interesting from 2 yrs ago...

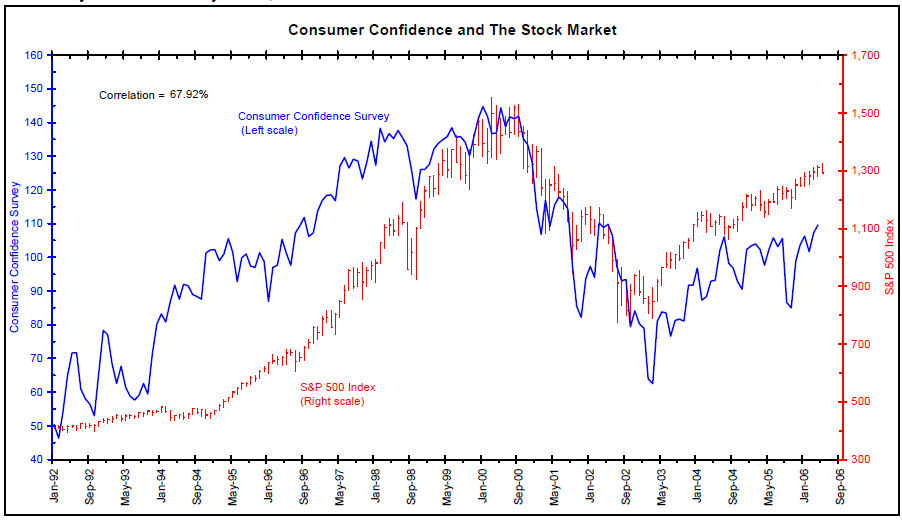

A quick tour through the DOW and consumer confidence numbers going back to the pre-bubble crash starting July 1998 reveals a peculiar disconnect that we discuss later. Our graph includes a relative unemployment rate to show the correlation between expected unemployment, as indicated by consumer confidence, and actual unemployment.

A) Fall 1999: The stock market bubble is over for the DOW.

B) Winter 2000: Consumers don't catch on right away that the previous few years of were not a "New Era" but were in fact the result of a stock market bubble. Consumer confidence peaks a couple of months after the DOW, then dips a couple of months after the beginning of the bear market. (April 5, 2000 iTulip notes: "A bear market is born." [http://www.itulip.com/urgentmessage.htm#Bear]. Consumer confidence lags the DOW in both directions.

C) Fall 2000: After about nine months in denial, after portfolios have been marked to market, gradually reality sinks in: it was a bubble and it's really over. Mass layoffs (not shown) rise, increasing the prospect of rising unemployment. Consumer confidence gets hammered.

D) Winter 2001: Unemployment indeed begins to rise, in line with the previous decline in consumer confidence.

E) Spring 2001: Consumer confidence levels off as consumers believe the worst is over. The DOW declines as the U.S. economy enters a brief recession. Contrary to popular belief, market declines are coincident not leading indicators of recession.

F) Summer 2001: DOW bear market leads a decline in consumer confidence.

G) Fall 2001: 9/11 attacks. Markets and consumer confidence plummet. (FYI: I was just about to close a round of venture funding for a company I was running when 9/11 occurred. That was at the end of a nine month process. Needless to say, the funding was withdrawn and I had to start over. Many start-ups failed due to lack of funding in this period.)

H) Fall 2001: DOW bottoms along with commodity prices (not shown) and CPI inflation is negative in one month and near zero for the quarter(not shown). Fed talks openly about the threat of deflation. Printing presses running full steam. (iTulip explains that the gold price appears to have bottomed [http://www.itulip.com/gold.htm].)

I) Fall 2001: Consumer confidence bottoms, lagging the start of a DOW recovery by several months.

J) Winter 2002: DOW hits a bear market rally peak.

K) Spring 2002: Consumer confidence peaks after rising as the impact on economy of 9/11 is not as bad as expected. Decline in consumer confidence lags the start of another DOW decline, as usual, by a couple of months.

L) Summer 2002: DOW makes its first bottom.

M) Spring 2003: U.S. launches world's first "pre-emptive war." Markets and consumer confidence plummet together. Consumer confidence bottoms for the economic cycle. (FYI: I'd just closed my 3rd round of funding for the company. We have our first flat quarter as sales activity stops. Orders are not cancelled, so the next quarter revenues increase 85% versus 40% as per the previous eight quarters.)

N) Summer 2003: Unemployment peaks for the economic cycle. Note that just as consumer confidence declines before unemployment begins to rise, consumer confidence rises before unemployment begins to fall.

O) Winter 2005: Consumer confidence remains range-bound until Oct. 2005.

P) Fall 2005: Hurricanes Katrina and Rita hammer consumer confidence but have little impact the markets.

Q) Spring 2007: DOW peaks over 14,000 after rising 15% for a year.

R) Summer 2007: Consumer confidence has changed only gradually over the period. The divergence of the DOW and consumer confidence over such an extended period is unusual.

Conclusions

1) The factors that have been driving the DOW up for the past year have not been reflected in consumer confidence because the rise has been driven by factors

DOW Dissonance

A) Fall 1999: The stock market bubble is over for the DOW.

B) Winter 2000: Consumers don't catch on right away that the previous few years of were not a "New Era" but were in fact the result of a stock market bubble. Consumer confidence peaks a couple of months after the DOW, then dips a couple of months after the beginning of the bear market. (April 5, 2000 iTulip notes: "A bear market is born." [http://www.itulip.com/urgentmessage.htm#Bear]. Consumer confidence lags the DOW in both directions.

C) Fall 2000: After about nine months in denial, after portfolios have been marked to market, gradually reality sinks in: it was a bubble and it's really over. Mass layoffs (not shown) rise, increasing the prospect of rising unemployment. Consumer confidence gets hammered.

D) Winter 2001: Unemployment indeed begins to rise, in line with the previous decline in consumer confidence.

E) Spring 2001: Consumer confidence levels off as consumers believe the worst is over. The DOW declines as the U.S. economy enters a brief recession. Contrary to popular belief, market declines are coincident not leading indicators of recession.

F) Summer 2001: DOW bear market leads a decline in consumer confidence.

G) Fall 2001: 9/11 attacks. Markets and consumer confidence plummet. (FYI: I was just about to close a round of venture funding for a company I was running when 9/11 occurred. That was at the end of a nine month process. Needless to say, the funding was withdrawn and I had to start over. Many start-ups failed due to lack of funding in this period.)

H) Fall 2001: DOW bottoms along with commodity prices (not shown) and CPI inflation is negative in one month and near zero for the quarter(not shown). Fed talks openly about the threat of deflation. Printing presses running full steam. (iTulip explains that the gold price appears to have bottomed [http://www.itulip.com/gold.htm].)

I) Fall 2001: Consumer confidence bottoms, lagging the start of a DOW recovery by several months.

J) Winter 2002: DOW hits a bear market rally peak.

K) Spring 2002: Consumer confidence peaks after rising as the impact on economy of 9/11 is not as bad as expected. Decline in consumer confidence lags the start of another DOW decline, as usual, by a couple of months.

L) Summer 2002: DOW makes its first bottom.

M) Spring 2003: U.S. launches world's first "pre-emptive war." Markets and consumer confidence plummet together. Consumer confidence bottoms for the economic cycle. (FYI: I'd just closed my 3rd round of funding for the company. We have our first flat quarter as sales activity stops. Orders are not cancelled, so the next quarter revenues increase 85% versus 40% as per the previous eight quarters.)

N) Summer 2003: Unemployment peaks for the economic cycle. Note that just as consumer confidence declines before unemployment begins to rise, consumer confidence rises before unemployment begins to fall.

O) Winter 2005: Consumer confidence remains range-bound until Oct. 2005.

P) Fall 2005: Hurricanes Katrina and Rita hammer consumer confidence but have little impact the markets.

Q) Spring 2007: DOW peaks over 14,000 after rising 15% for a year.

R) Summer 2007: Consumer confidence has changed only gradually over the period. The divergence of the DOW and consumer confidence over such an extended period is unusual.

Conclusions

1) The factors that have been driving the DOW up for the past year have not been reflected in consumer confidence because the rise has been driven by factors

DOW Dissonance

Leave a comment: