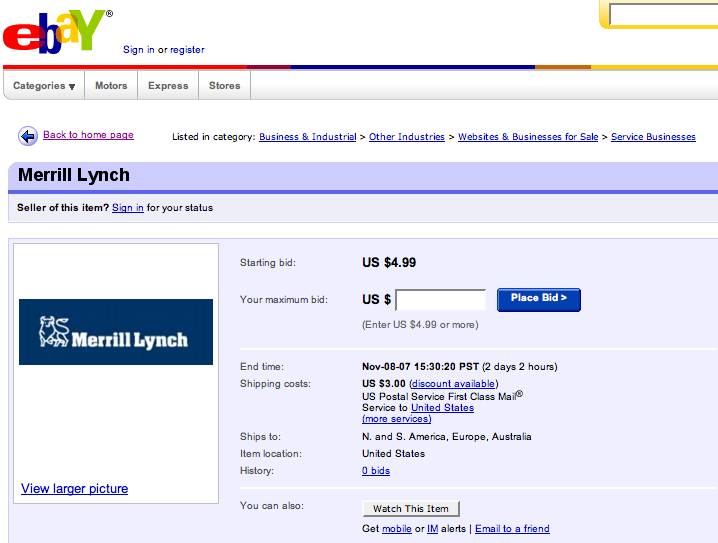

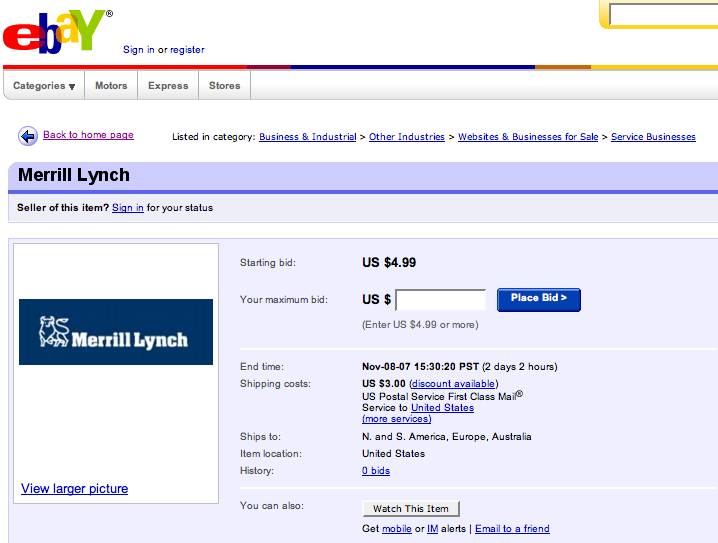

Want to buy one of the world's leading financial management and advisory companies, providing financial advice and investment banking services? Yours for only five bucks. Better hurry. Auction ends day after tomorrow.

AntiSpin: Of course, Merrill is not really for sale on eBay. The image is the handiwork of Kate, our intrepid manipulator of graphic bits. But Merrill is certainly for sale in the business press. You'd think from all the dire prognostications that Merrill was the worst off of all the investment banks caught holding the live structured credit hand grenades when they went off. But you'd be wrong.

iTuliper gone indy Aaron Krowne of Mortgage Lender Implode fame weighs in with the this nugget:

Maybe one of our members has an answer.

AntiSpin: Of course, Merrill is not really for sale on eBay. The image is the handiwork of Kate, our intrepid manipulator of graphic bits. But Merrill is certainly for sale in the business press. You'd think from all the dire prognostications that Merrill was the worst off of all the investment banks caught holding the live structured credit hand grenades when they went off. But you'd be wrong.

iTuliper gone indy Aaron Krowne of Mortgage Lender Implode fame weighs in with the this nugget:

"Wall Street banks, looking at how much each has in the way of level 3 (i.e., mark to model) assets, compared to total equity."

"If Goldman Sachs and Morgan Stanley are in the 1st and 2nd place level 3 grenade-wise among the investment banks, why is the business media focusing all of their attention on Merrill Lynch, which appears to have by far the least exposure?"

Good question, Aaron.Maybe one of our members has an answer.

Comment