|

Back in 2006, Rick Ackerman and I first started to debate the topic of whether deflation or inflation was coming. At the time, regular gasoline went for $2.25, a gallon of milk for three bucks and gold was trading at $650. Today, as readers know, regular gas is over $4, milk is also four bucks a gallon, and gold trades around $900. Incredibly, the argument is still going on as if regular gas had declined to $1, milk to a buck fifty a gallon, and gold to $300. Our latest exchange is here.

If we’d been arguing these last two years about floods instead of inflation it might have gone something like this.

2006 - Eric and Rick debate competing severe weather forecasts

Rick: We’re going to have a drought.

Eric: We’re going to have a flood.

Rick: What’s your definition of “flood” and of “drought”?

Eric: A flood occurs when rain falls for so long that levees break and rivers run through crop fields and towns. Drought occurs when it doesn’t rain for a long time and the rivers dry up.

Rick: Where’s the water going to come from to cause a flood?

Eric: Water vapor condenses in clouds until it precipitates out. Mostly it comes from the ocean.

Rick: That won’t happen. There isn't enough water in the ocean.

Eric: We shall see.

2008 - Eric and Rick compare the outcome of their respective forecasts from two years ago, while standing waist deep in flood water

Rick: See, still no flood. Drought's coming.

Eric: Actually, we’re standing in flood water. There's debris floating past us.

(Barking English Mastiff floats by standing on a sheet of plywood.)

Rick: I don't see anything. For the sixth or seventh time, what’s your definition of “flood”?

Eric: Same as everyone else’s. The four feet of water standing in the middle of the street where we are now? It's a flood. What’s your definition?

Rick: Floods are a rain phenomena. Where is the water vapor going to come from to create the clouds to make the rain to cause the flood?

Eric: He asked as rain poured down on him.

Mish: Floods are a rain phenomena.

Eric: Hey, Mike. Surprised to see you out here. You're wearing waders. Good thinking. You've been recommending waders to your readers for years, even though you've been calling for a drought.

Mish: If we can't agree on definitions, there is no point to this discussion. I don't have time.

Rick: I wish you’d just give me a straight answer. I'm busy.

Eric: Hey, watch out, guys. There’s an empty oil drum floating right at us.

The End

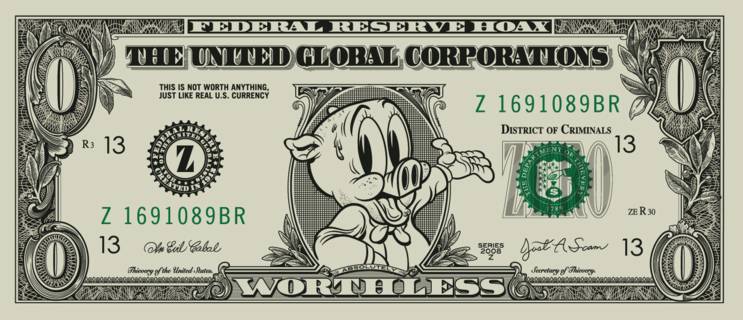

There is one thing Rick and I can agree on.

(Hat tip to iTulip member Art for the image)

iTulip's consistent record forecasting inflation 2005 - 2008:

Inflation is Dead! Long Live Inflation!

No Deflation! Disinflation then Lots of Inflation

Door Number Two: No hyperinflation but high inflation

The deflation case: caught, gutted, poached and eaten

You're not going to believe this: Inflation/deflation debate still alive?

Today's Inflation News:

Dow Chemical sets new price hikes, cuts output

NEW YORK (Reuters) - Dow Chemical Co (NYSE:DOW - News), the biggest U.S. chemicals manufacturer, said on Tuesday it will boost its prices by as much as 25 percent, institute freight surcharges and cut output of some products because of soaring energy prices.

The price hikes come after last month's across-the-board 20 percent increase by the Midland, Michigan-based company, which makes thousands of products ranging from plastic wraps to car parts and insecticides. more...

Fed in a Bind: Bears on the Rise as Stagflation Spooks Stocks Video

iTulip Select: The Investment Thesis for the Next Cycle™NEW YORK (Reuters) - Dow Chemical Co (NYSE:DOW - News), the biggest U.S. chemicals manufacturer, said on Tuesday it will boost its prices by as much as 25 percent, institute freight surcharges and cut output of some products because of soaring energy prices.

The price hikes come after last month's across-the-board 20 percent increase by the Midland, Michigan-based company, which makes thousands of products ranging from plastic wraps to car parts and insecticides. more...

Fed in a Bind: Bears on the Rise as Stagflation Spooks Stocks Video

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

L

L

Comment