from a different point of view and seeing massive swings in price relationship. Are you saying that long term, if oil moves up 5X, gold will move up 5X and not that the price moves are correlated? If so, is there more we can infer at a given point in time?Originally posted by patrikkorda View PostI did some statistical work on this last year. From 1986-2013, the correlation comes out to .86 and the R2 is .73. Attaching my paper.

For example, oil has moved up roughly 2.5X over the last 10 years while gold had moved up roughly 5X by mid 2011. Given the fragile state of the economy and new oil resources, should we not have expected gold to retreat? And even though it's down 30% since 2011, should we not expect oil to continue to move up and/or gold to continue to move down in price?

Thanks.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Hello Patrik,

Thank you for sharing your research paper. I found it very helpful in defining a plausible link between oil price and follow up central bank purchases (or sales) of gold in response.

This perspective helps me to better understand Eric's papers on Good as Gold for Oil.

Regards

Peter

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

ayuh... +1Originally posted by vinoveri View Postin fact, there are very few true "liberal arts" programs anymore; how many courses in aristotelian logic and rhetoric are even offered, much less required in our institutes of "higher learning". The orginal intent of a liberal arts education was to equip the student with know-how, how to listen, reason, articulate and dialog to reach a meeting of the minds advance understanding. What we have morphed into is a society of highly educated specialists - a madhouse of monomaniacs and mansion of learned ignoramuses as GKC and Ortega have observed.

many of whom seem to have need to pay for stuff that their parents - or our parents anyway(being a '58 model mesself) would've thot ridiculous extravagance... but then... spending beyond ones means (read: diving deep into the debt pool) for something like 'education' is now considered 'necessary' if not fashionable...

the marketing geniuses have done a simply splendid job of this - not only with (TO) the beltway bozos, but the last 2 generations, in general - it seems...

'but dont worry about it, your salary will increase over time to pay for it'

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

in fact, there are very few true "liberal arts" programs anymore; how many courses in aristotelian logic and rhetoric are even offered, much less required in our institutes of "higher learning". The orginal intent of a liberal arts education was to equip the student with know-how, how to listen, reason, articulate and dialog to reach a meeting of the minds advance understanding. What we have morphed into is a society of highly educated specialists - a madhouse of monomaniacs and mansion of learned ignoramuses as GKC and Ortega have observed.Originally posted by lektrode View Postwhich helps explain quite a lot of 'mysteries' about the lamestream media, in general....

i guess its that 'broad, liberal arts' aspect of their 'education' that seems to matter most - to some - in the 'value calculation' of the 'typical' degree program these daze (and just another example of why the .gov flooding the .edu sector with gazzilions of new debt-based 'funding' is right up there with their flooding the housing industry with same)

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

which helps explain quite a lot of 'mysteries' about the lamestream media, in general....Originally posted by EJ View PostThe correlation is difficult to not see:...

...

The right question is: Why have gold and oil correlated this way over decades before and after the end of the international gold standard?

GAGFO theory explains the causation. I've attempted to explain it to business journalists but Triffin and a dozen other economists are required background reading and the average US business reporter studied pottery in college, so there isn't much chance that they are going to understand it well enough to explain it simply to their readers.

i guess its that 'broad, liberal arts' aspect of their 'education' that seems to matter most - to some - in the 'value calculation' of the 'typical' degree program these daze (and just another example of why the .gov flooding the .edu sector with gazzilions of new debt-based 'funding' is right up there with their flooding the housing industry with same)

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

Very interesting and thank you for posting it.Originally posted by patrikkorda View PostI did some statistical work on this last year. From 1986-2013, the correlation comes out to .86 and the R2 is .73. Attaching my paper.

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

I did some statistical work on this last year. From 1986-2013, the correlation comes out to .86 and the R2 is .73. Attaching my paper.Originally posted by EJ View PostThe correlation is difficult to not see:

The right question is: Why have gold and oil correlated this way over decades before and after the end of the international gold standard?

GAGFO theory explains the causation. I've attempted to explain it to business journalists but Triffin and a dozen other economists are required background reading and the average US business reporter studied pottery in college, so there isn't much chance that they are going to understand it well enough to explain it simply to their readers.Attached Files

Leave a comment:

-

Re: The Post-Market Economy - Part I: Chaos on Planet ZIRP - Eric Janszen

The correlation is difficult to not see:Originally posted by Slimprofits View PostBloomberg journalists take note of link between crude oil and gold, sort of:

http://www.bloomberg.com/news/2014-0...omy-grows.html

The right question is: Why have gold and oil correlated this way over decades before and after the end of the international gold standard?

GAGFO theory explains the causation. I've attempted to explain it to business journalists but Triffin and a dozen other economists are required background reading and the average US business reporter studied pottery in college, so there isn't much chance that they are going to understand it well enough to explain it simply to their readers.

Leave a comment:

Leave a comment: