http://jessescrossroadscafe.blogspot.com/

an earlier post at jesse's

The Dollar Rally and Deflationary Imbalances in the US Dollar Holdings of Overseas Banks

Dollar Assets and Liabilities in the International Banking System

In reading the Assets and Liabilities reports of the Bank for International Settlements (BIS), we have been examining the holdings of the reporting banks with respect to the changes in US dollar denominated assets and liabilities.

The Eurodollar had been a component of M3 and was discontinued by the Fed in 2006.

When a multinational company deposits US dollar receipts from an export business in their domestic banks those deposits are frequently held in dollars. Think of it as a short term Certificate of Deposit denominated in US dollars.

Overseas banks may take those customer dollar deposits (liabilities) and place them in dollar assets such as CDO tranches and interest yielding debt instruments which are held as dollar assets on their books.

If those dollar assets decline because of a financial event as we are seeing today, the depositors may choose to withdraw their dollar deposit from the bank as they mature.

This places the bank in an awkward position since the corresponding assets have deteriorated in value, but the nominal value of the certificate of deposit liability remains the same with the requisite interest accrual.

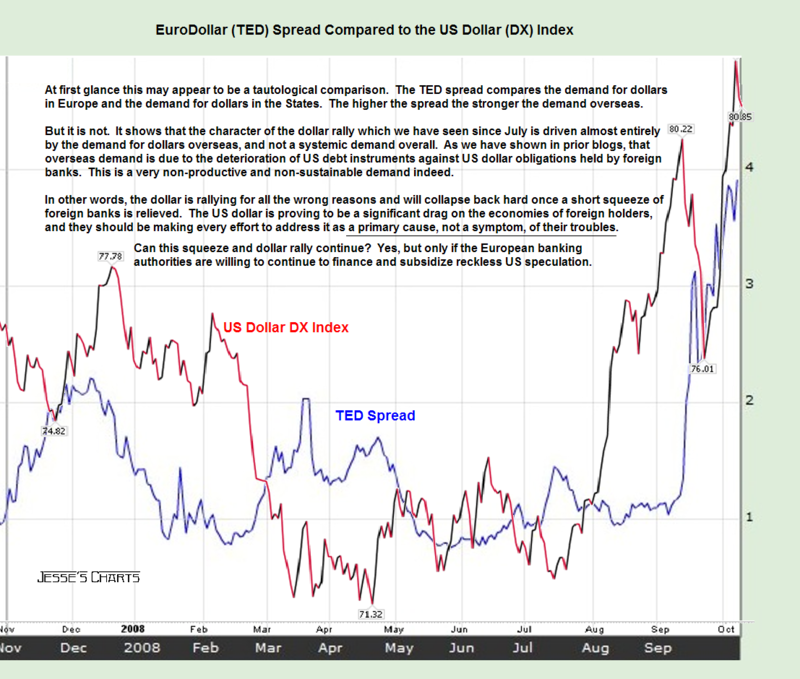

As a result, a demand for dollars can be generated in the foreign country that is artificial but very real in terms of day to day banking operations.

This is the 'artificial dollar short' and monetary deflation about which so many have spoken. It is specific to Europe in this case because the ECB cannot print dollars, it can only obtain them from the Federal Reserve.

It has more of the characteristics of a supply disruption or a liquidity crunch in that demand is temporarily exceeding supply because of an exogenous event.

The central banks arrange swap operations, such as between the Fed and the ECB, to exchange Euros and Dollars to maintain the liquidity of their domestic operations.

If handled inefficiently or under event duress this could have the effect of creating a short term currency imbalance, increasing the cost of euro-dollar swaps, and driving the 'price' of the dollar higher in the short term, and perhaps quite sharply if the event is of sufficient magnitude.

As the imbalances are resolved the 'fundamentals' should reassert and relative values among currencies revert to the mean.

But in the short term a significant amount of dislocation and distress could occur in the arbitrage and banking markets.

We believe that we are in such an occasion now, as the European banks had been slow to markdown their degraded US assets, and had relied on swaps written by companies such as AIG which have failed, leaving the banks a day late and literally 'a dollar short.'

The resulting sharp rally in the US dollar is therefore likely to be an anomaly which will correct, and perhaps quite sharply, once the effect of the short term imbalances dissipates.

We do not have access to a Bloomberg terminal but would speculate that EUR.USD swaps have risen higher recently as the withdrawal pressures in the European banking system increased. This has little to nothing to do with the relative prospects for the fundamentals, but are what we like to refer to as 'the technical trade.' Real enough to the trader, but transitory.

Have you missed the exquisite irony that it was the US banks that sold the foul debt assets to the overseas banks that are now driving the demand for US dollars. And the US banks are quite possibly squeezing their foreign countrparts in the process?

We wonder if the ECB and other Central Banks agree with this and therefore understand that decreasing the value of the US dollar relative to their currency might be an effective policy response to some liquidity problems in their domestic banking system.

They may already be attempting to accomplish this, given the recent increases in the Fed swaplines with their foreign central bank counterparts. But they may also be getting squeezed by some multinational trading banks and funds.

Although we have been discussing this using the Euro as an example, the situation would apply to any national banking system which has been long deteriorating US debt and the monetary dollar fruits of the US current account deficit and their own mercantilism.

Don't confidence men generally rely on the gullibility and greed of their marks? We doubt the economic hit men are missing this opportunity to profit from a position of relative advantage.

No wonder some nations are complaining that they need a new basis for international trade not based on the dollar.

"It's good to be the King."

i know my wife would vouch for it.:rolleyes:

i know my wife would vouch for it.:rolleyes:

Comment