Originally posted by Milton Kuo

View Post

I was in a similar situation after I lost almost all my cash chasing a stock that collapsed due to fraud. I just started work at that time, the loss though not significant in absolute terms, had a deep psychological impact on me. After that and the dot com bust, which I missed entirely, I decided to go "macro", and that's how I bumped into iTulip.com.

The stock market is an unfair game, retail investors like us won't know what the insiders and billionaire investors are doing (to pump up the stock or dump) or know the future changes to regulations and politics that can affect stock prices - for example, we won't know if politicians decide to bailout a particular bank. ;)

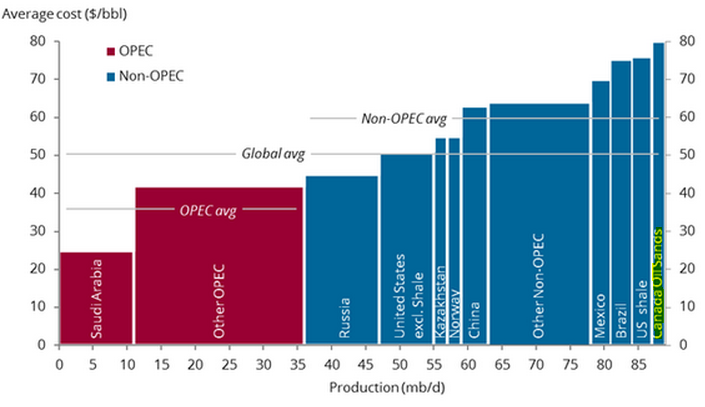

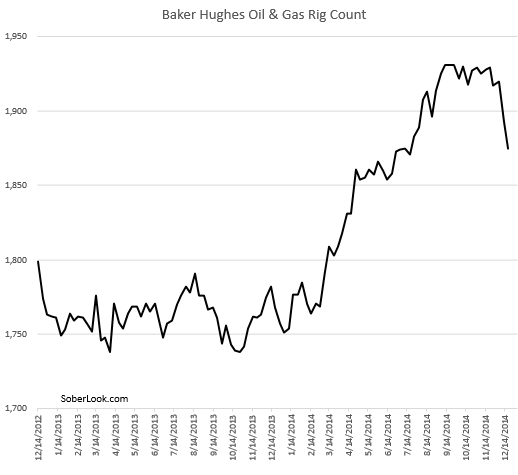

I've decided to follow billionaire investors such as Sir Buffett, among others. I also found out that they are not always right so I tried to diversify across different industries and even across different countries so any mistake won't wipe out everything. I made sure that any stock is not more than 5% of my total portfolio including cash. I also checked insider trades - but it's not always right. Insiders can also misjudge the market and lose their pants - which happened to many oil executives just recently.

After reading Chris Cook's video on oil prices I now know that a market can mis-price a stock or commodity for a significantly long period of time, like 5-8 years, so it's possible for a stock to remain depressed and below valuation for a significant period of time and likewise be overvalued for a lengthy period of time. To minimize risk, it's necessary to buy 10-20 years into the future.

I'm not sure if you've been to China to see some of the empty real estate projects. Even back then in 2008 I felt they are overbuilding offices, but after 2009, they built even more so it is impossible to time the market.

Leave a comment: