Wall Street curse claims billions, again

September 22, 2006 (International Herald Tribune)

The big losses at the hedge fund Amaranth Advisors have their roots in a Wall Street curse that seems to strike at least once a decade: high-flying trader takes outsized risks and makes ridiculous paycheck, then implodes, possibly dragging the firm down with him.

But the events at Amaranth could be repeated much more often in coming years, veteran fund mangers say, thanks to hedge funds' recent love affair with the fast-moving commodities markets, and the "youthful aggression" of many traders.

Amaranth racked up some $5 billion of losses at the hands of a 32-year-old natural gas trader named Brian Hunter.

On Wednesday, Amaranth sold its energy portfolio - which holds what remains of its disastrous trades on price differences in the natural gas market - to J.P. Morgan and Citadel Investment Group, according to two people briefed on the negotiations. The sale leaves Amaranth, once a well-regarded $9.25 billion hedge fund, with $3.5 billion to $4 billion, a person involved in the negotiations said.

But there's a lot more aggressive new money out there in the volatile sector: Nearly $60 billion was invested by energy-related hedge funds in these markets, the Energy Hedge Fund Center estimates. Commodity indexes have $85 billion in assets, up from single digits just a few years ago.

Not all of these funds, or even most of them, have made bad bets, of course, and there is no guarantee that oil or natural gas prices will not soar again.

Still, veteran traders say the commodity markets are full of Brian Hunters: traders in their late 20s or early 30s who have never traded through severe conditions like the gasoline crisis of the 1970s, or the plunge in oil prices in the 1980s. Instead, they have watched as natural gas prices, as well as those of many other commodities, rose - unevenly, but with clear annual gains - since 2001.

AntiSpin: Combine this with the following story and you have a prescription for major losses.

What's Behind The Meltdown In The Commodity Markets?

September 2006 (Global Money Trends Magazine)

Will An Oil Price Fall Push Inflation Down?

September 21, 2006 (Mises.org)

However, in the context of a housing bubble–that is global in nature but US centric–the draining of liquidity is not likely to last much longer. By the end of 2006 or the middle of 2007 at the latest, the Fed will need to respond to the US recession that disinflation is precipitating. New liquidity will be the only remaining policy tool left, as the US is already running historically high fiscal deficits and has allowed the dollar to depreciate 25% against a basket of currencies. This future liquidity injection will result in an unexpectedly high rate of inflation that we refer to as Poom.

September 22, 2006 (International Herald Tribune)

The big losses at the hedge fund Amaranth Advisors have their roots in a Wall Street curse that seems to strike at least once a decade: high-flying trader takes outsized risks and makes ridiculous paycheck, then implodes, possibly dragging the firm down with him.

But the events at Amaranth could be repeated much more often in coming years, veteran fund mangers say, thanks to hedge funds' recent love affair with the fast-moving commodities markets, and the "youthful aggression" of many traders.

Amaranth racked up some $5 billion of losses at the hands of a 32-year-old natural gas trader named Brian Hunter.

On Wednesday, Amaranth sold its energy portfolio - which holds what remains of its disastrous trades on price differences in the natural gas market - to J.P. Morgan and Citadel Investment Group, according to two people briefed on the negotiations. The sale leaves Amaranth, once a well-regarded $9.25 billion hedge fund, with $3.5 billion to $4 billion, a person involved in the negotiations said.

But there's a lot more aggressive new money out there in the volatile sector: Nearly $60 billion was invested by energy-related hedge funds in these markets, the Energy Hedge Fund Center estimates. Commodity indexes have $85 billion in assets, up from single digits just a few years ago.

Not all of these funds, or even most of them, have made bad bets, of course, and there is no guarantee that oil or natural gas prices will not soar again.

Still, veteran traders say the commodity markets are full of Brian Hunters: traders in their late 20s or early 30s who have never traded through severe conditions like the gasoline crisis of the 1970s, or the plunge in oil prices in the 1980s. Instead, they have watched as natural gas prices, as well as those of many other commodities, rose - unevenly, but with clear annual gains - since 2001.

AntiSpin: Combine this with the following story and you have a prescription for major losses.

What's Behind The Meltdown In The Commodity Markets?

September 2006 (Global Money Trends Magazine)

"A Trend in Motion will stay in motion, until some major outside force knocks it off its course." After climbing to a 25-year high of 365.45 on May 11th, the Reuters Jefferies Commodities (CRB) Index began to show signs of fatigue in June and July, and then stumbled into a free-fall in August and September. With the CRB index slicing below its four-year upward sloping trend-line in early September, chart watchers would probably agree that a peak in the bullish cycle has been reached.

At its peak frenzy, traders figured that worldwide demand would soon outstrip the worldwide supply for key industrial commodities, such as crude oil, copper, iron ore, nickel, and zinc. Over the past five years, Chinese demand for steel has grown by around 19% a year, for aluminum and copper it rose 16%, and imports of zinc soared to a record high of 860,000 tons in 2005. China will consume 7.4 million barrels of oil a day in 2006, an increase of nearly half a million from a year earlier, representing 38% of the total growth of the world's oil demand.

Is the latest down-turn in the industrial commodities signaling the onset of a global economic recession, led by a US housing slump or a hard landing in China, and not yet reflected in the global stock markets? Or did the rout in the Reuters Commodity index simply wipe out a swath of speculative froth after a four-year climb, a classic shake-out of over-extended long positions, and presenting bargain hunters with new opportunities to make money in a longer-term secular bull market?

The major forces that have rattled the Reuters CRB index within such a short period of time, to its lowest level in a year and a half include, (1) Global central bankers are lifting interest rates in unison, and slowly draining global liquidity. (2) Beijing is tightening its grip on the yuan money supply, leading to exaggerated fears of a hard landing for China's economy. (3) Crude oil traders unwound a $15 per barrel Iranian "war premium" after Europe's big-3 signaled a split from the Bush administration's campaign for UN economic sanctions against Iran. (4) Weaker crude oil prices triggered a rout in the gold and silver markets.

Which leads us to the next story...At its peak frenzy, traders figured that worldwide demand would soon outstrip the worldwide supply for key industrial commodities, such as crude oil, copper, iron ore, nickel, and zinc. Over the past five years, Chinese demand for steel has grown by around 19% a year, for aluminum and copper it rose 16%, and imports of zinc soared to a record high of 860,000 tons in 2005. China will consume 7.4 million barrels of oil a day in 2006, an increase of nearly half a million from a year earlier, representing 38% of the total growth of the world's oil demand.

Is the latest down-turn in the industrial commodities signaling the onset of a global economic recession, led by a US housing slump or a hard landing in China, and not yet reflected in the global stock markets? Or did the rout in the Reuters Commodity index simply wipe out a swath of speculative froth after a four-year climb, a classic shake-out of over-extended long positions, and presenting bargain hunters with new opportunities to make money in a longer-term secular bull market?

The major forces that have rattled the Reuters CRB index within such a short period of time, to its lowest level in a year and a half include, (1) Global central bankers are lifting interest rates in unison, and slowly draining global liquidity. (2) Beijing is tightening its grip on the yuan money supply, leading to exaggerated fears of a hard landing for China's economy. (3) Crude oil traders unwound a $15 per barrel Iranian "war premium" after Europe's big-3 signaled a split from the Bush administration's campaign for UN economic sanctions against Iran. (4) Weaker crude oil prices triggered a rout in the gold and silver markets.

Will An Oil Price Fall Push Inflation Down?

September 21, 2006 (Mises.org)

Reading these two Fed officials, you might conclude that the Fed has absolutely nothing to do with inflation. You might think they had never heard of a theory that suggests that monetary policy has an impact on prices. Rather, they seem to suggest, inflation is something visited upon us by dramatic price movements in important commodities, which in turn are dictated by world events or sudden and inexplicable changes in demand and supply.

This peculiar mix-up of cause and effect has nothing to do with reality. It is a myth that price inflation is somehow led around by the nose by major sectors such as energy and has nothing to do with the money stock. Further, it is not the case that consumers are but passive players in this drama, accepting whatever prices they are given.

As we reported in "Energy and Money Part I: Too Little Oil or Too Much Money?" May 4, 2006:This peculiar mix-up of cause and effect has nothing to do with reality. It is a myth that price inflation is somehow led around by the nose by major sectors such as energy and has nothing to do with the money stock. Further, it is not the case that consumers are but passive players in this drama, accepting whatever prices they are given.

Inflation is not only determined by the supply of goods available relative to the supply of money to buy them, but also the demand for the currency in which goods are priced relative to the supply of that currency. It can be hard to tell which factor is primarily driving prices.

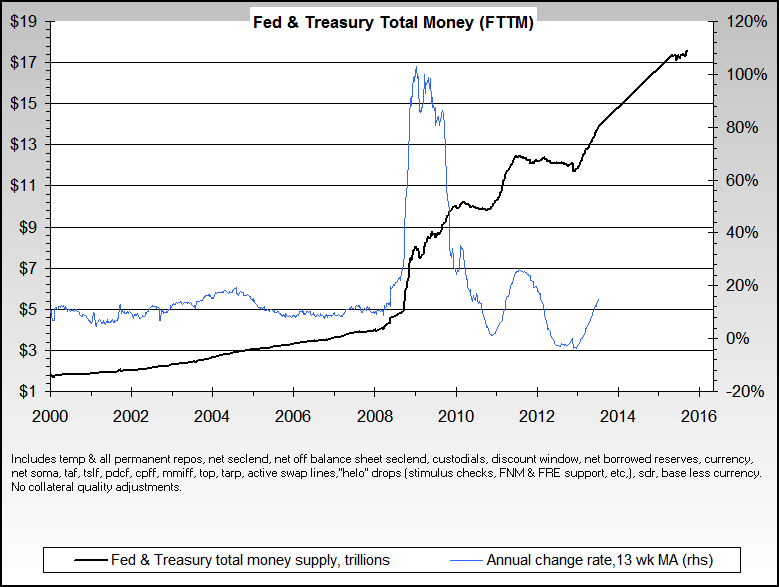

In the article we conclude that global liquidity, provided by global central banks, accounted for the bulk of the increases in commodity prices since 2004. Logically, then, as the world's central banks withdraw that liquidity, commodity prices can be expected to correct; central banks always cause the disinflationary Ka in disinflation-inflation Ka-poom cycle. Later, they reflate to end or try to prevent the recession caused by the drain.However, in the context of a housing bubble–that is global in nature but US centric–the draining of liquidity is not likely to last much longer. By the end of 2006 or the middle of 2007 at the latest, the Fed will need to respond to the US recession that disinflation is precipitating. New liquidity will be the only remaining policy tool left, as the US is already running historically high fiscal deficits and has allowed the dollar to depreciate 25% against a basket of currencies. This future liquidity injection will result in an unexpectedly high rate of inflation that we refer to as Poom.

Comment