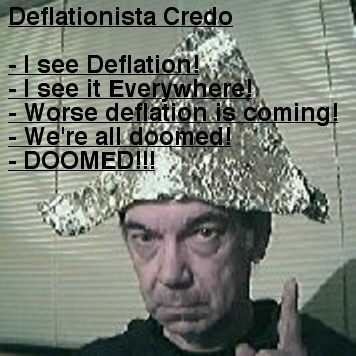

Re: Boom in the Doom

On a contrarian basis, deflation might be in the picture. You know like lemmings and the madness of crowds behaviors.

I'm not smart enough to argue there is deflation laying ahead. I tend to find little fault, in any, with EJ's thinking, but when everyone is on the same side of an argument, it truly makes me want to run away from the crowd.

Originally posted by FRED

View Post

I'm not smart enough to argue there is deflation laying ahead. I tend to find little fault, in any, with EJ's thinking, but when everyone is on the same side of an argument, it truly makes me want to run away from the crowd.

Comment