The Conquest of Worldwide Inflation: Currency Competition and Its Implications for Interest Rates and the Yield Curve

Remarks by Governor Randall S. Kroszner

At the Cato Institute Monetary Policy Conference, Washington, D.C.

November 16, 2006

Inflation is the one sin of politicians that is singled out for scorn by central bankers. The rest are our problem. Inflation is a prostitute, since the 1980s banned from the U.S. Club of Fiscal Imprudence frequented by Congressmen. She was thrown out by the club's managers, newly emboldened by a change at the top–the transfer of the Fed Chairmanship from Arthur Burns to Paul Volcker.

Viner Nixon, Friedman & Burns

Volcker didn't need "globalization, deregulation, and financial innovation" to enforce a simple monetary rule as old as the oldest profession, all he needed was an administration with the political will to carry it out: don't print so much money.

Milton Friedman died today at age 94. May he rest in peace.

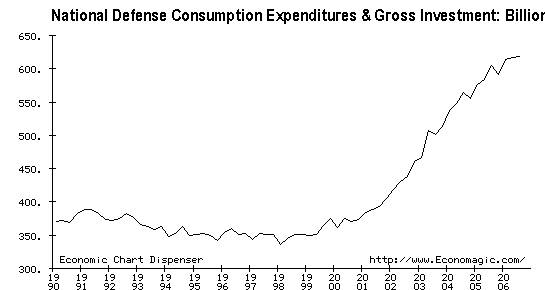

Such banishment did not, however, relieve the politicians of their need, or at least their desire, for Inflation's services. Not the "monetary services" that Governor Randall S. Kroszner refers to in this speech, by which I assume he means the modulation of money and credit in the economy–the other ones: a substitute for taxes to pay for unpopular wars, make payroll for a bloated federal government, feed the military-industrial complex, and fund all manner of fiscal excesses that no politician can ask his or her constituents to underwrite if he or she aspires to re-election, such criteria narrowing the field to roughly 100%. While Inflation has not since the early 1980s been allowed to prance in public with the pols, she changed her look and took up apartments in Europe and Asia. Central bankers no longer have to suffer the humiliation of paying her fee on the pol's behalf in full view, the transaction illuminated by all-goods price inflation. In her current domicile and attire, she is so well disguised that central bankers do not even need to acknowledge her presence. They can, as Kroszner asserts in this speech, claim she has been conquered.

But she is very much sassy and alive, paying for wars and bloated budgets, except with a twist: on credit. That's right–Inflation has become a prostitute who takes charge cards.

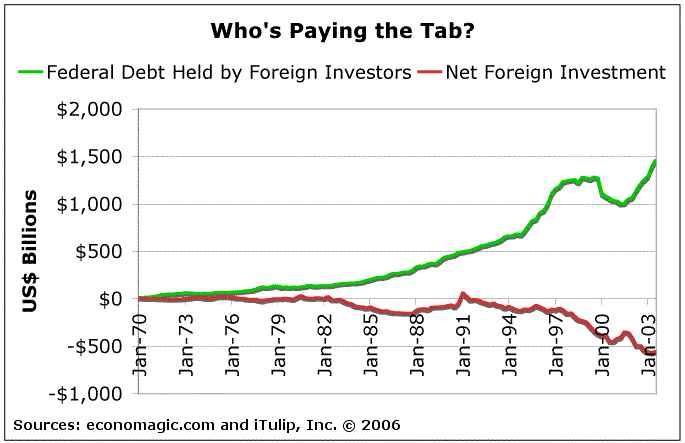

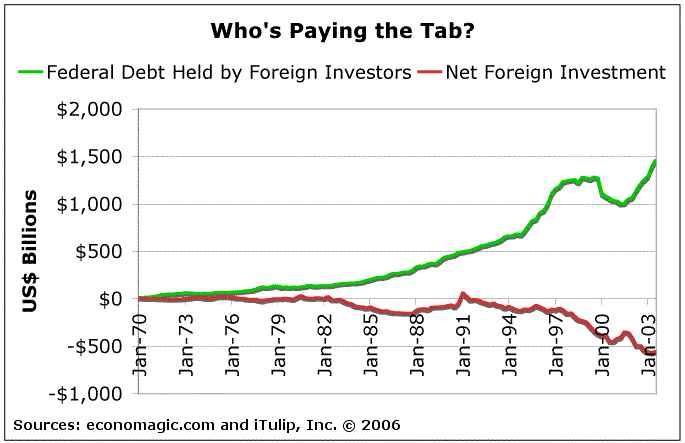

70% of the USA's fiscal (not trade) deficit was funded by foreign borrowing in 2003

Miracle of financial innovation?

The problem with enjoying Inflation's services–to fund activities that are politically inexpedient to tax today, and to keep your interest rates low and currency expensive–is that eventually you have to pay her back; today's foreign wanton borrowing to fund fiscal deficits are tomorrow's high taxes, inflation, and interest rates. Were this borrowing used for other purposes other than paying for expenses that politicians don't want to tax, and to delay dollar depreciation and high U.S. interest rates, they would not go to Inflation but instead to her why-can't-you-be-more-like-your-sister sister, Productive Capacity. Her sister takes borrowed money are pays it back, with interest, leaving businesses that produce things–whether tangible or not–that generate income that contribute to real GDP for the nation. But Inflation's services are more fleeting–such as wars–leaving nothing but bad memories, social diseases, and a big bill.

Money spent once, then gone forever.

Inflation on credit-call it a re-innovation, but do not call it new. As during the most recent incarnation in modern times, the inflation prostitute is so well disguised that central bankers do not even need to acknowledge her presence, because she is in fact a central bank herself–several. When a central bank steps in to help another out in this way, to support an imbalance, the long term results are usually less than deluxe.

Today, we have the central banks of export-based economies of Asia buying U.S. debt in order to keep U.S. interest rates low so that U.S. consumers can continue to buy their exports. In the case of China, we call this Economic M.A.D. What is difference between this effort by Asian central banks to hold down U.S. interest rates and support the dollar and the Fed's effort in the 1920s to hold down Great Britain's interest rates and support the pound, and funding a massive speculative boom, ala the 1920s, in the process?

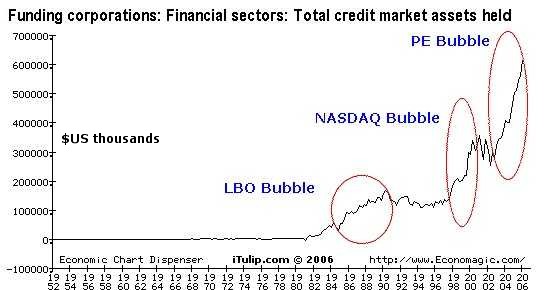

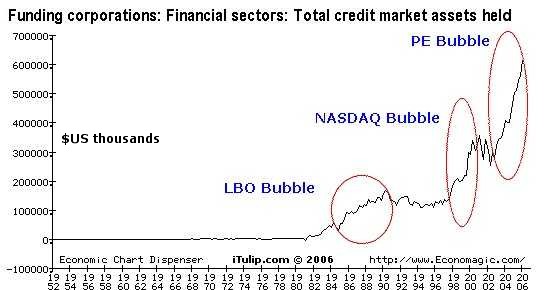

LBO, NASDAQ, and Private Equity bubbles supported by post-1983 credit markets

Returning to our current instance, we have a nation–an empire–that doesn't want its interest rates to rise, nor do its trading parters, and in this mutual desire to forestall the inevitable are repeating collectively, and in the modern way of fiat currencies, the same error made by the Fed to bail out Great Britain in the late 1920s.

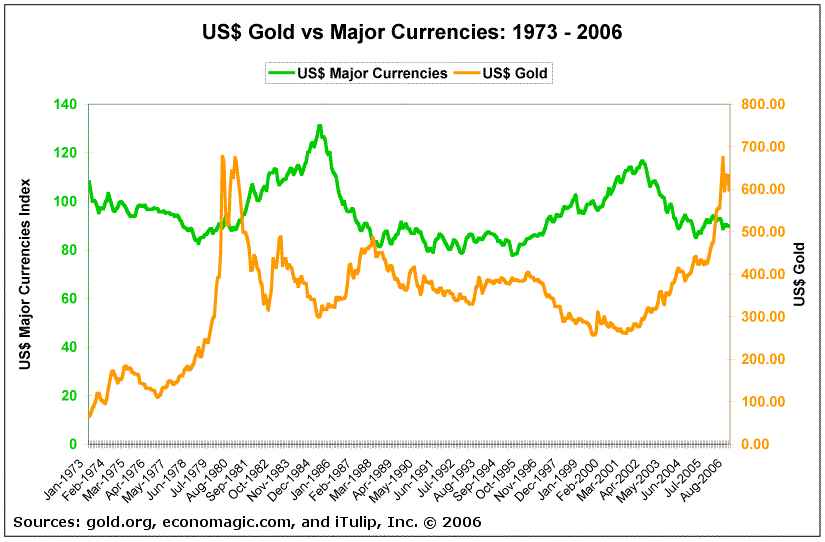

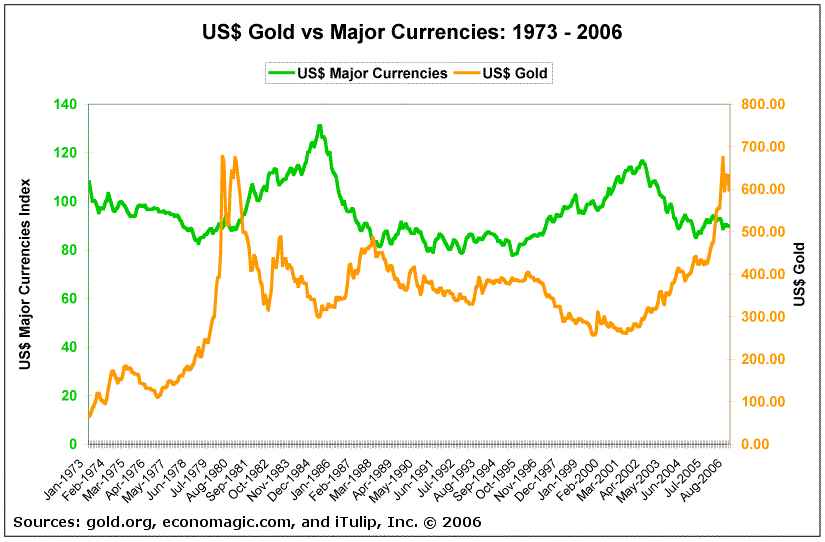

Since the chaotic period Greenspan describes in his outburst, we have had one other in which the international order was wrecked–but not by deflation, rather by inflation. It appears in the chart below.

The US dollar price of gold briefly broke above the index of the dollar priced against an index of major currencies for the second time ever. Unlike the pound sterling, the dollar didn't meet its demise in the bargain the first time around. Volcker came to the rescue, doing what needed to be done–raising interest rates to over 18%.

When the dollar price of gold breaks above the major currencies index, as it did in 1970s, it is in a process of being re-monetizated by the markets. As you can see from the chart, the process has started anew. Whether it continues to its logical conclusion is, unfortunately for us, up to the politicians. If they behave as in the past, and put off the necessary adjustments until it's too late, the global monetary regime may revert all the way back to gold temporarily before re-organizing under a more stable floating exchange rate system based on The Forth Currency, a topic for another day. On the other hand, perhaps by some stroke of good fortune, the wisdom of another era will wash over Washington. Then we in the U.S. will be asked to take our medicine in the form of higher interest rates and a lower standard of living for a few years, as we did from 1980 to 1983, to avoid risking the kind of chaotic event that Great Britain and the world endured in the 1930s. But with Fed Governors making speeches announcing The End of Inflation, I wouldn't bet on it.

_____

For a layman's explanation of financial bubble concepts, see our book americasbubbleeconomy

For macro-economic and geopolitical currency ETF advisory services see "Crooks on Currencies"

To buy and trade gold easily and inexpensively, see BullionVault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing ListCopyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Remarks by Governor Randall S. Kroszner

At the Cato Institute Monetary Policy Conference, Washington, D.C.

November 16, 2006

"In a nutshell, I believe that the factors of globalization, deregulation, and financial innovation, arising partly in response to episodes of high inflation, have effectively eroded the central bank monopoly on the provision of monetary services and have enhanced global competition among currencies. These changes have, in turn, altered the incentives for central banks to behave badly and for finance ministries to use central banks as "piggy banks" to finance their fiscal policies. The resulting constraint on monetary policy, combined with increased public understanding of the costs of inflation, have led to institutional changes in central bank governance that bolster their credibility for maintaining price stability in the future. Improved central bank performance and credibility, thus, are the consequences of this combination of factors."

In a nutshell, the logical fallacy of this speech is its false premise: that inflation has been contained. The rest of the speech is therefor specious.Inflation is the one sin of politicians that is singled out for scorn by central bankers. The rest are our problem. Inflation is a prostitute, since the 1980s banned from the U.S. Club of Fiscal Imprudence frequented by Congressmen. She was thrown out by the club's managers, newly emboldened by a change at the top–the transfer of the Fed Chairmanship from Arthur Burns to Paul Volcker.

Viner Nixon, Friedman & Burns

Volcker didn't need "globalization, deregulation, and financial innovation" to enforce a simple monetary rule as old as the oldest profession, all he needed was an administration with the political will to carry it out: don't print so much money.

Milton Friedman died today at age 94. May he rest in peace.

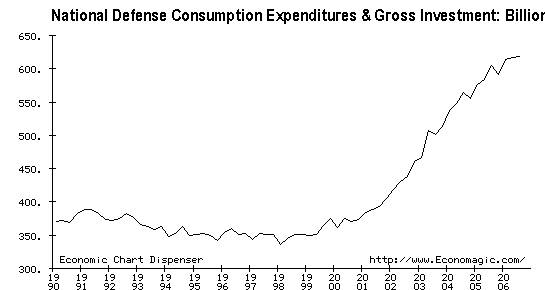

Such banishment did not, however, relieve the politicians of their need, or at least their desire, for Inflation's services. Not the "monetary services" that Governor Randall S. Kroszner refers to in this speech, by which I assume he means the modulation of money and credit in the economy–the other ones: a substitute for taxes to pay for unpopular wars, make payroll for a bloated federal government, feed the military-industrial complex, and fund all manner of fiscal excesses that no politician can ask his or her constituents to underwrite if he or she aspires to re-election, such criteria narrowing the field to roughly 100%. While Inflation has not since the early 1980s been allowed to prance in public with the pols, she changed her look and took up apartments in Europe and Asia. Central bankers no longer have to suffer the humiliation of paying her fee on the pol's behalf in full view, the transaction illuminated by all-goods price inflation. In her current domicile and attire, she is so well disguised that central bankers do not even need to acknowledge her presence. They can, as Kroszner asserts in this speech, claim she has been conquered.

But she is very much sassy and alive, paying for wars and bloated budgets, except with a twist: on credit. That's right–Inflation has become a prostitute who takes charge cards.

70% of the USA's fiscal (not trade) deficit was funded by foreign borrowing in 2003

Miracle of financial innovation?

The problem with enjoying Inflation's services–to fund activities that are politically inexpedient to tax today, and to keep your interest rates low and currency expensive–is that eventually you have to pay her back; today's foreign wanton borrowing to fund fiscal deficits are tomorrow's high taxes, inflation, and interest rates. Were this borrowing used for other purposes other than paying for expenses that politicians don't want to tax, and to delay dollar depreciation and high U.S. interest rates, they would not go to Inflation but instead to her why-can't-you-be-more-like-your-sister sister, Productive Capacity. Her sister takes borrowed money are pays it back, with interest, leaving businesses that produce things–whether tangible or not–that generate income that contribute to real GDP for the nation. But Inflation's services are more fleeting–such as wars–leaving nothing but bad memories, social diseases, and a big bill.

Money spent once, then gone forever.

Inflation on credit-call it a re-innovation, but do not call it new. As during the most recent incarnation in modern times, the inflation prostitute is so well disguised that central bankers do not even need to acknowledge her presence, because she is in fact a central bank herself–several. When a central bank steps in to help another out in this way, to support an imbalance, the long term results are usually less than deluxe.

"The basic domestic economic problem of the post–World War I years was the decline of Britain's traditional export industries, which made it more difficult for the country to pay for its imports of foods and raw materials. A Labour government, under Ramsay MacDonald, was in power for the first time briefly in 1924. In 1926 the country suffered a general strike. Severe economic stress increased during the worldwide economic depression of the late 1920s and early 30s. During the financial crisis of 1931, George V asked MacDonald to head a coalition government, which took the country off the gold standard, ceased the repayment of war debts, and supplanted free trade with protective tariffs modified by preferential treatment within the empire (see Commonwealth of Nations) and with treaty nations." Great Britain: World War I and Its Aftermath

A white paper written by Alan Greenspan in 1966, and often quoted by those in the gold business, explains what happened next:When business in the United States underwent a mild contraction in 1927, the Federal Reserve created more paper reserves in the hope of forestalling any possible bank reserve shortage. More disastrous, however, was the Federal Reserve's attempt to assist Great Britain who had been losing gold to us because the Bank of England refused to allow interest rates to rise when market forces dictated (it was politically unpalatable). The reasoning of the authorities involved was as follows: if the Federal Reserve pumped excessive paper reserves into American banks, interest rates in the United States would fall to a level comparable with those in Great Britain; this would act to stop Britain's gold loss and avoid the political embarrassment of having to raise interest rates.

The "Fed" succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market -- triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930's.

Alan Greenspan, 1966

As a result, the pound sterling lost its place as the world's reserve currency. Greenspan, when asked about this speech, by the way, these days sighs and dismisses it as an outburst of youthful passion; he was an impressionable lad of 42 at the time.The "Fed" succeeded; it stopped the gold loss, but it nearly destroyed the economies of the world in the process. The excess credit which the Fed pumped into the economy spilled over into the stock market -- triggering a fantastic speculative boom. Belatedly, Federal Reserve officials attempted to sop up the excess reserves and finally succeeded in braking the boom. But it was too late: by 1929 the speculative imbalances had become so overwhelming that the attempt precipitated a sharp retrenching and a consequent demoralizing of business confidence. As a result, the American economy collapsed. Great Britain fared even worse, and rather than absorb the full consequences of her previous folly, she abandoned the gold standard completely in 1931, tearing asunder what remained of the fabric of confidence and inducing a world-wide series of bank failures. The world economies plunged into the Great Depression of the 1930's.

Alan Greenspan, 1966

Today, we have the central banks of export-based economies of Asia buying U.S. debt in order to keep U.S. interest rates low so that U.S. consumers can continue to buy their exports. In the case of China, we call this Economic M.A.D. What is difference between this effort by Asian central banks to hold down U.S. interest rates and support the dollar and the Fed's effort in the 1920s to hold down Great Britain's interest rates and support the pound, and funding a massive speculative boom, ala the 1920s, in the process?

LBO, NASDAQ, and Private Equity bubbles supported by post-1983 credit markets

Returning to our current instance, we have a nation–an empire–that doesn't want its interest rates to rise, nor do its trading parters, and in this mutual desire to forestall the inevitable are repeating collectively, and in the modern way of fiat currencies, the same error made by the Fed to bail out Great Britain in the late 1920s.

Since the chaotic period Greenspan describes in his outburst, we have had one other in which the international order was wrecked–but not by deflation, rather by inflation. It appears in the chart below.

The US dollar price of gold briefly broke above the index of the dollar priced against an index of major currencies for the second time ever. Unlike the pound sterling, the dollar didn't meet its demise in the bargain the first time around. Volcker came to the rescue, doing what needed to be done–raising interest rates to over 18%.

When the dollar price of gold breaks above the major currencies index, as it did in 1970s, it is in a process of being re-monetizated by the markets. As you can see from the chart, the process has started anew. Whether it continues to its logical conclusion is, unfortunately for us, up to the politicians. If they behave as in the past, and put off the necessary adjustments until it's too late, the global monetary regime may revert all the way back to gold temporarily before re-organizing under a more stable floating exchange rate system based on The Forth Currency, a topic for another day. On the other hand, perhaps by some stroke of good fortune, the wisdom of another era will wash over Washington. Then we in the U.S. will be asked to take our medicine in the form of higher interest rates and a lower standard of living for a few years, as we did from 1980 to 1983, to avoid risking the kind of chaotic event that Great Britain and the world endured in the 1930s. But with Fed Governors making speeches announcing The End of Inflation, I wouldn't bet on it.

_____

For a layman's explanation of financial bubble concepts, see our book americasbubbleeconomy

For macro-economic and geopolitical currency ETF advisory services see "Crooks on Currencies"

To buy and trade gold easily and inexpensively, see BullionVault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing ListCopyright © iTulip, Inc. 1998 - 2006 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment