Announcement

Collapse

No announcement yet.

Shadow Government Statistics: Hyperinflation could be experienced as early as 2010

Collapse

X

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

I am sure had I not been reading iTulip for over two years now, John Williams report would strike me as incredible--not to be believed at all.

That I consider Williams credible makes his report scary, very much so to me.

He definitely is in agreement with EJ there will be no deflation, but he predicts there will be hyperinflation.

Whew!!Jim 69 y/o

"...Texans...the lowest form of white man there is." Robert Duvall, as Al Sieber, in "Geronimo." (see "Location" for examples.)

Dedicated to the idea that all people deserve a chance for a healthy productive life. B&M Gates Fdn.

Good judgement comes from experience; experience comes from bad judgement. Unknown.

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

... As you see yourself I saw myself, as I see myself you'll see yourself.

Following coin to the dollar.

sigpic

sigpic

Attention: Electronics Engineer Learning Economics.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

posted this on another thread...Originally posted by Jim Nickerson View PostI am sure had I not been reading iTulip for over two years now, John Williams report would strike me as incredible--not to be believed at all.

That I consider Williams credible makes his report scary, very much so to me.

He definitely is in agreement with EJ there will be no deflation, but he predicts there will be hyperinflation.

Whew!!

there's a very comprehensive discussion about hyperinflation Door Number Two, worth a reread, and also The End of Money

also found this from my search...

and... last but not least... from 2005Warning about a dollar hyperinflation makes good theater but has little value from an investment perspective. As we've pointed out many times and most recently here in How to make $301% in six years with low volatility, dollar hyperinflation is not in the cards.

For a nation to experience a hyperinflation, all four of the following conditions need to be met:- Large and growing external debt as a percentage of GDP with falling GDP (Yes, like the US.)

- Politically and economically isolated and irrelevant (Not like the US. Think: Zimbabwe.)

- No external demand for the currency (Not like the US dollar. Think: Iraqi Dinar.)

- Political chaos (i.e., tanks rolling down the street, not like the US.)

Hardly the stuff of hyperinflation. That said, the value of a common share of USA, Inc.–the US dollar–will continue to come under pressure.

We're working up the "Ka-Poom" update. In the process of researching it we came across a new way of thinking about the issues and it's taking us extra time to digest and process this but it'll be worth the added wait, we hope.

Inflation is Dead! Long Live Inflation!

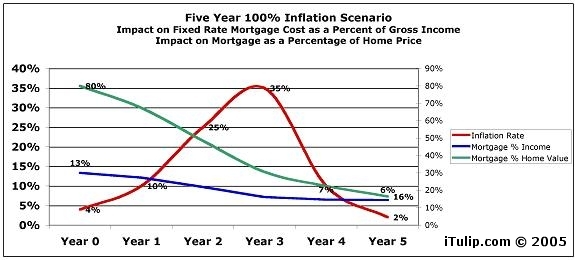

Five-Year 100% Inflation Scenario

If a Ka-Poom event happens, the inflationary part of the cycle might evolve according to the model below. The model predicts an inflation that results in a 100% increase in the general price level over five years, not far short of Price Waterhouse's definition of a hyperinflation, which is defined as 100% or more over three years. But keep in mind that the difference between a major inflation and a hyperinflation is not a matter of degree. Both result in a rapid increase in the general price level, but while a major inflation is due to a surfeit of money, a hyperinflation is due to a loss of confidence in a currency. While they are related, the key difference is that inflation is mostly a monetary event, while hyperinflation is primarily a psychological event, the process of a currency losing its function as a store of value in a society.

A major inflation can lead to a hyperinflation, but does not need to. The 100% inflation total that I use in the model is more or less arbitrary, used primarily to make the math easier. But there's no reason why in reality the inflation could not be either less or more. I have seen convincing arguments for 1000% inflation over a ten-year period, but few that anticipate an inflation of less than 50%. The Vietnam War period resulted in a 35% inflation over six years; it's hard to imagine how the additional amount of debt that needs to be monetized in our current period will not lead to inflation in excess of 35%.

We're likely to experience a major inflation in the U.S. as an outcome of the bond, housing, and dollar bubbles that came about as a result of past monetary and fiscal policy errors. In fact, a political decision process that favors inflation, as evidenced by the housing bubble, started in the mid-1990s. The U.S. may muddle through an adjustment to less reliance on foreign debt, and households may regress to the mean in terms of savings and debt, as John Mauldin suggests. That is my hope. But highly leveraged nations and households are prone to crises, and with little savings and much debt, the opportunity to muddle through a crisis is limited.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

Can condition 1 cause condition 3, then condition 2 and finally condition 4 (or in any other order)?Originally posted by metalman View PostFor a nation to experience a hyperinflation, all four of the following conditions need to be met:- Large and growing external debt as a percentage of GDP with falling GDP (Yes, like the US.)

- Politically and economically isolated and irrelevant (Not like the US. Think: Zimbabwe.)

- No external demand for the currency (Not like the US dollar. Think: Iraqi Dinar.)

- Political chaos (i.e., tanks rolling down the street, not like the US.)

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

I read John William's piece on hyperinflation. It struck me as extreme. So I returned to the Fed's site to see how the charts are doing that I asked Atlee and Hudson to check out. Here's what I found.Originally posted by atreyu42 View PostCan condition 1 cause condition 3, then condition 2 and finally condition 4 (or in any other order)?

This chart shows how much money was left in the Federal Reserve Banking System

reserve accounts in aggregate across the Federal Reserve system when member banks

drained funds from reserve accounts during previous crises versus this one.

This chart shows how much money was borrowed from Federal Reserve Banking System

reserve accounts in aggregate when member banks drained reserves from the

Fed system during previous crises versus this one.

Maybe Williams isn't so crazy after all and our modest 100% inflation over six years forecast from 2005 was wildly optimistic.

When I showed these charts previously I received nasty emails from readers who were convinced we'd made these charts ourselves. They are available at the St. Louis Fed's web site here and here.Last edited by FRED; May 10, 2008, 03:52 PM.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

Hell, EJ, it is extreme, it is the most extreme thing I have read from someone presumably credible.Originally posted by EJ View PostI read John William's piece on hyperinflation. It struck me as extreme. So I returned to the Fed's site to see how the charts are doing that I asked Atlee and Hudson to check out. Here's what I found.

This chart shows how much money was left in the Federal Reserve Banking Systems reserves accounts

after member banks drained reserves from the Fed system during previous crises versus this one.

This chart shows how much money was borrowed from Federal Reserve Banking System

reserve accounts in aggregate after member banks drained reserves from the

Fed system during previous crises versus this one.

Maybe Williams isn't so crazy after all and our modest 100% inflation over six years forecast from 2005 was wildly optimistic.

When I showed these charts previously I received nasty emails from readers who were convinced we'd made these charts ourselves. They are available at the St. Louis Fed's web site here and here.

Thank you for commenting, I appreciate it and I know everyone will too.Last edited by FRED; May 10, 2008, 12:31 PM.Jim 69 y/o

"...Texans...the lowest form of white man there is." Robert Duvall, as Al Sieber, in "Geronimo." (see "Location" for examples.)

Dedicated to the idea that all people deserve a chance for a healthy productive life. B&M Gates Fdn.

Good judgement comes from experience; experience comes from bad judgement. Unknown.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

Mr. Janszen - I would like to ask you for a clarification, to better understand the consistency with which your "terms of use" here are set up. I came across this explanation by one of your Fred's today:Originally posted by EJ View PostI read John William's piece on hyperinflation. Maybe Williams isn't so crazy after all and our modest 100% inflation over six years forecast from 2005 was wildly optimistic.

Fred is explaining here that the thread deleted yesterday (new SPAM guidelines), was deleted to ensure "bandwidth" and "traffic" are not retasked to directing traffic away from iTulip to "competitor" websites? It seems to me the epitome of pointlessnes for anyone to spend time proselytizing "someone or other is better than iTulip", on the presumption they are standing their like a traffic cop, to "redirect traffic" to a "competitors websites". Most people just go where they choose to read stuff regardless of what anyone is claiming. I'd appreciate it therefore if your Fred does not claim these "spam controls" are due to my "shilling" for another analyst, as that is in fact some real nonsense. "Disappearing" an entire thread, and justifying this kind of wholesale editorial "pruning" is to abate "abusive and blatant plugs for competitor's websites" is plain BS. I understand that there are some here that do subscribe to this kind of "shill" paranoia - maybe they really do see a shill hiding under every bed, but what the heck is iTulip saying of any seriousness in subscribing to that?Originally posted by FRED View PostThe "censorship" is called "moderation" ... If someone wants to spend bandwidth ... to make the case that some other site or other is better than iTulip they can go use that site ... not ours. ... As for criticizing iTulip or the Freds or EJ or anyone else, knock yourself out.

"Make the case that some other website is better than iTulip" is an egregious embellishment. What it does, is serve to obfuscate the point that perfectly simple questions were put forward instead. Can iTulip explain how they distinguish "serious" analysts from "unserious" ones, when many of the viewpoints are so close as to be indistinguishable? And if you delete entire threads, because they are supposedly "spamming by driving traffic to other sites", how should I interpret that as a clear policy when the CEO is directly linking and endorsing other analysts a day later who say things extraordinarily similar to the "shilled" analyst post that got "dissapeared"? Does this mean I am being told only the analysts that iTulip links to are "vetted"? Or do I wait until analysts are pointed out to me that I can then link to without triggering SPAM "infractions"? How the heck does anyone have a clue what SPAM is (Peter Schiff is SPAM now) while iTulip actively links and endorses John Williams? Is any part of this new "SPAM" guideline not frankly designed to be employed arbitrarily? I can understand a website which states "persisistently questioning any assertions made by the CEO is not permitted". That is nicely straightforward. I see that in practice here (disappeared threads, when unanswered questions get too persistent) but in fact I am being told the opposite, at least nominally:

"As for criticizing iTulip or the Freds or EJ or anyone else, knock yourself out."

I'm stumped. If we are encouraged to "knock ourselves out criticizing", let alone merely making repeated requests for a clarification as to what constitutes SPAM, why "dissappear" threads when someone asks what the difference is between John Williams, promoting "hyperinflation in the three digits", and the SPAM-LIKE Dr. XXXXXX promoting "inflationary collapse" which is greeted by editorial cat-calls??

Looks like your new SPAM guideline results in the wholesale wiping of threads which ask simple questions, like "how do you guys set objective evaluations of what is serious vs. SPAM analysis". So I'm wondering whether your new editorial guidance style means some editor here will be deciding for me on a regular basis which linked references will be considered valid or which will get another "shill" designation and the summary trash can. No less baffling to me is saying "everybody else blocks external references on their websites, so we are going to also, to control content better, and so that we won't lose readers". You have logged 8++ million readers and you are worried about losing some if you don't implement a SPAM policy with ambiguous guidelines? What if you lose a few readers precisely because you do implement such a policy? Who defines this "new-SPAM", and does that imply everyone "learning" to distinguish SPAM acceptably to iTulip? Does that mean iTulip brings us all "up to speed" on which thinkers out there are really specious doomers (maybe they are mixing up petroleum inputs into inflation with inflation inputs into petroleum and so misinforming everyone), or do we get to figure that part out for ourselves? What's the "attrition rate" for poor dumb schmucks who take a look at that kind of arrangement and conclude they would rather keep figuring valid authors and valid links out for themselves than have iTulip figure that out for them?

__________

NEW POST ON SAT MAY 10.

Sorry Ann - you have the heavy weight mitts on and I am newly dressed up with stylish barbells at the ankles here, by the sleek new "editorial oversight" CONTENT-BOT. I'm trying to respond to you here, but the only response the "automated software" deems appropriate for me seems "no response". Maybe the "parse Lukester syntax" filter, has been set to APPROPPRIATE = "0"? Have at it, the blackboard is all yours! =:-)

OK I'M sneaking this reply in here. My prior attempt to post is edited down to CONTENT = 0. (desaparecido). ... Itulip editors can resort to deleting this entire thread if they wish to start getting really heavyhanded. It would be a stretch to characterize this post containing any "inflammatory and specious claims" though. Apparently the following invitation is "subject to editorial whim" - "As for criticizing iTulip or the Freds or EJ or anyone else, knock yourself out."

(sigh).

Ann - iTulip, and apparently you, are so obsessed with the trauma of surviving "idea theft" that you failed to note the entire discussion that got sparked on the thread your term my "long screed" was because Janszen referred to Leeb as a "doomertainer" right off the bat, while evidently having read little or nothing of the man's writing. If someone called iTulip a bunch of entertainers in a very public venue they would probably be slightly pissed off at the flippancy of the remark if it became clear this commenter had never read anything of Janszen's, no?Originally posted by Ann View PostI think you just pissed them off with a bunch of screeds along the lines that iTulip is following the lead of others. ... It's disrespectful.

Janszen is very busy and I fully understand the potential for small oversights in attribution of other analysts positions, merit on an issue, etc. The more interesting thing is how one reacts when someone suggests a reexamination of the facts. Last time iTulip indulged this kind of erroneous dismissal of an analysts thesis was of Jim Puplava, calling him a "deflationista" and lumping him together with the likes of Mish, et. al. Anyone who has spent ten minutes reading Puplava knows he's an inflationist. It is of course a tiny issue, but you understand the point about editorial discretion I'm talking about here? You don't dismiss another analyst as an "entertainer" unless you are willing to substantiate it, period.

I offered up, repeatedly, a defense of Leeb, and iTulip editors take a moment to mull it over and come back with a "Yup, we just checked and Leeb is indeed a doomertainer folks", (and you can take that to the bank)!

You are posting a stern reprimand claiming I was engaging in a lengthy attempt to "prove that Leeb said this that or the other before iTulip"?. Ann, that's simply not factual. I have zero interest in who said what first. iTulip may be obsessed with idea theft, and I certainly endorse their right to be so, but I personally don't care at all who said what first, when, how, why, etceteras. What I DO care about is that if you issue a derisive remark one day on the ridIculousness of inflationary collapse, you take scrupulous care the next day when you suddenly rehabilitate that thesis to offer a sporting minor retraction to the author you derided for it the day before.

I seem to have you wagging a finger at me now for having the temerity to suggest with the wisdom of 24 hours hindsight, that deriding this author's ideas about inflationary collapse was indeed wrong. Look around - the very next day the CEO here is acknowledging the idea may be right, as it's now tabled by another analyst with a Masters in Economics, and meanwhile editors here have "explained" to readers that an entire erased thread was instead all about egregious "shilling for another analyst's website". This is a potentially a mischeiveous mis-representation. I have no interest in plugging one or the other, unlike a few people here so wrapped up in demonstrating their joined at the hip loyalty to iTulip (yes Ann, I think it's a great community also but with a little more independence), get to sounding like Marching Oompah Bands on occasion in their enthusiasm for plugging "iTulip Uber Alles".

I wish to note this much only: when you choose to deride someone for their "inflationary collapse" thesis, it's very good, and gracious form to offer just a tiny murmur of acknowledgement in rehabilitation of that analyst when circumstances have you formally endorsing the very idea you dismissed, the next day!

"Yup, we just checked and Leeb is indeed a doomertainer folks"!

You are scolding me for having the impropriety to call that to this website's attention? Inflationary collapse is BACK and iTulip is NOW GETTING BEHIND THE CONCEPT. Screw that idiot we just trashed for promoting THIS SAME LOOPY IDEA yesterday!

Now you observe "I think you just pissed them off". Yes Ann - that much is eminently clear, even to this poster. The question is whether your summary recollection of what I was posting is correct. My posts in what you and your editors here refer to now officially as an "egregiously offending thread" boiled down to simple questions to Eric Janszen - why one author talking "collapse" is reiterated (repeatedly and after a lightning deliberation) TO BE A KOOK, A FRUITCAKE DOOMER, while the next day another author talking the SAME HYPERINFLATIONARY COLLAPSE is directly endorsed. Thank you for your input. I must respectfully disagree with your summary.

If you are viewing this disagreement from the vantagepoint of a conclusion that iTulip can make no misstatements - ever - this is manifestly improbable in the real world we actually live in rather than some world of editorial perfection. And the awkward fact is, that throwing out breezy dismissals about other financial analysts with two Masters, a Doctorate, and an excellent near 30 year track record can occasionally be "hazardous", (even on your own website to an admittedly "safe" audience who won't openly challenge any of your assertions). Someone may actually ask you to substantiate your remark. Maybe "who predicted what first" is critical for some professional rankings of which I am wholly ignorant. I respect anyone's interest to preserve their rankings, but that is absolutely not my interest here. You omit any mention that Janszen turned right around the following day and directly endorsed precisely what he was deriding Leeb for yesterday. Meawhile iTulip editors apparently had checked scrupulously, and they insist that "yup, we just checked folks, and Leeb is a doomertainer" iTulip is just being stingy with the most fleeting acknowledgment that this analyst was not talking through his hat referring to inflationary collapse being on the table.

I suggest to you a truly audacious idea - No-one is being "disloyal" to iTulip in pointing out the above.

Is there any remote chance you may be mistaking loyalty to iTulip here with being editorially scrupulous enough to acknowledge what I'm pointing out to you perhaps? Please, before you get indignant about my questioning the objectivity of your editorial recall here stop, take a deep breath, and think through what I'm pointing out: One day there's no inflationary doom and collapse, and it's proponents are ENTERTAINER KOOKS, the next day hyperinflationary doom and collapse are SERIOUS BUSINESS, and are now officially OK, endorsed for serious debate - yet there is zero acknowledgment that an entire thread was erased the day before whose entire content revolved around the exact same "specious idea" that is now being prominently endorsed from John Williams? How do we spell 'cognitive editorial dissonance"?Last edited by Contemptuous; May 10, 2008, 10:47 PM.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

EJ, what struck me most about William's report was not just the incredible rate of inflation but that he also states that the FED hasn't even got started monetizing the debt. Given that is the case, will you be revising your expected probabilities that the US manages to reflate through another bubble?

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

.Last edited by Nervous Drake; January 19, 2015, 02:28 PM.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

there is a case williams did not consider: that at some point the fed RAISES rates to support the dollar. the argument would be that by the time of williams' hypothesized monetization, long bonds would have sold off and thus long rates would be quite high. if at that juncture the fed raises rates, the dollar would be supported and - hypothetically- long rates might come down some, flattening the curve a bit and, overall, reducing the treasury's cost of borrowing. perhaps, in order to facilitate this, the fed will buy long bonds in order to inject money, instead of buying tbills. we know that bernanke discussed this very possibility in his "keeping 'it' from happening here" paper.

so, to recap, imagine the fed raising short rates while buying long bonds. this might cause the unwinding of the dollar carry trade which is appearing now, and thus support the dollar even more strongly.

the concern, of course, is that higher short rates would hurt the economy, but in this scenario, i think it would be a preferable policy.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

You are not asking me but if I might, I have an observation. I read plenty of self-criticism here and do not get the sense that criticism is discouraged. In fact, my sense is that it is truly encouraged. Frankly, I think you just pissed them off with a bunch of screeds along the lines that iTulip is following the lead of others. You seem to be on a mission to prove it. Why? It's disrespectful. Where's your good sense, man? Even if it was true, and I can tell you from reading EJ's stuff for many years it is not, why dwell?Originally posted by Lukester View PostMr. Janszen - I would like to ask you for a clarification, to better understand the consistency with which your "terms of use" here are set up. I came across this explanation by one of your Fred's today:

Fred is explaining here that the thread deleted yesterday (new SPAM guidelines), was deleted to ensure "bandwidth" and "traffic" are not retasked to directing traffic away from iTulip to "competitor" websites? It seems to me the epitome of pointlessnes for anyone to spend time proselytizing "someone or other is better than iTulip", on the presumption they are standing their like a traffic cop, to "redirect traffic" to a "competitors websites". Most people just go where they choose to read stuff regardless of what anyone is claiming. I'd appreciate it therefore if your Fred does not claim these "spam controls" are due to my "shilling" for another analyst, as that is in fact some real nonsense. "Disappearing" an entire thread, and justifying this kind of wholesale editorial "pruning" is to abate "abusive and blatant plugs for competitor's websites" is plain BS. I understand that there are some here that do subscribe to this kind of "shill" paranoia - maybe they really do see a shill hiding under every bed, but what the heck is iTulip saying of any seriousness in subscribing to that?

"Make the case that some other website is better than iTulip" is an egregious embellishment. What it does, is serve to obfuscate the point that perfectly simple questions were put forward instead. Can iTulip explain how they distinguish "serious" analysts from "unserious" ones, when many of the viewpoints are so close as to be indistinguishable? And if you delete entire threads, because they are supposedly "spamming by driving traffic to other sites", how should I interpret that as a clear policy when the CEO is directly linking and endorsing other analysts a day later who say things extraordinarily similar to the "shilled" analyst post that got "dissapeared"? Does this mean I am being told only the analysts that iTulip links to are "vetted"? Or do I wait until analysts are pointed out to me that I can then link to without triggering SPAM "infractions"? How the heck does anyone have a clue what SPAM is (Peter Schiff is SPAM now) while iTulip actively links and endorses John Williams? Is any part of this new "SPAM" guideline not frankly designed to be employed arbitrarily? I can understand a website which states "persisistently questioning any assertions made by the CEO is not permitted". That is nicely straightforward. I see that in practice here (disappeared threads, when unanswered questions get too persistent) but in fact I am being told the opposite, at least nominally:

"As for criticizing iTulip or the Freds or EJ or anyone else, knock yourself out."

I'm stumped. If we are encouraged to "knock ourselves out criticizing", let alone merely making repeated requests for a clarification as to what constitutes SPAM, why "dissappear" threads when someone asks what the difference is between John Williams, promoting "hyperinflation in the three digits", and the SPAM-LIKE Dr. XXXXXX promoting "inflationary collapse" which is greeted by editorial cat-calls??

Looks like your new SPAM guideline results in the wholesale wiping of threads which ask simple questions, like "how do you guys set objective evaluations of what is serious vs. SPAM analysis". So I'm wondering whether your new editorial guidance style means some editor here will be deciding for me on a regular basis which linked references will be considered valid or which will get another "shill" designation and the summary trash can. No less baffling to me is saying "everybody else blocks external references on their websites, so we are going to also, to control content better, and so that we won't lose readers". You have logged 8++ million readers and you are worried about losing some if you don't implement a SPAM policy with ambiguous guidelines? What if you lose a few readers precisely because you do implement such a policy? Who defines this "new-SPAM", and does that imply everyone "learning" to distinguish SPAM acceptably to iTulip? Does that mean iTulip brings us all "up to speed" on which thinkers out there are really specious doomers (maybe they are mixing up petroleum inputs into inflation with inflation inputs into petroleum and so misinforming everyone), or do we get to figure that part out for ourselves? What's the "attrition rate" for poor dumb schmucks who take a look at that kind of arrangement and conclude they would rather keep figuring valid authors and valid links out for themselves than have iTulip figure that out for them?

Look, I'm in the publishing business and I can tell you that copying ideas, though not words because if you get caught it's curtains for you as a writer, is common and usually not done on purpose. Let's say writer A invents an idea like EJ's Economic MAD to describe China and the USA. Let's call EJ "Writer A." Ok, along comes writer B who takes elements of Writer A's idea and tweaks it then publishes it as his own. Different words but similar concept. Later Writer C comes along and does a similar thing with Writer B's idea. At the time Writer C is tweaking Writer B's idea he doesn't even know that Writer A, who came up with the original idea, even exists. One day Writer C comes across Writer A and says, "Hey!? What the hell??!! This guy is copying my idea!" Is Writer C motivated to go dig back through the past and go on a research program to follow the thread of ideas back to the original? No, sir. Writer C in his own mind thinks Writer A, the original, is copying him! How's that for irony? Happens ALL THE TIME!

Your "mission" to "figure out" who is first or not is a waste of time unless you are willing to go to an incredible amount of trouble. With my example, it is easy. Google "economic m.a.d." and iTulip lists first with this article from Apr. 2006. That's not proof of anything per se but it's a start. A couple links down and you find this from Oct. 2007. "Is the ongoing game Mutually Assured Destruction (MAD) or is it Chicken? I suggest economic MAD is more like the game being played. All of the world's the central banks are involved as players." Note the use of the first person. The author is certain he made that up himself. More likely he read the iTulip piece over a year before but forgot that. Or maybe he read Writer B who read iTulip as Writer A. Now I'm sure there are cases where EJ is Writer C, read some Writer A, then "thought up" an idea that he read 10 years ago but forgot where. And so it goes.

No one is 100% original. That is not possible. Everything is derivative, and there is nothing new under the sun. The only way to see who is generally original versus generally copying other people's ideas is to look at the volume and quality of work the writer has done over a long period of time. Watch the ideas develop. There has got to be a LOT of work available to see the writer working out the problem. Someone else made a comment along these lines recently, but I can't remember who

Final thought. Since you've obviously pissed them off, why not keep quiet for a while and more on to something else?

BTW, I'd have more confidence in Leeb if he had an archive.org record going back many years. Too easy to re-write your history on the web otherwise.Last edited by Ann; May 10, 2008, 11:55 AM.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

Perhaps the 4 criteria for hyperinflation mentioned above are not sufficient? It seems like one can pretty easily imagine a scenario in which we hyperinflate even if we only meet one of the four criteria.

Here's one. For political/vote buying purposes, dealing with a populace they know to be completely economically ignorant, the federal government plays "daddy" and just buys any and all debt, however worthless (mortgage, credit card, etc), to prop up the system, creating massive amounts of dollars to do it. This encourages lenders to continue lending too much with dubious lending standards, since they have the failsafe option of just selling the bad debt off to the government. (an obvious moral hazard)

Meanwhile, during the downturn, they also promise any and everyone whatever they need in terms of healthcare, food, and even housing subsidies. The demand for these will skyrocket with bad times. Nobody will be denied. This further increases the deficit, which further increases the money creation to pay the bills.

This cycle will simply increase in severity, and tada.....hyperinflation.

Perhaps criteria #4 and #3 are actually going to be met after all. Switching from capitalism to socialism within a few years is pretty chaotic. And if the dollar is falling rapidly in value there really won't be much demand for it internationally pretty soon.

It seems all of this can be 'turned off' at any time, but only at the cost of a severe recession and some suffering. I'm not sure we have the wisdom to suffer a little now rather than suffer a lot later. It's not in the American character these days.

Comment

-

Re: Shadow Government Statistics: Hyperinflation could be experienced as early as 201

It'd be the thing to do. But since when in the last 20 years or so have they done the 'right thing' vs the politically expedient in the short term thing?Originally posted by jk View Postthere is a case williams did not consider: that at some point the fed RAISES rates to support the dollar. the argument would be that by the time of williams' hypothesized monetization, long bonds would have sold off and thus long rates would be quite high. if at that juncture the fed raises rates, the dollar would be supported and - hypothetically- long rates might come down some, flattening the curve a bit and, overall, reducing the treasury's cost of borrowing. perhaps, in order to facilitate this, the fed will buy long bonds in order to inject money, instead of buying tbills. we know that bernanke discussed this very possibility in his "keeping 'it' from happening here" paper.

so, to recap, imagine the fed raising short rates while buying long bonds. this might cause the unwinding of the dollar carry trade which is appearing now, and thus support the dollar even more strongly.

the concern, of course, is that higher short rates would hurt the economy, but in this scenario, i think it would be a preferable policy.

Think about all the debt affected by raising short term rates. That 5% HELOC today isn't getting paid on time. What happens when there's even more interest? And then there's the national debt to be serviced. We're getting people to buy bonds at below-inflation rates now. What happens when that stops?

Comment

Comment