Janszen Scenario Update Two – Part III: Practice Run

Full size image (not retouched)

Every man, wherever he goes, is encompassed by a cloud of comforting convictions,

which move with him like flies on a summer day.

- Bertrand Russell (1872 - 1970), Sceptical Essays (1928), "Dreams and Facts"

• Macro fatigue

• Bull market in gold misinformation

• Scared into Bonds

Editor's Note: At the suggestion of several iTulip subscribers we have renamed Ka-Poom Theory the Janszen Scenario. We will use both terms for the next several articles before switching over to Janszen Scenario.

Macro Fatigue

CI: The main memes in the financial media since we last talked are synchronized global slowdown, falling stock markets, gold bear market then not, euro breakup, China weakness and stimulus, and QE3 anticipation. And "fiscal cliff."

EJ: Anything to fill the time between the last shoe to drop and the next, I suppose. The anticipation is driving everyone nutty. A friend told me the other day he’s suffering from “macro fatigue.” I don’t think he’s alone.

CI: Eye of the storm? How much longer until the next big crisis?

EJ: Eye of the storm is one way to put it, but it’s already been a very big eye. The leading wall of the hurricane receded and the trailing wall has approached for three years now. A wall of sorts in Europe isn’t hard to make out but it’s part of the escalation process that’s been going on for years and may go on for years more. Hard to tell if it concludes in a 2008 level liquidity crisis as the world's central banks expect in three weeks or three months or another three years. According to the doom-of-the-day financial sites, Europe was supposed to blow up any day now for the last year. One of our members started a Europe Crisis thread in December 2009. With 65,000 views and 1,100 replies including members based in Europe, the thread chronicles the long evolution of the European crisis in detail. If we’ve learned anything by running this site since 1998 it’s that even the most clearly foreseeable disaster in the making takes longer to arrive than the cruelest imagination can conceive. It’s hard to get excited about it when you know how long the process is going to take.

CI: The way the Wall Street Journal reports on Greece and Spain you’d think Europe will go down the tubes after the Greek elections Sunday. You said yourself in 2007 Europe will go down the tubes if the economic crisis reaches there from the US and spans the EU election cycle. Well, here it is. So why don’t you think this is it for Europe?

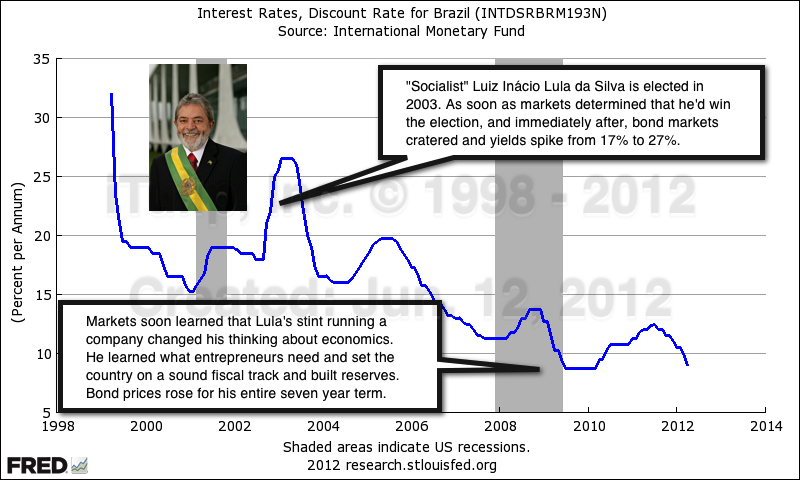

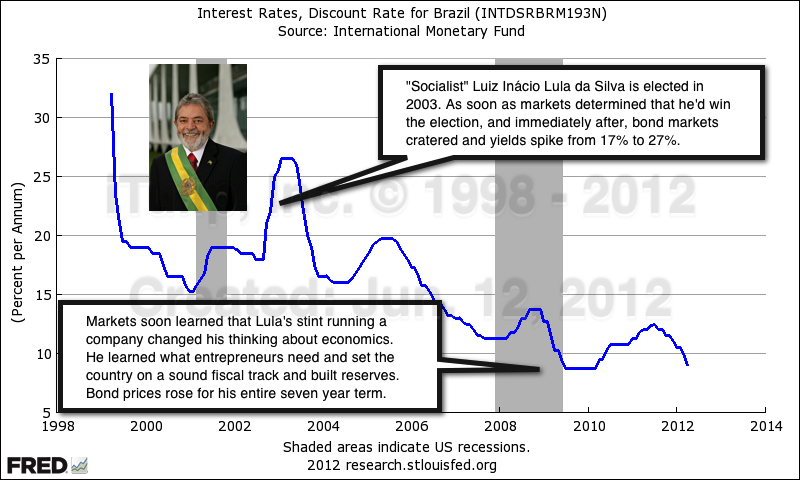

EJ: Because an object in motion tends to remain in motion. Even if the Greeks vote in a new radical or the old soft a squishy leftist party that doesn’t mean that Greece drops austerity and bolts the euro. As with business, so with elections. Never confuse sales with installation. Campaign promises are not post-election policy. Remember Brazil. Before the socialists arrived, conservatives delivered a socialist disaster. After socialists were elected they delivered a conservative nirvana.

Open your mind.

Elected on a socialist platform, Lula embraces fiscal policies that make the US look far more socialist.

The drama in Greece is similar.

In any case, you’re an iTulip reader. You’re not in the stock market. You’re in Treasury bonds and gold. You can sleep through all of this. Relax. It’s summer. Enjoy yourself. Life is short. This is a time to stop and smell the roses. Soon enough the whole world will appear to be collapsing all at once, the result of the reverberation of shock waves from the American Financial Crisis. What's the hurry?

CI: All at once?

EJ: The Middle East is entering an ugly new phase. The second revolution in Egypt won’t be as benign as the first. When it’s all over there will be two countries where now there is one.

CI: Syria?

EJ: The west will not be able to resist the temptation to get into it with Syria, with Russia and China on the other side, setting the stage for sectarian proxy wars across the Middle East that drags the Saudis in. The WTI versus Brent crude spread that opened in 2011 will get even wider as the Middle East security premium hits Europe harder than the US. It's as reliable an indicator of Middle East crisis escalation as the spread between Germany's and Italy's government bond yields is an indicator of euro escalation.

CI: Europe?

EJ: There are many more chapters to go for Europe and the euro, including assistance from the US, before that idealist experiment ends. Europe’s eventual final existential crisis after several more near death experiences in a few years will also be the end of Japan’s 20-year experiment in using Keynesian theory to grow government debt from 63% of GDP to 245%, to move credit bubble era debts from private to public account. Flight out of Japanese bonds and yen will get the Japanese government default ball rolling there finally.

CI: Keynes isn't Mises is he?

EJ: Wrong construct. Keynes argued that the government's balance sheet can be used for a short period to buffer the macro-economic volatility of the business cycle. Show me where Keynes recommends using fiscal policy for decades on end until a country is broke.

CI: I’m going to ask you more about that later, if you don’t mind. Now I’d like to get your take on the popular themes that I listed earlier, beginning with the synchronized global slowdown. You started to warn us in October 2010 about the Output Gap Trap. Your theory was that economic growth won’t be fast enough to get us out of the output gap before a new recession came along to make it larger. You said that hasn’t happened since 1938. Are we there yet?

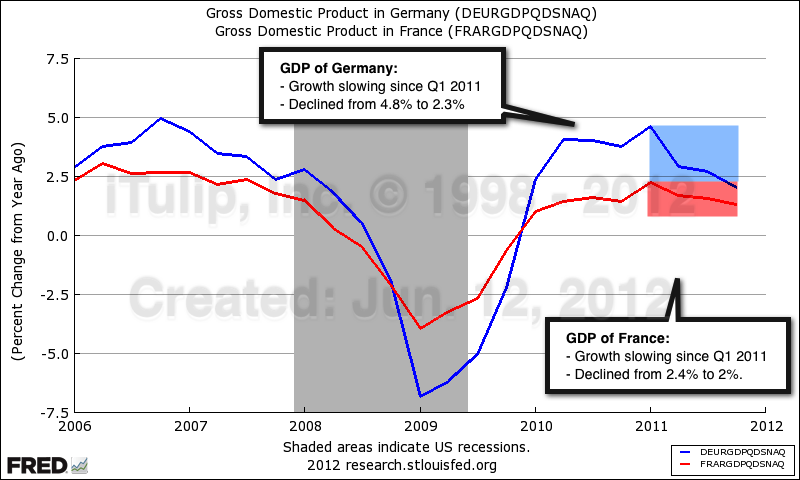

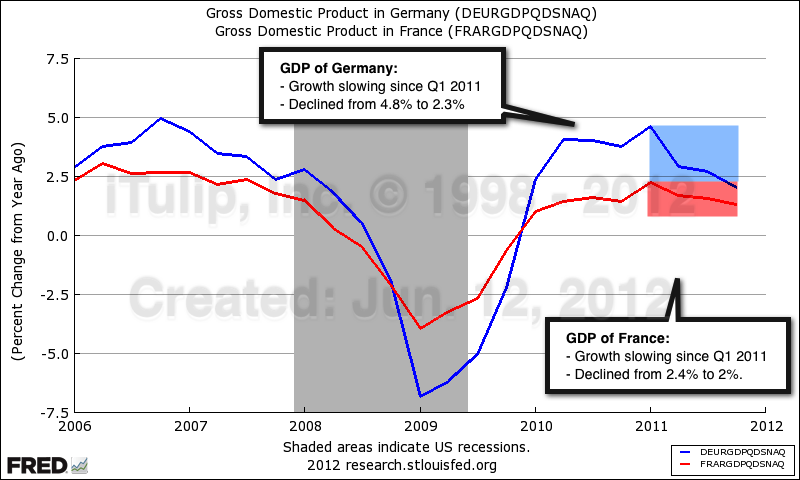

EJ: The trend for everything, and I mean everything, is down. All at once. Consider the GDP growth of the largest European economies that the world is counting on to save the euro zone from collapse.

So far, Germany along with France have been able to hold the euro zone together. But look at the long term picture.

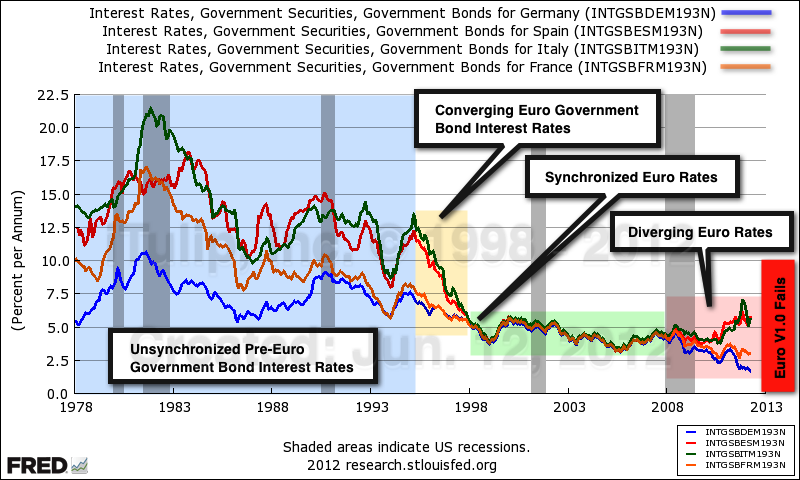

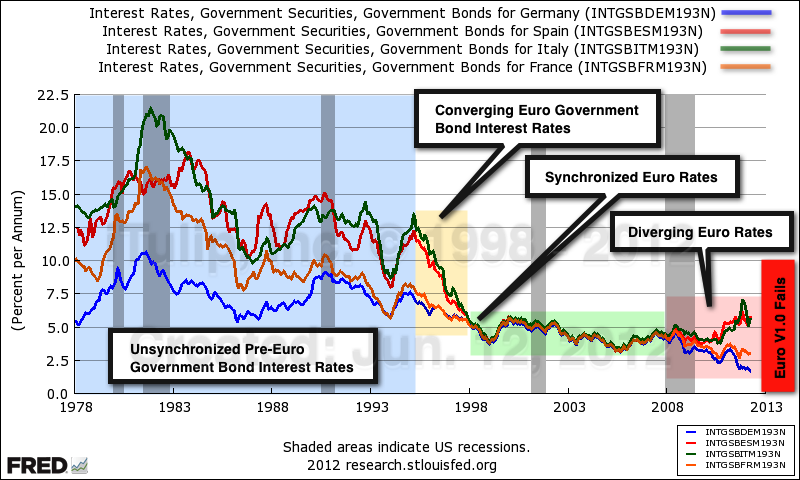

For six years before the euro introduction euro member countries implemented rules to join and government bond interest rates started to converge. In 1995 interest rates in Spain and Italy were around 12% while those of Germany and France were around 7.5%. By the time of the euro introduction rates were converged and stayed that way until the American Financial Crisis. That put Spain and Italy into recession. Rates began to diverge again. In Part II we'll take a closer look at what happened.

Bull market in gold misinformation

CI: You skipped the gold “bear market” that the MSM was on about a few weeks ago. No comments from you throughout.

EJ: Not so. I offered this bit of reassurance to subscribers on May 18 at the end of the short-lived period of gold’s most recent major correction. The financial media reported hopefully that gold was finally down for the count.

I have to say that after 11 years of watching Wall Street’s sales and marketing team push stocks and houses and bash gold, it gets tedious, like watching reruns of “Buffy The Vampire Slayer” except you’ll learn more from watching Buffy than reading the latest disinformation on gold. The theories you hear. Unbelievable.

CI: Plenty of gold bashing still. Like this one: Why Your Portfolio Doesn't Need Gold

EJ: Yes, the writer found a way to depict gold’s steady six-fold, 12-year continuous rise as chaotic, during which time the S&P500 declined 36% in real terms. For my amusement I wrote to the editor, as I sometimes do when one of these articles is brought to my attention by an iTuliper, to offer to write a rebuttal. As usual, it was ignored.

CI: Care to share the email?

EJ: Sure. Why not.

Dear Jeff,

I'm the creator of the finance and economics site iTulip.com, founded in 1998, and founder of iTulip, Inc. I wrote the cover article for Harper's Magazine "The Next Bubble" in 2008, published "The Postcatastrophe Economy" (Penguin, 2010), and write regularly for the Harvard Business Review.

I read with interest "Why Your Portfolio Doesn't Need Gold" by Jack Hough. It's one of the better-written arguments against gold, but I disagree with it.

Jack had FactSet Research Systems "analyze the metal's short-term correlation with two other investments: the 10-year Treasury note, representing safe havens, and the Standard & Poor's 500 stock index." Twin Focus Capital Partners conducted a similar but more rigorous analysis of the iTulip portfolio:

* From 2000 to 2001, 25% cash, 75% 10-year Treasury bonds

* From 2001 to Aug. 2010, 10% cash, 15% gold, 75% 10-year Treasury bonds

Twin Focus plugged this gold + bonds + cash portfolio into a modeling tool called Zephyr StyleADVISOR and compared it to two benchmarks, the Morningstar Moderate Allocation and the Balanced Fund Index composed of 60% S&P 500 Index and 40% Barclays Capital Aggregate Bond Index. The results in sum:

- The gold plus Tbonds portfolio killed both benchmarks over the past ten years by every measure

- Manager Performance: 220 versus 123 and 118 for the Balanced Fund Index and Morningstar Moderate Allocation respectively

- Risk/Return: 7% versus -1%.

- Excess Return: 6.4% versus -1%

- Drawdown: Never exceeded 5% versus 29% and 37% for the Balanced Fund Index and Morningstar Moderate Allocation respectively

- Batting average: 52% versus 46%

Full results here:

http://www.itulip.com/BannerZest/HIPcheetsheet/bz.html

Bottom line, gold has belonged in everyone's portfolio since 2001 when we took our 15% position and still does. Also, never buy the gold stocks, only the metal. The stocks are volatile because most mining companies are badly managed.

Glad to write a rebuttal article if you're interested.

Best Regards,

Eric

CI: No response?

EJ: Didn't expect one. They are selling stocks and related financial products. That’s what Wall Street’s media sells. GM sells cars. McDonald’s sells hamburgers. Apple sells mobile platforms for music and other consumer services. Wall Street sells financial products. Sometimes Wall Street’s financial products are a good buy and sometimes they’re not. Such as for the past 12 years. Why is this so hard for most people to understand?

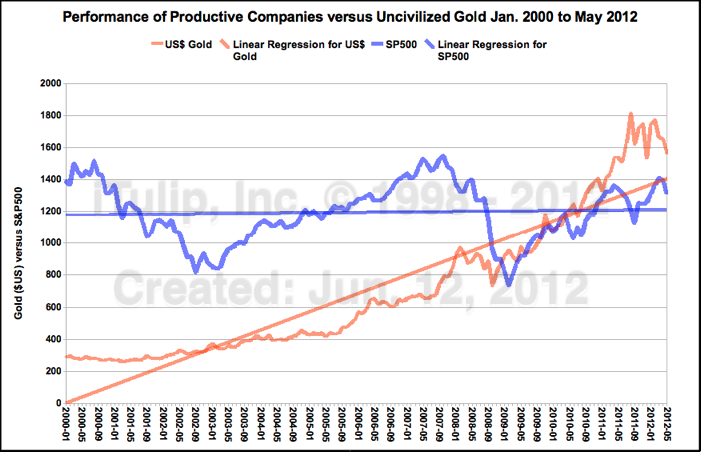

CI: Did you catch Berkshire Hathaway Vice Chairman Charles Munger’s quip that gold is not for civilized investors?

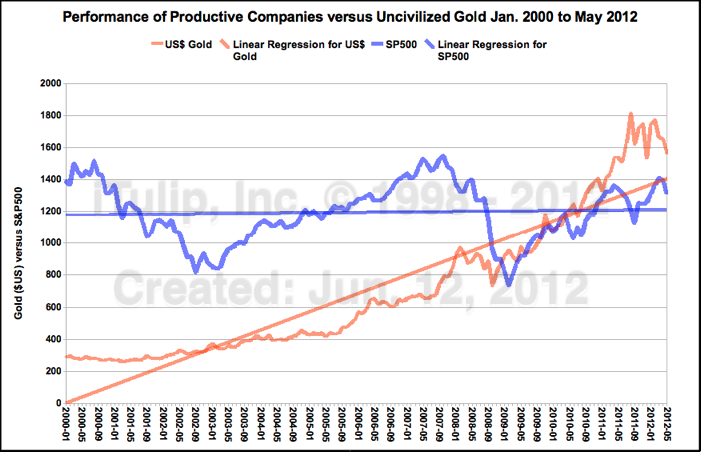

EJ: He said: "I think civilized people don’t buy gold; they invest in productive businesses.” It’s a dickish comment. Of course we’d all like to invest in productive businesses. I’ve been waiting for 12 years to invest in the stock market. If Munger’s and Buffett’s best friend, the government, would stop doling out freebees to our financial oligarchy, price fixing the bond market and fueling asset bubbles, I’d be all over it.

Buffett likes to say, in his rebuke of efficient market theory, that if markets were efficient that he’d be standing on the street corner with a tin cup. But he never talks about how it is that he can take advantage of information asymmetries because if he did it would become abundantly clear that the average investor cannot do it too and is therefore stuck investing in stock mutual funds and index funds and praying that efficient market theory is correct.

CI: Not everyone can be Warren Buffet and pick winning stocks?

EJ: For a while there up until a month ago it looked like not even Warren Buffet can be Warren Buffet, when the indexes were beating his stock picks. That was when the stock market was rallying off residual asset price inflation left over from QE2, not aggregate enterprise value. But the truth is that the average investor does not have billions of dollars to spend on a company's stock. The Hathaway boys do. With it they can buy access to company management so they have access to details about a company that average investors don’t have. Try getting a meeting with the management of Wall-Mart or GM by calling investor relations and telling them you are thinking about plunking down ten grand on the company’s stock and can they please spend a few hours with you going over financials, marketing and product plans, competitive strategy, and so forth. Good luck with that. Also, Hathaway has a small army of analysts to pour over the special information Hathaway has access to. Not only is the average stock market investor analyzing the same widely available information everyone else but is doing the work his or herself. The average investor is not expert and has many distractions to deal with, like a day job.

CI: I can’t be Warren Buffett?

EJ: The average stock investor can't possibly invest in productive companies one by one the way the Hathaway boys can. When the average investor tries he or she loses money. It's a statistical fact, except in a bull market and especially in a bubble. You know, if the wind blows hard enough even turkeys fly. The average investor between 25 and 55 who has a Wall Street certified financial planner will be advised to invest a good chunk of the portfolio in stock mutual funds and index funds to get a piece of the gains generated by productive businesses, which of course we’d all like to do. Certainly not in lumps of metal.

On the other hand you could say that Munger’s quip on gold is an improvement on Keynes who called gold barbaric. Uncivilized is better than barbaric, don’t you think?

CI: Um…

EJ: In any case, by following the advice of Wall Street’s financial products sale force investors have lost 25% of invested funds in real terms over the past 12 years. Meanwhile, we uncivilized gold hoarders have increased our investment fivefold.

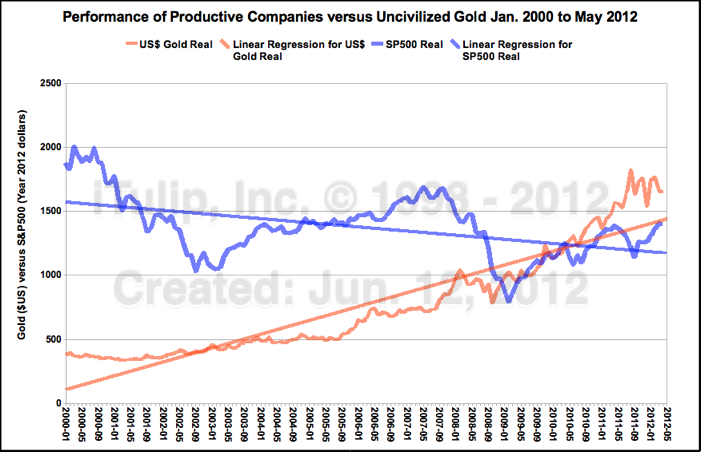

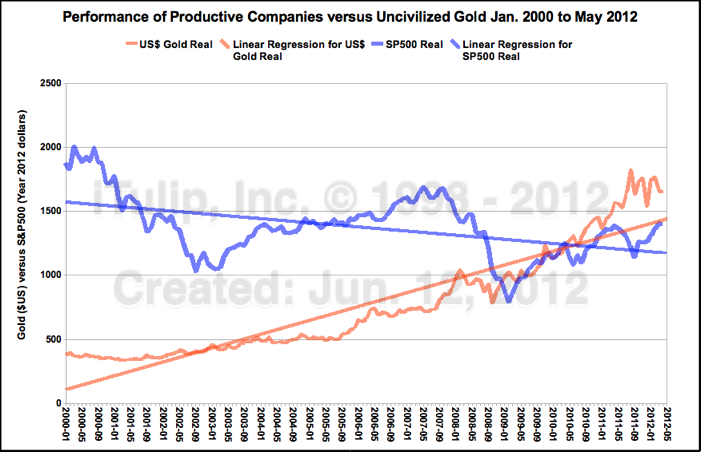

Nominal performance of gold versus the S&P500 since Jan. 2000. We exited the stock market

in March 2000 and bought gold in August 2001 at $270.

Inflation-adjusted performance of gold versus the S&P500 since Jan. 2000.

CI: The facts in those charts are common knowledge here but my mailman and neighbors do not know this. They look at me like they’re going to hit me with a wrench when I bring it up.

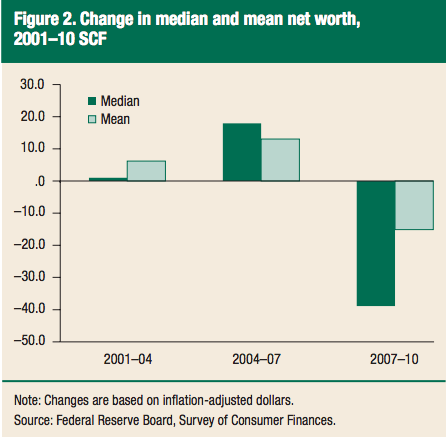

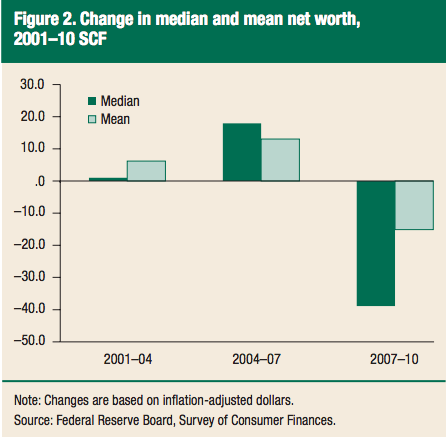

EJ: How could they know? Who’d tell them? Not media outlets that earn the bulk of their revenue from ads paid for by brokerages and investment banks. Your friends and neighbors become part of the horrific statistic released by the Fed last Monday, that median household net worth declined 40% since 2007.

CI: I think I speak for everyone here… I thank the stars to not be part of that statistic.

EJ: The hardest part of what we do here is not in convincing anyone of the wisdom of one investment or another but making and re-making the argument to not trade, to not own stock mutual funds in a bubble cycle economy, to not panic and sell gold or Treasury bonds whenever the MSM says they are over-priced. We ask readers to see financial products as like any other product and suggest they ask the same kinds of questions such as, Who is selling the product? What is their interest, reputation and track record? It’s an endless effort because the financial media are aimed in the other direction. The message is trade, or if you are going to buy and hold anything then buy and hold stocks – and a home, of course. The housing recovery is just around the corner, they say.

Stocks are motherhood and apple pie, an investment in “productive businesses.” Not owning stocks is as un-American as not owning a home. Name another product with that kind of branding. Maybe deodorant. Everyone is now convinced that they stink without it. A hundred years ago smell was how you knew who was in the room before you saw them.

CI: Your readers will be in for a shock the day you come out in favor of stocks over gold and Treasury bonds.

EJ: We’ll hold gold until the international monetary system finishes its slow motion collapse, unless war breaks out and it collapses in a hurry. As for Treasury bonds, we’ve been re-allocating out of Treasury bonds gradually for a couple of years now into a few private equity deals, multi-family real estate, and other vehicles. But there’s no urgency yet, especially with Europe coming unglued.

Scared into Bonds

CI: You’re not concerned that everyone and his dog piled into Treasury bonds this year?

EJ: That’s not a new phenomenon and it’s bound to accelerate as the Middle East, Europe and Asia get more and more scary. The US will as usual be the world’s political and economic oasis again. Sure we scared the crap out of everyone with our financial crisis and yes the US revealed itself to be run by a financial oligarchy but, paradoxically, our financial crisis precipitated the euro crisis, although it was not the cause. A euro zone designed for perpetual good times was the root cause. But the stampede into Treasury bonds concerns the Fed, or at least that’s what Dr. Yellen told me after her speech last week. She told me – it was an on-the-record event – that the Fed is concerned that so many private and institutional investors have such large allocations of their portfolios in long-term Treasury bonds. The concern is that rates may suddenly rise as they did in the early 1990s and holders will dump them, causing rates to rise and the dollar to fall, and motivating holders to dump them even faster. That’s the mechanism that fuels the Poom part of Ka-Poom Theory, which, by the way, members have lobbied me to rename the Janszen Scenario. For branding reasons.

CI: The Fed is worried about deflation and about a boom that spikes bond yields? Aren't those in conflict?

EJ: Don’t tell me you were hoping for consistency. I asked her when this mythical “right time” to balance the budget might appear. The last right time in the past 30 years was in the year 2000 when windfall capital gains from the stock market bubble sent so much tax revenue to the IRS that we ran a surplus.

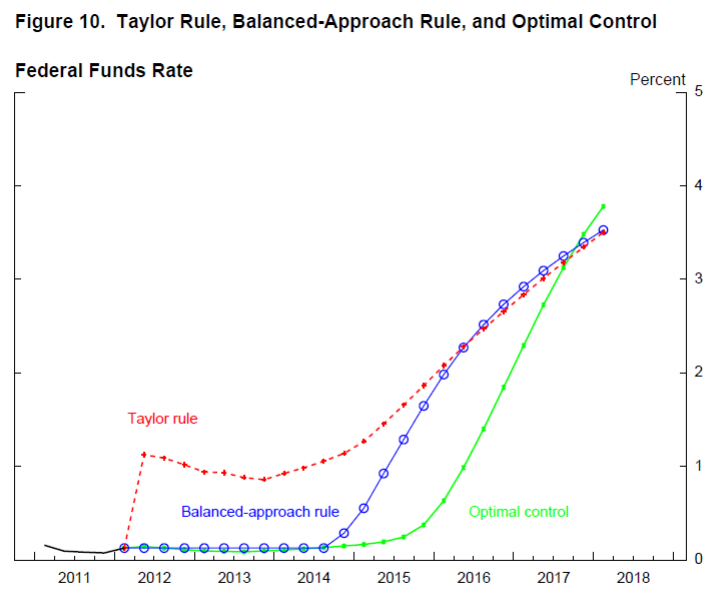

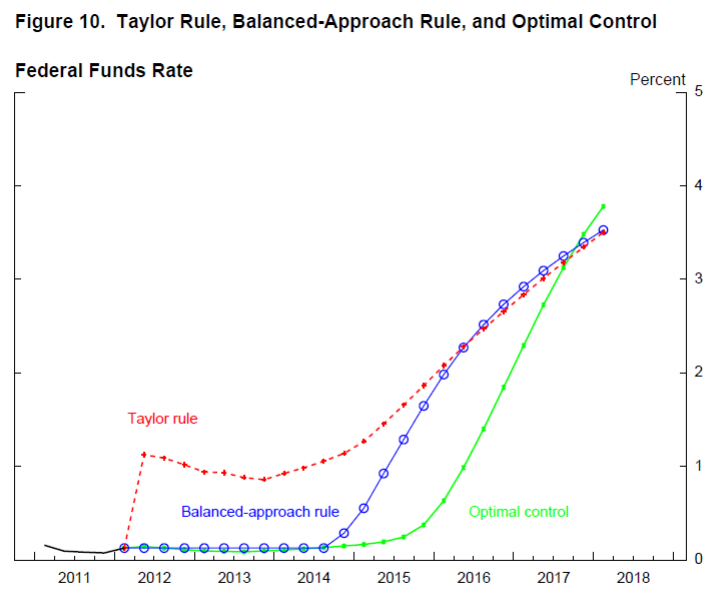

Anyway, that was a million years ago and now we’re in a protracted post-bubble output gap. The chart below is from her speech. The Fed has no intention of touching interest rates for at least a couple of years, until 2014 at the soonest.

CI: No rate hikes until a year after elections.

EJ: Not according to the models that the Fed is eyeing as they consider a move back to rule-based policy decision-making. She pointed out that per the Taylor rule the Fed should have started to raise rates in Q3 2011. John Taylor himself has this to say this April about Yellen’s invocation of the Taylor rule in her speeches.

References to Policy Rules in a Speech by the Fed Vice Chair

In a speech to the Money Marketeers in New York City this past week, Fed Vice Chair Janet Yellen gave a useful description of how she and other policy makers are thinking analytically about monetary policy. The speech referred extensively to monetary policy rules, and I hope it generates more discussion of policy rules and strategies both within and outside the Fed. I have argued that the Fed has moved too far in a discretionary direction, and if it is going to move back to a rules-based policy, this is the kind of discussion that has to take place.

At this point I would only comment on two issues, both related to references to the Taylor rule in the speech.

First, the speech indicates that I proposed two different policy rules for the federal funds rate, one in a paper published in 1993 and the other published in 1999. As Janet Yellen puts it, “John Taylor has proposed two simple and well-known policy rules.” She then goes on to consider what she refers to as the Taylor (1993) rule and the Taylor (1999) rule. However, I did not propose or advocate another rule in 1999, as I emphasized after similar statements were made at a Senate Banking Committee hearing with Ben Bernanke in March of last year.

In the 1999 paper that Janet Yellen refers to, I did examine two rules: one that I described as the “policy rule I suggested” and another that I said “others have suggested.” The “others” were people at the Fed, and I did not propose this other rule. It is important to correct the record because the “others have suggested” rule has a much larger coefficient on the GDP gap and is therefore more likely to generate zero interest rates now and be used to rationalize quantitative easing.

Second, in the graphs contained in the speech Janet Yellen has the Taylor rule showing zero or below now and for quite a while longer. But if you assume inflation of 2 percent, the Taylor rule implies that the funds rate should be 1 percent even if you assume an output gap of negative 6 percent. (1 = 1.5X2 + .5X(-6) + 1). The implied rate is higher for a smaller gap of 4 percent.

CI: Translation?

EJ: Taylor is saying two things. One, that the Fed should stop making “discretionary” policy decisions, which is a polite way of saying that two years after the acute phase of the crisis the Fed should stop making it up as they go along and get back to a more disciplined, rules-based policy approach. Two, that if inflation is 2% and the output gap is minus 6% percent, then the Taylor rule agrees with the “other” rules but not if the output gap is lower because potential output is lower. My take is that the Fed assumes that the output gap will remain stuck at minus five to six percent and that the Fed will continue to manage inflation to 2% so no rate moves are in the cards until a year after elections but no QE either unless a liquidity crisis develops out of Europe.

CI: What does this mean for our Treasury bonds?

EJ: More of the same since 2008 but not the same as since 2001 when we got into long-term Treasury bonds, however. The great bond bull market started in 1983 and ended in 2001. Since then the bond market and the economy have been on life support. We have profited since 2001 by government largess. It has driven bond prices and gold prices up. Lucky us.

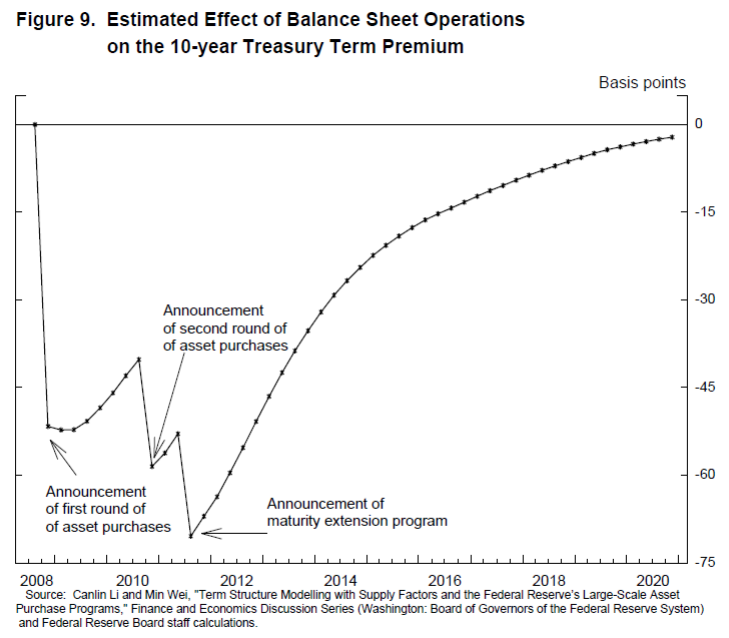

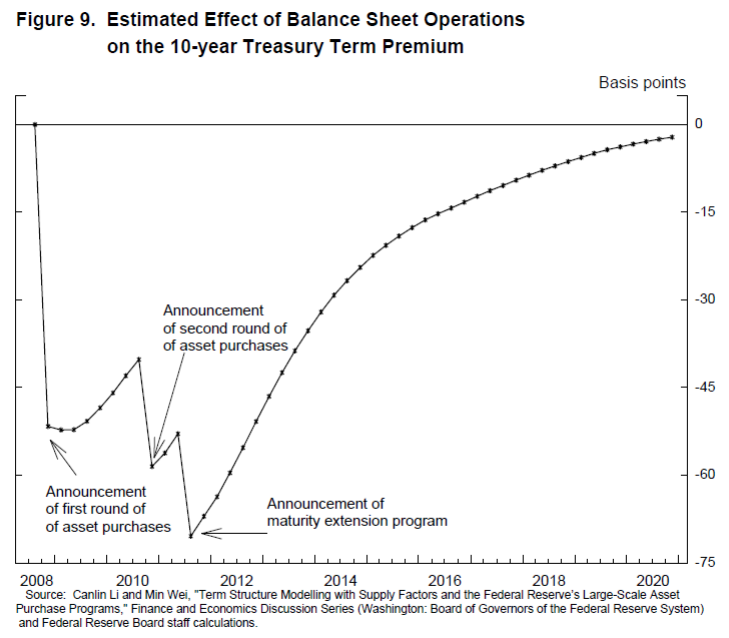

Here’s the chart Yellen showed on the expected impact of the Fed’s Treasury bond purchases.

CE: What is “term premium”?

EJ: Technically, term premium refers to the amount by which the yield differs from the quantity predicted by market expectations. For our purposes the chart shows how long the Fed thinks it’s going to take for the impact of the last bond price fixing operation to wear off.

Ka-Poom Practice Run – Part IV: The Whites of their Eyes ($ubscription)

The Concord River in Bedford, MA. After the IMS implodes, it will look the same.

• The Fed's fed up with Congress

• Euro Beta but no upgrade

• Output gap trap snaps shut

CI: You attended Janet Yellen’s speech at the Boston Fed week before last. You asked her a question during the Q&A session and after. What did you ask her? What did she say?

EJ: The Fed has been out selling the "fiscal cliff" message with all their might and she is doing her part. Yellen told us that the CBO had weighed in with an estimate of a 4% of GDP decline, from 2% to -2%, in the event that Congress allows the Bush tax cuts to expire in July, and unemployment benefits to expire at the end of 2012, and statutory budget cuts to go into effect in 2013. They are giving combination of all three of these "fiscal accommodation" measures gets the B horror movie title Fiscal Cliff.

A couple of photos from the meeting, below.

Media gets the Dr. Yellen's "fiscal cliff" argument on the record, again, in case we didn't hear it the first dozen times

Within hours there are 690 stories on the Internet about it.

Our noisy camera shutter distracts Dr. Yellen during her speech. Sorry!

I asked Dr. Yellen one question in the Q&A session and more afterward one-on-one.

She covered a lot of ground but it's the contradictions that stand out.

The Fed seems to believe that the only event that can cause long bond interest rates to rise in the future is for the output gap to close and for markets to then begin to price in unmanageable US fiscal liabilities. They are worried that so much money has piled into long bonds because they think robust growth, coming from who knows where some day, will in the future cause a sudden spike in bond yields as happened in the early 1990s, and that may produce a stampede out of bonds that pushes yields up further in a self-reinforcing selloff.

But in the next moment we hear what amounts to bragging about the world's insatiable appetite for US bonds that allows the US to finance a major budget deficit at ultra-low interest rates forever, a deficit that the Fed thinks should at this time be expanded in order to further stimulate the economy in this period of slack.

Soon thereafter we are told that the Fed is worried about the US falling into a deflationary spiral triggered by a liquidity crisis in Europe. In the next breath we hear the Fed has a "tool kit" to prevent it.

CI: Sounds confusing.

EJ: They are lost. They don't know where they are, how they got here, or where they are going.

CI: What did you think of Yellen? What was your impression?

EJ: Likable overall. She comes across as a thoughtful academic, and is direct with her answers. She's quite short, with warm, intelligent eyes. She reminded me of my grandmother. One of the things I appreciated about her versus Bernanke is that she doesn't look like she's about to jump out of her skin at any moment the way Bernanke does. She's comfortable at the podium, on the record in front of the press and taking questions. When Bernanke spoke to our group (Boston Economics Club) last November he did not take questions. She took questions for an hour and gave detailed responses. Her response to my question went on for close to five minutes. It's a tough crowd, too, including heavy hitter conservative economists who challenged the Fed's latest meme campaign on the threat of a "fiscal cliff." But the road to hell is paved with good intentions. At the end of the day, who cares if the folks at the Fed are likable or not. more... $ubscription...

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Full size image (not retouched)

Every man, wherever he goes, is encompassed by a cloud of comforting convictions,

which move with him like flies on a summer day.

- Bertrand Russell (1872 - 1970), Sceptical Essays (1928), "Dreams and Facts"

• Macro fatigue

• Bull market in gold misinformation

• Scared into Bonds

Editor's Note: At the suggestion of several iTulip subscribers we have renamed Ka-Poom Theory the Janszen Scenario. We will use both terms for the next several articles before switching over to Janszen Scenario.

Macro Fatigue

CI: The main memes in the financial media since we last talked are synchronized global slowdown, falling stock markets, gold bear market then not, euro breakup, China weakness and stimulus, and QE3 anticipation. And "fiscal cliff."

EJ: Anything to fill the time between the last shoe to drop and the next, I suppose. The anticipation is driving everyone nutty. A friend told me the other day he’s suffering from “macro fatigue.” I don’t think he’s alone.

CI: Eye of the storm? How much longer until the next big crisis?

EJ: Eye of the storm is one way to put it, but it’s already been a very big eye. The leading wall of the hurricane receded and the trailing wall has approached for three years now. A wall of sorts in Europe isn’t hard to make out but it’s part of the escalation process that’s been going on for years and may go on for years more. Hard to tell if it concludes in a 2008 level liquidity crisis as the world's central banks expect in three weeks or three months or another three years. According to the doom-of-the-day financial sites, Europe was supposed to blow up any day now for the last year. One of our members started a Europe Crisis thread in December 2009. With 65,000 views and 1,100 replies including members based in Europe, the thread chronicles the long evolution of the European crisis in detail. If we’ve learned anything by running this site since 1998 it’s that even the most clearly foreseeable disaster in the making takes longer to arrive than the cruelest imagination can conceive. It’s hard to get excited about it when you know how long the process is going to take.

CI: The way the Wall Street Journal reports on Greece and Spain you’d think Europe will go down the tubes after the Greek elections Sunday. You said yourself in 2007 Europe will go down the tubes if the economic crisis reaches there from the US and spans the EU election cycle. Well, here it is. So why don’t you think this is it for Europe?

EJ: Because an object in motion tends to remain in motion. Even if the Greeks vote in a new radical or the old soft a squishy leftist party that doesn’t mean that Greece drops austerity and bolts the euro. As with business, so with elections. Never confuse sales with installation. Campaign promises are not post-election policy. Remember Brazil. Before the socialists arrived, conservatives delivered a socialist disaster. After socialists were elected they delivered a conservative nirvana.

Open your mind.

Elected on a socialist platform, Lula embraces fiscal policies that make the US look far more socialist.

The drama in Greece is similar.

In any case, you’re an iTulip reader. You’re not in the stock market. You’re in Treasury bonds and gold. You can sleep through all of this. Relax. It’s summer. Enjoy yourself. Life is short. This is a time to stop and smell the roses. Soon enough the whole world will appear to be collapsing all at once, the result of the reverberation of shock waves from the American Financial Crisis. What's the hurry?

CI: All at once?

EJ: The Middle East is entering an ugly new phase. The second revolution in Egypt won’t be as benign as the first. When it’s all over there will be two countries where now there is one.

CI: Syria?

EJ: The west will not be able to resist the temptation to get into it with Syria, with Russia and China on the other side, setting the stage for sectarian proxy wars across the Middle East that drags the Saudis in. The WTI versus Brent crude spread that opened in 2011 will get even wider as the Middle East security premium hits Europe harder than the US. It's as reliable an indicator of Middle East crisis escalation as the spread between Germany's and Italy's government bond yields is an indicator of euro escalation.

CI: Europe?

EJ: There are many more chapters to go for Europe and the euro, including assistance from the US, before that idealist experiment ends. Europe’s eventual final existential crisis after several more near death experiences in a few years will also be the end of Japan’s 20-year experiment in using Keynesian theory to grow government debt from 63% of GDP to 245%, to move credit bubble era debts from private to public account. Flight out of Japanese bonds and yen will get the Japanese government default ball rolling there finally.

CI: Keynes isn't Mises is he?

EJ: Wrong construct. Keynes argued that the government's balance sheet can be used for a short period to buffer the macro-economic volatility of the business cycle. Show me where Keynes recommends using fiscal policy for decades on end until a country is broke.

CI: I’m going to ask you more about that later, if you don’t mind. Now I’d like to get your take on the popular themes that I listed earlier, beginning with the synchronized global slowdown. You started to warn us in October 2010 about the Output Gap Trap. Your theory was that economic growth won’t be fast enough to get us out of the output gap before a new recession came along to make it larger. You said that hasn’t happened since 1938. Are we there yet?

EJ: The trend for everything, and I mean everything, is down. All at once. Consider the GDP growth of the largest European economies that the world is counting on to save the euro zone from collapse.

So far, Germany along with France have been able to hold the euro zone together. But look at the long term picture.

For six years before the euro introduction euro member countries implemented rules to join and government bond interest rates started to converge. In 1995 interest rates in Spain and Italy were around 12% while those of Germany and France were around 7.5%. By the time of the euro introduction rates were converged and stayed that way until the American Financial Crisis. That put Spain and Italy into recession. Rates began to diverge again. In Part II we'll take a closer look at what happened.

Bull market in gold misinformation

CI: You skipped the gold “bear market” that the MSM was on about a few weeks ago. No comments from you throughout.

EJ: Not so. I offered this bit of reassurance to subscribers on May 18 at the end of the short-lived period of gold’s most recent major correction. The financial media reported hopefully that gold was finally down for the count.

I have to say that after 11 years of watching Wall Street’s sales and marketing team push stocks and houses and bash gold, it gets tedious, like watching reruns of “Buffy The Vampire Slayer” except you’ll learn more from watching Buffy than reading the latest disinformation on gold. The theories you hear. Unbelievable.

CI: Plenty of gold bashing still. Like this one: Why Your Portfolio Doesn't Need Gold

EJ: Yes, the writer found a way to depict gold’s steady six-fold, 12-year continuous rise as chaotic, during which time the S&P500 declined 36% in real terms. For my amusement I wrote to the editor, as I sometimes do when one of these articles is brought to my attention by an iTuliper, to offer to write a rebuttal. As usual, it was ignored.

CI: Care to share the email?

EJ: Sure. Why not.

Dear Jeff,

I'm the creator of the finance and economics site iTulip.com, founded in 1998, and founder of iTulip, Inc. I wrote the cover article for Harper's Magazine "The Next Bubble" in 2008, published "The Postcatastrophe Economy" (Penguin, 2010), and write regularly for the Harvard Business Review.

I read with interest "Why Your Portfolio Doesn't Need Gold" by Jack Hough. It's one of the better-written arguments against gold, but I disagree with it.

Jack had FactSet Research Systems "analyze the metal's short-term correlation with two other investments: the 10-year Treasury note, representing safe havens, and the Standard & Poor's 500 stock index." Twin Focus Capital Partners conducted a similar but more rigorous analysis of the iTulip portfolio:

* From 2000 to 2001, 25% cash, 75% 10-year Treasury bonds

* From 2001 to Aug. 2010, 10% cash, 15% gold, 75% 10-year Treasury bonds

Twin Focus plugged this gold + bonds + cash portfolio into a modeling tool called Zephyr StyleADVISOR and compared it to two benchmarks, the Morningstar Moderate Allocation and the Balanced Fund Index composed of 60% S&P 500 Index and 40% Barclays Capital Aggregate Bond Index. The results in sum:

- The gold plus Tbonds portfolio killed both benchmarks over the past ten years by every measure

- Manager Performance: 220 versus 123 and 118 for the Balanced Fund Index and Morningstar Moderate Allocation respectively

- Risk/Return: 7% versus -1%.

- Excess Return: 6.4% versus -1%

- Drawdown: Never exceeded 5% versus 29% and 37% for the Balanced Fund Index and Morningstar Moderate Allocation respectively

- Batting average: 52% versus 46%

Full results here:

http://www.itulip.com/BannerZest/HIPcheetsheet/bz.html

Bottom line, gold has belonged in everyone's portfolio since 2001 when we took our 15% position and still does. Also, never buy the gold stocks, only the metal. The stocks are volatile because most mining companies are badly managed.

Glad to write a rebuttal article if you're interested.

Best Regards,

Eric

CI: No response?

EJ: Didn't expect one. They are selling stocks and related financial products. That’s what Wall Street’s media sells. GM sells cars. McDonald’s sells hamburgers. Apple sells mobile platforms for music and other consumer services. Wall Street sells financial products. Sometimes Wall Street’s financial products are a good buy and sometimes they’re not. Such as for the past 12 years. Why is this so hard for most people to understand?

CI: Did you catch Berkshire Hathaway Vice Chairman Charles Munger’s quip that gold is not for civilized investors?

EJ: He said: "I think civilized people don’t buy gold; they invest in productive businesses.” It’s a dickish comment. Of course we’d all like to invest in productive businesses. I’ve been waiting for 12 years to invest in the stock market. If Munger’s and Buffett’s best friend, the government, would stop doling out freebees to our financial oligarchy, price fixing the bond market and fueling asset bubbles, I’d be all over it.

Buffett likes to say, in his rebuke of efficient market theory, that if markets were efficient that he’d be standing on the street corner with a tin cup. But he never talks about how it is that he can take advantage of information asymmetries because if he did it would become abundantly clear that the average investor cannot do it too and is therefore stuck investing in stock mutual funds and index funds and praying that efficient market theory is correct.

CI: Not everyone can be Warren Buffet and pick winning stocks?

EJ: For a while there up until a month ago it looked like not even Warren Buffet can be Warren Buffet, when the indexes were beating his stock picks. That was when the stock market was rallying off residual asset price inflation left over from QE2, not aggregate enterprise value. But the truth is that the average investor does not have billions of dollars to spend on a company's stock. The Hathaway boys do. With it they can buy access to company management so they have access to details about a company that average investors don’t have. Try getting a meeting with the management of Wall-Mart or GM by calling investor relations and telling them you are thinking about plunking down ten grand on the company’s stock and can they please spend a few hours with you going over financials, marketing and product plans, competitive strategy, and so forth. Good luck with that. Also, Hathaway has a small army of analysts to pour over the special information Hathaway has access to. Not only is the average stock market investor analyzing the same widely available information everyone else but is doing the work his or herself. The average investor is not expert and has many distractions to deal with, like a day job.

CI: I can’t be Warren Buffett?

EJ: The average stock investor can't possibly invest in productive companies one by one the way the Hathaway boys can. When the average investor tries he or she loses money. It's a statistical fact, except in a bull market and especially in a bubble. You know, if the wind blows hard enough even turkeys fly. The average investor between 25 and 55 who has a Wall Street certified financial planner will be advised to invest a good chunk of the portfolio in stock mutual funds and index funds to get a piece of the gains generated by productive businesses, which of course we’d all like to do. Certainly not in lumps of metal.

On the other hand you could say that Munger’s quip on gold is an improvement on Keynes who called gold barbaric. Uncivilized is better than barbaric, don’t you think?

CI: Um…

EJ: In any case, by following the advice of Wall Street’s financial products sale force investors have lost 25% of invested funds in real terms over the past 12 years. Meanwhile, we uncivilized gold hoarders have increased our investment fivefold.

Nominal performance of gold versus the S&P500 since Jan. 2000. We exited the stock market

in March 2000 and bought gold in August 2001 at $270.

Inflation-adjusted performance of gold versus the S&P500 since Jan. 2000.

CI: The facts in those charts are common knowledge here but my mailman and neighbors do not know this. They look at me like they’re going to hit me with a wrench when I bring it up.

EJ: How could they know? Who’d tell them? Not media outlets that earn the bulk of their revenue from ads paid for by brokerages and investment banks. Your friends and neighbors become part of the horrific statistic released by the Fed last Monday, that median household net worth declined 40% since 2007.

CI: I think I speak for everyone here… I thank the stars to not be part of that statistic.

EJ: The hardest part of what we do here is not in convincing anyone of the wisdom of one investment or another but making and re-making the argument to not trade, to not own stock mutual funds in a bubble cycle economy, to not panic and sell gold or Treasury bonds whenever the MSM says they are over-priced. We ask readers to see financial products as like any other product and suggest they ask the same kinds of questions such as, Who is selling the product? What is their interest, reputation and track record? It’s an endless effort because the financial media are aimed in the other direction. The message is trade, or if you are going to buy and hold anything then buy and hold stocks – and a home, of course. The housing recovery is just around the corner, they say.

Stocks are motherhood and apple pie, an investment in “productive businesses.” Not owning stocks is as un-American as not owning a home. Name another product with that kind of branding. Maybe deodorant. Everyone is now convinced that they stink without it. A hundred years ago smell was how you knew who was in the room before you saw them.

CI: Your readers will be in for a shock the day you come out in favor of stocks over gold and Treasury bonds.

EJ: We’ll hold gold until the international monetary system finishes its slow motion collapse, unless war breaks out and it collapses in a hurry. As for Treasury bonds, we’ve been re-allocating out of Treasury bonds gradually for a couple of years now into a few private equity deals, multi-family real estate, and other vehicles. But there’s no urgency yet, especially with Europe coming unglued.

Scared into Bonds

CI: You’re not concerned that everyone and his dog piled into Treasury bonds this year?

EJ: That’s not a new phenomenon and it’s bound to accelerate as the Middle East, Europe and Asia get more and more scary. The US will as usual be the world’s political and economic oasis again. Sure we scared the crap out of everyone with our financial crisis and yes the US revealed itself to be run by a financial oligarchy but, paradoxically, our financial crisis precipitated the euro crisis, although it was not the cause. A euro zone designed for perpetual good times was the root cause. But the stampede into Treasury bonds concerns the Fed, or at least that’s what Dr. Yellen told me after her speech last week. She told me – it was an on-the-record event – that the Fed is concerned that so many private and institutional investors have such large allocations of their portfolios in long-term Treasury bonds. The concern is that rates may suddenly rise as they did in the early 1990s and holders will dump them, causing rates to rise and the dollar to fall, and motivating holders to dump them even faster. That’s the mechanism that fuels the Poom part of Ka-Poom Theory, which, by the way, members have lobbied me to rename the Janszen Scenario. For branding reasons.

CI: The Fed is worried about deflation and about a boom that spikes bond yields? Aren't those in conflict?

EJ: Don’t tell me you were hoping for consistency. I asked her when this mythical “right time” to balance the budget might appear. The last right time in the past 30 years was in the year 2000 when windfall capital gains from the stock market bubble sent so much tax revenue to the IRS that we ran a surplus.

Anyway, that was a million years ago and now we’re in a protracted post-bubble output gap. The chart below is from her speech. The Fed has no intention of touching interest rates for at least a couple of years, until 2014 at the soonest.

CI: No rate hikes until a year after elections.

EJ: Not according to the models that the Fed is eyeing as they consider a move back to rule-based policy decision-making. She pointed out that per the Taylor rule the Fed should have started to raise rates in Q3 2011. John Taylor himself has this to say this April about Yellen’s invocation of the Taylor rule in her speeches.

References to Policy Rules in a Speech by the Fed Vice Chair

In a speech to the Money Marketeers in New York City this past week, Fed Vice Chair Janet Yellen gave a useful description of how she and other policy makers are thinking analytically about monetary policy. The speech referred extensively to monetary policy rules, and I hope it generates more discussion of policy rules and strategies both within and outside the Fed. I have argued that the Fed has moved too far in a discretionary direction, and if it is going to move back to a rules-based policy, this is the kind of discussion that has to take place.

At this point I would only comment on two issues, both related to references to the Taylor rule in the speech.

First, the speech indicates that I proposed two different policy rules for the federal funds rate, one in a paper published in 1993 and the other published in 1999. As Janet Yellen puts it, “John Taylor has proposed two simple and well-known policy rules.” She then goes on to consider what she refers to as the Taylor (1993) rule and the Taylor (1999) rule. However, I did not propose or advocate another rule in 1999, as I emphasized after similar statements were made at a Senate Banking Committee hearing with Ben Bernanke in March of last year.

In the 1999 paper that Janet Yellen refers to, I did examine two rules: one that I described as the “policy rule I suggested” and another that I said “others have suggested.” The “others” were people at the Fed, and I did not propose this other rule. It is important to correct the record because the “others have suggested” rule has a much larger coefficient on the GDP gap and is therefore more likely to generate zero interest rates now and be used to rationalize quantitative easing.

Second, in the graphs contained in the speech Janet Yellen has the Taylor rule showing zero or below now and for quite a while longer. But if you assume inflation of 2 percent, the Taylor rule implies that the funds rate should be 1 percent even if you assume an output gap of negative 6 percent. (1 = 1.5X2 + .5X(-6) + 1). The implied rate is higher for a smaller gap of 4 percent.

CI: Translation?

EJ: Taylor is saying two things. One, that the Fed should stop making “discretionary” policy decisions, which is a polite way of saying that two years after the acute phase of the crisis the Fed should stop making it up as they go along and get back to a more disciplined, rules-based policy approach. Two, that if inflation is 2% and the output gap is minus 6% percent, then the Taylor rule agrees with the “other” rules but not if the output gap is lower because potential output is lower. My take is that the Fed assumes that the output gap will remain stuck at minus five to six percent and that the Fed will continue to manage inflation to 2% so no rate moves are in the cards until a year after elections but no QE either unless a liquidity crisis develops out of Europe.

CI: What does this mean for our Treasury bonds?

EJ: More of the same since 2008 but not the same as since 2001 when we got into long-term Treasury bonds, however. The great bond bull market started in 1983 and ended in 2001. Since then the bond market and the economy have been on life support. We have profited since 2001 by government largess. It has driven bond prices and gold prices up. Lucky us.

Here’s the chart Yellen showed on the expected impact of the Fed’s Treasury bond purchases.

CE: What is “term premium”?

EJ: Technically, term premium refers to the amount by which the yield differs from the quantity predicted by market expectations. For our purposes the chart shows how long the Fed thinks it’s going to take for the impact of the last bond price fixing operation to wear off.

Ka-Poom Practice Run – Part IV: The Whites of their Eyes ($ubscription)

The Concord River in Bedford, MA. After the IMS implodes, it will look the same.

• The Fed's fed up with Congress

• Euro Beta but no upgrade

• Output gap trap snaps shut

CI: You attended Janet Yellen’s speech at the Boston Fed week before last. You asked her a question during the Q&A session and after. What did you ask her? What did she say?

EJ: The Fed has been out selling the "fiscal cliff" message with all their might and she is doing her part. Yellen told us that the CBO had weighed in with an estimate of a 4% of GDP decline, from 2% to -2%, in the event that Congress allows the Bush tax cuts to expire in July, and unemployment benefits to expire at the end of 2012, and statutory budget cuts to go into effect in 2013. They are giving combination of all three of these "fiscal accommodation" measures gets the B horror movie title Fiscal Cliff.

A couple of photos from the meeting, below.

Media gets the Dr. Yellen's "fiscal cliff" argument on the record, again, in case we didn't hear it the first dozen times

Within hours there are 690 stories on the Internet about it.

Our noisy camera shutter distracts Dr. Yellen during her speech. Sorry!

I asked Dr. Yellen one question in the Q&A session and more afterward one-on-one.

She covered a lot of ground but it's the contradictions that stand out.

The Fed seems to believe that the only event that can cause long bond interest rates to rise in the future is for the output gap to close and for markets to then begin to price in unmanageable US fiscal liabilities. They are worried that so much money has piled into long bonds because they think robust growth, coming from who knows where some day, will in the future cause a sudden spike in bond yields as happened in the early 1990s, and that may produce a stampede out of bonds that pushes yields up further in a self-reinforcing selloff.

But in the next moment we hear what amounts to bragging about the world's insatiable appetite for US bonds that allows the US to finance a major budget deficit at ultra-low interest rates forever, a deficit that the Fed thinks should at this time be expanded in order to further stimulate the economy in this period of slack.

Soon thereafter we are told that the Fed is worried about the US falling into a deflationary spiral triggered by a liquidity crisis in Europe. In the next breath we hear the Fed has a "tool kit" to prevent it.

CI: Sounds confusing.

EJ: They are lost. They don't know where they are, how they got here, or where they are going.

CI: What did you think of Yellen? What was your impression?

EJ: Likable overall. She comes across as a thoughtful academic, and is direct with her answers. She's quite short, with warm, intelligent eyes. She reminded me of my grandmother. One of the things I appreciated about her versus Bernanke is that she doesn't look like she's about to jump out of her skin at any moment the way Bernanke does. She's comfortable at the podium, on the record in front of the press and taking questions. When Bernanke spoke to our group (Boston Economics Club) last November he did not take questions. She took questions for an hour and gave detailed responses. Her response to my question went on for close to five minutes. It's a tough crowd, too, including heavy hitter conservative economists who challenged the Fed's latest meme campaign on the threat of a "fiscal cliff." But the road to hell is paved with good intentions. At the end of the day, who cares if the folks at the Fed are likable or not. more... $ubscription...

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment