|

You've heard it all. FIRE Economy economists play a critical role to misinform the public about the true nature and condition of the US economy. They do for the FIRE sector industries what doctors did for the tobacco industry for decades before we all came to our senses

by Eric Janszen

In 2001 we granted the Professor Irving Fisher Award for Accuracy in Stock Market Forecasting to Abbey Joseph Cohen for her timely and prescient market calls in the year 2000. So exactly did events contradict her forecasts that anyone acting on her advice not only forfeited a fortune but likely as much as any investor working eagerly to maximize losses could possibly hope to achieve. In that same year we granted the Flying Pig Award for Economic Predictions Least Likely to Come to Pass to Martin Baily, chairman of president Clinton's three-member Council of Economic Advisers. On January 13 of that year he stated: "We think the fundamentals are strong and we are not going into a recession," just in time for the US economy at large to descend into recession and the technology industry, the fulcrum of that particular asset price inflation, to collapse into a deep depression.

Economist and professor Ruediger Dornbusch of the Massachusetts Institute of Technology on March 18, 2001 said of that recession, "We are now experiencing a wonderful soft-landing after five boom years. By the summer, this cleansing storm will have passed." Readers, especially those in the high technology industry, will recall the years that followed as less than economically pacific.

Opportunities to grant these two grand awards are legion in the wake of the collapsing housing bubble, a marvel of political and financial engineering designed by the Greenspan Fed to pull the US economy from the edge of the abyss and give Wall Street new products to sell. As is well known now, new forms of securitized mortgage debt was pitched to youthful and credulous pension fund managers from Florida to Munich and the financial markets were polluted with credit risk.

Enchanted fixed income assets promised a holy combination of high yield and low risk, like a motorcycle that gets safer to ride the faster you go or a high calorie desert that makes you thinner the more you eat. These products happened to perfectly fit the profile in duration, yield, and risk of an asset that pays neatly into a pension fund manager's carry, based on an industry standard formula. Why, it's as if it were designed with that in mind. Also, they were modeled by financial engineers to not blow up on the bond salesman's watch but on the next guy's – in, say, five years or so. In this fact is the answer to the question we often get: how did Bear Sterns, Lehman, et al, do so well for so long only to get into so much trouble? Why are they now booking revelatory losses after years of fat profits? What went wrong?

This is the story we have pieced together from a dozen conversations with industry insiders over the years – there is more to it than mere lack of accountability as reported recently by NPR and others: adding a sales channel alone did not create the problem.

Consider the mischief that can be accomplished in your industry if Sales and Marketing ran the company with Engineering reporting to it. So it was across the financial services industry after the Fed and other regulators first took on the role of regulator then abandoned it as a third party sales channel, without account to long term performance, was added to the sales process. Imagine Sales is then able to dictate to Engineering the following product requirements: make a financial product that is too good to be true, more than any pension fund manager or other money manager might dream of, like a light bulb that shines twice as bright on half the electricity consumed compared to any other. The financial engineer, also known as a quant, says that the trade-off cost for this fantastical performance is a financial product that will burn out and become worthless at some point, a limitation not in the sales literature nor even precisely known at the time of sale due to the complexity and ambiguities of financial modeling, known in other industries as "product testing." The only real guarantee these products carried was to time-out after Sales collected sales commissions and the sales people had left the company, and so they did. Now we read about the FBI chasing a few of them down to try to get some of the money back.

Add to this the normal condition of competition that occurs in any market. The Fed itself reported when looking into the matter of the exploding volume of credit default swaps, used to insure these new products against losses, were used to expand the banks' balance sheets not to diminish the risk of the existing high risk assets. This is logical. In an unregulated market, market participants must use all means available to compete, including the piling on of risky assets on top of risky assets if that is what the competition is doing, otherwise profits will suffer along with the stock price. A more efficient machine to mass produce bad debt has never before existed. It ran full throttle for years on end.

Free versus free-for-all market

In a financial system organized, if that is the word, by ideological rather than practical principles the result was much the same as the conduct of war by ideology: many poor decisions are made, corruption is commonplace, and the whole thing blows up. This was followed by the Fed's "surge" of discount window lending to bail the system out much as pallets of hundred dollar bills were dumped on Iraq. The Fed's special facilities are also, like the Iraq invasion, sans exit plan. Will the discount window be left open for 100 years?

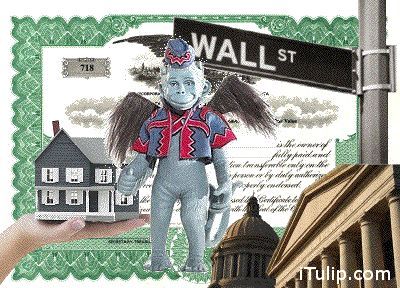

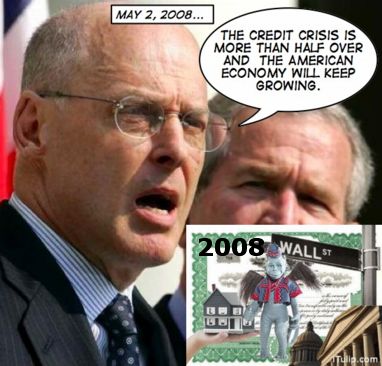

In the resulting atmosphere of mischief and malfeasance, our old dot com era Flying Pig and Irving Fisher awards are too quaint. The Flying Pig goes to politicians who dabble unsuccessfully in economics, the Irving Fisher to industry shills. New circumstances compelled us to create our Flying Monkeys of the FIRE Economy award to recognize egregious and brazen politically motivated misrepresentations of economic fact that help foster and maintain the system.

The Flying Monkey's message is always the same and with like intent: hold on to the overpriced asset, don't panic and sell.

"The stock market is not over-priced or risky," they said during the tech bubble. "Home prices are not too high and, in any case, home prices are regional and never fall across the entire nation at once," they said at the height of the housing bubble. "The credit crisis is contained, limited to a small and insignificant corner of the bond market," they said after sub-prime mortgages blew up but before Alt-A, Auction Rate Securities, and other debt products followed. "Inflation expectations are moderate, confined to volatile energy prices," they said before milk and wheat prices doubled. "Oil is a speculative bubble about to pop," they said in 2004, in 2005, in 2006, in 2007, and now again in 2008.

You've heard it all. FIRE Economy economists play a critical role to misinform the public about the true nature and condition of the US economy. They do for the FIRE sector industries what doctors did for the tobacco industry for decades.

Once upon a time, more doctors smoked Camels than any other cigarette. At least, that’s what the RJ Reynolds tobacco company claimed. From the 1920’s through the 1950’s, many cigarette manufacturers used images of medical professionals and their implied endorsements to help sell their products. Tobacco companies even advertised in the New England Medical Journal and other respected medical journals.

The Alabama Museum of the Health Sciences at UAB’s (University of Alabama at Birmingham) Reynolds Historical Library presents a display of cigarette advertising titled “When 'More Doctors Smoke Camels'… A Century of Health Claims in Cigarette Advertisements.” The exhibit was prepared by Dr. Alan Blum, professor of family medicine and director and founder of the Center for the Study of Tobacco and Society, part of the University of Alabama College of Community Health Sciences, Tuscaloosa.

“Ads from this period often carried wide-ranging medical claims and depicted cigarette-touting physicians in the company of endorsers such as movie stars and sports heroes,” says Blum. “Some ads paid tribute to medical pioneers in an effort to associate themselves with great advancements in science.”

The museum display features 25 ads selected from thousands that Blum has collected. One 1946 ad tells you “24 hours a day, your doctor is on duty ... a few winks of sleep, a few puffs of a cigarette …and he’s back at the job again.” Other ads claim cigarettes promote good digestion, or beat stress.

The exhibit also includes examples of cigarette advertising aimed directly at physicians. A 1949 ad in the Journal of the American Medical Association boasted that scientific studies showed Phillip Morris cigarettes were less irritating, and suggested that physicians should recommend them to their patients.

“In the early 1950’s, 67 percent of physicians smoked,” says Blum, “although they were among the first group to quit as the scientific evidence of health risks began to mount. But cigarette advertising appeared in medical journals as late as 1983.”

The last ad in the exhibit is for Omni, introduced in 2001 by the Ligget Company and advertised in People magazine as having less carcinogens.

“This is just the latest incarnation in a long line of false advertising,” noted Blum. “It’s pure, unadulterated hokum and just as deceptive as Ligget and Meyers ads from the 1950’s that proclaimed, ‘Stay safe, smoke Chesterfield’ and ‘L and M, just what the doctor ordered.” - When More Doctors Smoked Camels

No one today questions the health hazards of cigarettes, government mandated warning labels, laws that restrict cigarette sales to impressionable minors or prohibit cigarette advertising on TV where a steady stream of high production value images showing happy healthy young couples smoking and prancing through fields of spring grass combined over the years to unconsciously convince millions that smoking is youthful, romantic and athletic. There was a time when big tobacco convincingly claimed that government interference will irreparably damage the competitiveness of the US tobacco industry resulting in lost jobs, a major hit to the US economy, and giving US competitors a leg up in the global market.The Alabama Museum of the Health Sciences at UAB’s (University of Alabama at Birmingham) Reynolds Historical Library presents a display of cigarette advertising titled “When 'More Doctors Smoke Camels'… A Century of Health Claims in Cigarette Advertisements.” The exhibit was prepared by Dr. Alan Blum, professor of family medicine and director and founder of the Center for the Study of Tobacco and Society, part of the University of Alabama College of Community Health Sciences, Tuscaloosa.

“Ads from this period often carried wide-ranging medical claims and depicted cigarette-touting physicians in the company of endorsers such as movie stars and sports heroes,” says Blum. “Some ads paid tribute to medical pioneers in an effort to associate themselves with great advancements in science.”

The museum display features 25 ads selected from thousands that Blum has collected. One 1946 ad tells you “24 hours a day, your doctor is on duty ... a few winks of sleep, a few puffs of a cigarette …and he’s back at the job again.” Other ads claim cigarettes promote good digestion, or beat stress.

The exhibit also includes examples of cigarette advertising aimed directly at physicians. A 1949 ad in the Journal of the American Medical Association boasted that scientific studies showed Phillip Morris cigarettes were less irritating, and suggested that physicians should recommend them to their patients.

“In the early 1950’s, 67 percent of physicians smoked,” says Blum, “although they were among the first group to quit as the scientific evidence of health risks began to mount. But cigarette advertising appeared in medical journals as late as 1983.”

The last ad in the exhibit is for Omni, introduced in 2001 by the Ligget Company and advertised in People magazine as having less carcinogens.

“This is just the latest incarnation in a long line of false advertising,” noted Blum. “It’s pure, unadulterated hokum and just as deceptive as Ligget and Meyers ads from the 1950’s that proclaimed, ‘Stay safe, smoke Chesterfield’ and ‘L and M, just what the doctor ordered.” - When More Doctors Smoked Camels

You do not see ads for cigarettes in medical journals anymore. Big Tobacco has been on the run for years but the US economy has survived. Government regulation of the industry has been highly effective, reducing the cancer rate in the US by double digits since they were enacted. Other analogies include restrictions on the dumping of toxic chemicals into the environment and mandated auto safety features in cars which first Volvo and then others turned into competitive differentiators. But suggest government mandated warnings of the hazards of complex loans sold to the financially uneducated who are desperate for the American dream without the income needed to support it, warning labels on financially dangerous loan products that increase in cost at a time when the buyer can least afford the increase, or restrictions on sales of credit cards to students on college campuses who have never attended a single class on household finance, or prohibitions against advertising home equity debt on TV as the road to a carefree high net worth lifestyle and the cry arises: "Oh, no! You can't do that! That's anti-free market. What about the poor banks?"

Some day when the FIRE Economy no longer dominates our political system, media, and corporate life, and the system of economic rent extraction that weighs down on our economy is lifted, we will recall ads for complex mortgages on TV and heaps of direct mail credit card offers the way we do cigarette ads from the dark ages when Big Tobacco controlled Congress and covered the ad budget for ABC, NBC, and CBS.

Triumph of ideology over common sense, opportunity for opportunists

Naivete or incompetence root a Flying Pig Award winner’s inaccurate forecasts. Some even brag about it as when John McCain told reporters December 17, 2007 in New Hampshire: "The issue of economics is not something I've understood as well as I should," punctuated by, "I've got Greenspan's book." So do we. As Groucho Marx said of a book by an author he did not admire that he was asked to review: “From the moment I picked your book up until I laid it down I was convulsed with laughter. Someday I intend reading it.”

FIRE Economy economist analysis and forecasts are anything but naive or incompetent. They are made under the influence special interests and, we suspect in cases of expositive that is noisily contradicts glass clear evidence, hard drugs as well.

At a wealth management conference at the New York City Athletic Club put on by Reuters recently, I participated on a panel with Barry Rhitholtz and Henry Blodget. Barry and I were asked by an audience of fund and wealth managers why our web sites tended to have a better record of forecasting accuracy than mainstream business media. When the mainstream television business media covers an event that impacts the banking, real estate, or financial services industries how do they do it? Barry had fun with this one. Below, I elaborate on his comments.

Take debate over the housing bubble between 2004 and 2007, for example. First, the producer seeks out a representative of real estate industry for "expert" opinion. The producer may or may not be aware that the real estate expert, employed in the real estate industry, getting a pay check from a real estate industry dependent company whose share price and fortunes depend on a positive public impression of the real estate industry, and whose future earning potential is correlated to positive assertions about the future of the real estate industry, might – perhaps – not have an entirely disinterested opinion on the subject of real estate. If this doubt does arise in the producer's mind, for balance and to represent “the other side of the issue" the producer dutifully locates an inarticulate and disheveled academic of a college no one has ever heard of. If none is available, an astrologist, conspiracy theorist, or other crackpot is located who has less credibility than Paris Hilton training Ben Bernanke on the subject of hedge funds. Scratch that – maybe Paris can help Ben out. If the antagonist does not arrive at the studio wearing a tin foil hat, one is provided.

The perception of counterpoise is created and the objective is achieved: to make the FIRE Economy expert look smart and his or her position the only one a rational mind can accept. Major advertisers from the banking, real estate, and financial services industries are happy; the show’s anchors are happy; the FIRE Economy expert is happy; viewers are satisfied to hear how smart they are for buying expensive real estate – at least for a time – and the fine patina of respectability that veils the rotting structure of the Forth Estate lies unperturbed.

Everyone is content, except down the road the hapless homeowner who is once again blind-sided by predictable outcomes of excess.

This is why many mainstream news and analysis outlets are in trouble. It’s not only that Craig’s List made off with all of the classified advertising revenue. There are ways to solve that problem. The greater challenge is that conflicts of interest between the FIRE Economy trade press and its customers have led inexorably to a pattern of reality disconnects with the result that no one believes them anymore.

Systemic error

Beside the intentional misreporting of fact, the Flying Monkey may be awarded for the business media practice of economic data misreporting which, if not for its flawless consistency, might be mistaken for ineptitude. The panel I referred to above was asked at the event mentioned above why this is the case. My response was that reporters behave as if they want to leave the door open to some day go work for the firms they are reporting on. But there is another factor. A business reporter told me, after we'd spent an hour on the phone during which time I attempted to explain why using a home equity loan to buy a car was a bad idea, that if he understood enough about finance and economics to report on it the way iTulip does he'd be in the finance industry making real money. Fair enough. If this is true of business reporters in general, it may explain a lot about why economic data is reported as awfully as it is.

Take retail data reporting and analysis, for example.

|

Every year for as long as we can remember, in the spring with the first bloom of crocuses we are treated to the following story about retail sales.

March retail sales unexpectedly rise 0.2 pct

April 14, 2008 (Reuters)

WASHINGTON (Reuters) - U.S. retail sales unexpectedly rose 0.2 percent in March, pushed up by a jump in gasoline sales, a government report released on Monday showed.

Sales at gasoline stations rose 1.1 percent, the Commerce Department said. Excluding gasoline sales, retail sales were flat last month.

Retail sales jump unexpectedly in May

June 6, 2008 (LA Times)

Costco and Wal-Mart benefit greatly from the 3% boost at chain stores, according to the International Council of Shopping Centers, as shoppers carefully spend their tax rebates.

Shoppers, some armed with tax rebate checks, spent more than forecast at discount and wholesale stores in May and boosted U.S. retail sales.

Analysts had anticipated a slow month as people grappled with the housing slump, stringent credit and skyrocketing gasoline prices. Even as checks from the federal economic stimulus package began arriving, many Americans funneled the money into savings or paid bills, and those who ventured into stores exercised caution, experts said Thursday.

April 14, 2008 (Reuters)

WASHINGTON (Reuters) - U.S. retail sales unexpectedly rose 0.2 percent in March, pushed up by a jump in gasoline sales, a government report released on Monday showed.

Sales at gasoline stations rose 1.1 percent, the Commerce Department said. Excluding gasoline sales, retail sales were flat last month.

Retail sales jump unexpectedly in May

June 6, 2008 (LA Times)

Costco and Wal-Mart benefit greatly from the 3% boost at chain stores, according to the International Council of Shopping Centers, as shoppers carefully spend their tax rebates.

Shoppers, some armed with tax rebate checks, spent more than forecast at discount and wholesale stores in May and boosted U.S. retail sales.

Analysts had anticipated a slow month as people grappled with the housing slump, stringent credit and skyrocketing gasoline prices. Even as checks from the federal economic stimulus package began arriving, many Americans funneled the money into savings or paid bills, and those who ventured into stores exercised caution, experts said Thursday.

|

There are three parts to the annual "retail sales unexpectedly rise" reporting farce.

For as long as the retail data go back the retail industry has been driven by a cycle of holiday and credit-driven gift-buying sales around the winter holidays when retailers pull out all the stops for Black Monday, the Monday after Thanksgiving when retailers hope to go turn a profit and go into the black and out of the red to turn for the year. Like clockwork the first quarter of the next year follows like a New Year's consumption hangover as households start paying off holiday credit card debts. The pattern is not haard to spot if you look at the non-seasonally adjusted data for all retail sales, in the chart to the left.

The cycle is even more profound for items typically purchased as holiday gifts, such as electronics, as shown in the chart below.

Second, retail sales data measure dollar volume not unit volume. The report above states without humor, “U.S. retail sales unexpectedly rose 0.2 percent in March, pushed up by a jump in gasoline sales.” During inflationary periods, such as we are enjoying today, inflation is reported as increased retail sales.

The following graph of consumer gasoline expenditures shows why rising costs reported as rising sales tends to give a misleading impression of the retail sales picture.

Selling lots of gasoline by dollar not unit volume. The economy must be doing great!

Naturally, the retail sales figures for items that, unlike gasoline, are not essential are not rising. More on that later.

Third, retail is all about consumer credit; when you report retail sales it never hurts to mention the consumer credit picture because they are mirror images. Note the correlation between retail sales and consumer credit in the chart below going back to 1967 that shows the percentage change in consumer credit versus the same period last year (blue) compared to retail sales dollar (red).

The retail cycle is the credit cycle

Note that the series is discontinued. This is unfortunate because it makes long term trends difficult to analyze. Some of our favorite series have been discontinued and replaced with new and, supposedly, improved series. We're not so sure.

Fourth and final point: why would "analysts" fail to expect an increase in May retail sales when households started to receive tax rebate checks? Wasn't that the whole point of the rebate, to get household out for one final shopping spree before the presidential elections?

Retail sales activity declining for years

In our example of FIRE Economy economic data misreporting we’ve buried the lead. The real story not told in the retail number is not the lack of acknowledgment of seasonal cycles reported as surprise retail sales increases every year, that rising inflation is reported as rising retail sales, or that a report on retail sales is a report on cyclical consumer credit. The big story is that the rate of growth of retail sales has been declining year over year ever since the housing bubble topped out in 2006.

Retails sales growth has been slowing since 2006

The last time retail sales growth slowed similarly, briefly turning negative, was during the last recession.

Retail sales growth slows during recession (red box) and since mid 2006 (yellow box)

Retail sector analysis

A deeper dive into the data reveals the specific character of our recession. Before we take one, as a quick aside, we point out that understanding US retail trade data is not as easy as it looks. Readers may think it's a matter of going to a government data site, cutting and pasting the data into iTulip's excel graph format and – viola!

First of all, the data are often bad. Take the data on Beer, Wine, and Liquor stores. All we wanted to do was disprove or confirm the theory that we all go boozing during recession. I was asked this by a reporter for a national magazine doing a story on recession-proof business ideas. All we need is reliable and consistent retail sales data. No such luck.

Starting with the Census Bureau's data based on the NAICS system, here's the non-seasonally adjusted data going back to 1992.

Goofy non-seasonally adjusted Census Bureau data. What's that spike?

Are we supposed to believe that monthly booze sales after ranging from $1 billion to $2 billion a year since 1992 spiked to over $4.7 billion in Dec. 2007? That was some New Year's party they were having over there at the Census Bureau. Then there is the Bureau's seasonally adjusted data.

Goofy seasonally adjusted Census Bureau data

Yikes! Sales really fell off a cliff on a seasonally adjusted basis, didn't they? This does not inspire confidence in the data.

The next problem is that there are often multiple government groups collecting and analyzing retail. Of course, they do not agree with each other.

After making some assumptions, we corrected the Census Department and compare it to the BEA and Census data. Do booze sales rise during recessions?

Who to believe?

Census Bureau data say booze sales are off -8% from a year ago last year while the BEA data says they're up 5%. Who's right? Generally, we trust the BEA data as the most accurate. It says booze sales are up since the recession started end of 2007. We'll drink to that.

When you see a chart on iTulip it often represents as many a dozen hours of work that has to be done to make sure the data are not garbage, because – in case you hadn't noticed – our government churns out a lot of goofy and contradictory data. There is an upside for FIRE Economy flying monkeys: they can cherry pick the data to come up with "facts" that support their ideology and thereby give the impression that their employers want them to convey.

Retail sales: Show me the pain

On to the data that tell us how the Monthly Payment Consumer is holding up. First stop, we see a big drop in the sales of furniture that isn't needed to fill the floor space all of those MacMansions that are not being sold.

Who needs new furniture?

No surprise there. How about car sales?

Auto sales off but further declines to go

Car sales are showing a negative growth rate, but we are not in 2002 yet. We suspect most of the sales are of the trade-to-small swap of Ford Explorers for Honda Civics variety. This report SUV and Pickup Truck Buyers Now “Owners for Life” from one of our favorite sites http://www.thetruthaboutcars.com offers anecdotal evidence.

As we mentioned before, you can't talk about retail without talking about credit, and the reason why auto sales are holding up better than you'd otherwise expect is not only the trade-to-small trend but also consumer credit for car loans is still holding up.

Also not surprisingly, used goods are selling well.

Used goods sales are up

What you may be hearing about the restaurant industry, that rising costs and recession are hitting it with a double macro-economic whammy, is consistent with the data.

They stopped eating out

In fairness, the retail story has not been mangled by every business media outlet. Bloomberg covered the retail sales data well.

U.S. Retail Sales Increase Twice as Much as Forecast

June 12, 2008 (Bob Willis - Bloomberg)

Retail sales in the U.S. rose twice as much as forecast in May as Americans used their tax rebates to shop at electronics and department stores, and record gasoline prices swelled service-station receipts.

The surge in fuel costs is "a structural change, not just a cyclical change,'' General Motors Corp. Chief Executive Officer Rick Wagoner said June 3 as Detroit-based GM said it would close four North American pickup and large SUV factories and focus more on making small, fuel-efficient cars.

"Many of our customers need to live from paycheck to paycheck," Wal-Mart Chief Financial Officer Thomas Schoewe told reporters last week. "The amount they're spending on basics is a big portion of the total basket."

"This good report suggests the tax rebates are having an impact," Mark Zandi, chief economist at Moody's Economy.com in West Chester, Pennsylvania, said in a Bloomberg Radio interview. "As these tax-rebate effects fade, the weaker job market is going to take over."

Retail sales expectedly surge due to rebate checks? Energy cost increases are structural? Unemployment and inflation to cancel out the stimulus of Inflation Tax Abatement Checks? Makes sense to us.June 12, 2008 (Bob Willis - Bloomberg)

Retail sales in the U.S. rose twice as much as forecast in May as Americans used their tax rebates to shop at electronics and department stores, and record gasoline prices swelled service-station receipts.

The surge in fuel costs is "a structural change, not just a cyclical change,'' General Motors Corp. Chief Executive Officer Rick Wagoner said June 3 as Detroit-based GM said it would close four North American pickup and large SUV factories and focus more on making small, fuel-efficient cars.

"Many of our customers need to live from paycheck to paycheck," Wal-Mart Chief Financial Officer Thomas Schoewe told reporters last week. "The amount they're spending on basics is a big portion of the total basket."

"This good report suggests the tax rebates are having an impact," Mark Zandi, chief economist at Moody's Economy.com in West Chester, Pennsylvania, said in a Bloomberg Radio interview. "As these tax-rebate effects fade, the weaker job market is going to take over."

|

This year's Flying Monkey of the FIRE Economy prize goes to the general of the army of FIRE Economy flying monkeys, US Treasury Department head and ex-Goldman Sachs CEO, Henry Paulson. A few examples:

In his latest speech, US Treasury Secretary Henry Paulson has continued to push for more power for the Federal Reserve in the oversight of financial institutions. - June 20, 2008

Treasury Secretary Henry Paulson said Thursday that the Federal Reserve may need to extend liquidity facilities to a broader range of financial firms. - June 19, 2008

U.S. Treasury Secretary Henry Paulson on Monday defended the dollar's status as the world's reserve currency and said its recent decline was only a small factor behind a surge in oil prices. - June 2, 2008

And so on. Is it really such a good idea to give more power to the Fed, institution most responsible for creating the credit crisis in the first place? Should yet more institutions really be given access to Fed lending facilities and how is that consistent with a strong dollar policy? Is anything Paulson says true or make any sense? Treasury Secretary Henry Paulson said Thursday that the Federal Reserve may need to extend liquidity facilities to a broader range of financial firms. - June 19, 2008

U.S. Treasury Secretary Henry Paulson on Monday defended the dollar's status as the world's reserve currency and said its recent decline was only a small factor behind a surge in oil prices. - June 2, 2008

I conclude on a positive note, that the Flying Monkeys have their foes.

N.Y. Fed's private OTC actions under fire

June 15, 2008 (Joanne Morrison - Reuters)

The New York Federal Reserve's closed-door rule making with top players in the massive $60 trillion credit default swaps market came under legal fire on Sunday, as a fair finance activist filed a complaint questioning why it was done in the dark.

"The Federal Reserve seems to think it can engage in rule making in secret only with the industry," said Matthew Lee, executive director of the New York-based non-profit group Inner City Press/Community on the Move.

Lee filed the administrative complaint on Sunday with both the New York Fed and the Federal Reserve Board in Washington. In the complaint, he demanded that the central bankers explain why the meetings earlier this month were private and requested copies of all communications and details about the New York Fed-sponsored talks.

Officials at the Federal Reserve could not immediately be reached for comment.

The meetings were held with more than a dozen companies led by investment bank Goldman Sachs Group Inc. The companies -- which account for the bulk of business in the $60 trillion market -- met to help set new rules for credit default swaps trading, including the establishment of a clearinghouse.

Credit default swaps are privately negotiated transactions used by companies to hedge against default risks. Over the past decade, the market has grown exponentially, from about $1 trillion to $60 trillion.

Lee, referring to the Fed-led rescue of investment bank Bear Stearns by JPMorgan Chase & Co, said, "It was one thing to bail out Bear Stearns without any comments from the public. Now the Fed is trying to bail out or benefit 17 of the largest financial institutions behind closed doors."

Citing the federal Administrative Procedures Act, he said it was illegal to have conducted the meetings.

Who knows. With guys like Lee leading the charge and reporters like Joanne Morrison covering their efforts, perhaps some time after the Presidential elections in November and the next Congressional elections we will be able to put this whole sad and sordid episode of ideologically based financial system policy management behind us and restore common sense to the system, and the Flying Monkeys of the FIRE Economy will go the way of the Wicked Witch of the West.June 15, 2008 (Joanne Morrison - Reuters)

The New York Federal Reserve's closed-door rule making with top players in the massive $60 trillion credit default swaps market came under legal fire on Sunday, as a fair finance activist filed a complaint questioning why it was done in the dark.

"The Federal Reserve seems to think it can engage in rule making in secret only with the industry," said Matthew Lee, executive director of the New York-based non-profit group Inner City Press/Community on the Move.

Lee filed the administrative complaint on Sunday with both the New York Fed and the Federal Reserve Board in Washington. In the complaint, he demanded that the central bankers explain why the meetings earlier this month were private and requested copies of all communications and details about the New York Fed-sponsored talks.

Officials at the Federal Reserve could not immediately be reached for comment.

The meetings were held with more than a dozen companies led by investment bank Goldman Sachs Group Inc. The companies -- which account for the bulk of business in the $60 trillion market -- met to help set new rules for credit default swaps trading, including the establishment of a clearinghouse.

Credit default swaps are privately negotiated transactions used by companies to hedge against default risks. Over the past decade, the market has grown exponentially, from about $1 trillion to $60 trillion.

Lee, referring to the Fed-led rescue of investment bank Bear Stearns by JPMorgan Chase & Co, said, "It was one thing to bail out Bear Stearns without any comments from the public. Now the Fed is trying to bail out or benefit 17 of the largest financial institutions behind closed doors."

Citing the federal Administrative Procedures Act, he said it was illegal to have conducted the meetings.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment