Originally posted by dcarrigg

View Post

Announcement

Collapse

No announcement yet.

Illusion of Recovery – Part I: Print and pray has officially failed - Eric Janszen

Collapse

X

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

Thanks for your efforts in consistently replying to the libertarian talking points. A lot of the time I see them and get annoyed, but just don't have the energy or don't want to bother. Keep fighting the good fight.

-

Re: Illusion of Recovery – Part I: Print and pray has officially failed - Eric Janszen

This is reasonable.Originally posted by ASHMy understanding is that a wage-price spiral is helpful for discharging debt because the nominal wages of individual workers rise, providing them with the cash to pay down their debt, and generating nominal tax income for the government. In contrast, cost-push inflation from commodities and imports is unlikely to help much by itself, because that mostly translates into income for producers of commodities and imports. From what I understand, labor had a lot more pricing power in the 70's and 80's, so it was able to secure nominal wage increases to help offset inflation. That isn't going to be the case this time around, so possibly high cost-push inflation won't help as much with the debt.

I would point out that one major reason why labor has so poor pricing power is the influence of FIRE and debt on labor costs. While an injection of inflation due to commodity price increases in turn due to dollar devaluation might not be accompanied immediately by labor wage increases - at the same time the discharge mechanism might just shift from "inflating away" to "defaulted on".

Thus while we might not get a inflation-wage increase-price increase spiral a la the disco era, could we not instead get an inflation-mass default-debt reduction-effective income increase due to reduced debt load effect, the ultimate result being reduced private and corporate debt levels and a 2nd order improvement in labor competitiveness?

The overall impact is still pretty darned bad I think.

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

My understanding is the same and I agree with your assessment.

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

The Panama Canal is terrible. It benefits nobody. The Hoover Dam sucks too. So does the interstate system.Originally posted by SamAdams View PostAnd like similar espc programs, overwhelmingly used by governments since business will make roi investment themselves, the roi, if any is achieved without creating functional problems, goes towards further growth of bureaucracy or keeping alive bureaucracy that should not be operational in the first pace. Presumably there is some mechanism for government projects to deliver roi to the broad economy? How would this work? Hypothetically if the government built a nuclear power plant to deliver cheap electricity would this not be built at a premium to a non-stimulus project and therefore require additional subsidy to keep prices competitive? Why not just make select private utility and energy companies public? They already have the infrastructure or can more easily build. My hunch is all these "solutions"will not work in the long run or will create new "public"problems or subsidize select favored corporations at the expense of small business and innovation. The only solutions from public spending fix problems made with public policy in the first place. Maybe we should build a new Panama canal? Space elevator? Grants for energy efficiency? The us had those in the stimulus.

,

Small business!!!! Innovation!!!! Bureaucracy!!!!

Further catch phrases containing no "solutions"!!!!

Let me guess, your other tab's open to reason.com. Even they wouldn't hate on the Panama Canal. Ideology is getting thick these days. I think libertarianism will be the new version of marxism. Blind faith in its power grows by the day.Last edited by dcarrigg; September 03, 2011, 01:41 PM.

Leave a comment:

-

Typos in this post!

.If the US government debt-to-GDP ratio reaches 20% or perhaps even 15% of GDP,

Should be "deficit" not debt. The debt is already near 100% of GDP.

Should be "up". Lowering interst rates does not stop an inflation spiral!In 1980 interest rates had one way to go if the Fed was determined to stop an inflation spiral from developing into full blown hyperinflation: down.

Please let me proof read your posts! You big picture guys need a bean counting, hair splitting, underling like me to catch all your typos and semantic mistakes.

Leave a comment:

-

Re: Fed gov debt >> 6%

18%?Originally posted by Polish_Silver View PostPlease explain this 6% figure. Fed Gov debt is 10 trillion at least.

Unless total debt is 160 trillion, federal debt is a lot more than 6%, not to mention state and local.

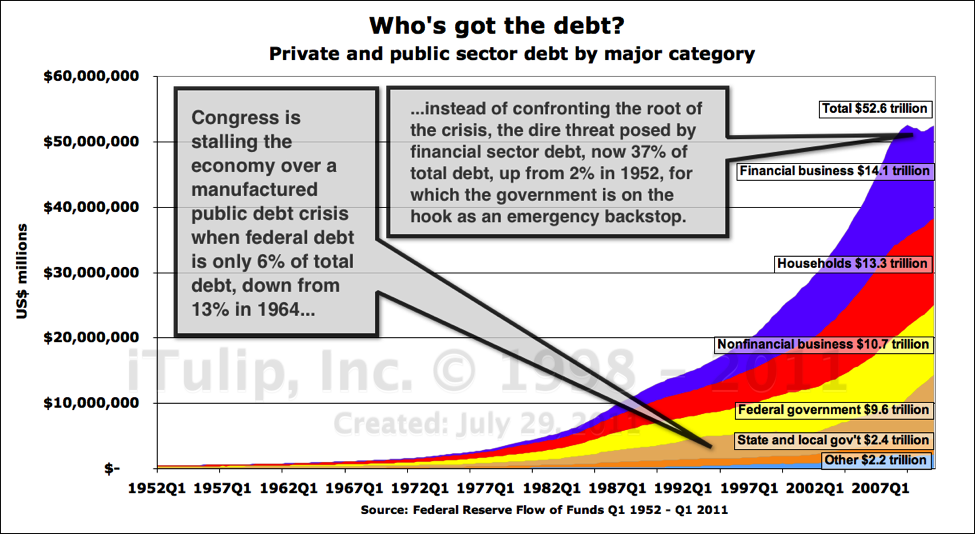

I'm also not sure how EJ/Fred arrived at 6%. Here is their graph from another thread:

Originally posted by EJ View Post Last edited by Slimprofits; September 03, 2011, 08:30 AM.

Last edited by Slimprofits; September 03, 2011, 08:30 AM.

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print and pray has officially failed - Eric Janszen

It seems like we need 4% growth per annum. You make it sound like we need 4% each quarter.average of 4% per quarter starting in Q2 2009.

Please be more careful! I'll agree to be numeric proof reader, something desperately needed around here!

Leave a comment:

-

Fed gov debt >> 6%

Please explain this 6% figure. Fed Gov debt is 10 trillion at least.Then we wasted more time arguing about whether the nation has too much public debt, when in fact public debt as a portion of total private and public debt outstanding is only 6% of total debt, down from 13% in the 1960s. Financial corporate debt, on the other hand, has over the same period grown from 2% to 37% of total debt

Unless total debt is 160 trillion, federal debt is a lot more than 6%, not to mention state and local.

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

no one but gov't builds e.g. roads and bridges. and some private investments may be too large or too risky for any private entity to undertake in the absence of a gov't guarantee or financing. re: your nuclear plant example: there is a limited private insurance pool available for nuclear plants in the u.s., with the tail risk assumed to be taken by the gov't. http://en.wikipedia.org/wiki/Economi...ants#InsuranceOriginally posted by SamAdams View PostAnd like similar espc programs, overwhelmingly used by governments since business will make roi investment themselves, the roi, if any is achieved without creating functional problems, goes towards further growth of bureaucracy or keeping alive bureaucracy that should not be operational in the first pace. Presumably there is some mechanism for government projects to deliver roi to the broad economy? How would this work? Hypothetically if the government built a nuclear power plant to deliver cheap electricity would this not be built at a premium to a non-stimulus project and therefore require additional subsidy to keep prices competitive? Why not just make select private utility and energy companies public? They already have the infrastructure or can more easily build. My hunch is all these "solutions"will not work in the long run or will create new "public"problems or subsidize select favored corporations at the expense of small business and innovation. The only solutions from public spending fix problems made with public policy in the first place. Maybe we should build a new Panama canal? Space elevator? Grants for energy efficiency? The us had those in the stimulus.

,

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

Originally posted by dcarrigg View PostThe benefits should be designed to outweigh the costs of financing work up-front.

This way a project is financed through projected monthly energy expenditure (operational) savings with no (or little) cash outlay by the entity ordering the work to be performed.

This can be done in the residential and small commercial sectors through utility-based on-bill financing and ESPCs in the large commercial, industrial and .gov sectors. They function as the financing mechanisms, with kWh savings guaranteed (assuming one has a proper contract) by the ESCO.

In this way, energy infrastructure can be upgraded faster than one would imagine without requiring much up-front cash. There is still loss to finance charges, and downside risk if oil/electricity/etc. drop significantly in price, but mechanisms to spur rapid investment that pay for themselves, plus offer a good chance for additional financial benefit, do exist.

Of course, this works best with relatively vanilla activities (insulating, retro-commissioning, replacement of older furnaces/boilers etc.) It also requires more sophistication in contractual agreements than many entities possess to ensure one does not get ripped off (there are a few third-party firms that do this - also for a fee).

When an investment makes sense (has a positive ROI), as energy efficiency typically does, there will always be ways to accelerate adoption. Also see Fred's post above ^.

And like similar espc programs, overwhelmingly used by governments since business will make roi investment themselves, the roi, if any is achieved without creating functional problems, goes towards further growth of bureaucracy or keeping alive bureaucracy that should not be operational in the first pace. Presumably there is some mechanism for government projects to deliver roi to the broad economy? How would this work? Hypothetically if the government built a nuclear power plant to deliver cheap electricity would this not be built at a premium to a non-stimulus project and therefore require additional subsidy to keep prices competitive? Why not just make select private utility and energy companies public? They already have the infrastructure or can more easily build. My hunch is all these "solutions"will not work in the long run or will create new "public"problems or subsidize select favored corporations at the expense of small business and innovation. The only solutions from public spending fix problems made with public policy in the first place. Maybe we should build a new Panama canal? Space elevator? Grants for energy efficiency? The us had those in the stimulus.

,Last edited by SamAdams; September 03, 2011, 04:38 AM.

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

Speaking of infrastructure projects, I heard some rumblings on CNBC this morning that Obama's speech next week might propose something along those lines -- as well as something about providing targeted work for people who have been unemployed for 6 months or more. Building roads and bridges? Or what?

Also, based on conversations with some friends in Hong Kong, I believe the "boom" in mainland China is really nothing more than a giant jobs program. Without a for-profit motive (other than cronyism and back-room dealing), it doesn't strike me as a bubble as much as anti-riot insurance for those in power. Makes me wonder if the US might start down the same road....

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

Indeed, this particular chart shows us another aspect that is easily lost from view; the proportionate increase in the population. What has occurred over the last few decades is that the underlying prosperity, cash in the back pocket, if you like, has been steadily drawn into the FIRE economy. As a single function, that would not become a problem; but what has happened is that the money drawn into FIRE has not been re-invested back as further productive output.Originally posted by erwinky View PostAnother great post and analyses. Perhaps I am missing something, but in the first charts showing unemployment and CPI, wouldn't it be valuable to also show unemployment as a percent since this would correct for population growth? I guess it doesn't look much different from your chart though.

So we end up with twice the number of potential employees while at the same time, vastly reduced underlying prosperity to pay for the products that might have been created.

Without that underlying prosperity; there is no way for the underlying economy to recover. No one can afford to buy the products.

It was that reasoning that underpins EJ's contention that there must be a systematic increase in investment, in his case into new infrastructure projects. That they inject back into the underlying economy, sufficient lost prosperity to recover the output gap.

But even then, that will not recover the lost prosperity right down at the grass roots, right down at the individual level. On my own projections, it will take ~ $2.25 Trillion of new business creation to replenish those prosperity levels back to end WW2 levels. (£450 billion here in the UK).

Here in the UK we have the recent report of £5 billion to be lent as further FIRE economic investment into new business between now and 2015. That is like trying to replenish the Amazon river with a teapot.

Unless and until the full level of required investment is recognised; there is no possibility of the output gap being closed.

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

My understanding is that a wage-price spiral is helpful for discharging debt because the nominal wages of individual workers rise, providing them with the cash to pay down their debt, and generating nominal tax income for the government. In contrast, cost-push inflation from commodities and imports is unlikely to help much by itself, because that mostly translates into income for producers of commodities and imports. From what I understand, labor had a lot more pricing power in the 70's and 80's, so it was able to secure nominal wage increases to help offset inflation. That isn't going to be the case this time around, so possibly high cost-push inflation won't help as much with the debt.Originally posted by c1ue View PostI understand the rationale being different, but why is the effect different this time?

... high interest rates coupled with high debts not yet significantly deflated by inflation? Leading in turn to an economic death spiral?

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

This is an interesting statement.Originally posted by EJThe 1981 to 1983 recessions were manufactured by the Fed with double digit short-term interest rates designed to kill off the inflation spiral that ran from 1975 to 1980. The inflation of that period wiped out private sector debt -- mortgage and credit card debt, auto and student loans, and corporate debt – that accumulated on household and business balance sheets over the previous decades.

If I understand it correctly, the previous bout with inflation was deliberately allowed to occur precisely in order to free up the economy from debt, then said inflation spiral was killed off by Volcker high interest rates.

I understand the rationale being different, but why is the effect different this time?

While certainly the interest rates may rise outside of Fed control this time, is not the effect of high inflation identical?

Or are you saying that we're going to get the worst of both situations: high interest rates coupled with high debts not yet significantly deflated by inflation? Leading in turn to an economic death spiral?

Leave a comment:

-

Re: Illusion of Recovery – Part I: Print, spend, and wait has officially failed - Eric Janszen

The benefits should be designed to outweigh the costs of financing work up-front.Originally posted by mmreilly View PostI can certainly appreciate how investing in improved energy efficiency would produce the benefits that you describe over a long time horizon. However, even if such a plan had been announced in early 2009, would two years have been enough time for such a program to have had a meaningful impact? I would have guessed that the returns on such a program would have taken several years to realize, by which time it would have been too late, although maybe the US energy infrastructure could have been overhauled more quickly than I would have imagined.

This way a project is financed through projected monthly energy expenditure (operational) savings with no (or little) cash outlay by the entity ordering the work to be performed.

This can be done in the residential and small commercial sectors through utility-based on-bill financing and ESPCs in the large commercial, industrial and .gov sectors. They function as the financing mechanisms, with kWh savings guaranteed (assuming one has a proper contract) by the ESCO.

In this way, energy infrastructure can be upgraded faster than one would imagine without requiring much up-front cash. There is still loss to finance charges, and downside risk if oil/electricity/etc. drop significantly in price, but mechanisms to spur rapid investment that pay for themselves, plus offer a good chance for additional financial benefit, do exist.

Of course, this works best with relatively vanilla activities (insulating, retro-commissioning, replacement of older furnaces/boilers etc.) It also requires more sophistication in contractual agreements than many entities possess to ensure one does not get ripped off (there are a few third-party firms that do this - also for a fee).

When an investment makes sense (has a positive ROI), as energy efficiency typically does, there will always be ways to accelerate adoption. Also see Fred's post above ^.

Leave a comment:

Leave a comment: