|

The following fictional conversation never occurred in June 2009 between Treasury Secretary Tim Geithner and a Chinese negotiator named Cheng for the sale of U.S. assets, at least not that we know of.

The first fictional meeting July 3, 2007 between Cheng and America’s representative broke off without a deal. Maybe Geithner did better on his latest trip to China.

Cheng: You’re back.

Geithner: I’m here to represent the government of the people of the United States of America...

Cheng: Of course you are.

Geithner: ...and I’d like to begin by saying that I cannot speak to commitments made by the previous administration by my predecessor...

Cheng: This is the difficulty with your “multi-party” system. Leadership change there between your two political parties controverts the principle of accountability that is supposedly the chief benefit of your so-called “democratic” system. The system is supposed to replace ineffective leadership with more effective leadership. Represent the will of the people? In truth both political parties in the United States are captive of influence from your finance, insurance, real estate, weapons manufacturing, and pharmaceutical industries that finance elections there. The leaders they choose constantly rotate in and out of power, avoiding blame for the problems they leave behind. Voters chase one meaningless promise for “change” after another. The latest administration is not held responsible for the previous administration’s mistakes. There is no continuity or sustained effort toward a goal for the nation and its people. Errors accumulate.

Geithner: I do not hope to get into a political argument...

Cheng: I'm getting to my point. The greatest accumulated error of all? Foreign government debt.

Geithner: If we can get back to...

Cheng: Your so-called economy, and those of your western allies who have followed you on your misguided path to finance-based wealth, have become a burden to the savers of the world. How do you feel to come here once again, hat in hand, to us, a nation that the west only recently granted admission to the WTO but still holds out of the OECD and other international governing bodies? We read in your press that China is a third world country. Why then is the United States, the leader of western democracies, borrowing from us, and under ever more desperate circumstances?

Geithner: I’d like to get back to the matter at hand...

Cheng: Please be patient. I not you will frame this discussion, thank you.

We are tired of the accusations of your Congress that we manipulate our currency. Tired of your western paid so-called “economists” criticizing our use of our “excess” savings, as you call them, as we see fit. Tired of so-called human rights organizations, financed by your British allies, accusing us of human rights abuses because we will not abide dangerous cults inside our own borders. Tired of your “Pentagon” accusing us of increasing our military capabilities to threaten the United States, even though our spending is a fraction of your own. There is not a single Chinese military base outside Chinese territory yet America has 747 bases around the world, including many near to China. Everyone can see that your weapons industry has ties to your government. It creates this excuse of a military threat from China to justify appropriations of public funds from your legislature. And who do you ask to cover the gap in funding for these programs when you can’t raise the funds through taxes or from domestic or foreign borrowing? Us! Your “enemy.” It’s outrageous. Ridiculous.

Geithner: To keep this conversation constructive...

Cheng: These are the matters that we will discuss today.

Geithner: I’m am not sure how in the context of these negotiations I can address your...

Cheng: I will help you. All in good time. When we met in July 2007 we held $480 billion in U.S. Treasury bonds. Now we hold $768 billion, an increase in nearly 40% in less than two years. Obviously, our foreign exchange needs did not grow by 40% in two years. We want to exchange a portion of these securities for assets of value to us. What have you come to offer?

Geithner: I have come prepared with a few ideas, but before I get to those there is a matter of concern to us. Officials of the Chinese government have over the past months made a number of public statements questioning U.S. sovereign debt quality, particularly since we began to execute emergency government investment programs to support our economy similar to the Chinese government spending programs. Your central bank representative Yu Yongding repeated these points to me yesterday, and the matter also came up at a speech I gave at Peking University. U.S. government bonds represent the gold standard of sovereign debt in the world...

Cheng: Yes, we read the reports in your press.

Geithner tells China its dollar assets are safe

June 1, 2009 (Reuters)

"Chinese assets are very safe," Geithner said in response to a question after a speech at Peking University, where he studied Chinese as a student in the 1980s.

His answer drew loud laughter from his student audience, reflecting skepticism in China about the wisdom of a developing country accumulating a vast stockpile of foreign reserves instead of spending the money to raise living standards at home.

But again, the purpose of this meeting, nor the last one, is not about future purchases. We own a great deal of U.S. debt. We do not need to be “sold” on U.S. debt. The question is, what do we do with the U.S. government securities we already hold? This question has been a matter of intense internal debate here, and—quite frankly—deep and growing concern. We used to argue within the government about the urgency of it, about the soundness of the policy of buying U.S. debt with savings of our people, but there is no disagreement anymore. The actions of your department, and your central bank, and your legislature over the past year have decided the argument. Something must be done. Something has to change. June 1, 2009 (Reuters)

"Chinese assets are very safe," Geithner said in response to a question after a speech at Peking University, where he studied Chinese as a student in the 1980s.

His answer drew loud laughter from his student audience, reflecting skepticism in China about the wisdom of a developing country accumulating a vast stockpile of foreign reserves instead of spending the money to raise living standards at home.

Geithner: Are you referring to our fiscal stimulus programs? These amount to 5.5% of 2009 GDP. These are reasonable compared to China’s outlays of 6.8% of GDP...

Cheng: Your projections assume that your GDP will not shrink. That is unrealistic. Our stimulus programs are not, as you claim, like those pursued by your government. They are not even remotely similar. When your legislature approved spending in February this year no national improvement plan existed to build on. The as yet unelected Obama administration hastily threw together a plan that focused on infrastructure and alternative energy, near as we can tell based on articles published in magazines. But here in China we accelerated a well-defined and efficient plan for investment. Our spending will result in an even more competitive economy, yours in even more public debt and little improvement in infrastructure to help make your economy more productive. And if not in rising productivity, then in what are we investing by buying your bonds?

No, we are certain that we will not make additional purchases of US treasury bonds, or at least no significant new purchases, and only in short term instruments. Further purchases shall be modest and sufficient to avoid a dollar crash.

Geithner: The US dollar is not in danger of crashing.

Cheng: You have us "over a barrel," right? If we do not buy a certain quantity of US debt, and Japan does not, and the UK does not, and other nations do not—and who but China is in a position to buy now?—that U.S. interest rates will rise, by our estimates 100 basis points per year. Such a rise in interest rates in the U.S., caused simply by your creditors collectively “doing nothing” will halt and reverse your economy’s weak recovery. Your already falling housing market will crash from rising mortgage rates. If the U.S. economy shrinks more than others’ then the dollar falls against the others, and the value of our U.S. debt holdings with it. Then your interest rates rise more. And so on. We want to use these holdings to finance purchases of assets abroad. We want to avoid that cycle. We have an interest in seeing the purchasing power of these remain high, but do not take that for a perpetual commitment to buying US debt. We shall purchase U.S. debt only at levels necessary to avoid such an outcome if we can, but no more.

Geithner: I appreciate that, your position. As you know, our central bank has taken steps to mitigate the problem of rising interest rates caused by reductions in foreign purchases of U.S. debt, to support the U.S. housing market, by making purchases of treasury and agency debt directly.

Cheng: I hope you are not suggesting that your central banks’ monetization of expenditures appropriated by your legislature for the benefit of politically important industries was done for the benefit of your foreign creditors? Quite obviously these are desperate measures, covering for the damage done by your corrupt financial industry. If continued these spending policies lead to certain calamity for your currency no matter what we want, unless your economy recovers within, say, six months and tax receipts with it.

We see your state media selling the idea of recovery hard, for the benefit of the currency and bond markets. Consumers are asked to go spend money. Your stock markets are inflated to increase consumer confidence. The hope is that recovery of the American Economy can be willed into being. But if economic growth were so easy to accomplish why can’t the Mexican economy become as strong as Canada’s by the act of convincing the Mexican people to spend more? The idea is absurd.

Look at the data. Your people don’t have money to spend. They have debts. They have no savings. Their incomes are falling. Tax receipts are off by more than 30%.

Closing a multi-trillion dollar gap in tax receipts and foreign borrowing by monetizing debt is a dangerous game. Your government is playing with the reserve status of the currency. Every other nation that has tried this has failed. The dollar has saved you so far, but the reprieve is temporary. That gives this meeting urgency.

Geithner: The reserve currency status of the dollar is not in question.

Cheng: Your creditors will be the judge of that.

Geithner: China purchased U.S. assets for the risk-adjusted returns and let us not forget that China pursues a policy foreign bond purchases, especially U.S. debt, in order to effectively make the yuan more competitive, to improve China’s trade position.

Cheng: We are tired of this claim. If we do not purchase sufficient dollar denominated financial assets to offset foreign exchange, the yuan will appreciate against the U.S. dollar.

The euro as a viable alternative to the dollar, and we are increasing our euro position.

But getting back to the purpose of this meeting, as I told your predecessor two years ago, we value assets such as raw materials that allow us build our economy. We want to buy resources companies in the US as we do in Australia, but we understand the political difficulties. We have rules on foreign ownership here, as well. But there are philosophical differences that we can work on. Your government’s decision to acquire a 70% stake in your nation’s largest automobile manufacturer is a step in the right direction. Here 32 of our largest 33 companies are majority owned by government. Over time, we see America becoming more like China and welcome this development. When more US companies are majority government owned, our governments can arrange for transfers without the current difficulties. Our concern is that the dollar does not sustain value through that process.

Geithner: The dollar...

Cheng: We also welcome American companies to China to build plants here. Not only do these plants supply products for export earnings but our managers learn important skills, such as how to design and build high technology products. For example, telecommunications. As you know it is not toys and clothes sold at Walmart that make up the bulk of China’s exports to the U.S. but industrial goods, by dollar volume.

I’ve brought charts to show you to make my points.

We learn from Americans, Germans, Japanese, Taiwanese and others how to make these high value goods. Over time we become more independent and able to compete in the global market for high value goods and labor. This is a well-worn path to development that other nations have taken, such as Japan. But in the case of China your dysfunctional political bubble economy has sped up the transfer process. Your bubble economy booms and busts have been a boon to us.

I will provide you an example. After your reckless early 2000s technology market bubble, U.S. companies such as Cisco Systems cast off their U.S. based technology manufacturing to improve profits and today China manufactures and exports far more telecomms equipment than the U.S.

I will provide you an example. After your reckless early 2000s technology market bubble, U.S. companies such as Cisco Systems cast off their U.S. based technology manufacturing to improve profits and today China manufactures and exports far more telecomms equipment than the U.S.

After the U.S. crash, many of your major manufacturing companies, particularly in computer hardware technology, outsourced production to China. Many, such as Dell and Cisco, are now R&D and marketing companies. We manufacture high tech products for export but we make our own high tech equipment for domestic use. We use different standards and protocols, as Japan did, for networking and wireless, so our market is not “interesting” to your technology equipment companies. Remember 3Com?

Geithner: I’m sorry, you’ve lost me.

Cheng: Well, your latest difficulties with your political bubble economy present a new opportunity for us. We’d like to import the most important of all U.S. assets: human capital. After 2001, America trained our engineers in the U.S.—at MIT and Stanford—then sent them home to us for “security” reasons! Today, with U.S. economy in shambles but China still growing robustly, they no longer wait to be shipped off by your immigration services. They come here for better job opportunities and a high standard of living. They earn less than in America but live like kings by American standards.

We like to say that America does not have the most engineers but has the best. Ten years after this latest blow up of your economy, China will have both the most and the best human capital.

Geithner: I’d like to get back to...

Cheng: What does this have to do with our discussion today, of America’s debt to China? I’m getting to that. You see, as long as the Chinese economy performs better than the U.S. economy, without the baggage of empire it is a matter of time before China acquires most of the advantages that the U.S. has enjoyed for over a century. We do not have an overextended military with hundreds of bases and millions of troops stationed around the world. We do not labor under the political liabilities of special interests as you have in your finance, insurance, real estate, weapons, tobacco, agriculture, oil, and pharmaceuticals industries. Our social programs are modest. And not only do we have no foreign debt, we are creditors to so-called “rich” western states.

Geithner: I’d like to assure you that the U.S. government has no intention of allowing the U.S. to lose its sterling credit rating...

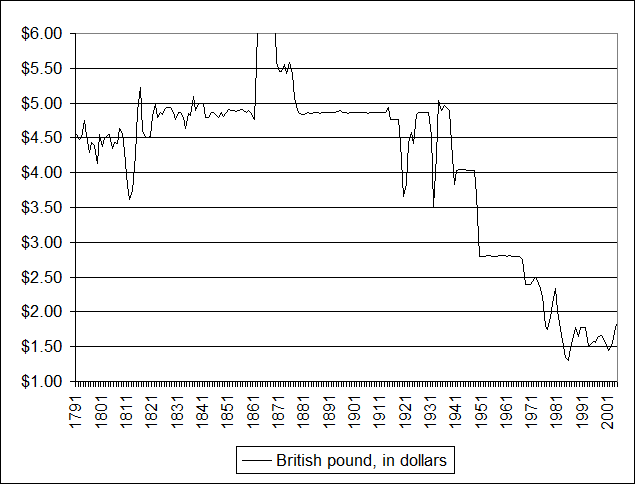

Cheng: A curious choice of words, considering that the pound sterling was once a reserve currency, before the United Kingdom committed itself to projects that it could not afford, much as the United States has. Perhaps if I recount recent history I may orient you to our perspective.

You will recall that your nation’s stock market bubble popped in 2000 and deflated well into 2003. A recession in 2001 hit incomes hard. Corporate and individual tax receipts declined with incomes and profits. Taxes on capital gains fell with stock prices. Private foreign investors in U.S. agency and Treasury debt exited the market as they have during each recession since the early 1980s, but this time the United States government could not take the loss. Your government was in need, both money to fill the tax gap to fund government operations and also money to finance economic stimulus programs—focused on housing—to restart growth. Central banks stepped in to fill the gap left open by private investors.

Geithner: I’m sorry, you’ve lost me.

Cheng: Well, your latest difficulties with your political bubble economy present a new opportunity for us. We’d like to import the most important of all U.S. assets: human capital. After 2001, America trained our engineers in the U.S.—at MIT and Stanford—then sent them home to us for “security” reasons! Today, with U.S. economy in shambles but China still growing robustly, they no longer wait to be shipped off by your immigration services. They come here for better job opportunities and a high standard of living. They earn less than in America but live like kings by American standards.

We like to say that America does not have the most engineers but has the best. Ten years after this latest blow up of your economy, China will have both the most and the best human capital.

Geithner: I’d like to get back to...

Cheng: What does this have to do with our discussion today, of America’s debt to China? I’m getting to that. You see, as long as the Chinese economy performs better than the U.S. economy, without the baggage of empire it is a matter of time before China acquires most of the advantages that the U.S. has enjoyed for over a century. We do not have an overextended military with hundreds of bases and millions of troops stationed around the world. We do not labor under the political liabilities of special interests as you have in your finance, insurance, real estate, weapons, tobacco, agriculture, oil, and pharmaceuticals industries. Our social programs are modest. And not only do we have no foreign debt, we are creditors to so-called “rich” western states.

Geithner: I’d like to assure you that the U.S. government has no intention of allowing the U.S. to lose its sterling credit rating...

Cheng: A curious choice of words, considering that the pound sterling was once a reserve currency, before the United Kingdom committed itself to projects that it could not afford, much as the United States has. Perhaps if I recount recent history I may orient you to our perspective.

You will recall that your nation’s stock market bubble popped in 2000 and deflated well into 2003. A recession in 2001 hit incomes hard. Corporate and individual tax receipts declined with incomes and profits. Taxes on capital gains fell with stock prices. Private foreign investors in U.S. agency and Treasury debt exited the market as they have during each recession since the early 1980s, but this time the United States government could not take the loss. Your government was in need, both money to fill the tax gap to fund government operations and also money to finance economic stimulus programs—focused on housing—to restart growth. Central banks stepped in to fill the gap left open by private investors.

Private investors nearly stopped buying US treasury debt in 2003

Private investors stopped buying US Agency debt in 2006

America’s political and economic ally Japan took the lead role in the bailout of the United States economy and government that time. By the end of 2006, Japan held $650 billion of a total of $2.2 trillion in U.S. treasury debt held outside the U.S. while China held $320 billion, half as much as Japan.

We made most of our purchases of U.S. debt after 2006. As I mentioned before, between October 2007 and October 2008 we increased our holdings from $450 billion to $650 billion.

China took decades to purchase $320 billion. We doubled our holdings in only two years! We had our reasons for buying so many bonds at that time. We were more dependent on the U.S. for export income. In 2006, we earned 31% of our export income from the U.S. and Canada.

Today our dependence is less than 20%. If U.S. demand for our exports falls by 50% our exports will fall by 10%, a tolerable loss.

Then in 2008 the U.S. suffered an even greater financial and economic crisis than in 2001 as your country’s financial system collapsed, then your economy, then much of the global economy, but not all of it.

At the end of 2008 only China stood by the United States as a significant net buyer of U.S. Treasury bonds. Other U.S. allies made token contributions to the effort.

Then in 2008 the U.S. suffered an even greater financial and economic crisis than in 2001 as your country’s financial system collapsed, then your economy, then much of the global economy, but not all of it.

At the end of 2008 only China stood by the United States as a significant net buyer of U.S. Treasury bonds. Other U.S. allies made token contributions to the effort.

Curiously, the largest net sellers were America’s former traditional tax havens, Caribbean banking centers and Luxemburg. Cracking down on savers with more stringent tax laws did not quite have the net benefit expected, did it? The United Kingdom from which, it is widely known, Middle East Oil money flows also reduced holdings.

But I digress.

China is now far and away the largest holder of U.S. Treasury debt, with more than twice the holdings of Japan, and one third of the total.

China is now far and away the largest holder of U.S. Treasury debt, with more than twice the holdings of Japan, and one third of the total.

The chart shows only Treasury debt. We as well hold a considerable amount of agency debt, the bonds that back your housing market that is collapsing despite your government’s best efforts to support it through your nationalized government sponsored enterprises Fannie Mae and Freddie Mac. We agree with those who predict that the price of the collateral on those mortgage loans—housing—will continue to decline for more than a decade as occurred in Japan after a similar property bubble collapsed in 1992, where prices fell for 18 years. We are more optimistic about the U.S., however, and agree with forecasts that prices will not bottom until 2015 or so.

No, no. We are certainly not interested in buying more agency bonds.

Again, our interest is only in purchasing as many short term Treasury bonds as necessary to maintain the purchasing power of our current dollar holdings and to manage our exchange rate as we see fit. We will use our long duration US securities holdings as collateral to buy assets such as oil and metals in Latin America, Africa, Australia, and Canada that we need here in China, to improve the living standards of our people. These are, after all, their savings. In return, the United States will reduce its foreign lending requirements by cutting wasteful spending, starting with your bloated military. The U.S. will cease to meddle in our internal affairs. Your Congress will stop berating us for "manipulating" our currency. We will diversify into other currencies and implement foreign exchange programs with our trade partners, providing convertibility of the yuan directly into currencies other than the dollar. The U.S. dollar will over time cease to be the major global reserve currency but will become equal to the euro, yen, and yuan.

That is, as you say in your country, “how we roll.”

Thank you for coming.

Part II: Economic M.A.D. Revisited: Turning point ($ubscription)

The global economic crisis has given China even more leverage over the US, but the question remains, if the US does not give China what China wants, what can China do about it?

Hard to argue with that assessment. more... ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Again, our interest is only in purchasing as many short term Treasury bonds as necessary to maintain the purchasing power of our current dollar holdings and to manage our exchange rate as we see fit. We will use our long duration US securities holdings as collateral to buy assets such as oil and metals in Latin America, Africa, Australia, and Canada that we need here in China, to improve the living standards of our people. These are, after all, their savings. In return, the United States will reduce its foreign lending requirements by cutting wasteful spending, starting with your bloated military. The U.S. will cease to meddle in our internal affairs. Your Congress will stop berating us for "manipulating" our currency. We will diversify into other currencies and implement foreign exchange programs with our trade partners, providing convertibility of the yuan directly into currencies other than the dollar. The U.S. dollar will over time cease to be the major global reserve currency but will become equal to the euro, yen, and yuan.

That is, as you say in your country, “how we roll.”

Thank you for coming.

|

The global economic crisis has given China even more leverage over the US, but the question remains, if the US does not give China what China wants, what can China do about it?

“China and the US are running inter-dependent bubble economies, relying on the economic equivalent of Mutually Assured Destruction (M.A.D.) to keep one from blowing up the other’s economy. Whether by intent or accident, sooner or later market forces will assert themselves and both economies will go through tough transitions. How will the world look after that?”

- “Economic Mutually Assured Destruction” Janszen, iTulip.com, April 19, 2006

James Fallows authored the December 2008 Atlantic Monthly cover article, Be Nice to the Countries That Lend You Money, an interview with Gao Xiqing, the president of resident of the China Investment Corporation, a sovereign wealth fund that oversees $200 billion of China’s $2 trillion in dollar holdings. Gao Xiqing makes a number of assertions that will not challenge established iTulip views:- “Economic Mutually Assured Destruction” Janszen, iTulip.com, April 19, 2006

- The dollar will weaken

- The overall financial situation in the US will change fundamentally

- Americans can’t live on other people’s savings forever

- US households will have less access to credit in the future

- Financial wizards were paid too much and will be paid less from now on

- There will be more “real” economy in the US and less finance-based economic growth

- The world needs a new global monetary system

- There are hard line factions within the Chinese Communist party that want to see less Chinese support for the US

- The US remains a safe haven for capital because it is still the most politically predictable

Hard to argue with that assessment. more... ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment