What do you learned folks think of this? Would appreciate thoughts...

http://www.cbc.ca/money/story/2008/0...-forecast.html

OG

Replay of Great Depression unlikely, TD bank says

Central bankers avoiding errors of 1920s and 1930s, economists claim

Last Updated: Thursday, September 25, 2008 | 12:08 PM ET Comments17Recommend19

CBC News

Is the United States about to revisit the Dirty Thirties and take the rest of us along for the ride?

Probably not, say economists at the Toronto Dominion Bank.

They argue that the Federal Reserve Board, the U.S. central bank, is avoiding mistakes it made before the big crash of 1929 and during the long economic darkness that followed.

"Some draw parallels between the current situation and the Great Depression," the bank's economics department said in a quarterly economic forecast issued Thursday, dismissing such comparisons as "a stretch."

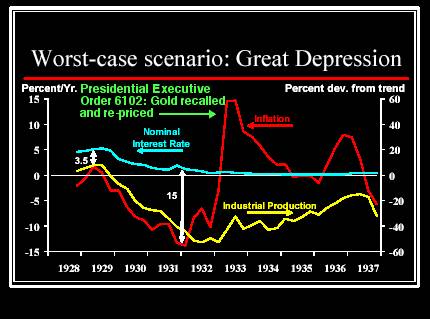

The TD economists list three major Fed blunders of the 1920s and 1930s:

• "First, the onset of the Great Depression owed to a tightening of monetary policy. The Fed raised rates in 1928 to stem what they deemed excessive speculation fuelling a stock market bubble."

• "Second, the Fed of the early 1930s abdicated its lender-of-last-resort responsibility, allowing widespread failure of banks and undermining confidence in the system."

• "Third, at the onset of the contraction in the Great Depression, the Fed failed to maintain price stability, inducing deflation."

In contrast, the modern Fed strives to keep prices from rising or falling dramatically and has unquestionably pursued a financial loosening over the past year, lending aggressively and finding new ways to channel cash to shaky institutions, the economists say.

"Central banks around the world have learned from the mistakes of the Great Depression, which is why we’re seeing more aggressive and coordinated efforts around the world to ensure the global financial system has access to sufficient funds to weather the crisis," they say.

The economists argue that the current mess — which follows a mortgage lending binge, a tidal wave of defaults and a collapse of house prices — is more like the U.S. savings and loan crisis of the 1980s, only worse.

The S&L crisis was smaller and lacked the international reach of today’s financial crisis, they say.

"During the S&L crisis, the government established a Resolution Trust Corporation at just over $400 billion. The purpose was to purchase the bad debts of financial institutions and over time sell them back into the market as financial conditions improved. The RTC was able to sell over 95 per cent of the assets they had initially seized with a recovery rate of over 85 per cent. That left the taxpayer ultimately footing a bill of $124 billion, while corporations absorbed $29 billion in losses.

"The current financial crisis is carrying a bigger price tag. Corporate write-downs and losses have already mounted to over $500 billion, with about half of that being borne by non-American firms ... The total public and private tally will greatly exceed that of the S&L crisis.

"While this may seem daunting, at this stage in the cycle, it is more important to head off a more painful, deep and extended economic downturn by enacting measures that can quickly restore market confidence and financial market operations in order to prevent a complete freezing up of credit supply."

In its forecast, TD predicts a mild world recession next year and little economic growth in Canada or the United States.

"Notably, while not crashing American style, Canadian real estate has come off the boil," TD says. "It is almost inconceivable that painful adjustments in our manufacturing sector have been completed. In all, these factors lead us to a profile for the Canadian economy that resembles the American. Essentially, more sideways movement on output with only a shallow recovery in late 2009."

http://www.cbc.ca/money/story/2008/0...-forecast.html

OG

Replay of Great Depression unlikely, TD bank says

Central bankers avoiding errors of 1920s and 1930s, economists claim

Last Updated: Thursday, September 25, 2008 | 12:08 PM ET Comments17Recommend19

CBC News

Is the United States about to revisit the Dirty Thirties and take the rest of us along for the ride?

Probably not, say economists at the Toronto Dominion Bank.

They argue that the Federal Reserve Board, the U.S. central bank, is avoiding mistakes it made before the big crash of 1929 and during the long economic darkness that followed.

"Some draw parallels between the current situation and the Great Depression," the bank's economics department said in a quarterly economic forecast issued Thursday, dismissing such comparisons as "a stretch."

The TD economists list three major Fed blunders of the 1920s and 1930s:

• "First, the onset of the Great Depression owed to a tightening of monetary policy. The Fed raised rates in 1928 to stem what they deemed excessive speculation fuelling a stock market bubble."

• "Second, the Fed of the early 1930s abdicated its lender-of-last-resort responsibility, allowing widespread failure of banks and undermining confidence in the system."

• "Third, at the onset of the contraction in the Great Depression, the Fed failed to maintain price stability, inducing deflation."

In contrast, the modern Fed strives to keep prices from rising or falling dramatically and has unquestionably pursued a financial loosening over the past year, lending aggressively and finding new ways to channel cash to shaky institutions, the economists say.

"Central banks around the world have learned from the mistakes of the Great Depression, which is why we’re seeing more aggressive and coordinated efforts around the world to ensure the global financial system has access to sufficient funds to weather the crisis," they say.

The economists argue that the current mess — which follows a mortgage lending binge, a tidal wave of defaults and a collapse of house prices — is more like the U.S. savings and loan crisis of the 1980s, only worse.

The S&L crisis was smaller and lacked the international reach of today’s financial crisis, they say.

"During the S&L crisis, the government established a Resolution Trust Corporation at just over $400 billion. The purpose was to purchase the bad debts of financial institutions and over time sell them back into the market as financial conditions improved. The RTC was able to sell over 95 per cent of the assets they had initially seized with a recovery rate of over 85 per cent. That left the taxpayer ultimately footing a bill of $124 billion, while corporations absorbed $29 billion in losses.

"The current financial crisis is carrying a bigger price tag. Corporate write-downs and losses have already mounted to over $500 billion, with about half of that being borne by non-American firms ... The total public and private tally will greatly exceed that of the S&L crisis.

"While this may seem daunting, at this stage in the cycle, it is more important to head off a more painful, deep and extended economic downturn by enacting measures that can quickly restore market confidence and financial market operations in order to prevent a complete freezing up of credit supply."

In its forecast, TD predicts a mild world recession next year and little economic growth in Canada or the United States.

"Notably, while not crashing American style, Canadian real estate has come off the boil," TD says. "It is almost inconceivable that painful adjustments in our manufacturing sector have been completed. In all, these factors lead us to a profile for the Canadian economy that resembles the American. Essentially, more sideways movement on output with only a shallow recovery in late 2009."

Comment