Re: Subprime Credit Crunch Could Trigger Collapse

re: fcb's moving to agencies. i think that over the time the fcb's are becoming more "daring." it's like in the 1980's and early '90's, it was said that corporate equipment buyers would never get fired for buying ibm. then they learned that other equipment was reliable and a much better bargain. the fcb's bought treasuries in the past, now they buy agencies but they TALK about maybe, someday, buying equities!

re: private foreign purchases v fcb purchases of treasuries and agencies. i think the fcb's buy while the dollar is declining. at those times private investors won't buy, and the fcb's are supporting the dollar. when the dollar started rising in 2005, likely 2o to the tax break for u.s. corps repatriating profits, fcb's no longer had to buy to support the dollar. but then private investors, with assets magnified by the carry trade, jumped in to ride the dollar and the interest rate spreads.

Announcement

Collapse

No announcement yet.

Subprime Credit Crunch Could Trigger Collapse

Collapse

X

-

Re: Subprime Credit Crunch Could Trigger Collapse

Some excellent work on your part with that tracking via your Implode-o-meter too. Great title, some definite wry grins from here.Originally posted by akrowneThanks for the great charts, Bart. Interesting stuff.. this makes sense: credit is contracting (or at least, growth is slowing down) of its own accord, so the domestic powers-that-be are pumping whatever they can (showing up in M3).

By the way, I've noticed that FCBs seem to predictably rotate out of Treasuries into Agencies, as an ongoing pattern. Do you have any theory as to why this is?

There's a similar pattern where foreign private parties follow foreign official in their buying patterns, with something like a one-year lag.

Pumping wise, yes the permanent repo and Eurodollar growth rates are sure way up there in M3. We've also had some major hot money pumping going on with TOMOs and TIOs since last June or so too. The daily balance totals have exceeded $100 billion on many occasions - one of those periods just ended a few days ago.

No guarantees of course, but the current credit pattern sure looks similar to 2000 and early 2001.

My primary theory on the FCB agency purchasing pattern is somewhat tinfoil hat enhanced - there are real housing assets behind them, whereas Treasuries have no fundamental longer term floor.

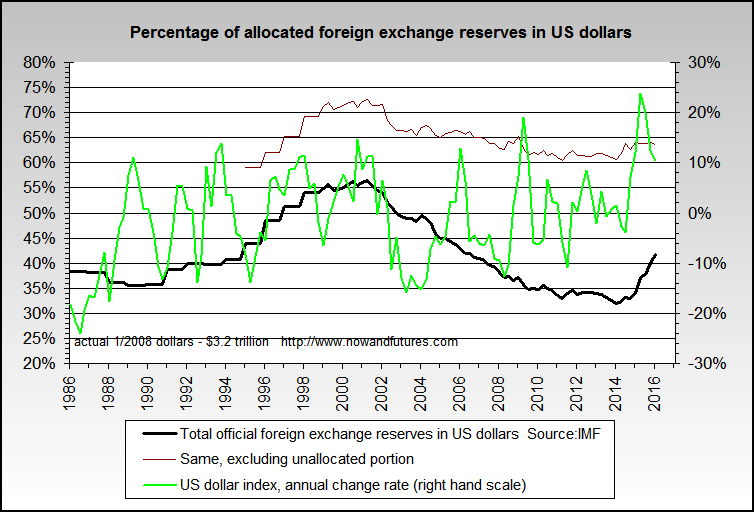

Very much true on foreign private parties following foreign official ones in their buying patterns with a lag. One of the better examples of that is the IMF's COFER data showing FCB's US dollar holding percentagess. FCB's moved way before almost anyone else.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Thanks for the great charts, Bart. Interesting stuff.. this makes sense: credit is contracting (or at least, growth is slowing down) of its own accord, so the domestic powers-that-be are pumping whatever they can (showing up in M3).

By the way, I've noticed that FCBs seem to predictably rotate out of Treasuries into Agencies, as an ongoing pattern. Do you have any theory as to why this is?

There's a similar pattern where foreign private parties follow foreign official in their buying patterns, with something like a one-year lag.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Originally posted by Charles Mackayin the era of Goldman rigged carry trade

hmmm, maybe a little off your rocker.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Well, that was a real breath of fresh air! It gives me additional reason to believe that I haven't gone completely off my rocker like my friends and family say I have. I liked the part where he said that interest rates can't go any lower because interest rates are set by whatever rate is necessary to stabilize the currency. amen to that! The new vigilante is the dollar rate and gold. The old vigilante (bonds) are passť in the era of Goldman rigged carry trade and derivatives.Originally posted by EJI strongly recommend this lecture by Michael Hudson. (Warning for Jim Nickerson: Michael makes me sound like a Wall Street cheerleader!)

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Originally posted by EJThat means by 2008, if not sooner.

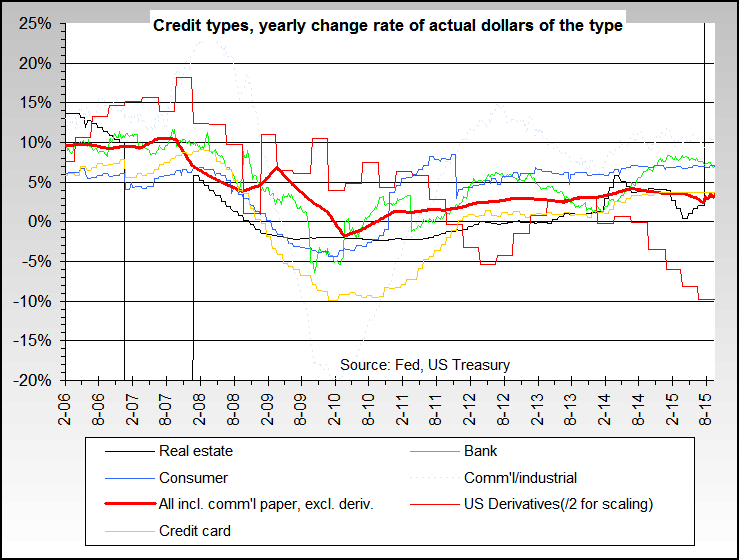

And speaking of sooner, and also to back up Aaron's great work, here's the current weekly picture of all 5 major types of credit showing annual rates of change.

The take away is simple - all five are down trending and two or three have dropped rather sharply in the last few weeks, and reflect the same basic sub prime issue that Aaron noted. This is a very key development in my book and if the Fed & Treasury don't do some fairly large hot money injections over the next few weeks, I think we're within a few weeks (by mid March at the latest) of a significant world wide correction.

Last edited by bart; February 02, 2007, 07:44 PM.

Last edited by bart; February 02, 2007, 07:44 PM.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

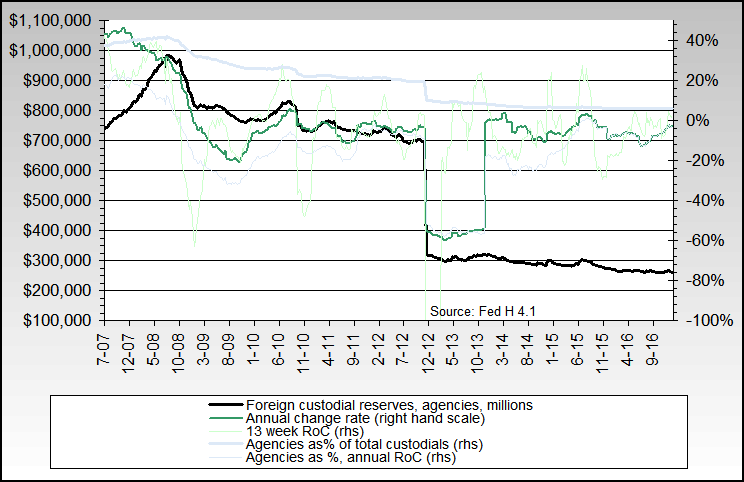

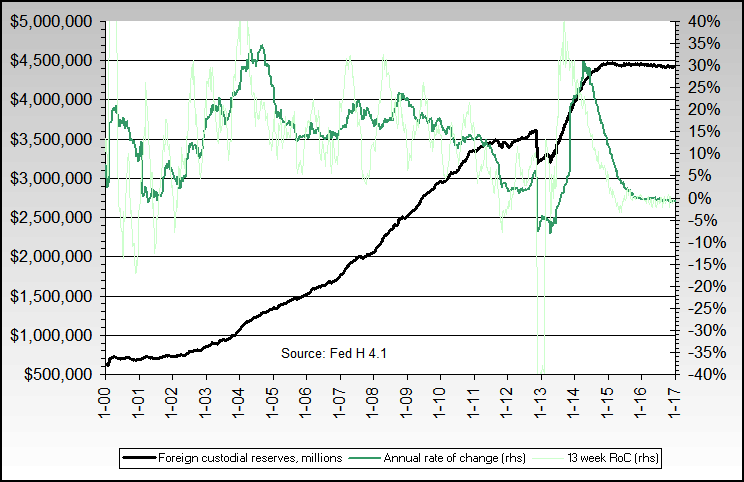

The big growth from foreign central banks has been in government agency bonds, not Treasuries as you know.Originally posted by EJ...

Anyone who is curious about the rise in home-builder stocks (and I'm surprised Tet hasn't already chimed in): The Boyz need to lay the groundwork for the latest sales trip by treasury head and ex-Goldman employee Paulson and co. to find more suckers to buy U.S. bonds.

...

They're reflected in the burgundy lines in the chart below, and have been dropping rate of change wise since early 2006 (and one of the major reasons for the trip you noted), although they're still growing at over a 20% rate.

"Custodials", for those who may not know, is a just a fancy word to describe the accounts that the Fed used to funnel money from foreign central banks into the various US markets. The Fed has "custody" of that money.

Here's the full picture of custodials for the last few years, showing over a trillion dollar flow from abroad in about the last 5 years.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Yes, right here. Circa 2005:Originally posted by akrowneThanks, Eric!

This article may aptly compliment Nouriel Roubini's post for the day, where he points out parallels to the 1998 financial crisis (similar if not more extreme vulnerabilities) and asks where the catalyst might be.

I say, it might be right here, in the supposedly staid and solid US financial economy.

"What I want to make sure I get across here, in case it's not obvious, is that I'm fairly certain that an unseemly economic turn of events is more likely to happen than not, probably in the next three years, and it's going to happen here, in the U.S."

That means by 2008, if not sooner.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

And that's also a classic sign that a top is approaching, timing issues notwithstanding.Originally posted by Jim NickersonIf things are so bleak. Someone seems not to be noting it in the homebuilders.

The $DJR for example just last September or so moved into its 3rd (and to my mind final for years to come on an inflation adjusted basis) increase of slope of its trend line.

Leave a comment:

-

Next Dominoes to Fall

Any ideas, anyone, on what those potentially buckling strong companies are?Originally posted by jkIt is a bloodbath, and is pressuring even strong companies to buckle. NO ONE is making any money in the market right now. We are at a point of no return for many. The next two weeks will be wild."

I'd like to take a look at their put options.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

My browser says the link above cannot be found.Originally posted by EJI strongly recommend this lecture by Michael Hudson. (Warning for Jim Nickerson: Michael makes me sound like a Wall Street cheerleader!)

edit:

http://www.michael-hudson.com/audio/...ealEstates.mp3

This works but it takes a few minutes to load.Last edited by Jim Nickerson; February 02, 2007, 05:26 PM.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

I personally don't have the guts to short any market or individual stocks, but wouldn't this make a great time to short the homebuilders?

Also, the fact that the stock market is being inflated to me seems like a short to mid-term reason to stay in stocks for the time being (yes I know I'm playing with fire trying to time the market, but individual stock valuations of the Dow30 still haven't reached even half of dot.com bubble levels, so I still see a margin of safety there).

Again, this is why stocks seem to me to be a safer investment than almost everything... why bet against the House when you can bet with it?

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Thanks, Eric!

This article may aptly compliment Nouriel Roubini's post for the day, where he points out parallels to the 1998 financial crisis (similar if not more extreme vulnerabilities) and asks where the catalyst might be.

I say, it might be right here, in the supposedly staid and solid US financial economy.

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Excellent piece, as always, Aaron.

Anyone who is curious about the rise in home-builder stocks (and I'm surprised Tet hasn't already chimed in): The Boyz need to lay the groundwork for the lastest sales trip by treasury head and ex-Goldman employee Paulson and co. to find more suckers to buy U.S. bonds. It's a tough sell when the U.S. stock market is confirming a declining U.S. economy, and it's trivial for a few investment banks to hold up the price of a few stocks for a while for optics. All of the reports you are reading are designed to support the lastest effort to unload the cost of the Iraq War on Asia. (See The Coming End of the US Foreign Investment Bubble: What if we lose?) The rising gold price seems to be hedging the success of this latest trip. Sales are clearly getting harder and harder to pull off.

I strongly recommend this lecture by Michael Hudson. (Warning for Jim Nickerson: Michael makes me sound like a Wall Street cheerleader!)

Leave a comment:

-

Re: Subprime Credit Crunch Could Trigger Collapse

Aaron, just a point of clarity, the chart you posted is for BBB- not BBB.

Here is the chart for BBB. Still Ugly.

Leave a comment:

Leave a comment: