Worse than the Great Depression

So, why Worse Than The Great Depression ? What makes me believe that the current depression will be worse than the Great Depression? I present six of the most important fundamentals that are “baked in the cake” and that suggest of a Greater Depression .

Conclusion

Since August of 2007 we have witnessed the relentless escalation of the credit crisis: a steady constriction of credit markets, starting with subprime mortgage-backed securities, spreading to commercial paper, then to interbank credit, and then to CDOs, CLOs, jumbo mortgages, home equity lines of credit, LBOs and private equity markets, and then generally to the bond and securities markets.

While the media describes the problem as one of illiquidity and confidence, a more serious analysis indicates that boom-time credit has been employed unproductively and so losses must be incurred. In other words, scarce capital has been misallocated, poorly invested, and effectively wasted. No amount of monetary or fiscal policy can fix the errors of the past, just like no modern treatment can quickly restore to health a drug addict debilitated from a decade-long drug abuse.

Based on indicators like - (1) global real estate overvaluation, (2) indebtedness, (3) leverage, (4) outstanding derivatives, (5) global bubbles, and (6) the precariousness of the global monetary system, I would argue that the accumulated imbalances in the current period surpass significantly those preceding the Great Depression. I therefore conclude that the coming U.S. (and possibly) global depression will be of greater magnitude than the Great Depression of the 1930s. It likely suggests that we are entering a historic period that will likely be known as The Greater Depression .

Investor beware! Only gold can protect you from the ravages of another Depression!

By Dr Krassimir Petrov

Krassimir Petrov ( Krassimir_Petrov@hotmail.com ) has received his Ph. D. in economics from the Ohio State University and currently teaches Macroeconomics, International Finance, and Econometrics at the American University in Bulgaria. He is looking for a career in Dubai or the U. A. E.

http://www.marketoracle.co.uk/Article7099.html

So, why Worse Than The Great Depression ? What makes me believe that the current depression will be worse than the Great Depression? I present six of the most important fundamentals that are “baked in the cake” and that suggest of a Greater Depression .

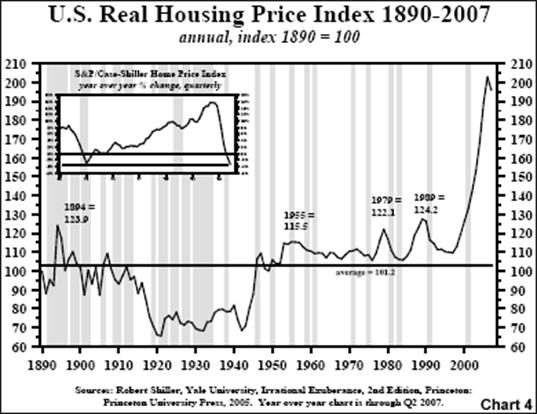

- Overvalued Real Estate. The real estate market has been driven by a number of innovations in real estate finance. Overvaluation in real estate implies overvaluation in real estate financial instruments; an implosion of real estate prices implies an implosion in those instruments. It is widely recognized by economists that the Case-Shiller Index is a good proxy for the prices of real estate. A widely-recognized chart from 1890 to 2007 tells the story. The chart makes it crystal clear that the current overvaluation of real estate in real terms grossly exceeds the one during the 1920s. The coming correction in real estate will be protracted and gut-wrenching, with an expected cumulative effect that is much worse than the Great Depression.

- Total U.S. Credit. Credit makes leverage: the more credit in the financial system, the more leveraged it is. Today's total U.S. credit relative to GDP has surpassed significantly the levels preceding the Great Depression. Back then, the total amount of credit in the financial system almost reached an astonishing 250% of GDP. Using the same metric today, the debt level in the U.S. financial system surpassed 350% in 2008, while the level in 1982 was “only” 130%. As Charles Dumas from Lombard Street Research put it quite aptly, "we've had a 30-year leveraging up of America, ending in an unchecked orgy."

The chart below shows a dramatic buildup of debt (leverage) in the 1920s and a deleveraging from 1930 to 1945 (or 1952). Then it shows a consistent buildup of debt afterwards, with a dramatic rise since the 1990s, and surpassing in 2000 the previous peak in 1929. The chart shows the level of 299% at the end of 2005, but the level has already reached 350% by 2008.

Of course, leveraging, as already indicated above, must necessarily be followed by deleveraging.

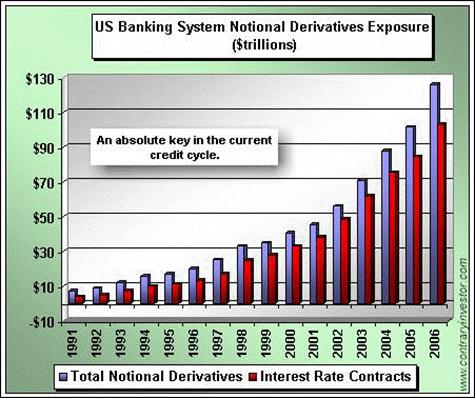

The best way to think about leverage is to compare it with using drugs, while deleveraging is like detox. The problem is not that the detox is killing the patient who has abused drugs for years; what is really killing the patient is the drug abuse itself. However, one thing is clear – the patient must either go through a painful detox or die; the same applies for the financial system – it must either deleverage or implode. - Explosion of Derivatives. Derivatives have been likened by Warren Buffet to “financial weapons of mass destruction”. The notional amount of total derivatives, as well as “Value at Risk” (VaR), has skyrocketed in recent years with the potential to destabilize the financial system for decades. To put it more allegorically, derivatives hang like a sword of Damocles over the financial system.

A comparison with the 1920s is difficult to make. mostly Derivatives back then were extensively used, although not widely understood. Given that I am not aware of any statistics of derivatives for the period of the 1920s, a meaningful comparison based on hard data is admittedly impossible. Nevertheless, I would venture to make an intelligent guess that the size of modern-day derivatives is hundreds or even thousands of times larger relative to the size of the economy in comparison to the 1920s. Some of the latest reports indicate that the total notional value of derivatives outstanding surpasses one quadrillion dollars. To put this into perspective, this amounts to almost 100 times the GDP of the U.S. economy.

The chart below shows the explosion of derivatives in the U.S. banking system. You can see that in 1991 the notional value of the derivatives was about the size of the U.S. GDP. By 2006 the size has grown to about 10 times the GDP, vastly outgrowing the real economy.

The chart below shows an even more telling picture. It shows world GDP and world's notional value of derivatives. Again, while there is no direct comparison with the 1920s, it is clear that the overall level of derivatives has skyrocketed during the last two decades and presents risks that were simply not present at the onset of the Great Depression. The unwinding of these derivatives could only be compared with a nuclear explosion in the financial system.

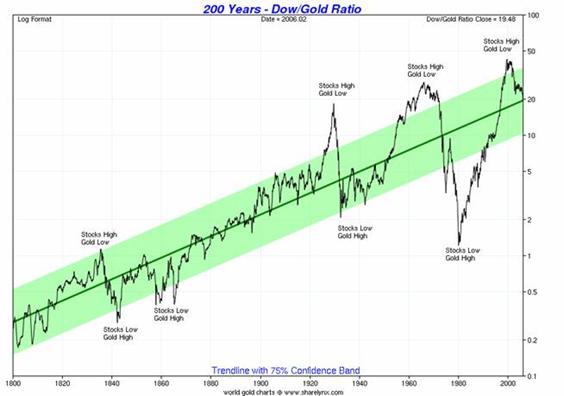

- Dow-Gold Ratio. The Dow-Gold ratio represents the most important ratio between the relative prices of financial assets and real assets. The Dow component represents the valuation of financial assets; the gold component – of real assets. When leverage in the financial system increases significantly, so does this ratio. A very high ratio is interpreted as an imbalance between financial and real assets – financial assets are grossly overvalued, while real assets are grossly undervalued. It also implies that a correction eventually will be necessary – either through deflation, which implies deleveraging and a collapsing stock market, or through inflation, which implies stagnant stock market for many years and steadily rising prices of real assets, commodities, and gold, usually associated with stagnant economy and typically resulting in stagflation. The first case—deflation—occurred during the 1930s, while the second case—stagflation—occurred during the 1970s.

The graph below illustrates the above concepts. The very high Dow-Gold Ratio in 1929 was followed by the Great Depression, while the higher level in 1966 was followed by the stagflationary 70s. It is evident from the chart the peak in 2000 surpassed the previous two peaks in 1929 and 1966, so this provides a reasonable expectation that the forthcoming return to “normalcy” will be more painful than the Great Depression, at least in terms of cumulative pain over the next 10-15 years.

- Global Bubbles . It is impossible to make direct comparison with the 1920s, but today the global economy is rife with bubbles. Back then in the 1920s, the U.S. had its stock and real estate bubbles, while the European economies were struggling to rebuild from the devastations of WW1 that ended in 1919. I am personally not aware of any other bubbles during this period, although I welcome reader feedback on this topic.

Today the picture is very different. The U.S. economy had a stock market and real estate bubble that has surpassed its own during the 1920s. Colossal US current account deficits have fuelled extraordinary growth in global monetary reserves. As a result, Europe has real estate bubbles across the board, from the U.K. and Ireland, throughout the Mediterranean (Spain, France, Italy and Greece), to the entire Baltic region (Latvia, Lithuania, and Estonia) and the Balkans (Romaina and Bulgaria). Even worse, many Asian countries (China, Korea, etc.) also have their own stock and property bubbles, only with the exception of Japan, which is still in the process of recovering from its own during the 1980s. Thus, during the 1920s only the U.S. suffered from gross financial imbalances, while today the imbalances have engulfed the whole world – both developed and developing. It stands to reason that the unwinding of those global imbalances is likely to be more painful today than it was during the Great Depression due to both size and scope. - Collapsing Bretton Woods II. The global monetary system was on a quasi-gold standard during the 1920s. Back then dollars and pounds were convertible to gold, while all other currencies were convertible to dollars and pounds. An appropriate way to think about it is that of a precursor to the Bretton Woods from 1945-1971. What is important to understand is that while the system was fiat in nature, gold imposed significant limitations to credit expansion and leveraging.

Somewhat similar was the role of Bretton Woods that lasted from 1945 to 1971. The dollar was tied to gold, while all other fiat currencies were tied to the dollar. Just like the interwar period, gold imposed some limitations on credit and financial imbalances.

We now live in what has been termed Bretton Woods II. Essentially, this is a pure fiat dollar standard, where all currencies are convertible to dollars, either at fixed or floating exchange rates, while the dollar itself is convertible to “nothing”. Thus, the dollar has no limitations imposed to it by gold, so without the discipline of gold, the current global monetary system has accumulated significantly more imbalances than ever before in modern capitalism. These imbalances show up in the international monetary system as unsustainable trade deficits (and surpluses), skyrocketing official dollar reserves in some European and many Asian central banks, and the proliferation of Sovereign Wealth Funds; more generally, these imbalances result in a myriad of bubbles, overleveraging, and other maladjustments already discussed above.

Today Bretton Woods II is in the process of disintegration. The world is slowly but steadily losing its confidence in the dollar as the world reserve currency. A flight from the dollar is in progress and the collapse of the global monetary system is imminent. As Bretton Woods II disintegrates and a new system replaces it, the process of readjustment will be necessarily more painful than the respective process during the Great Depression.

A caution on terminology is necessary here. While the literature over the last 10-20 years has widely recognized the term “Bretton Woods II”, in September-October of 2008 the term was widely used by the media to describe a proposed international summit with the goal of reconstructing a new international monetary system designed from scratch, just like “Bretton Woods”. Instantly dubbed by the media “Bretton Woods II”, this term could be potentially very confusing as it could mean very different things to different people. The interested reader should consult Wikipedia's Bretton Woods II where both meanings are explained in detail.

Conclusion

Since August of 2007 we have witnessed the relentless escalation of the credit crisis: a steady constriction of credit markets, starting with subprime mortgage-backed securities, spreading to commercial paper, then to interbank credit, and then to CDOs, CLOs, jumbo mortgages, home equity lines of credit, LBOs and private equity markets, and then generally to the bond and securities markets.

While the media describes the problem as one of illiquidity and confidence, a more serious analysis indicates that boom-time credit has been employed unproductively and so losses must be incurred. In other words, scarce capital has been misallocated, poorly invested, and effectively wasted. No amount of monetary or fiscal policy can fix the errors of the past, just like no modern treatment can quickly restore to health a drug addict debilitated from a decade-long drug abuse.

Based on indicators like - (1) global real estate overvaluation, (2) indebtedness, (3) leverage, (4) outstanding derivatives, (5) global bubbles, and (6) the precariousness of the global monetary system, I would argue that the accumulated imbalances in the current period surpass significantly those preceding the Great Depression. I therefore conclude that the coming U.S. (and possibly) global depression will be of greater magnitude than the Great Depression of the 1930s. It likely suggests that we are entering a historic period that will likely be known as The Greater Depression .

Investor beware! Only gold can protect you from the ravages of another Depression!

By Dr Krassimir Petrov

Krassimir Petrov ( Krassimir_Petrov@hotmail.com ) has received his Ph. D. in economics from the Ohio State University and currently teaches Macroeconomics, International Finance, and Econometrics at the American University in Bulgaria. He is looking for a career in Dubai or the U. A. E.

http://www.marketoracle.co.uk/Article7099.html

Comment