|

A year later, as a few thousand carefully modeled but carelessly made property loans turn turtle, the toxic risk is starting to ooze out of the bottom of the credit market sea, in the form of sub-prime market loan defaults. As our qwerty pointed out, anyone trying to find good debt plays in the current risk polluted sea of bad credit is diving for pearls in a sewer.

Our Aaron Krowne's lender implode-o-meter site got some press this week from Bloomberg. Listed among his news links is this story from HousingWire, Mortgage Risk Exposes CDOs to Significant Potential Losses.

Risk in the U.S. mortgage market may have been severely understated for years, according to market analysts in a paper presented late Thursday at Hudson Institute, a public policy research organization.

Drexel University’s Joseph Mason and housing analyst Joshua Rosner from Graham Fisher & Co. unveiled new research which raises concerns that mortgage-linked collateralized debt obligations (CDOs) are exposed to significant and unanticipated losses if the U.S. housing market continues to stagnate.

CDOs are structured derivatives that aggregate existing securities, and the authors argue that MBS pools have become the predominant class of assets backing a majority of collaterized debt obligation issuance.

“The FDIC reports that 81 percent of the $249 billion of CDO collateral pools issued in 2005, or $200 billion, was made up of residential mortgage products,” the study said. “Moody’s CDO Asset Exposure Report for October 2006 reveals that 39.5 percent of the collateral within the 678 deals covered by Moody’s consists of RMBS, just over 70 percent of that in subprime and home equity loans and the other 30 percent in prime first-lien loans.”

Drexel University’s Joseph Mason and housing analyst Joshua Rosner from Graham Fisher & Co. unveiled new research which raises concerns that mortgage-linked collateralized debt obligations (CDOs) are exposed to significant and unanticipated losses if the U.S. housing market continues to stagnate.

CDOs are structured derivatives that aggregate existing securities, and the authors argue that MBS pools have become the predominant class of assets backing a majority of collaterized debt obligation issuance.

“The FDIC reports that 81 percent of the $249 billion of CDO collateral pools issued in 2005, or $200 billion, was made up of residential mortgage products,” the study said. “Moody’s CDO Asset Exposure Report for October 2006 reveals that 39.5 percent of the collateral within the 678 deals covered by Moody’s consists of RMBS, just over 70 percent of that in subprime and home equity loans and the other 30 percent in prime first-lien loans.”

|

The highlights are that vintage 2006 mortgage loans are ugly, that the risks are in the sub-prime and second home markets, but that the CDO market will hold up if home prices nationally do not decline more than 15%, and if they decline 20% or more, all bets are off. Robert Shiller predicts such a 20% decline nationally is likely, and the lesser known Karl Case, as reported here, believes a greater than 20% price correction is virtually guaranteed.

Makes for an interesting interview. Look for it next week.

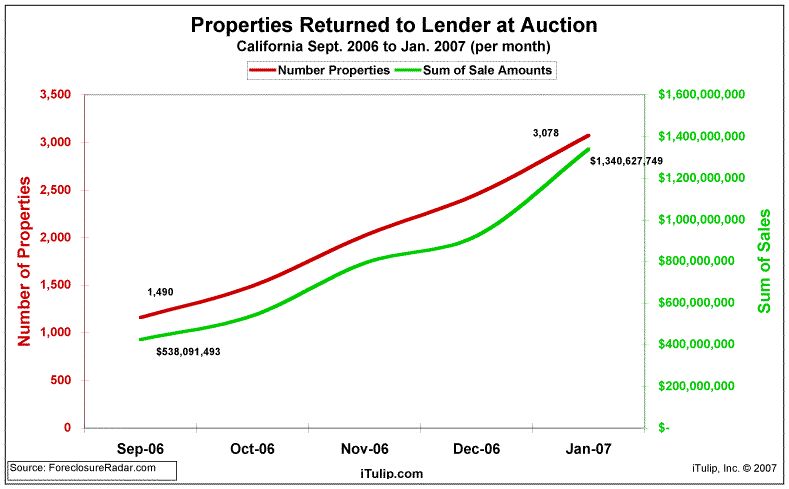

Our Sean O'Toole's proprietary data from his new company Foreclosure Radar–released today and only available here–shows the dollar volume of properties returned to lender at auction. Volumes were $543 million in September last year and... $1.3 billion in January 2007.

On careful inspection, it doesn't appear that this particular set of defaults conforms to model. Sean reports that vintage 2005 loans dominate the 3000 properties in January's count, not 2006. That makes sense, as three year ARMs are just starting to adjust from 2005. What does this bode for the 2006 vintage? Even worse, we'd guess.

__________________________________________________

Special iTulip discounted subscription and pay services flogged here:

For a book that explains iTulip concepts in simple terms americasbubbleeconomy

For a macro-economic and geopolitical View from Europe see Europe LEAP/2020

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment