|

Expect more attempts to rescue the FIRE Economy, but don’t expect them to work

He ceased; and Satan staid not to reply,

But, glad that now his sea should find a shore,

With fresh alacrity and force renewed

Springs upward, like a pyramid of fire,

Into the wild expanse, and through the shock

Of fighting elements, on all sides round

Environed, wins his way; harder beset

And more endangered than when Argo passed

Through Bosporus betwixt the justling rocks,

Or when Ulysses on the larboard shunned

Charybdis, and by the other Whirlpool steered.

- John Milton (1608–1674), Paradise Lost: The Second Book

Disguised as relief for home debtors, Congress this weekend passed a bill with the Orwellian title "Housing and Economic Recovery Act of 2008" to rescue famously corrupt and mismanaged government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac. The legislation is a scandal. It not only bails out the bondholders but allows the Treasury to deliver shareholders from their folly: investing in mortgage companies that were for a decade run like high flying hedge funds, with investments in exotic interest rate and other derivatives that have no place in a GSE portfolio, while company executives raked in millions. The White House originally promised to veto the bill, but reversed its position last week and will sign it this week.But, glad that now his sea should find a shore,

With fresh alacrity and force renewed

Springs upward, like a pyramid of fire,

Into the wild expanse, and through the shock

Of fighting elements, on all sides round

Environed, wins his way; harder beset

And more endangered than when Argo passed

Through Bosporus betwixt the justling rocks,

Or when Ulysses on the larboard shunned

Charybdis, and by the other Whirlpool steered.

- John Milton (1608–1674), Paradise Lost: The Second Book

Most Americans do not question the existence of giant government sponsored corporations that subsidize the real estate industry with discounted loans. When I was interviewed by German Public Radio (See Recorded at Wall Street) my interviewer, besides expressing surprise at absurdly low prices in New York City where the interview took place, wondered why Americans tolerated US government subsidies of the US real estate industry via institutions and tax policies that the German constitution, as most European constitutions including the French, forbid. Good question. In August 2007, French President Nicolas Sarkozy proposed the mortgage interest deduction, a cornerstone of US FIRE Economy policy passed as part of the 1986 Tax Relief Act. The Constitutional Council, the highest court in France, struck it down as unconstitutionally creating a tax advantage for property owners. The development of a system of rent extraction by one class of society over another worried the framers of the US constitution, but in the end loopholes remained that left us open to the crisis of systemic corruption that we face today.

I agree with Sen. Charles Grassley, R-Iowa, who voted against the bill but supported earlier versions of the legislation. He objected to the Fannie and Freddie rescue plan. Yesterday CNN reported Grassley remarking, "This bill has fallen prey to the special interests on Wall Street and K Street at an unjustifiable expense to taxpayers and homeowners on Main Street."

Once Bush signs the bill into law, the Treasury will have the right to buy unlimited stock in Fannie Mae and Freddie Mac, which are known as government-sponsored enterprises. The measures provide a federal backstop for the two companies, letting them borrow at a cheaper rate than private corporations.

Unlike past corporate rescues, Congress is not requiring the companies to pay anything up front for the backing, said Joshua Rosner, an analyst with independent research firm Graham Fisher & Co. in New York.

``Once again, Fannie and Freddie rolled Congress’’ Rosner, 41, said. ``This is maybe the most taxpayer-unfriendly legislation we've seen in the past decade.'' – Bloomberg, July 28, 2008

Critics of the bill see it further weakening the US fiscal position and sapping the dollar. That is true and is well known to policy makers, especially the Fed. Indeed the dollar fell today at least partly in reaction to the legislation news. But the bill went through, and in a mad hurry, knowingly at the expense of the dollar to save the US FIRE Economy from certain catastrophe, for reasons dating back to the end of the gold standard and the administration of the last academic Fed chairman Arthur Burns in the early 1970s.Unlike past corporate rescues, Congress is not requiring the companies to pay anything up front for the backing, said Joshua Rosner, an analyst with independent research firm Graham Fisher & Co. in New York.

``Once again, Fannie and Freddie rolled Congress’’ Rosner, 41, said. ``This is maybe the most taxpayer-unfriendly legislation we've seen in the past decade.'' – Bloomberg, July 28, 2008

In 2003 a sea change goes unnoticed: politicization of foreign investment in the US

To make a long story short, the practice of keeping foreign holdings of US agency and treasury debt on Fed account started under Arthur Burns in the early 1970s as a way for the US to regain control of its currency that the US was losing to the euro dollar market.

Banking expert Martin Mayer, author of The Bankers: The Next Generation The New Worlds Money Credit Banking Electronic Age

and a dozen other books on banking and frequent writer for Barron’s Magazine, Institutional Investor, and others explains:

and a dozen other books on banking and frequent writer for Barron’s Magazine, Institutional Investor, and others explains:Exporters to America who keep the dollars and use them for American purchases and investments create what economists call an autonomous flow of funds back to the United States, financing the American trade deficit with an American investment surplus.

This produces the argument most closely associated with the new Federal Reserve chairman, Ben Bernanke (though Alan Greenspan believed it, too), that our trade deficit is caused by a surplus of savings that can't be profitably invested in the home countries of our trading partners. Financing for our trade deficit comes before — and actually causes — the deficit itself.

If instead of investing their dollars in the United States, foreign exporters want to take the proceeds of their sales in their own currency, their central banks will in effect sell them that currency for their dollars. Back in the late 1960's, when Great Society deficits and the Vietnam War prompted the first serious sell-off of dollars (and forced the United States to abandon the gold standard because too many holders of dollars, led by President Charles de Gaulle of France, wanted gold), those central banks lent those dollars into the new Eurodollar market, where they traded somewhat separately from domestic dollars.

This created a nightmarish prospect of the United States losing control of its own currency, and in 1971 the Fed chairman, Arthur Burns, negotiated a deal with the European and Japanese central banks. The deal was that they would return to America the dollars they acquired in their own economies, and the Fed would invest the money on their behalf, in absolutely safe government securities, without charge and at the best rates.

Today, the Fed continues as custodian of the "foreign official holdings" of such government obligations. During the Clinton administration, the Fed agreed to invest in federally guaranteed housing securities for those foreign central banks that wanted a better yield on their dollar reserves than they would get from government bonds, and now half a trillion dollars* of the total official holdings are invested in agency paper.

Foreign official holdings of government paper is a miner's canary number. It tells you if there is big trouble ahead. The most common worry is that the number will shrink suddenly, with foreign governments dumping their dollar holdings, driving down the dollar's value and driving up American interest rates, but that's not a real danger. If the price of our government securities dived, the foreign central banks would have to bear the loss. This would be a budget item for their governments, whose leaders would not like it at all.

- Federal Reserve System: The Mark of the Bust, Martin Mayer, June 14, 2006

* Half a trillion two years ago, almost a trillion today.

In 1999 we developed a theory of asset bubble inflations, crashes, and government economic reflation that forecasts the process as ultimately inflationary: Ka-Poom Theory. The theory holds that at the end of one of the bubble cycles that started in the late 1980s, foreign investors sell US debt, the dollar falls, and an inflation cycle begins driven by rising import prices, leading to economic contraction, further loss of confidence in the US economy and foreign sales of US debt and repatriation of dollars, creating a whirlpool of inflation and economic contraction.This produces the argument most closely associated with the new Federal Reserve chairman, Ben Bernanke (though Alan Greenspan believed it, too), that our trade deficit is caused by a surplus of savings that can't be profitably invested in the home countries of our trading partners. Financing for our trade deficit comes before — and actually causes — the deficit itself.

If instead of investing their dollars in the United States, foreign exporters want to take the proceeds of their sales in their own currency, their central banks will in effect sell them that currency for their dollars. Back in the late 1960's, when Great Society deficits and the Vietnam War prompted the first serious sell-off of dollars (and forced the United States to abandon the gold standard because too many holders of dollars, led by President Charles de Gaulle of France, wanted gold), those central banks lent those dollars into the new Eurodollar market, where they traded somewhat separately from domestic dollars.

This created a nightmarish prospect of the United States losing control of its own currency, and in 1971 the Fed chairman, Arthur Burns, negotiated a deal with the European and Japanese central banks. The deal was that they would return to America the dollars they acquired in their own economies, and the Fed would invest the money on their behalf, in absolutely safe government securities, without charge and at the best rates.

Today, the Fed continues as custodian of the "foreign official holdings" of such government obligations. During the Clinton administration, the Fed agreed to invest in federally guaranteed housing securities for those foreign central banks that wanted a better yield on their dollar reserves than they would get from government bonds, and now half a trillion dollars* of the total official holdings are invested in agency paper.

Foreign official holdings of government paper is a miner's canary number. It tells you if there is big trouble ahead. The most common worry is that the number will shrink suddenly, with foreign governments dumping their dollar holdings, driving down the dollar's value and driving up American interest rates, but that's not a real danger. If the price of our government securities dived, the foreign central banks would have to bear the loss. This would be a budget item for their governments, whose leaders would not like it at all.

- Federal Reserve System: The Mark of the Bust, Martin Mayer, June 14, 2006

* Half a trillion two years ago, almost a trillion today.

The “Poom” portion of the cycle did not occur after the 2000 technology stock bust for reasons that, while profound, were unforeseen by us and passed largely unnoticed in the business press. When it occurred in 2003, alarm bells should have rung from sea to shining sea: private money exited the market and government money filled in the gap.

Foreign central banks rushed in starting in 2003 where private investors

feared to tread after the technology stock bubble collapsed in 2000

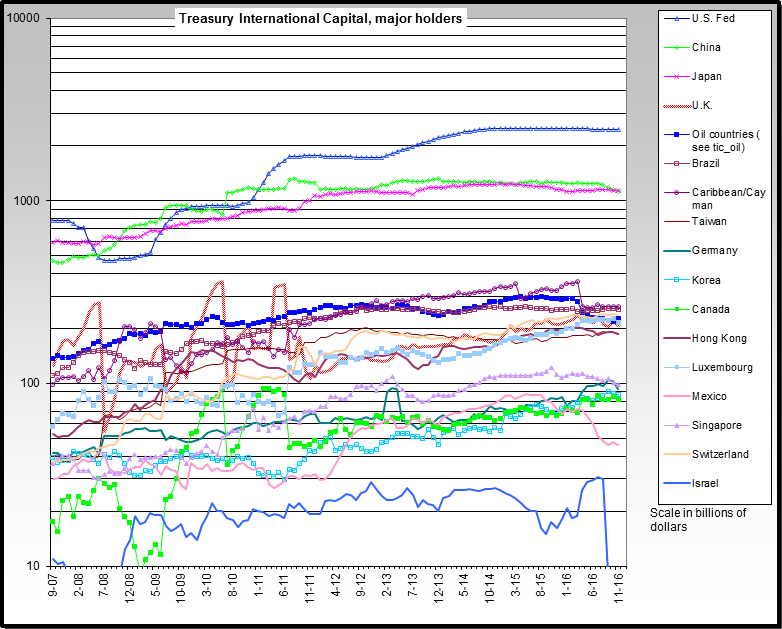

In 1998 foreign private and official holdings of US Treasury debt by foreign central banks were about equal, at 51% and 49% respectively. But after the technology stock bubble and bust, private investors lost faith in the US economy and markets. To prevent a destructive self-reinforcing cycle of rising interest rates and economic contraction if foreign flows were allowed to reverse, starting in 2003 foreign central banks purchased treasuries at a higher rate to compensate for the decline in private foreign investment until by Q1 2008 the ratio stood at 61% official holdings to 39% private.

This marked the beginning of a period of political versus economic investment by foreign governments in the US. One government does not support another without purpose; compensation is expected in return, which compensation may not accord with US domestic interests. The bailout of Fannie and Freddie is the first example of a domestic economic policy decision made to satisfy short term foreign and US interests to the detriment of long term US interests. As we circle the whirlpool created by foreign debt and the folly of the FIRE Economy that the debt has enabled, you can be certain it will not be the last. To make matters worse, the maintenance of the FIRE Economy depends on foreign lending from non-market oriented, unelected often repressive governments. More on that and the implications later.

In 2006, when Treasuries get too expensive, the US sells agency debt instead

After the tech bubble burst, treasury bond yields fell below 5%

After the bursting of the technology bubble and private foreign investors left the US Treasury market to investment by foreign lenders, Treasury bond yields dropped below 5%, the lowest rate in decades. Both foreign private and government investors sought US debt that earned more interest. The Treasury had a solution: buy more debt issued by GSEs known as agency debt, especially Fannie Mae and Freddie Mac whose bonds were earning over 6%. While not explicitly guaranteed by the US government, an implicit US government guarantee of agency debt is widely perceived in the marketplace.

Agency debt carries an implicit US government guarantee and pays a

higher rate of interest than US treasuries

Foreign private and official investors began to pile into agency debt after the end of the last recession, A in the chart below, that followed the technology stock bubble bust because the yield was better than Treasury bonds but with perceived similar default risk due to an implicit government guarantee. In 2006, B in the chart below, as the housing bubble started to peter out once again private investors pulled back from US markets and foreign central banks took up the slack, just as they had by buying treasury bonds following the technology stock bubble bust in 2003.

First arrow A shows an increase in agency debt purchases by foreign investors

starting around the last recession in 2001. Central banks picked up

where private investors left off in 2006, as shown by second arrow B

In 1994, private foreign investment in US agency debt was more than 11 times the level of investment by foreign central banks. By 2002, central banks stepped up their purchases in search of higher yields than Treasury bonds offered and private investors shunned the US post-bubble economy; the proportion of private foreign investment fell to a level not quite twice the level of the central banks. As of Q1 2008 foreign central bank agency liability increased 442% to $984 billion from $181 billion in 2002. Foreign central banks now hold almost twice as many agency bonds as private holders.

For the first time in history, the US government is now beholden to foreign governments for the bulk of the treasury debt used to finance its government and the bedrock of its financial system, and also agency debt, the foundation of its housing market, the crown jewel of the FIRE Economy. Here’s the total foreign debt picture since 2001 from a 2007 presentation by the Congressional Budget Office.

If the US did not act quickly to make the implicit guarantee of GSE credit explicit for $984 billion in foreign central bank liabilities, agency debt would have sold off and mortgage rates would have spiked. We estimate that the potential increase in agency bond yields and mortgage rates as similar to or greater than occurred in 1994 when 30 year mortgage rates increased from 6.75% to 9.25%

The 30 year fixed mortgage rate is vulnerable to an increase from the current 6.43% rate to over 10% in 2008 if foreign central banks lower their exposure to Fannie and Freddie bonds because the US government failed to bail. With the US housing market already in tatters, such an increase in mortgage rates would steer the US economy into the whirlpool of credit contraction, economic contraction, currency depreciation, and inflation – the bane of all nations in history that have developed external debts beyond their means to repay.

That is why Congress rushed this legislation through, and why the White House capitulated.

Meet the new boss, not the same as the old boss

We must not let our rulers load us with perpetual debt.

- Thomas Jefferson (1743 - 1826), letter to Samuel Kercheval, July 12, 1816

Who holds the debt? Holdings of US Treasuries by Japan peaked in Nov. 2004 at $693 billion and by May 2008 were down 16% to $579 billion. Over the same period, China’s holdings increased 130% from $220 billion to $507, oil exporters 164% from $62B to $164B, and Caribbean Banking Centers up 111% from $51 billion to $108 billion. Of the 28 holders of $10 billion or more in US Treasury debt, the four above account for 40% of the total. - Thomas Jefferson (1743 - 1826), letter to Samuel Kercheval, July 12, 1816

Sources of capital for Caribbean Banking Centers is open to speculation. Some say most of the growth over the last few years is from hedge funds. Others claim that the US government is borrowing from itself through these unregulated banks. Unfortunately, there is no way of knowing for certain.

Japan's reduction in US debt holdings began soon after the presidential elections in the early 2000s when the Japanese people elected the first generation of politicians to grow up after WWII. They do not have the same political allegiance to the US government as the WWII generation did, that for example ran a Japanese bubble economy in the late 1980s to help get Ronald Reagan elected, and have been putting economic, political and military distance between themselves and the US ever since. The intentions of the Chinese and oil producing countries' governments to support the US government via lending are open to speculation, but it should be noted that the largest lenders are unelected governments that operate according to philosophies of personal liberty and representative government that are antithetical to the US model. A government ostensibly for the people that is heavily in debt to governments that view the people as a means to an end – to gain power and wealth – is a political force inside the whirlpool that we will some day reckon with.

Brazil's lending to the US is up to $151 billion from $94 billion a year ago because most of the country's government and corporate foreign liabilities are in U.S. currency, so as they increase their own foreign dollar denominated debt they have to increase their purchases of US debt as reserves. Brazil's total debt owed to foreign creditors increased to $182 billion by the end of June, up from $157 billion last year.

The US economy has since the early 1980s developed into the FIRE Economy, with finance, insurance, and real estate interests guiding economic policy through tax and regulatory legislation. The FIRE Economy, based on systemic rent extraction and earnings from capital gains versus profits from production, is funded with foreign borrowing. Now that most of the foreign lending on which the US FIRE Economy depends is being done by foreign governments and not by private investors, the FIRE Economy has become highly politicized. No longer can the US government make decisions primarily in the national interest, as it did when Paul Volcker raised interest rates in the early 1980s and crashed economies around the world to halt inflation, but in the combined interests of its foreign government creditors and those in the US who benefit the most from the FIRE Economy itself – lenders, insurance companies, and real estate interests.

Conclusion

The legislation that was passed this weekend is scandalous. It bails out not only GSE bond holders, an act that while bad for the US long term can be justified to prevent a major correction in mortgage bonds and catastrophic collapse of the housing market, but the shareholders who should be wiped out. Norwegians, when faced with a similar challenge in the early 1990s, ensured that shareholders of insolvent lenders received nothing and the senior management was entirely purged. Two of the country's top four banks - Christiania Bank and Fokus - were seized by force majeure. "We were determined not to get caught in the game we've seen with Bear Stearns where shareholders make money out of the rescue," said one Norwegian adviser.

The anti-free market, rent levying policies and institutions that subsidize the lending industry in the US pile additional un-payable foreign debts on top the mountain of agency and treasury debt we already owe. The resulting mis-allocation of capital to special interests, to the exclusion of productive enterprise and capital formation, weakens our economy, lessens our nation's ability to act in its own interests, and cedes sovereignty to governments organized according to principles that are antithetical to America’s.

Two years ago Martin Mayer concluded his June 2006 warning with the following prescient forecast:

What we have to watch out for is a sudden and drastic increase in foreign official holdings. Rapid growth in this number in the late 1960's and 1970's forecast the recessions of the early 1970's and 1980's, and it could happen again.

Recent large increases in foreign official holdings indicate that foreign private investors see fewer attractive places to put their money in the American economy. They could presage a significant fall in the price of American assets, stocks (witness the recent drops in American stock markets) and bonds and real estate and all, and a hard landing for a world economy still floating on the crest of cheap credit.

As predicted, rapid growth in foreign official holdings did forecast the recession we are having today, and presaged a significant fall in the price of American assets. What’s next?Recent large increases in foreign official holdings indicate that foreign private investors see fewer attractive places to put their money in the American economy. They could presage a significant fall in the price of American assets, stocks (witness the recent drops in American stock markets) and bonds and real estate and all, and a hard landing for a world economy still floating on the crest of cheap credit.

Our government may have for a time steered us around the whirlpool of self-reinforcing credit and economic crisis of their own making, but we remain at its edge, guided by the relentless pull of foreign debt obligations and the inexorable political logic of repayment.

Next bailout? Perhaps the FDIC. It appears under-capitalized for the task at hand.

Where might the politics of foreign debt eventual take us if we do not confront the problem early? Watch this series of videos for a worst case scenario.

We did a follow-up interview with Martin Mayer today that will be available to subscribers here later this week. Highlights:

- The Bernanke Fed inadvertently induced commodity price increases starting mid 2007 by giving banks treasuries in exchange for securitized debt and other securities. The banks then used the treasuries as cash in the commodities market.

- Bernanke is an academic. We have not had good experiences with academics heading the Fed. The last one was Arthur Burns.

- Uncertainty about Bear Stearn's OTC credit derivatives position was the reason for the bailout.

- Derivatives are gambling instruments that shift risk onto those who can least bear it. With $60 trillion in credit derivatives outstanding, and no figures on open interest, the situation is dangerous. Will novation hold up? No one knows.

- Greenspan's nonsense assertion that inflation can only come from wages is being proven wrong.

- We are "circling the whirlpool," the phrase from which this commentary gets its name

Look for his New York Times editorial on Fannie Mae and Freddie Mac this week.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Addendum:

Followers of The Next Bubble will not be surprised to find the seeds of the next bubble planted right in legislation designed to rescue the economy from the fallout of the last bubble. To the uninitiated, the following might be a complete mystery. After all, what does energy legislation have to do with foreclosures?

To wit, H.R.3221, Foreclosure Prevention Act of 2008 (Engrossed Amendment as Agreed to by Senate) states:

TITLE X--CLEAN ENERGY TAX STIMULUS

SEC. 1001. SHORT TITLE; ETC.

(a) Short Title- This title may be cited as the `Clean Energy Tax Stimulus Act of 2008'.

(b) Amendment of 1986 Code- Except as otherwise expressly provided, whenever in this title an amendment or repeal is expressed in terms of an amendment to, or repeal of, a section or other provision, the reference shall be considered to be made to a section or other provision of the Internal Revenue Code of 1986.

Subtitle A--Extension of Clean Energy Production Incentives

SEC. 1011. EXTENSION AND MODIFICATION OF RENEWABLE ENERGY PRODUCTION TAX CREDIT.

(a) Extension of Credit- Each of the following provisions of section 45(d) (relating to qualified facilities) is amended by striking `January 1, 2009' and inserting `January 1, 2010':

(1) Paragraph (1).

(2) Clauses (i) and (ii) of paragraph (2)(A).

(3) Clauses (i)(I) and (ii) of paragraph (3)(A).

(4) Paragraph (4).

(5) Paragraph (5).

(6) Paragraph (6).

(7) Paragraph (7).

(8) Paragraph (8).

(9) Subparagraphs (A) and (B) of paragraph (9).

(b) Production Credit for Electricity Produced From Marine Renewables-

(1) IN GENERAL- Paragraph (1) of section 45(c) (relating to resources) is amended by striking `and' at the end of subparagraph (G), by striking the period at the end of subparagraph (H) and inserting `, and', and by adding at the end the following new subparagraph:

`(I) marine and hydrokinetic renewable energy.'.

(2) MARINE RENEWABLES- Subsection (c) of section 45 is amended by adding at the end the following new paragraph:

`(10) MARINE AND HYDROKINETIC RENEWABLE ENERGY-

`(A) IN GENERAL- The term `marine and hydrokinetic renewable energy' means energy derived from--

`(i) waves, tides, and currents in oceans, estuaries, and tidal areas,

`(ii) free flowing water in rivers, lakes, and streams,

`(iii) free flowing water in an irrigation system, canal, or other man-made channel, including projects that utilize nonmechanical structures to accelerate the flow of water for electric power production purposes, or

`(iv) differentials in ocean temperature (ocean thermal energy conversion).

`(B) EXCEPTIONS- Such term shall not include any energy which is derived from any source which utilizes a dam, diversionary structure (except as provided in subparagraph (A)(iii)), or impoundment for electric power production purposes.'.

(3) DEFINITION OF FACILITY- Subsection (d) of section 45 is amended by adding at the end the following new paragraph:

`(11) MARINE AND HYDROKINETIC RENEWABLE ENERGY FACILITIES- In the case of a facility producing electricity from marine and hydrokinetic renewable energy, the term `qualified facility' means any facility owned by the taxpayer--

`(A) which has a nameplate capacity rating of at least 150 kilowatts, and

`(B) which is originally placed in service on or after the date of the enactment of this paragraph and before January 1, 2010.'.

(4) CREDIT RATE- Subparagraph (A) of section 45(b)(4) is amended by striking `or (9)' and inserting `(9), or (11)'.

(5) COORDINATION WITH SMALL IRRIGATION POWER- Paragraph (5) of section 45(d), as amended by subsection (a), is amended by striking `January 1, 2010' and inserting `the date of the enactment of paragraph (11)'.

(c) Sales of Electricity to Regulated Public Utilities Treated as Sales to Unrelated Persons- Section 45(e)(4) (relating to related persons) is amended by adding at the end the following new sentence: `A taxpayer shall be treated as selling electricity to an unrelated person if such electricity is sold to a regulated public utility (as defined in section 7701(a)(33).'.

(d) Trash Facility Clarification- Paragraph (7) of section 45(d) is amended--

(1) by striking `facility which burns' and inserting `facility (other than a facility described in paragraph (6)) which uses', and

(2) by striking `COMBUSTION'.

(e) Effective Dates-

(1) EXTENSION- The amendments made by subsection (a) shall apply to property originally placed in service after December 31, 2008.

(2) MODIFICATIONS- The amendments made by subsections (b) and (c) shall apply to electricity produced and sold after the date of the enactment of this Act, in taxable years ending after such date.

(3) TRASH FACILITY CLARIFICATION- The amendments made by subsection (d) shall apply to electricity produced and sold before, on, or after December 31, 2007.

SEC. 1012. EXTENSION AND MODIFICATION OF SOLAR ENERGY AND FUEL CELL INVESTMENT TAX CREDIT.

(a) Extension of Credit-

(1) SOLAR ENERGY PROPERTY- Paragraphs (2)(A)(i)(II) and (3)(A)(ii) of section 48(a) (relating to energy credit) are each amended by striking `January 1, 2009' and inserting `January 1, 2017'.

(2) FUEL CELL PROPERTY- Subparagraph (E) of section 48(c)(1) (relating to qualified fuel cell property) is amended by striking `December 31, 2008' and inserting `December 31, 2017'.

(3) QUALIFIED MICROTURBINE PROPERTY- Subparagraph (E) of section 48(c)(2) (relating to qualified microturbine property) is amended by striking `December 31, 2008' and inserting `December 31, 2017'.

(b) Allowance of Energy Credit Against Alternative Minimum Tax- Subparagraph (B) of section 38(c)(4) (relating to specified credits) is amended by striking `and' at the end of clause (iii), by striking the period at the end of clause (iv) and inserting `, and', and by adding at the end the following new clause:

`(v) the credit determined under section 46 to the extent that such credit is attributable to the energy credit determined under section 48.'.

(c) Repeal of Dollar Per Kilowatt Limitation for Fuel Cell Property-

(1) IN GENERAL- Section 48(c)(1) (relating to qualified fuel cell), as amended by subsection (a)(2), is amended by striking subparagraph (B) and by redesignating subparagraphs (C), (D), and (E) as subparagraphs (B), (C), and (D), respectively.

(2) CONFORMING AMENDMENT- Section 48(a)(1) is amended by striking `paragraphs (1)(B) and (2)(B) of subsection (c)' and inserting `subsection (c)(2)(B)'.

(d) Public Electric Utility Property Taken Into Account-

(1) IN GENERAL- Paragraph (3) of section 48(a) is amended by striking the second sentence thereof.

(2) CONFORMING AMENDMENTS-

(A) Paragraph (1) of section 48(c), as amended by this section, is amended by striking subparagraph (C) and redesignating subparagraph (D) as subparagraph (C).

(B) Paragraph (2) of section 48(c), as amended by subsection (a)(3), is amended by striking subparagraph (D) and redesignating subparagraph (E) as subparagraph (D).

(e) Effective Dates-

(1) EXTENSION- The amendments made by subsection (a) shall take effect on the date of the enactment of this Act.

(2) ALLOWANCE AGAINST ALTERNATIVE MINIMUM TAX- The amendments made by subsection (b) shall apply to credits determined under section 46 of the Internal Revenue Code of 1986 in taxable years beginning after the date of the enactment of this Act and to carrybacks of such credits.

(3) FUEL CELL PROPERTY AND PUBLIC ELECTRIC UTILITY PROPERTY- The amendments made by subsections (c) and (d) shall apply to periods after the date of the enactment of this Act, in taxable years ending after such date, under rules similar to the rules of section 48(m) of the Internal Revenue Code of 1986 (as in effect on the day before the date of the enactment of the Revenue Reconciliation Act of 1990).

SEC. 1013. EXTENSION AND MODIFICATION OF RESIDENTIAL ENERGY EFFICIENT PROPERTY CREDIT.

(a) Extension- Section 25D(g) (relating to termination) is amended by striking `December 31, 2008' and inserting `December 31, 2009'.

(b) No Dollar Limitation for Credit for Solar Electric Property-

(1) IN GENERAL- Section 25D(b)(1) (relating to maximum credit) is amended by striking subparagraph (A) and by redesignating subparagraphs (B) and (C) as subparagraphs (A) and (B), respectively.

(2) CONFORMING AMENDMENTS- Section 25D(e)(4) is amended--

(A) by striking clause (i) in subparagraph (A),

(B) by redesignating clauses (ii) and (iii) in subparagraph (A) as clauses (i) and (ii), respectively, and

(C) by striking `, (2),' in subparagraph (C).

(c) Credit Allowed Against Alternative Minimum Tax-

(1) IN GENERAL- Subsection (c) of section 25D is amended to read as follows:

`(c) Limitation Based on Amount of Tax; Carryforward of Unused Credit-

`(1) LIMITATION BASED ON AMOUNT OF TAX- In the case of a taxable year to which section 26(a)(2) does not apply, the credit allowed under subsection (a) for the taxable year shall not exceed the excess of--

`(A) the sum of the regular tax liability (as defined in section 26(b)) plus the tax imposed by section 55, over

`(B) the sum of the credits allowable under this subpart (other than this section) and section 27 for the taxable year.

`(2) CARRYFORWARD OF UNUSED CREDIT-

`(A) RULE FOR YEARS IN WHICH ALL PERSONAL CREDITS ALLOWED AGAINST REGULAR AND ALTERNATIVE MINIMUM TAX- In the case of a taxable year to which section 26(a)(2) applies, if the credit allowable under subsection (a) exceeds the limitation imposed by section 26(a)(2) for such taxable year reduced by the sum of the credits allowable under this subpart (other than this section), such excess shall be carried to the succeeding taxable year and added to the credit allowable under subsection (a) for such succeeding taxable year.

`(B) RULE FOR OTHER YEARS- In the case of a taxable year to which section 26(a)(2) does not apply, if the credit allowable under subsection (a) exceeds the limitation imposed by paragraph (1) for such taxable year, such excess shall be carried to the succeeding taxable year and added to the credit allowable under subsection (a) for such succeeding taxable year.'.

(2) CONFORMING AMENDMENTS-

(A) Section 23(b)(4)(B) is amended by inserting `and section 25D' after `this section'.

(B) Section 24(b)(3)(B) is amended by striking `and 25B' and inserting `, 25B, and 25D'.

(C) Section 25B(g)(2) is amended by striking `section 23' and inserting `sections 23 and 25D'.

(D) Section 26(a)(1) is amended by striking `and 25B' and inserting `25B, and 25D'.

(d) Effective Date-

(1) IN GENERAL- The amendments made by this section shall apply to taxable years beginning after December 31, 2007.

(2) APPLICATION OF EGTRRA SUNSET- The amendments made by subparagraphs (A) and (B) of subsection (c)(2) shall be subject to title IX of the Economic Growth and Tax Relief Reconciliation Act of 2001 in the same manner as the provisions of such Act to which such amendments relate.

SEC. 1014. EXTENSION AND MODIFICATION OF CREDIT FOR CLEAN RENEWABLE ENERGY BONDS.

(a) Extension- Section 54(m) (relating to termination) is amended by striking `December 31, 2008' and inserting `December 31, 2009'.

(b) Increase in National Limitation- Section 54(f) (relating to limitation on amount of bonds designated) is amended--

(1) by inserting `, and for the period beginning after the date of the enactment of the Clean Energy Tax Stimulus Act of 2008 and ending before January 1, 2010, $400,000,000' after `$1,200,000,000' in paragraph (1),

(2) by striking `$750,000,000 of the' in paragraph (2) and inserting `$750,000,000 of the $1,200,000,000', and

(3) by striking `bodies' in paragraph (2) and inserting `bodies, and except that the Secretary may not allocate more than 1/3 of the $400,000,000 national clean renewable energy bond limitation to finance qualified projects of qualified borrowers which are public power providers nor more than 1/3 of such limitation to finance qualified projects of qualified borrowers which are mutual or cooperative electric companies described in section 501(c)(12) or section 1381(a)(2)(C)'.

(c) Public Power Providers Defined- Section 54(j) is amended--

(1) by adding at the end the following new paragraph:

`(6) PUBLIC POWER PROVIDER- The term `public power provider' means a State utility with a service obligation, as such terms are defined in section 217 of the Federal Power Act (as in effect on the date of the enactment of this paragraph).', and

(2) by inserting `; Public Power Provider' before the period at the end of the heading.

(d) Technical Amendment- The third sentence of section 54(e)(2) is amended by striking `subsection (l)(6)' and inserting `subsection (l)(5)'.

(e) Effective Date- The amendments made by this section shall apply to bonds issued after the date of the enactment of this Act.

SEC. 1015. EXTENSION OF SPECIAL RULE TO IMPLEMENT FERC RESTRUCTURING POLICY.

(a) Qualifying Electric Transmission Transaction-

(1) IN GENERAL- Section 451(i)(3) (defining qualifying electric transmission transaction) is amended by striking `January 1, 2008' and inserting `January 1, 2010'.

(2) EFFECTIVE DATE- The amendment made by this subsection shall apply to transactions after December 31, 2007.

(b) Independent Transmission Company-

(1) IN GENERAL- Section 451(i)(4)(B)(ii) (defining independent transmission company) is amended by striking `December 31, 2007' and inserting `the date which is 2 years after the date of such transaction'.

(2) EFFECTIVE DATE- The amendment made by this subsection shall take effect as if included in the amendments made by section 909 of the American Jobs Creation Act of 2004.

Subtitle B--Extension of Incentives to Improve Energy Efficiency

SEC. 1021. EXTENSION AND MODIFICATION OF CREDIT FOR ENERGY EFFICIENCY IMPROVEMENTS TO EXISTING HOMES.

(a) Extension of Credit- Section 25C(g) (relating to termination) is amended by striking `December 31, 2007' and inserting `December 31, 2009'.

(b) Qualified Biomass Fuel Property-

(1) IN GENERAL- Section 25C(d)(3) is amended--

(A) by striking `and' at the end of subparagraph (D),

(B) by striking the period at the end of subparagraph (E) and inserting `, and', and

(C) by adding at the end the following new subparagraph:

`(F) a stove which uses the burning of biomass fuel to heat a dwelling unit located in the United States and used as a residence by the taxpayer, or to heat water for use in such a dwelling unit, and which has a thermal efficiency rating of at least 75 percent.'.

(2) BIOMASS FUEL- Section 25C(d) (relating to residential energy property expenditures) is amended by adding at the end the following new paragraph:

`(6) BIOMASS FUEL- The term `biomass fuel' means any plant-derived fuel available on a renewable or recurring basis, including agricultural crops and trees, wood and wood waste and residues (including wood pellets), plants (including aquatic plants), grasses, residues, and fibers.'.

(c) Modifications of Standards for Energy-Efficient Building Property-

(1) ELECTRIC HEAT PUMPS- Subparagraph (B) of section 25C(d)(3) is amended to read as follows:

`(A) an electric heat pump which achieves the highest efficiency tier established by the Consortium for Energy Efficiency, as in effect on January 1, 2008.'.

(2) CENTRAL AIR CONDITIONERS- Section 25C(d)(3)(D) is amended by striking `2006' and inserting `2008'.

(3) WATER HEATERS- Subparagraph (E) of section 25C(d) is amended to read as follows:

`(E) a natural gas, propane, or oil water heater which has either an energy factor of at least 0.80 or a thermal efficiency of at least 90 percent.'.

(4) OIL FURNACES AND HOT WATER BOILERS- Paragraph (4) of section 25C(d) is amended to read as follows:

`(4) QUALIFIED NATURAL GAS, PROPANE, AND OIL FURNACES AND HOT WATER BOILERS-

`(A) QUALIFIED NATURAL GAS FURNACE- The term `qualified natural gas furnace' means any natural gas furnace which achieves an annual fuel utilization efficiency rate of not less than 95.

`(B) QUALIFIED NATURAL GAS HOT WATER BOILER- The term `qualified natural gas hot water boiler' means any natural gas hot water boiler which achieves an annual fuel utilization efficiency rate of not less than 90.

`(C) QUALIFIED PROPANE FURNACE- The term `qualified propane furnace' means any propane furnace which achieves an annual fuel utilization efficiency rate of not less than 95.

`(D) QUALIFIED PROPANE HOT WATER BOILER- The term `qualified propane hot water boiler' means any propane hot water boiler which achieves an annual fuel utilization efficiency rate of not less than 90.

`(E) QUALIFIED OIL FURNACES- The term `qualified oil furnace' means any oil furnace which achieves an annual fuel utilization efficiency rate of not less than 90.

`(F) QUALIFIED OIL HOT WATER BOILER- The term `qualified oil hot water boiler' means any oil hot water boiler which achieves an annual fuel utilization efficiency rate of not less than 90.'.

(d) Effective Date- The amendments made this section shall apply to expenditures made after December 31, 2007.

SEC.

http://thomas.loc.gov/cgi-bin/query/...wcinP:e165886:

Comment