|

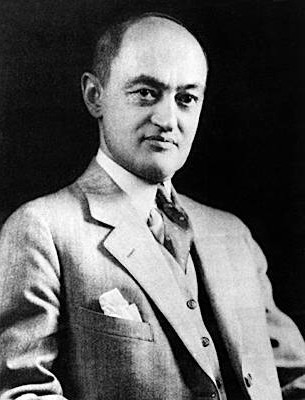

Words heard from Henry Paulson July 2008 compelled us to note That dreaded phrase: ''The system is fundamentally sound''. Our observation is that every time in history during a financial crisis that a Treasury Secretary or other government authority utters that phrase it means that the system is fundamentally unsound -- head for the hills. Continuing our historical perspective, this week's business and economic news recall an excerpt that we first ran in 1999, from the brilliant economist Joseph A. Schumpeter's (1883 - 1950) classic book, Business Cycles, published in 1939. His theories on the relationship among firms, credit creation, and money in booms and busts are unmatched -- and prescient. First, today's headlines.

• Circuit City to close 567 remaining US stores

• ConocoPhillips to Take $34 Billion Charges, Cut Staff

• Intel's Net Plunges 90% as Demand Dries Up

• California delaying tax refunds and welfare payments amid cash crisis

• Nearly 40K job cuts announced as weakness persists

• Deflation concerns grow as consumer prices shrink

• Shipping rates hit zero as trade sinks

• Trichet Vision Unravels as Italy, Spain Debt Shunned

• Baltic Protests Erupt as EU’s Worst Economies Shake

• German Bond Auction Fails to Attract Enough Demand

May an analysis of our current crisis eight years from now read like this?

On Consumer Credit

Consumers' borrowing is one of the most conspicuous danger points in the secondary phenomena of prosperity, and consumers' debts are among the most conspicuous weak spots in recession and depression.

In other words, we shall readily understand why the load of debt thus light heartedly incurred by people who foresaw nothing but booms should become a serious matter whenever incomes fell, and that construction would then contribute, directly and through the effects on the credit structure of impaired values of real estate, as much to a depression as it had contributed to the preceding booms. Nothing is so likely to produce cumulative depressive processes as such commitments of a vast number of households to an overhead financed to a great extent by commercial banks. - Joseph A. Schumpeter -- Business Cycles, 1939

In other words, we shall readily understand why the load of debt thus light heartedly incurred by people who foresaw nothing but booms should become a serious matter whenever incomes fell, and that construction would then contribute, directly and through the effects on the credit structure of impaired values of real estate, as much to a depression as it had contributed to the preceding booms. Nothing is so likely to produce cumulative depressive processes as such commitments of a vast number of households to an overhead financed to a great extent by commercial banks. - Joseph A. Schumpeter -- Business Cycles, 1939

On Businesses Creating their Own Money via Credit

If innovation is financed by credit creation, the shifting of the factors is effected not by the withdrawal of funds -- "canceling the old order" -- from the old firms, but by the reduction of the purchasing power of existing funds which are left with the old firms while newly created funds are put at the disposal of entrepreneurs: the new "order to the factor" comes, as it were, on top of the old one, which is not thereby canceled. It will be shown later how this will affect prices and values and produce a string of important consequences which are responsible for many characteristic features of the capitalist process. This side of credit creation may also be clarified by means of the analogy with the issue of government fiat, although in all other respects the differences are much more important than the similarities.

By confining the manufacture of credit to banks (within his model), we are roughly conforming to fact. But this restriction is not necessary. In various ways, firms may create means of payments themselves. A bill of exchange or a note is not, in itself, such a means. On the contrary, it generally requires financing and thus figures on the demand rather than the supply side of the money market. If, however, it circulates in such a way as to effect payments, it becomes an addition to the circulating medium. Historically, this has occurred repeatedly. An example is afforded by the practice which prevailed in the Lancashire cotton industry until at least the middle of the nineteenth century. Manufactures and traders drew bills on each other which, after acceptance, were used for the settlement of debts due to other manufacturers and traders, much as bank notes would be. This should be taken into account in any estimate of the quantity of credit creation. - Joseph A. Schumpeter -- Business Cycles, 1939

By confining the manufacture of credit to banks (within his model), we are roughly conforming to fact. But this restriction is not necessary. In various ways, firms may create means of payments themselves. A bill of exchange or a note is not, in itself, such a means. On the contrary, it generally requires financing and thus figures on the demand rather than the supply side of the money market. If, however, it circulates in such a way as to effect payments, it becomes an addition to the circulating medium. Historically, this has occurred repeatedly. An example is afforded by the practice which prevailed in the Lancashire cotton industry until at least the middle of the nineteenth century. Manufactures and traders drew bills on each other which, after acceptance, were used for the settlement of debts due to other manufacturers and traders, much as bank notes would be. This should be taken into account in any estimate of the quantity of credit creation. - Joseph A. Schumpeter -- Business Cycles, 1939

On Money Failures

We insisted above on the differences between the issue of government fiat and credit creation by banks, not because of the difference between the creating agencies but because of the difference in the purposes usually associated with the two, which is what accounts for the difference in effects. For it must never be forgotten that the theory of credit creation as, for that matter, the theory of saving, entirely turns on the purpose for which the created -- or saved -- means of payment are used and on the success which attends that purpose. The quantity-theory aspect or, as we might also say, the aggregative aspect of the practice is entirely secondary. The trouble with John Law was not that he created means of payment in vacuo, but that he used them for purposes which failed to succeed. This will have to be emphasized again and again. - Joseph A. Schumpeter -- Business Cycles, 1939

On Liar Loans and other Lax Lending Practices

It is important for the functioning of the system that the banker should know, and be able to judge, what his credit is used for and that he should be an independent agent. To realize this is to understand what banking means... Even if he confines himself to the most regular of commodity bills and looks with aversion on any paper that displays a suspiciously round figure, the banker must not onlyknow what the transaction is which he is asked to finance and how it is likely to turn out, but he must also know the customer, his business, and even his private habits, and get, by frequently, "talking things over with him," a clear picture of his situation. But if banks finance innovation, all this becomes immeasurably more important. - Joseph A. Schumpeter -- Business Cycles, 1939

On a Low Banking Standards and Bank Regulation

Whatever our theories, we must all recognize that the leading functions are not simple matters which people can be expected to perform as effectively as they can be expected to leave an employment that offers a lower for one that offers a higher wage, or to produce beans instead of peas if it pays better; but that they are difficult to fulfill, so much so that many of those who attempt to fill them are hopelessly below the mark in a sense in which even the subaverage workman, craftsman, farmer is not. This is, of course, so with entrepreneurs. But in their case we take account of it by recognizing from the start that a majority of would-be entrepreneurs never get their projects under sail and that, of those who do, nine out of ten fail to make success of them. In the case of bankers, however, failure to be up to what is very high mark interferes with the working of the system as a whole. Moreover, bankers may, at some times and in some countries, fail to be up to the mark corporatively: that is to say, tradition and standards may be absent to such a degree that practically anyone, however lacking in aptitude and training, can drift into the banking business, find customers, and deal with them according to his own ideas. In such countries or times, wildcat banking develops. This in itself is sufficient to turn the history of capitalist evolution into a history of catastrophes. One of the results of our historical sketch will, in fact, be that the failure of the banking community machine accounts for most of the events which the majority of observers call "catastrophes."

Not less important for the functioning of the capitalist machine is it that banks should be independent agents... This means, practically speaking, that banks and their officers must not have any stake in the gains of enterprise beyond what is implied by the loan contract. - Joseph A. Schumpeter -- Business Cycles, 1939

On Excessive Speculation in Residential and Commercial Real Estate

But under the circumstances of that period (the 1920s boom) and in the glow of its uncritical optimism, neither costs nor interest charges mattered much. It seemed more important to get quickly the home one wanted -- or the skyscraper the prospective rents of which in any case compared favorably with the rare on mortgage bonds -- than to bother whether it would cost a few thousand dollars -- or in the case of the skyscraper, a million or so -- more or less, provided money was readily forthcoming at those rates. And it was. First mortgages on urban real estate represent, on the one hand, not all the loans that were made available for building and, on the other hand, also financed not only other types of building but other things than building. But it is still permissible to point to the fact that they increased from, roughly, 13 billion in 1922 to, roughly, 27 in 1929... This increase is out of all proportion, not only with the increase in what can in any reasonable sense be called savings, but also with the expansion of bank credit in other lines of business, and illustrates well how a cheap money policy may affect other sectors than those in which it is conspicuously successful in bringing down rates.

On Over-Optimism

In the prosperity phase, investment from innovating activity increases consumers spending almost as quickly as producers spending. ...old firms will react to this situation and... many of them will 'speculate' on this situation. A new factory in a village, for example, means better business for the local grocers, who will accordingly place bigger orders with wholesalers, who in turn will do the same with manufacturers, and these will expand production or try to do so, and so on. But in doing this many people will act on the assumption that the rates of change they observe will continue indefinitely, and enter into transactions which will result in losses as soon as facts fail to verify that assumption... New borrowing will then no longer be confined to entrepreneurs, and 'deposits' will be created to finance general expansion, each loan tending to induce another loan, each rise in prices another rise'... this is a well-known cumulative process Schumpeter called "the secondary wave." In it is included the clusters of errors, waves of optimism, and overindebtedness... - Joseph A. Schumpeter -- Business Cycles, 1939

On American Bank Epidemics

The American debt situation and the American bank epidemics -- there were three of them -- are in a class by themselves. Given the way in which both firms and households had run into debt during the twenties, the accumulated load -- in many cases, though not in all, very sensitive to a fall in price level -- was instrumental in precipitating depression. In particular, it set into motion a vicious spiral within which everybody's efforts to reduce that loan for a time, only availed to increase it. There is thus no objection to the debt-deflation theory of the American crisis, provided it does not mean more than this. The element it stresses is part of the mechanism of any serious depression. But increase of total indebtedness at the rate at which it had occurred in this country is neither a normal element of the mechanisms of Kondratieff downgrades nor in itself an "understandable" incident, like speculative excesses and the debts induced by these. It must be attributed to the humor of the times, to cheap money policies, and to the practices of concerns eager to push their sales; and it enters the class of understandable incidents only if we include specifically American conditions among our data. Similarly, bank failures are of course very regular occurrences in the course of any major crisis and invariably an important cause of secondary phenomena... Those epidemics cannot, however, be considered as wholly explained by the ordinary mechanism of crises or by the mechanism plus the fact of excessive indebtedness all round or even by all that plus the stock exchange crash. The American epidemics become fully understandable only if account be taken of the weaknesses peculiar to the American banking structure... - Joseph A. Schumpeter -- Business Cycles, 1939

On Drawing the Wrong Conclusions from an Incorrect Reading of Data Made Irrelevant by Structural Economic Change

It is of the utmost importance to realize this: given the actual facts which it was then possible for either businessman or economists to observe, those diagnoses -- or even the prognosis that, with the existing structure of debt, those facts plus a drastic fall in price level would cause major trouble but that nothing else would -- were not simply wrong. What nobody saw, though some people may have felt it, was that those fundamental data from which diagnoses and prognoses were made, were themselves in a state of flux and that they would be swamped by the torrents of a process of readjustment corresponding in magnitude to the extent of the industrial revolution of the preceding 30 years. People, for the most part, stood their ground firmly. But that ground itself was about to give way.

- Joseph A. Schumpeter -- Business Cycles, 1939

Are we are seeing data "swamped by the torrents of a process of readjustment corresponding in magnitude to the extent" of the FIRE Economy of the preceding 30 years?

Was the FIRE Economy a form of corporatism, much as Schumpeter forecast?

How will our political economy develop out of the global crisis that the demise of the FIRE Economy is creating?

I leave you with this from his Capitalism, Socialism and Democracy, and a view of the future that strikes us as unfortunately prophetic.

Schumpeter's theory is that the success of capitalism will lead to a form of corporatism and a fostering of values hostile to capitalism, especially among intellectuals. The intellectual and social climate needed to allow entrepreneurship to thrive will not exist in advanced capitalism; it will be replaced by socialism in some form. There will not be a revolution, but merely a trend in parliaments to elect social democratic parties of one stripe or another. He argued that capitalism's collapse from within will come about as democratic majorities vote for the creation of a welfare state and place restrictions upon entrepreneurship that will burden and destroy the capitalist structure. Schumpeter emphasizes throughout this book that he is analyzing trends, not engaging in political advocacy. In his vision, the intellectual class will play an important role in capitalism's demise. The term "intellectuals" denotes a class of persons in a position to develop critiques of societal matters for which they are not directly responsible and able to stand up for the interests of strata to which they themselves do not belong. - Wikipedia

iTulip Select: The Investment Thesis for the Next Cycle™__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment