|

The Treasury paid soldiers during the inflationary period of the American Revolutionary War with bonds indexed to a basket of commodities. Can the method be applied to tax rebate checks?

The business media are getting better at covering the silly political response to the collapse of the housing and mortgage bubbles. This story from Forbes is one of the better treatments of the subject.

Eight luxurious ways to spend your rebate

April 11, 2008 (Forbes.com)

"It was a harebrained scheme," says Pam Danziger about the economic stimulus legislation. The president of Unity Marketing, a marketing consulting firm based in Stevens, Pa., she believes Americans will not hit the shopping malls, as the government intends. Instead, she says, they will pay off debt.

Danziger's view is confirmed by a February Associated Press-Ipsos telephone poll of 1,006 randomly selected adults. Only 19% of those surveyed said they planned to spend their economic stimulus rebate checks. Forty-five percent said they would pay off bills, while 32% said they planned to invest the money. Four percent said they would donate their money to charity. more...

AntiSpin: Not bad but they are still missing the story. We call it the Inflation Abatement Check because it might just about cover a year’s inflation costs for the average recipient. For example, the DOE and DOT say an American auto is driven about 12,000 miles a year and gets an average of 24 MPG. The average price of a gallon of regular gas a year ago was $2.27 versus $3.11 today. The average car owner will spend about $375 more this year than last year just on gasoline, or 63% of that $600 “rebate” check. Sum the higher costs of energy, food, utilities, insurance, and tuition and that $600 check is already spent by inflation. Sad that so many recipients think they are going to be able to save it. April 11, 2008 (Forbes.com)

"It was a harebrained scheme," says Pam Danziger about the economic stimulus legislation. The president of Unity Marketing, a marketing consulting firm based in Stevens, Pa., she believes Americans will not hit the shopping malls, as the government intends. Instead, she says, they will pay off debt.

Danziger's view is confirmed by a February Associated Press-Ipsos telephone poll of 1,006 randomly selected adults. Only 19% of those surveyed said they planned to spend their economic stimulus rebate checks. Forty-five percent said they would pay off bills, while 32% said they planned to invest the money. Four percent said they would donate their money to charity. more...

But maybe there's a better way. The picture above is of the world's first known inflation-indexed bond. They were issued by the Commonwealth of Massachusetts in 1780 during the Revolutionary War. Robert Shiller made the discovery in his research in 2003: "These bonds were invented to deal with severe wartime inflation and with angry discontent among soldiers in the U.S. Army with the decline in purchasing power of their pay."

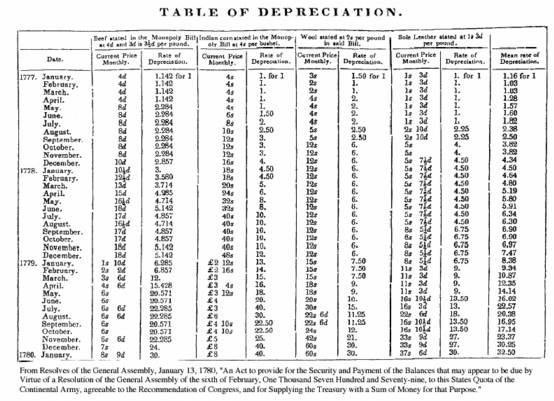

The bonds were indexed to the prices of a basket of commodities: beef, corn, wool, and sole leather. The table below shows how depreciation was calculated for each item.

Click to enlarge

Shiller goes on: "Although the bonds were successful, the concept of indexed bonds was abandoned after the immediate extreme inflationary environment passed, and largely forgotten until the twentieth century. In 1780, the bonds were viewed as at best only an irregular expedient, since there was no formulated economic theory to justify indexation."

Our next story tell us it's time to bring the concept back. Let's demand that the Treasury send out tax rebate checks indexed to a basket of commodities once again, but brought up to date indexing to gasoline, heat, housing, college tuition, and health insurance instead of beef, corn, wool, and leather.

Our next story tell us it's time to bring the concept back. Let's demand that the Treasury send out tax rebate checks indexed to a basket of commodities once again, but brought up to date indexing to gasoline, heat, housing, college tuition, and health insurance instead of beef, corn, wool, and leather.

|

Speaking of inflation, in line with our December 2005 forecast that the Fed was eventually going to have to inflate US households out of debt, today we are treated to the following oped article in the Wall Street Journal by John Makin of the American Enterprise Institute.

The Inflation Solution to the Housing Mess

April 14, 2008 (JOHN H. MAKIN - WSJ)

The policy alternatives in the post-housing-bubble world are painfully unpleasant. In my view, the least bad option is for the Federal Reserve to print money to help stabilize housing prices and financial markets. Yes, use reflation to soften the pain for Main Street and Wall Street. If instead we let housing prices fall another 25%-30% – as predicted by the Case-Shiller Home Price Index – it's almost certain that Washington will end up nationalizing the mortgage business. More...

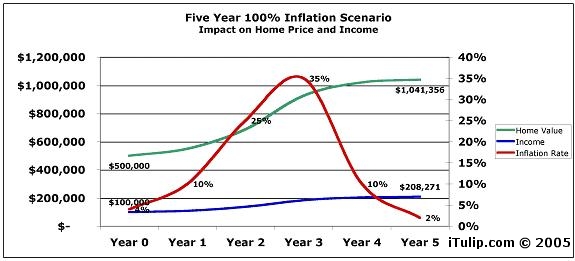

AntiSpin: Three years ago in Inflation is Dead! Long Live Inflation! The Five Year, 100% Inflation Scenario we said:April 14, 2008 (JOHN H. MAKIN - WSJ)

The policy alternatives in the post-housing-bubble world are painfully unpleasant. In my view, the least bad option is for the Federal Reserve to print money to help stabilize housing prices and financial markets. Yes, use reflation to soften the pain for Main Street and Wall Street. If instead we let housing prices fall another 25%-30% – as predicted by the Case-Shiller Home Price Index – it's almost certain that Washington will end up nationalizing the mortgage business. More...

In this model both nominal income and home value double. In reality, since so much inflation has already happened in real estate and high interest rates will increase the real cost of borrowing, home prices are likely to rise more slowly, flatten out, or even decline.

We're likely to experience a major inflation in the U.S. as an outcome of the bond, housing, and dollar bubbles that came about as a result of past monetary and fiscal policy errors. In fact, a political decision process that favors inflation, as evidenced by the housing bubble, started in the mid-1990s. The U.S. may muddle through an adjustment to less reliance on foreign debt, and households may regress to the mean in terms of savings and debt, as John Mauldin suggests. That is my hope. But highly leveraged nations and households are prone to crises, and with little savings and much debt, the opportunity to muddle through a crisis is limited.

What to do to protect ourselves from the inevitable? In 2001 we recommended gold. Today the financial services industry is stepping in with novel solutions of its own. Perfectly timed to coincide with the WSJ oped piece today we received the following from EDHEC-Risk Asset Management Research in the mail.We're likely to experience a major inflation in the U.S. as an outcome of the bond, housing, and dollar bubbles that came about as a result of past monetary and fiscal policy errors. In fact, a political decision process that favors inflation, as evidenced by the housing bubble, started in the mid-1990s. The U.S. may muddle through an adjustment to less reliance on foreign debt, and households may regress to the mean in terms of savings and debt, as John Mauldin suggests. That is my hope. But highly leveraged nations and households are prone to crises, and with little savings and much debt, the opportunity to muddle through a crisis is limited.

The "Novel Approaches to Inflation Hedging" seminar, which will take place at the EDHEC Institutional Days in Paris on June 12 and 13, 2008 will respond to some key questions for institutional investment management:

» How to cope with inflation? The new inflation hedging strategies.

» Can real assets constitute a genuine inflation-hedging portfolio?

» How can one hedge against wage inflation?

» Is it possible to reconcile inflation hedging with profitability in institutional investment?

Devraj Basu, senior research engineer, and Samuel Sender, research associate with the EDHEC Risk and Asset Management Research Centre, will present the state of the art of research in this area.

EDHEC Institutional Days 2008 will comprise an unprecedented number of events allowing professionals to review major industry challenges, explore state-of-the-art investment techniques, and benchmark practices against research advances.

ETF Summit: Surveying the New ETF Landscape

» EDHEC European ETF Survey 2008

» Achieving Absolute Returns with ETFs

» New Forms of Indices and Benchmarks

Institutional Investment Management Seminars

» Commodities Investment

» Novel Approaches to Inflation Hedging

EuroPerformance-EDHEC Alpha League Table Forum

» What are the investment processes implemented by leading asset managers?

» What are their sources of outperformance?

Important information for us to gather, and Paris is lovely in June, but with the dollar at $1.58 prices for hotel rooms, airfare, and meals are, well, too inflated. We'll wait for a stateside event. » How to cope with inflation? The new inflation hedging strategies.

» Can real assets constitute a genuine inflation-hedging portfolio?

» How can one hedge against wage inflation?

» Is it possible to reconcile inflation hedging with profitability in institutional investment?

Devraj Basu, senior research engineer, and Samuel Sender, research associate with the EDHEC Risk and Asset Management Research Centre, will present the state of the art of research in this area.

EDHEC Institutional Days 2008 will comprise an unprecedented number of events allowing professionals to review major industry challenges, explore state-of-the-art investment techniques, and benchmark practices against research advances.

ETF Summit: Surveying the New ETF Landscape

» EDHEC European ETF Survey 2008

» Achieving Absolute Returns with ETFs

» New Forms of Indices and Benchmarks

Institutional Investment Management Seminars

» Commodities Investment

» Novel Approaches to Inflation Hedging

EuroPerformance-EDHEC Alpha League Table Forum

» What are the investment processes implemented by leading asset managers?

» What are their sources of outperformance?

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment