Worst U.S. Mortgage Foreclosure Crisis

Sub-prime Market to be Hit by Record-Setting Level of Failures

December 19, 2006

Today the Center for Responsible Lending (CLR) issued a report:

This report is consistent with a paper by William C. Wheaton, Department of Economics, Center for Real Estate, MIT; and Gleb Nechayev, Vice President, Senior Economist, Torto Wheaton Research: Past Housing 'Cycles' and the Current Housing 'Boom': What’s Different This Time?

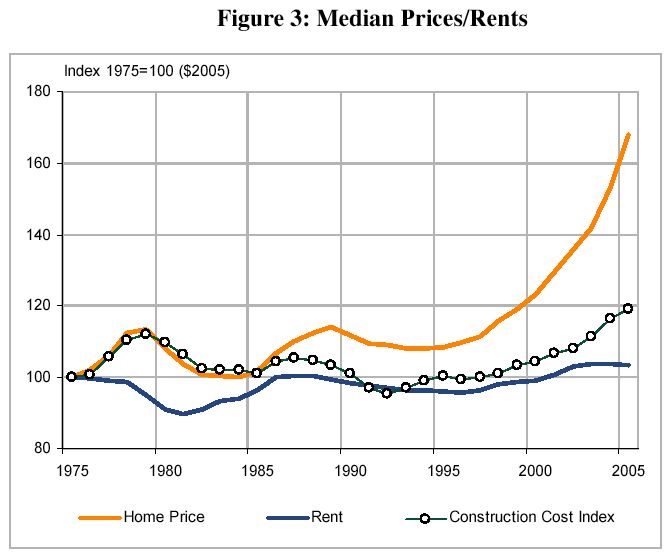

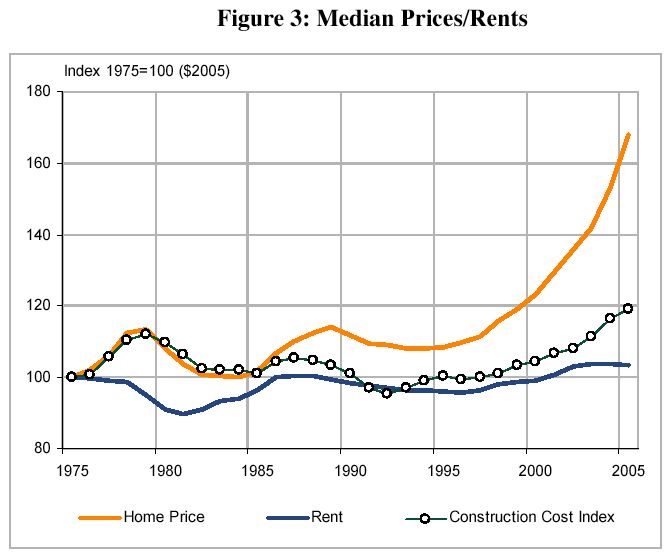

By any measure, equivalent rent or construction cost, median home prices have gone through the roof

To revert to the mean, either incomes will nominally rise or home prices will nominally decline

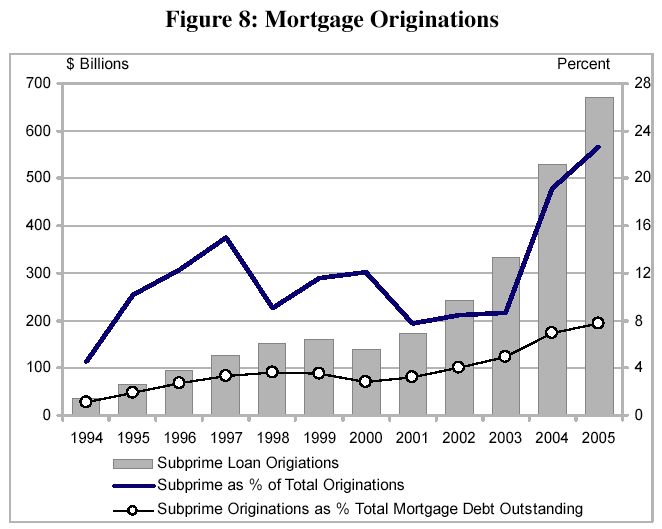

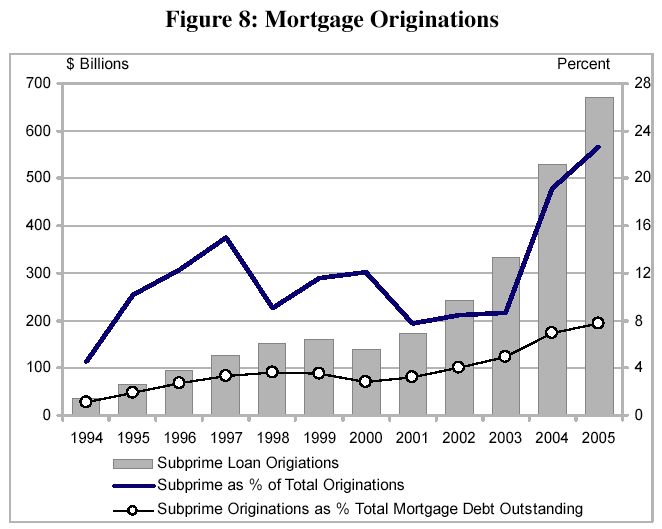

Lots of sub-prime loans sold, lots to go bad

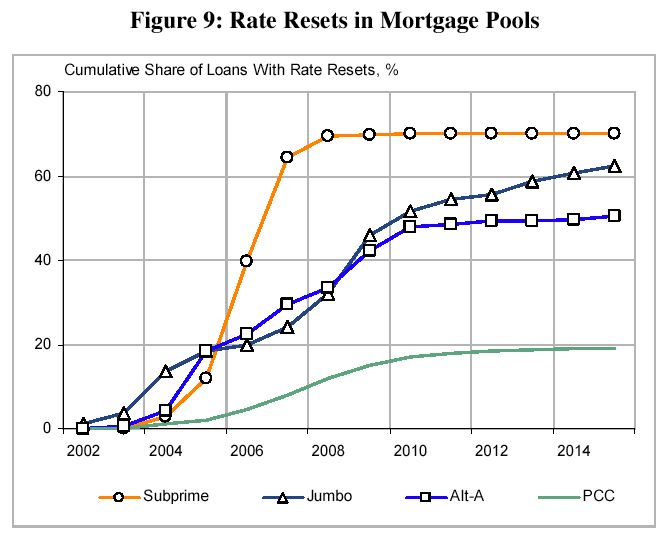

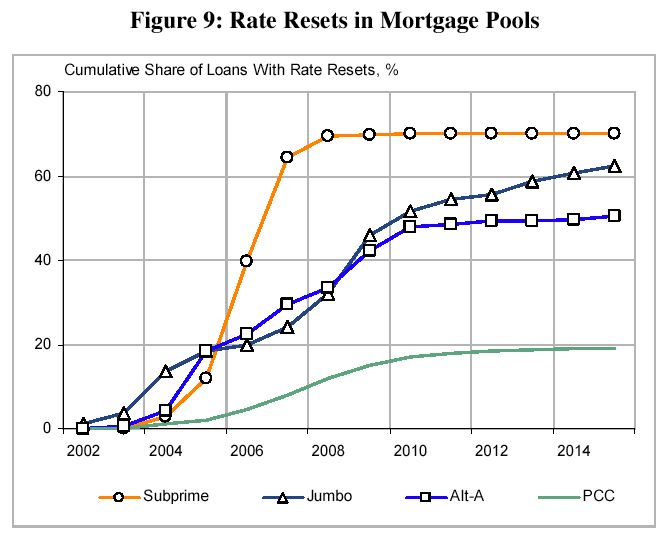

Looks like 25% of adjustabe mortgages will reset before the 2008 elections, so perhaps Congress will "do something" before then

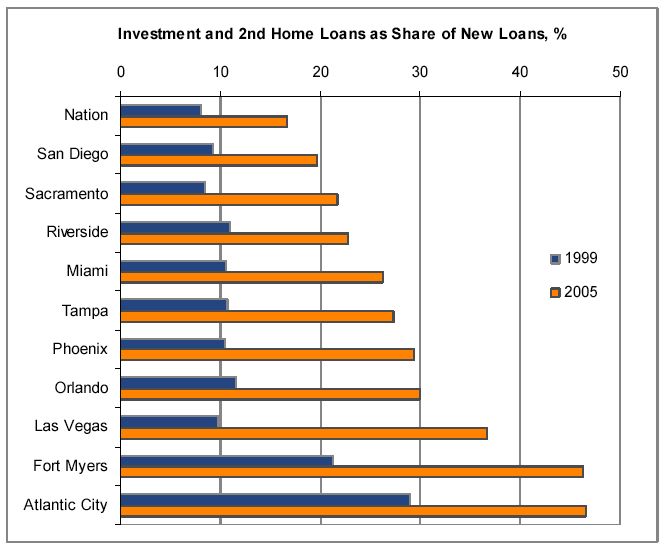

A boom in second homes presages a bust in second homes, so it's not only a "sub-prime problem"

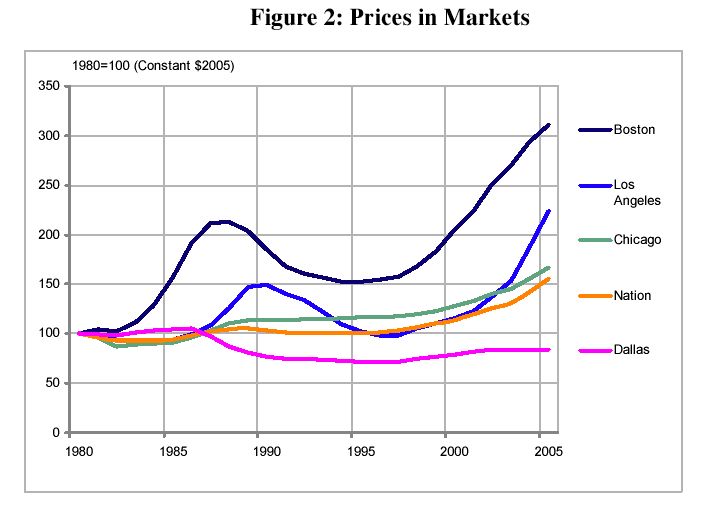

Boston housing bubble

Sub-prime Market to be Hit by Record-Setting Level of Failures

December 19, 2006

Today the Center for Responsible Lending (CLR) issued a report:

CRL Report to Project $160 Billion+ in Home Wealth Lost By American Families; Data Available For All Major U.S. Markets on Expected Foreclosure Levels.

In what is shaping up to be one of the worst foreclosure crises in American history, subprime mortgages originated from 1998 through the first half of 2006 will wipe out billions of dollars of the homeownership wealth of low-income and minority American families, according to a Center for Responsible Lending (CRL) report. With projected foreclosure data on all major U.S. metropolitan statistical areas (MSAs), the CRL study is the first comprehensive, nationwide look at how subprime mortgages perform.

Speakers: In what is shaping up to be one of the worst foreclosure crises in American history, subprime mortgages originated from 1998 through the first half of 2006 will wipe out billions of dollars of the homeownership wealth of low-income and minority American families, according to a Center for Responsible Lending (CRL) report. With projected foreclosure data on all major U.S. metropolitan statistical areas (MSAs), the CRL study is the first comprehensive, nationwide look at how subprime mortgages perform.

- Michael D. Calhoun, president, Center for Responsible Lending;

- Pat Vredevoogd Combs, president, National Association of Realtors; and

- Wade Henderson, executive director, Leadership Conference on Civil Rights.

- The CLR expects 2.2 million mortgage loans with a value of $164B to eventually fail. Cause is accountability disconnect in the chain brokers, borrowers, lenders, and trustees in sub-prime market

- The sub-prime market is huge–25% of all loans made since 1998 were sub-prime.

- More than 20% of sub-prime loans made since 1998 will end in foreclosure. For comparison, the infamous "worst case" Houston housing market of the 1980s experienced a 15% peak foreclosure rate with 1 million homes abandoned. They are predicting a greater than 2x worse problem.

This report is consistent with a paper by William C. Wheaton, Department of Economics, Center for Real Estate, MIT; and Gleb Nechayev, Vice President, Senior Economist, Torto Wheaton Research: Past Housing 'Cycles' and the Current Housing 'Boom': What’s Different This Time?

Abstract

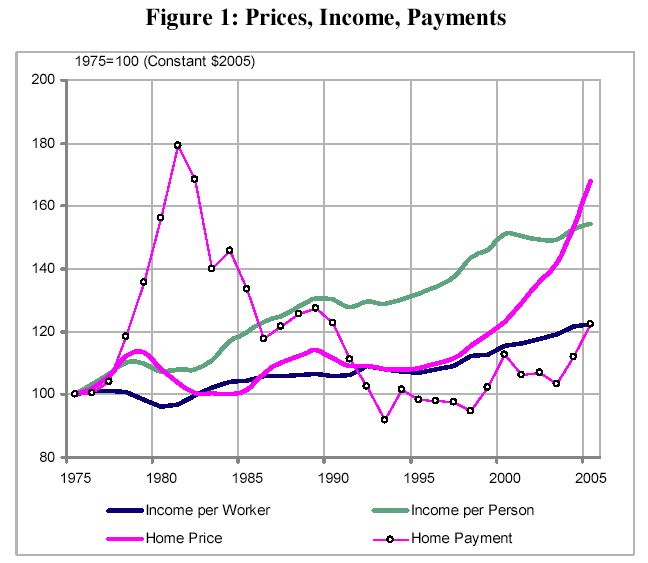

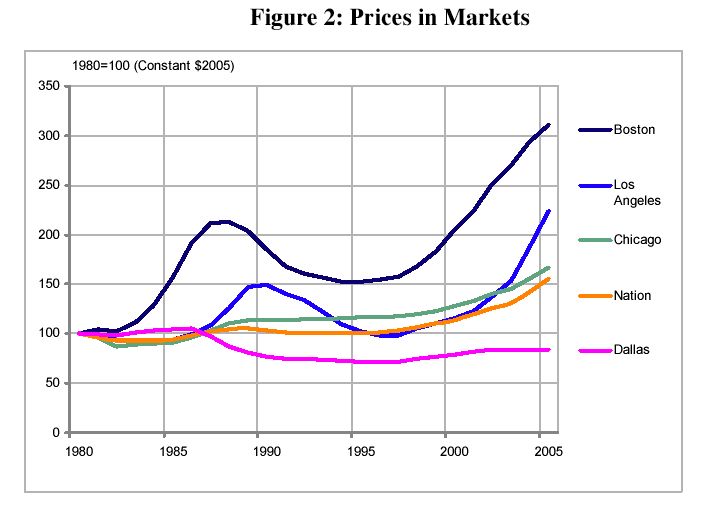

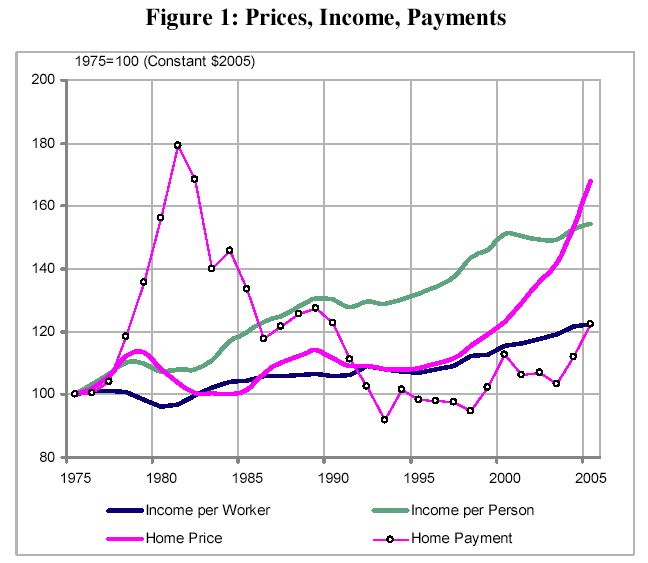

This paper examines the historic cyclic movement in house prices since 1975. Past swings in home prices have been largely a result of economic recessions. The exception is the 2001 recession caused by a plunging stock market wherein the Fed loosened credit, rather than fighting inflation with tight credit. Home prices have soared since then, while income, job, and rent growth were slow to recover.

We show that incorporating all the actual movements in economic variables (including mortgage rates), forecasts made back in 1998 completely fail to capture the recent rise in prices. The current housing market however has been subjected to two "shocks" not seen previously. The emergence of an active sub-prime lending market has raised the homeownership rate nationally to historic highs. In a state cross-section we show that recent increases in homeownership correlate strongly with increases in Price/rent ratios.

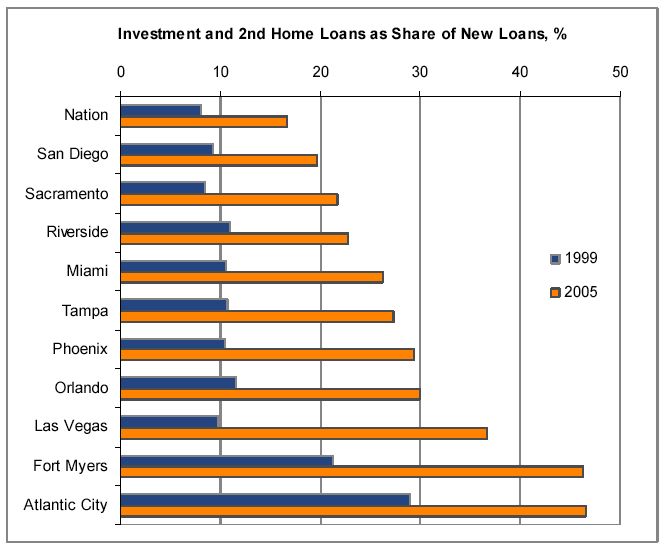

Secondly, households have been purchasing homes as a "2nd" residence or for "investment" at record rates. In 2005 total housing production exceeded household formation by 60%! Again using a cross section, we show that markets where this has been on the rise are also experiencing greater price inflation. These new factors are "outside" of model forecasts and hence a cause for concern. Going forward, rising interest rates could both reduce homeownership and cause a more sudden exodus from the 2nd home investment market. These changes would cause prices to correct more severely than in the past.

A few charts from the paper: This paper examines the historic cyclic movement in house prices since 1975. Past swings in home prices have been largely a result of economic recessions. The exception is the 2001 recession caused by a plunging stock market wherein the Fed loosened credit, rather than fighting inflation with tight credit. Home prices have soared since then, while income, job, and rent growth were slow to recover.

We show that incorporating all the actual movements in economic variables (including mortgage rates), forecasts made back in 1998 completely fail to capture the recent rise in prices. The current housing market however has been subjected to two "shocks" not seen previously. The emergence of an active sub-prime lending market has raised the homeownership rate nationally to historic highs. In a state cross-section we show that recent increases in homeownership correlate strongly with increases in Price/rent ratios.

Secondly, households have been purchasing homes as a "2nd" residence or for "investment" at record rates. In 2005 total housing production exceeded household formation by 60%! Again using a cross section, we show that markets where this has been on the rise are also experiencing greater price inflation. These new factors are "outside" of model forecasts and hence a cause for concern. Going forward, rising interest rates could both reduce homeownership and cause a more sudden exodus from the 2nd home investment market. These changes would cause prices to correct more severely than in the past.

By any measure, equivalent rent or construction cost, median home prices have gone through the roof

To revert to the mean, either incomes will nominally rise or home prices will nominally decline

Lots of sub-prime loans sold, lots to go bad

Looks like 25% of adjustabe mortgages will reset before the 2008 elections, so perhaps Congress will "do something" before then

A boom in second homes presages a bust in second homes, so it's not only a "sub-prime problem"

Boston housing bubble

Comment