Year of the Jump Ball - Part I: Payback

“Politics, n. A strife of interests masquerading as a contest of principles.”

― Ambrose Bierce

“Right, as the world goes, is only in question between equals in power, while the strong do what they can and the weak suffer what they must.”

― Thucydides, The Landmark Thucydides: A Comprehensive Guide to the Peloponnesian War

In a time of drastic change it is the learners who inherit the future. The learned usually find themselves equipped only to live in a world that no longer exists.

―Eric Hoffer

The year 2012 is shaping up to be the year when five decades of economic, energy, monetary, and foreign policy errors by eight successive US administrations finally catch up with us. The rise and collapse of two asset bubbles in ten years has left the US economy structurally weakened and government finances in shambles. As dwindling global oil supplies shuffle economic and political power in the Middle East, the shrinking contribution of the US and Europe to global economic output is shifting economic and political power West to East. The global political economy is reorganizing around the world's sources of oil and savings. Eastern and Middle Eastern powers are pulled together and pushed away from Western power and influence.

After decades of accumulation of risk to the steady-state political economy formed in the decades after WWII and reformed after the Cold War, in 2012 we see the potential for step function change that puts it all, or nearly all, up for grabs. On an a multi-millennial historical time line, it may happen in blink of an eye.

Call it the Year of the Jump Ball. Like a jump ball, the win goes to the quick and the strong. Who will it be and what does it mean for us as investors?

America's Five Critical Risk Factors

The US made five manageable and recoverable public policy errors in the early 1970s and 1980s. Then, as each administration failed to confront them, these once manageable and recoverable errors grew and metastasized into America's Five Critical Risk Factors. One or more of these factors may culminate in crisis in 2012 with consequences that are as difficult to predict as the timing.

The potential consequences can be traced back to the original source of each of the five risks.

Risk Factor Cause #1: Unilaterally abandoning the international gold standard to force the world onto the US Treasury dollar standard in 1971

Economist Robert Triffin and French president Charles de Gaulle warned of the consequences of currency reserve accumulation by US trade partners and of the US "going into debt for free" if global monetary system based on the currency and debt of a single sovereign nation -- the US -- persisted. The imbalances predicted by the Triffin Dilemma and the threats they pose to the international monetary system (IMS) and the global economy became apparent decades later, in the 1990s, yet Prisoner's Dilemma economics motivated all major parties in the system to perpetuate it. The cost of reform will fall largely on the IMS's main beneficiary, the United States. Major parties to the system are in no position to press the US for reform at US expense because they reply on the US for either export demand -- are dependent on the "over-consumption" growth model that Triffin warned about -- and thus domestic economic security, or military security, or both. Paradoxically, the economies of US its trade partners have over time become dependent on the global imbalances that Triffin predicted.

Triffin did not offer predictions on how re-balancing might occur if the policy of a US$ reserve currency persisted and imbalances were permitted to accumulate for decades. Readers know my theory since 1999 aka "Ka-Poom Theory" wherein a geopolitical event causes a collapse in global demand dollar liquidity that leads to spiking interest rates and a falling dollar exchange rate, which process is stopped only when the US re-opens the gold window to put up 8,000 plus tons of Treasury gold as collateral to halt the wave. While the unwinding of a reserve currency issued by an over-indebted nation will be in form unlike any previously known sovereign debt and currency crises, the catalyst for a dollar crisis will share the common element of surprise with countries like Greece (failing euro peg) or Argentina (failed dollar peg) at the periphery of their respective currency systems; a political event suddenly changes the economic relationships that underpinned the arrangement -- an election, fiscal position revelation, war. Suddenly the deal is off.

In Part II we unpack the sanitized speech "The Triffin dilemma revisited" by Lorenzo Bini Smaghi, Member of the Executive Board of the ECB, at the "Conference on the International Monetary System: sustainability and reform proposals, marking the 100th anniversary of Robert Triffin (1911-1993)" held at the Triffin International Foundation, Brussels, 3 October 2011. My conclusion: the SDR is a non-starter because, as Smaghi says without making a politically incorrect reference to the SDR directly, "A supranational currency would need to be kept strong in order not to depreciate against the other major existing currencies. Any weakening would undermine its attractiveness, and hence its function as a reserve asset. However, if the supply of a supranational currency were to be restricted, it might fail to meet demand and so fall short of its function." That leaves only gold as a backup if a multi-polar IMS cannot be developed -- which it can't, because the US economy depends on the “exorbitant privilege” to keep its economy growing and federal government operating.

Risk Factor Cause #2: Failing to reduce economic dependence on cheap oil starting in the 1970s

The 1970s oil crisis handed US policy makers a singular political opportunity to reduce the energy intensity (BTU of energy per US$ GDP) of our transportation system and US dependence on oil imports at the same time. While European countries used the crisis as political cover to raise taxes on gasoline and diesel to force consumers to conserve oil in the future after the immediate oil crisis passed, the US went the other way, subsidizing oil imports by exploiting the “exorbitant privilege” and by propping up authoritarian regimes in oil producing countries who cooperated with the US$ monetary regime.

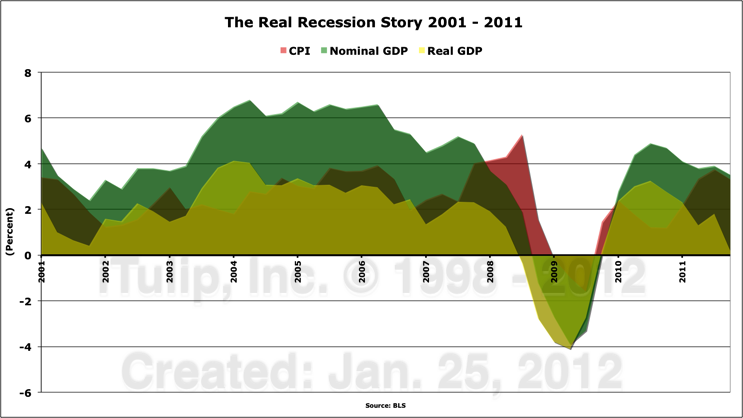

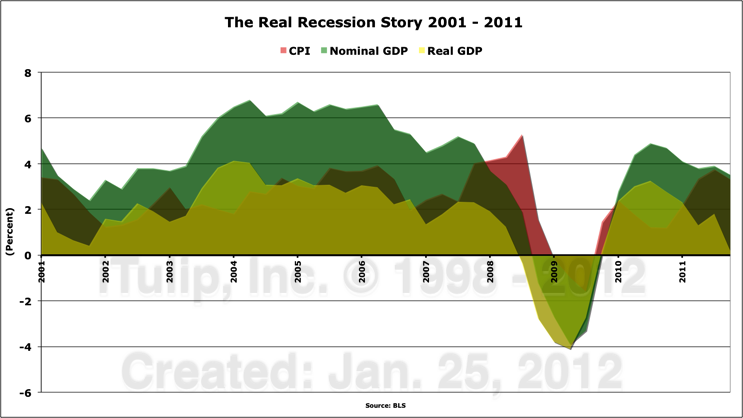

Today the US relies on a far-flung transportation network of paved roads and little else for moving people and cargo. As a result, high oil prices have an asymmetric impact on the US economy relative to European and Asian countries. The IMF estimates that every $10-a-barrel increase in the price of oil over $80 reduces U.S. GDP growth by 0.5 percent. Small wonder that the US economy lugged through 2011 in a 7% of GDP output gap left open by the 2007 to 2009 American Financial Crisis and Housing Bust Recession. Once the Bureau of Economic Analysis completes a third revision to the Q3 and Q4 GDP data, we will find that the economy grew by only 1.4% in real terms in 2011.

The US economy needs cheap oil, as well as a FIRE Economy era debt write-off, to get back on a growth track. Unfortunately, cheap oil depends on US-friendly regimes in the Middle East and the balance of power to resume cheap oil flows westward is tipping decidedly in the opposite direction.

Risk Factor Cause #3: Making alliances with repressive political regimes in Middle East countries

One area of the world we know that we knew nothing about and now, after two years of work, know only slightly more than nothing about, is the Middle East. Friends we know who live there, who are close enough to be considered truly expert, are often too close to it to be objective.

The complexity of political inter-dependencies makes for a wide range of predictions, from optimistic to dire. The optimists dominated in the early innings of the ongoing power shift a year ago when they labeled the first uprisings an Arab Spring. As dust is settles in Egypt a year after the start of the uprising there the Muslim Brotherhood emerges, predictably, as the only well organized political party able to get out the vote. Combined with more radical factions, the Muslim Brotherhood are in line to control more than 75% of the legislature, leaving slightly more than 15% to moderate non-sectarian groups, and less than 10% to the groups that led the actual revolt. While Egypt is not a major oil producer, our sources explain that the governance model of an Islamic state developing in Egypt now may over time come to pass in countries like Libya that are.

One might reasonably ask, So what? No matter who is in charge, Middle Eastern oil producing states will always sell oil to the West. It is the oil itself, I have argued, that promotes corrupt dictatorships as the dominant form of political organization in the region rather than cultural, historical, and institutional antecedents. A government that can dig its tax revenues out of the ground has no motive to develop human capital. Lack of motivation to develop human capital for economic development reinforces cultural and religious factors. The question going forward is whether Arab oil producing states can overcome the curse of oil after they evolve into quasi-democratic Islamic states and become more liberalized and aligned with Western ideas of social and economic progress from which mutual economic interests arise versus the previous repression-assistance-for-oil arrangement.

Speaking at a conference last year I was asked by an audience member if I didn't worry that democratically elected Arab leaders are likely to "charge us more for our oil."

I hear this phrase "our oil" all the time. The idea that tens of millions of Arab and Persian people are obligated to sell oil to the US at a price that works for our Eisenhower era transportation system is deeply lodged in the American psyche. It may be dislodged as early as by year end as " democratically elected" Islamic dominated governments determine to sell the US oil at prices that force the US populace to change how we think about consuming a disproportionate share of the planet's oil endowment relative to our population. I expect that over time this change will be achieved by the expedient of the US paying for oil in a currency other than an irredeemable dollar the US can print at will. Consider the recent decision by staunch US ally the UAE to conduct future oil transactions in yuan.

I'm not worried about US$ oil prices eventually reflecting the loss of America's "exorbitant privilege" in oil trade. I'm not worried about the governments of oil producing countries demanding payment for oil in a redeemable currency and at a price that reflects the reality of constrained supply as demonstrated by a flattening of global oil production since 2005.

I'm counting on it. It is a key part of our gold buy-and-hold thesis since 2001.

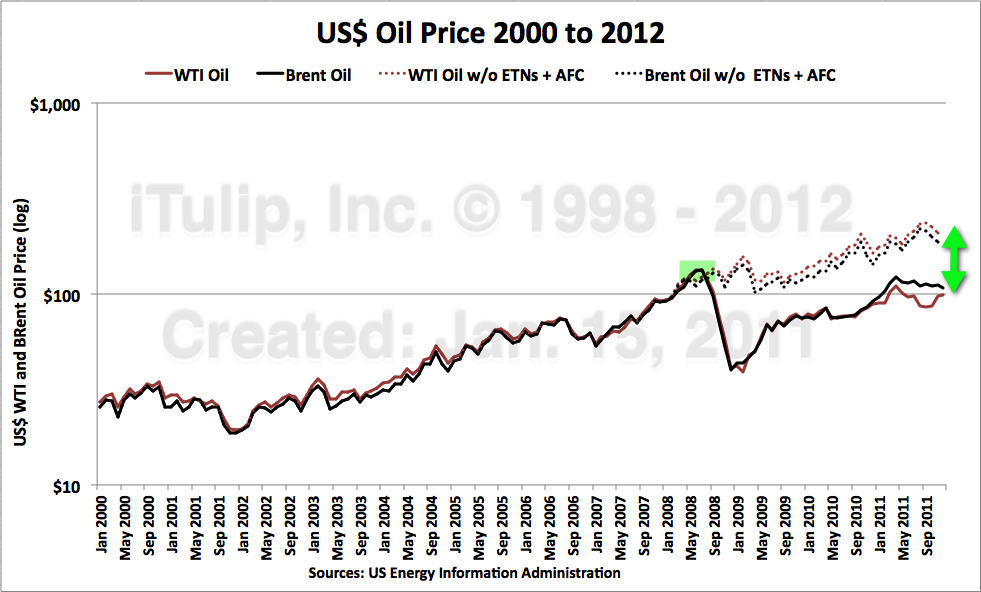

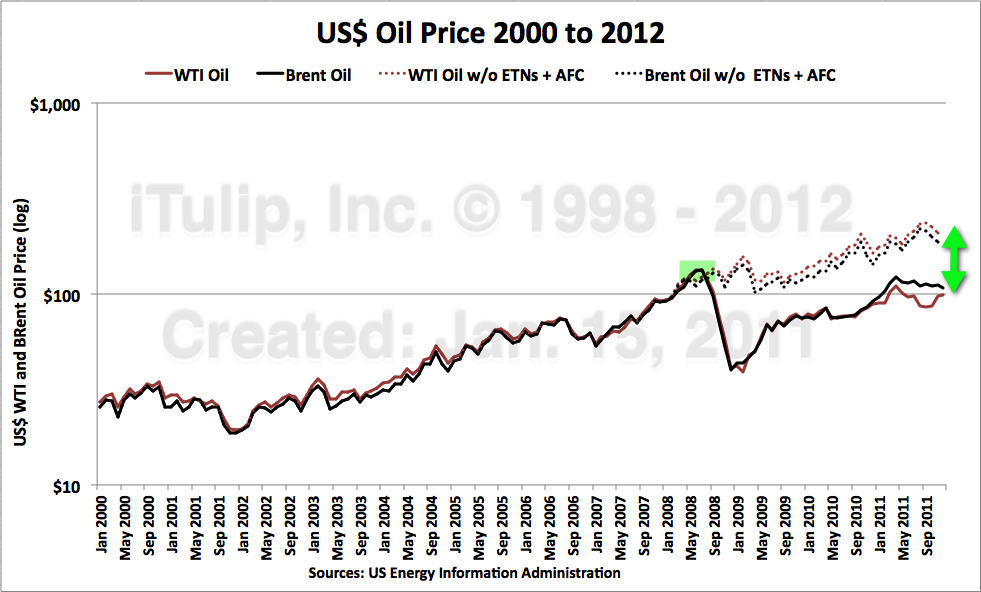

Crude Oil price log scale with (solid line, actual) and without (dotted line, projected theoretical) the American Financial Crisis and global recession

Risk Factor Cause #4: Allowing the US economy to develop around the Finance, Insurance, and Real Estate Industries at the expense of all but the most productive industries (high tech) since the early 1980s

After a decade of erratic and high inflation, the Fed pushed short-term interest rates up into double digits, all the way to a full 6% above a double digit rate of inflation in the early 1980s. In the decades that followed, as inflation plummeted, wholesale interest rates fell but retail rates remained high creating a "fat spread" that motivated US producers to chase earnings from lending over profits from production. Why kill yourself to eek out a 5% margin on sales when 10% margins on lending are there for the taking? As the head of the credit arm of a major US auto maker told me at a conference in 2005, "We used to be a car maker that lent money. Now we're a bank that makes cars." The FIRE Economy was born.

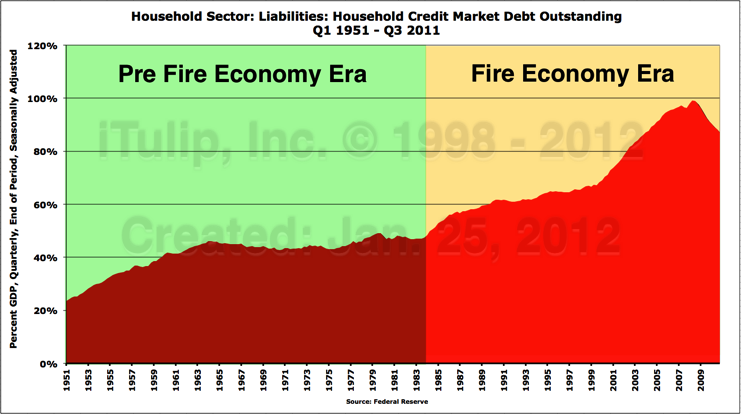

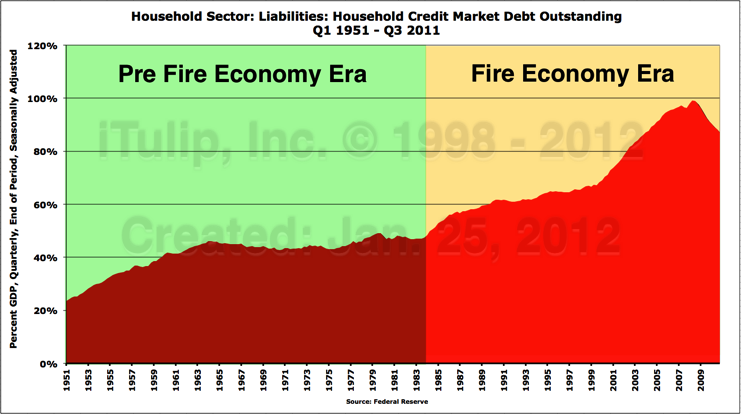

Starting in the early 1980s, the FIRE Economy extended itself into every aspect of American life, into education and health care as transactions previously done in cash were replaced with credit. Household sector debt ballooned from 45% to 100% of GDP where it topped out in 2007.

The FIRE Economy starts to bury US households in debt in 1983 but debt peaks and starts to deflate in 2008

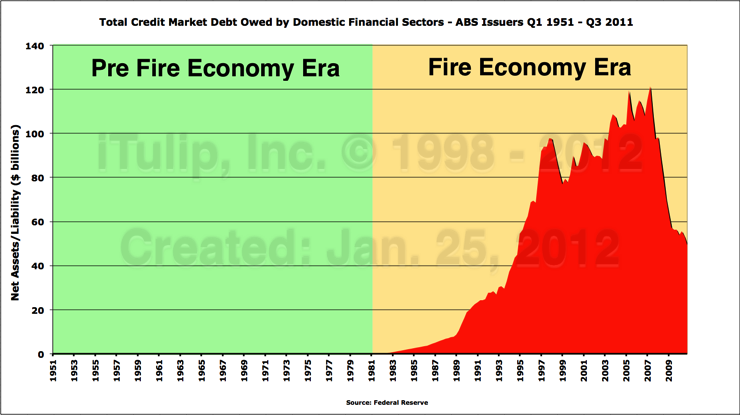

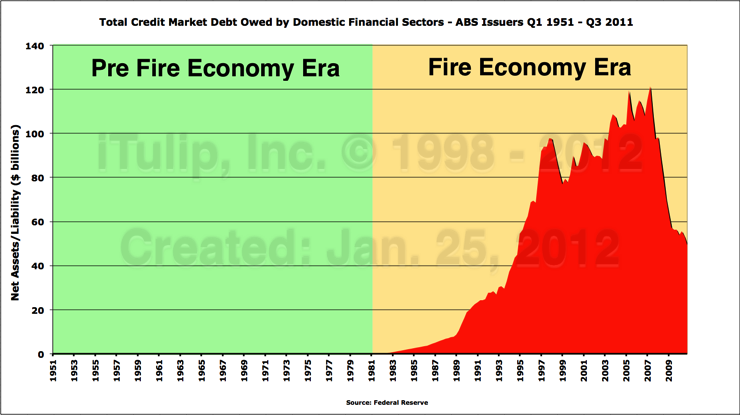

The last gasp of the FIRE Economy came in two asset bubbles in the first decade of the 2000s, the technology stock bubble and the housing bubble. Ultimately, both ran on cheap credit with securitized debt fueling the final decade of the FIRE Economy boom from 1997 to 2007.

The FIRE Economy runs out of housing bubble fuel with the collapse of the ASB market in 2007. All the government

housing programs in the world won't make up for the loss of cheap, low risk credit that the ASB bonanza

temporarily created, compliments of the ratings agencies and a captured regulatory regime.

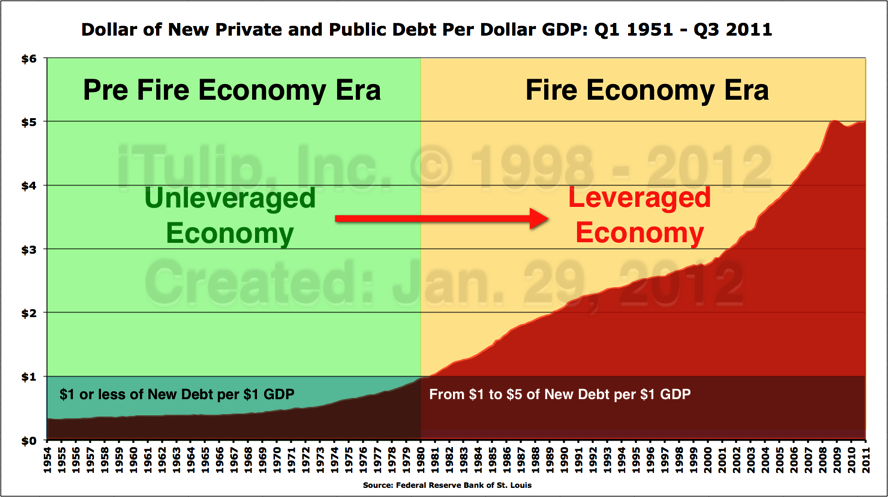

The self-limiting factor of the FIRE Economy is that it ran not only on credit but on an accelerating rate of private sector credit growth. As private sector debt deflates, the Federal government is obliged to step in to make up the loss lest debt deflation spill over into the real economy to produce wage and commodity price deflation and a deadly deflation spiral.

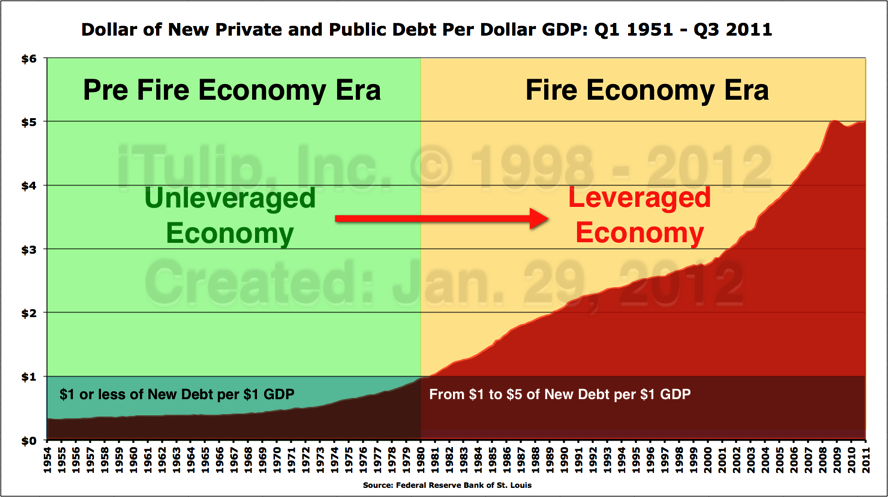

In the early 1980s, the FIRE Economy turns the US economy from unleveraged to leveraged. Total Debt plateaus in 2008.

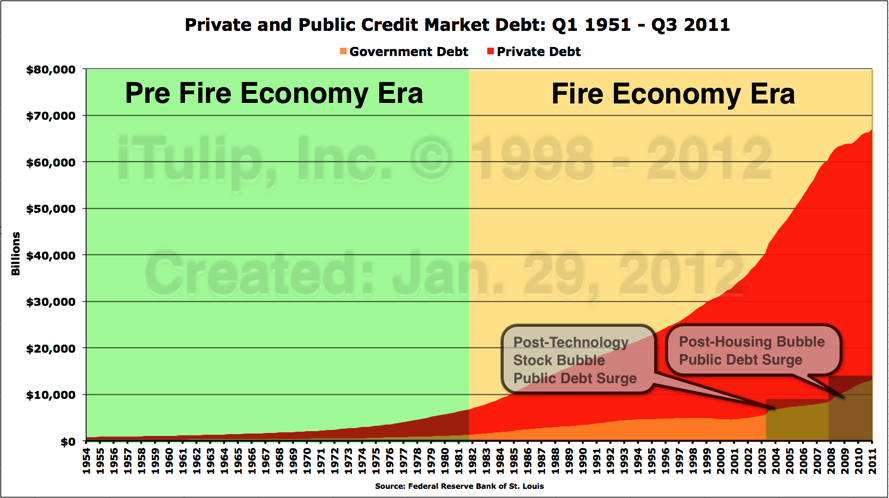

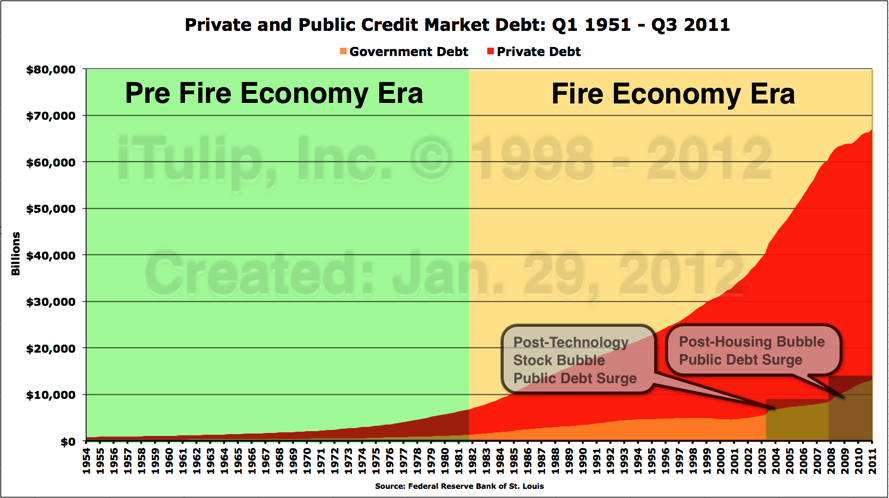

Pundits fret about government debt but it pales beside the mountain of private debt that grew in the decades of the FIRE Economy.

When the stock market bubble caused a recession, government spending surged to compensate for lost demand, then surged

again in 2009 after the housing bubble collapse caused the so-called Great Recession. The government balance sheet

has since 2003 served as a back-stop for the recessions created by asset bubbles spawned by the FIRE Economy.

A Transitional Economy, as I describe it, with government compensating for demand that was lost to two post-bubble recessions, is a bridge from the FIRE Economy to a New American economy. However, as a good friend once said, a bridge without an end is a pier. The Transitional Economy, based on extension of private credit via government borrowing to reflate housing, among a myriad uneconomical activities, is a politically motivated attempt to prolong the inevitable -- the end of the FIRE Economy. As I warned in my 2008 Harper's Magazine article, if our politicians try to maintain the FIRE Economy by use of the federal government's balance sheet, the country will run out of foreign credit before a new, sustainable FIRE-free, production-focused private sector economy can be established.

Risk Factor Cause #5: Mortgaging American Economic Independence

The US is dependent on China as the "swing" lender when other sources of foreign lending the US needs to maintain positive net capital inflows dry up.

The global 2012 power shift will include a political transition in China that decides China's future economic and political course in the Year of the Dragon.

This year younger, more liberal, American and European educated Chinese leaders face off against the conservative old guard that rose to power after Mao. In the balance is the future of China's economic model based as it is on a combination of mercantilism, central planning, and finance-economics within the repressive political cauldron of totalitarianism. China's form of state-directed capitalism unique in history except perhaps for Nazi Germany in the 1930s. The rapid recovery of Germany under Nazi rule far outpaced the US in the 1930s. The relatively swift recovery motivated US and British industrialists to pour capital into Germany, much as US and European investors giddily shovel capital into communist China. They chose to compartmentalize Hitler's promise of radical social reform along racial lines as an awkward atom in an otherwise promising political and economic molecule. They ignored the historical fact that the internal logic of political systems produce outcomes as inevitably as sulfur, charcoal, and potassium nitrate when lit by a match. Had the Nazis not been murderous, racist megalomaniacs then perhaps a kinder, gentler form of Germany's state-directed capitalism could, in theory, have evolved to unite Europe and out-compete the US decades before the European Union.

China's economy as evolved from communism is neither expansionist or militarist, but it is decidedly not a free-market economy. From the outside it seems to operate as a kind of economic perpetual motion machine that has given China 35 years of continuous growth without one recession. No one asks how such a system might eventually run into trouble, and when it does how domestic economic difficulties might be externalized by an unelected leadership that owes its right to govern to the miracle of continuous economic growth. The attitude of US leadership is that China's repression of China's people on Chinese soil is China's business. If that's how China's elites want to run their country, that's fine with ours. But economic conflict that are the seeds of greater tensions in the future are inherent to China's mercantile, centrally planned FIRE Economy. It is predicated on government subsidies that eliminate competitive risk across the part of the private sector that competes with the rest of the world, which private sector builds products the designs of which were purchased under contracts that are frequently broken or outright stolen.

A book on China's economy could simply titled "China: Theft and Subsidy" as that sums up China's so-called economic miracle in its entirety. How long can an economy operate on the principle of labor exploitation and property theft left over from the Communist era, institutionalized intellectual property theft, and government subsidies paid for via finance capitalism?

The labor exploitation and property theft has created a social time bomb of anger and resentment, while government subsidies create a time bomb of trade partner animosity, while finance capitalism creates a time bomb of domestic debt. When they eventually go off, more or less at once, trust that the political leadership that created the circumstances for the calamity that will follow will not stand up and take the blame any more than ours did for allowing the conditions for the American Financial Crisis to develop under their noses as we and a dozen other sights offered warning after warning since early 2006.

China is not going to stop making low quality products and transition to high quality products the way Japan did 20 years ago. Japanese culture is about iterating on design and production to "refine and refine to get it done the best way possible" whereas Chinese culture is about "get it done in the shortest time with the least effort possible, then move on to the next thing." China's cultural determinism applies across the ideological spectrum. China is not going to develop institutions of property rights protection, or institutions to protect the rights of individuals and individual property rights. China is not going to hold elections. China is on an ideological and economic collision course with itself and the US. The conflict will be over oil and commodities via proxies in the Middle East, Africa, and Latin America.

This is why the Pentagon is worried about China. They are not concerned about China's current military capability today but about the future capacity that China could develop in a matter of two years by turning the nation's industrial capacity from peace time to war time production.

All of the above Five Critical Risk Factors figure into our 2012 forecast. Before we go into that forecast in Part II, we review the performance of our January 2011 forecast last year.

2011 Performance Summary

In January 2011 I forecast gold, the S&P500, the 10-yr Treasury Bond, and housing for the year. First the good news, then the bad news.

Gold, stocks, 10-Year Treasury, and Housing forecast for 2011 dated January 2011

Silver price forecast dated April 28, 2011

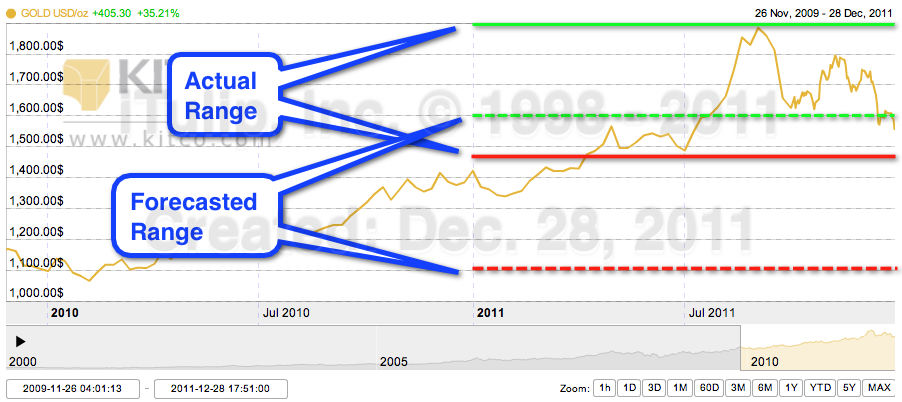

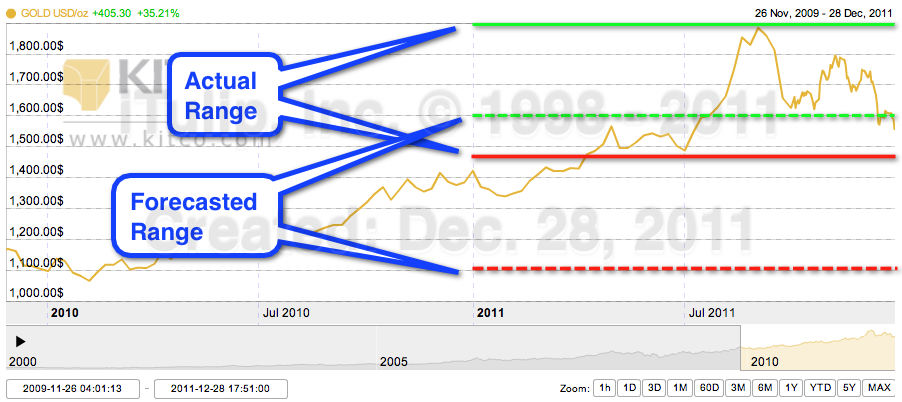

Both gold and silver cooperated with my 2011 end of year forecasts of $1500 for gold and $25 for silver. But while I can claim to have correctly estimated how silver was to arrive at $25 I cannot claim the same regarding gold.

Gold never fell as far to the $1100 to $1200 range as I forecast, and reached well above $1600 to $1900.

Actual gold price range for 2011 versus forecast

Setting aside gold's route to $1550, the price end of year conformed well to the forecast.

Actual gold end of year price for 2011 versus forecast

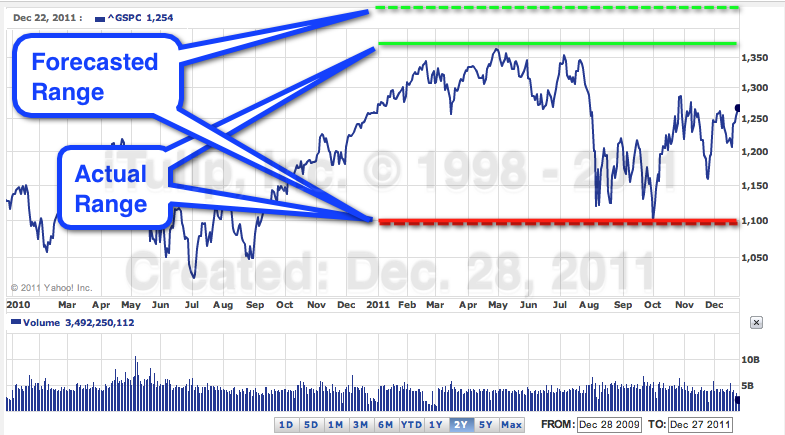

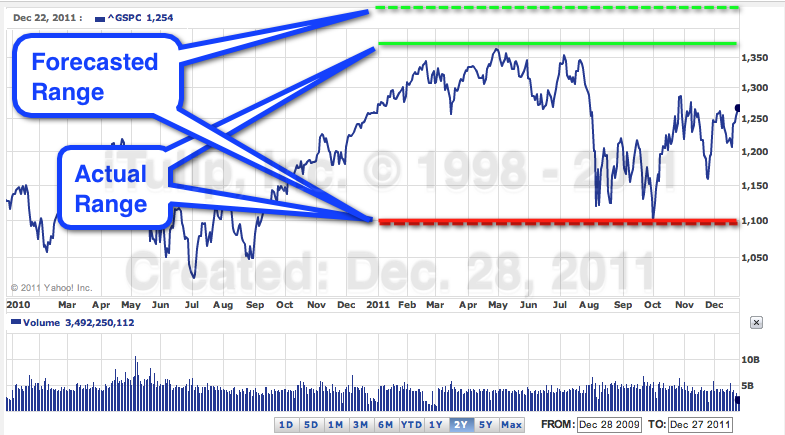

The S&P conformed to the forecast range by exactly reaching and not exceeding my 1100 forecast, although it never came close to my 1600 peak estimate.

Actual S&P500 range for 2011 versus forecast

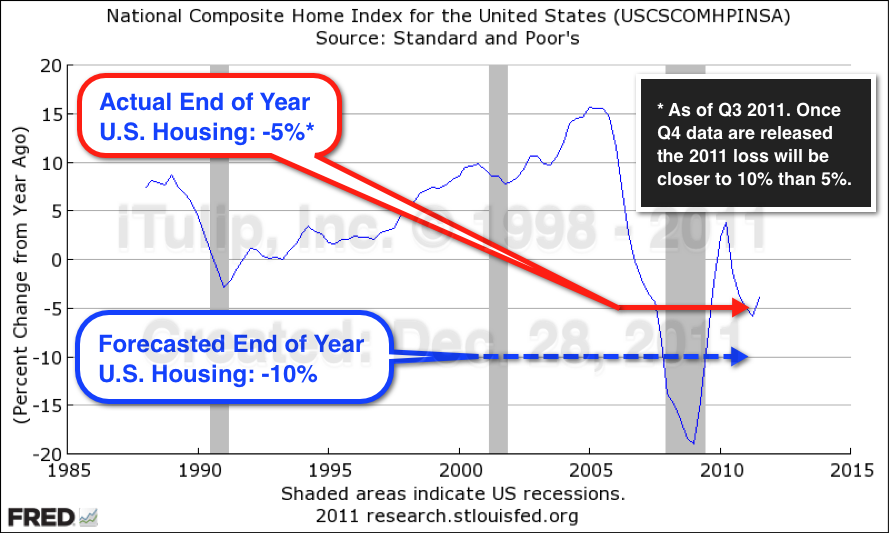

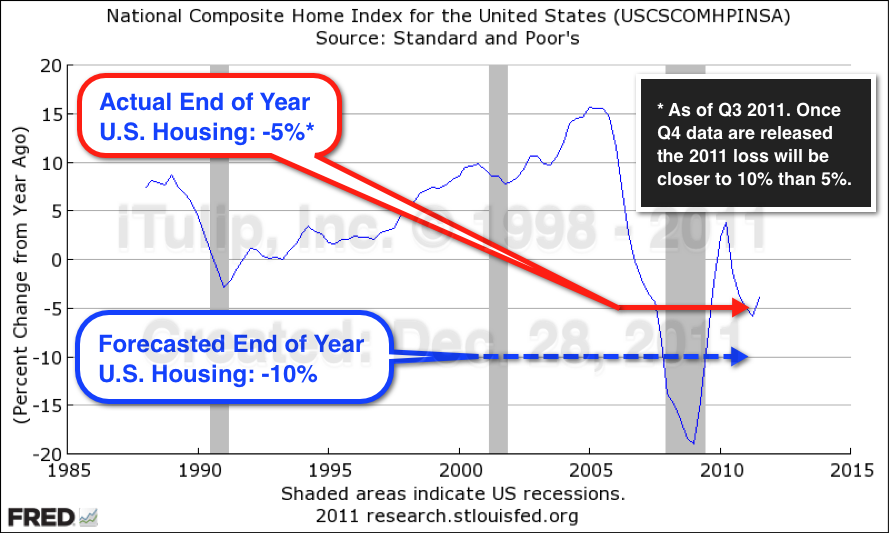

Housing fell as expected. As of Q3 by 5% versus the 10% I forecast, but I still expect that once the Q4 data are reported that the final decline for the year will be closer to 10% than 5%.

Unfortunately, my forecast for the S&P500 to end the year at its 1100 low was way off.

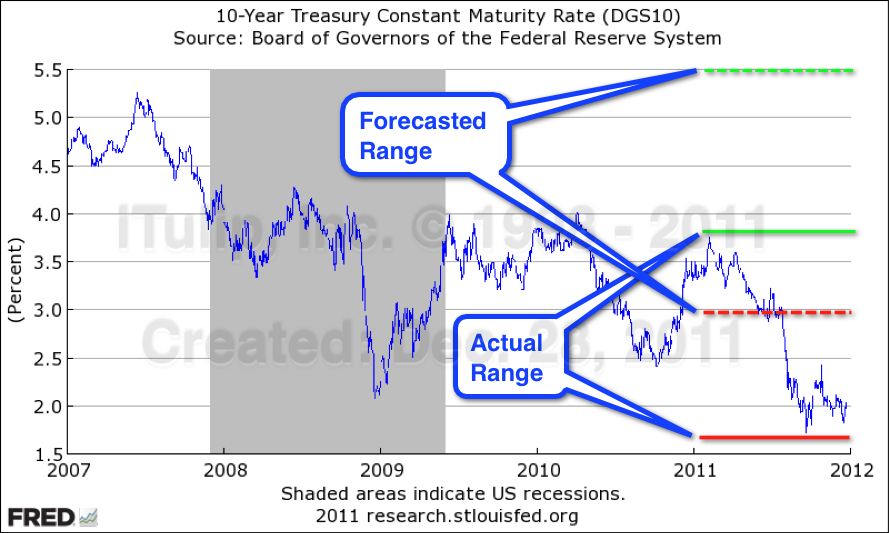

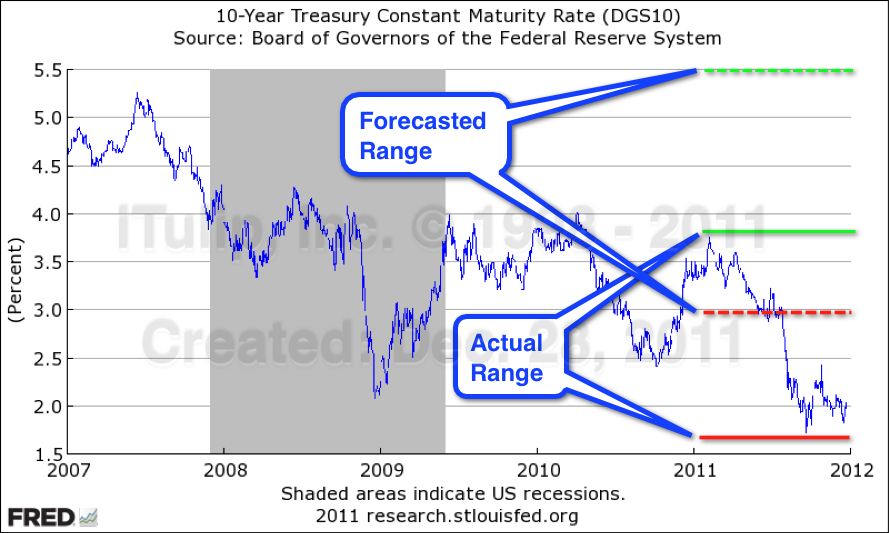

With respect to my 10-Year Treasury Bond forecast my forecast was way off.

Rather than prices falling and yields rising, the yield was at its nadir at the start of the year and declined in fits all year.

On the theory there is more to be learned from mistakes than from the forecasts we get right, in Part II we devote more attention to stocks and bonds than usual.

Year of the Jump Ball - Part II: Random

Next we survey a panorama of potential outcomes of Five Critical Risk Factors for 2012. The results will be difficult to distinguish from randomness. In Part II we nonetheless identify scenarios that are more likely than others.

2012 Forecast: A strife of FIRE Economy interests masquerading as a contest of principles

With January arrives a smorgasbord of annual forecasts on the economy and markets penned by every pro with money under management. Each portrays economic developments as precipitous for the asset class they manage: inflation and currency depreciation for the hard assets guys, deflation and QE for the bond guys, currency volatility for the long-short currency guys, and the perennial promise by the long equity guys on a return to robust growth and multi-year bull market. Never mind that the bull market in equities has failed to materialize after more than a decade of similar calls.

Denial springs eternal.

Among the prognosticators, hedge funds and family practices tend to most truly report the figures they spy in the crystal ball without passing them through an asset class based bias filter. Although these managers have greater editorial flexibility than their mono-asset class management brethren they are still bound by the mindset of the clients they have attracted with a storyline of ideologically oriented analysis, an editorial style of financial analysis that came into fashion in the wake of the American Financial Crisis (AFC) that caught so many believers in Wall Street's game flat footed.

The AFC caught most funds flat-footed. Who to blame for missing an event that loomed large enough to inspire us to call in December 2007 for a 40% decline in the stock indexes in 2008? How to deflect the ire of clients for neglecting to point them to gold and lowly Treasury bonds, two seemingly antithetical assets that live on opposite ends of the ideological spectrum, one a short government position and the other long, while perfectly balancing the bi-polar political economy dominated by FIRE interests and failed monetary policy?

Funds embellished client letters thereafter with heavy doses of contempt for panoply of miscreants, from the Fed to the ratings agencies to bankers as a group, one and all accused of causing the Who-Could-Have-Known? cheap oil and cheap credit bust debacle.

Big government and fiscal irresponsibility is a popular theme among the ideologically conservative long commodities crowd -- and the short bonds crowd, too, albeit on different time-lines. Stifling regulation resonates with conservative long equities fund investors to explain the decade-old lackluster performance of stock indexes while liberal oriented long equity funds prefer to blackball Wall Street in toto and, paradoxically, the corporations whose stocks comprise the indexes themselves. They are frequently heard speaking the mantra that greedy corporations instead of creating jobs are hoarding trillions in cash, neglecting the fact that net of new debt taken on since 2009 US corporations as a group have no cash whatsoever.

Misdiagnosis

These diagnoses of our economic troubles confuse the symptoms of the malady for the malady itself.

How to talk about federal deficits without talking about the cause, the collapse of two asset bubbles in ten years that created two massive recessions and historic deficits in the aftermath?

How to talk about the beneficiaries of said asset price inflation, both political parties?

How to choose between a Speaker of the House who presided over a budget surplus financed with equity bubble capital gains taxes and a governor who made his fortune levering up corporations and selling them with debt-laden balance sheets that later caused many of the firms to fail?

The FIRE Economy divides the polity into creditors and debtors but the public policy debate remains framed as rich versus poor. One goes off the fight in foreign wars, the other doesn't. One is afforded full protection under the law, the other isn't. One gets sick and receives treatment without going bankrupt, the other doesn't. One attends universities that open doors to a lifetime of power and wealth, the other doesn't. The FIRE Economy is antithetical to meritocracy. But if the inequities produced by the FIRE Economy were widely known the public policy debate might shift off its axis from liberal versus conservative, left versus right, small government versus large, and every other fabricated dichotomy that has been invented to obfuscate the strife of rent seeking interests as a contest of capitalist versus socialist principles, ironically at the expense of producers.

The illness is the FIRE Economy, and it is structurally in-curable within the confines of the American political economy. The internal logic of the FIRE Economy propels it inexorably forward to a binary conclusion. This fact "should" figure into any serious investment thesis as it has ours since 2001. On the day the FIRE Economy and its federal government backstop finally reach a breaking point, hardly anyone except a few retail investors who are still watching Jim Cramer will own anything except Treasury bonds and gold, the two weights on either end of the the dollar holder's purchasing power risk barbell.

The most insidious feature of the FIRE Economy that gives it its political intractability is the manner in which we are all made accomplices to it. We all, to a greater or lesser extent, owe our livelihoods and economic fortunes over the past 30 years to a system of asset price inflation and accelerating debt expansion. The FIRE Economy is a system of government subsidies to finance-based industries. FIRE Economy economic policy subsidizes mortgages, stock and bond prices, and asset prices generally. Who does not benefit directly or indirectly, by owning a mortgage, stocks, bonds, or any other subsidized asset? We are as residents of a nation-wide company town owned by a steel maker that has slowly and imperceptibly diversified the company's operations into drug trafficking and slavery. We might like to see it reformed but for the inconvenient fact that these lines of business now give us half of the living standard to which we have become accustomed.

Nobody wants to hear this or say it, least of all those at the top of the FIRE pyramid on Wall Street where the big FIRE money is made. The top beneficiaries finance the political campaigns of leaders selected by the campaign finance machine. Who out of this self-selected group will step up to untangle the perverse dependencies that 30 years of reliance on asset price inflation, debt expansion, and oil subsidies have produced?

Rhetorical deflection preserved many of us through 2010 and even a few months into 2011 when shell-shocked investors still had their eyes on the show and until the results came in. As time goes on, entertainingly expressed and ideologically flavored theories of the political economy give way to the weight of facts. Investor eyes turned to the quarterly statement and soon the feet followed; hedge fund redemptions picked up to near post-Lehman 2008 levels by summer.

The Hazard of "Should"

Reading back over last year's fund managers' forecasts, virtually nothing went the way it was supposed to. Once again 2011 revealed "should" as the most dangerous word in the investment lexicon.

How many managers lost their shirts in 2011 betting on a Treasury Bond bear market because the bond vigilantes "should" punish the over-indebted federal government with lower bond prices? Or betting on silver going to $100 before going to $30 because JP Morgan and other market players "should" be wiped out in a short squeeze? Or betting on a collapse of the euro because the currency union, in practical terms a glorified currency peg in my view, "should" dissolve as European bureaucrats fuss and fiddle while Rome burns, and Athens, Madrid, and Lisbon, too? Or betting that the yen that should crash as Japan's aging population shrinks the pool of domestic purchasers of sovereign debt issuance, forcing the government onto global debt markets to finance the nation's now more than 200% of GDP budget deficit?

Betting and losing on "should" does not spell immediate disaster for the fund manager who can talk a good game. If things don't go your way, double down on rhetoric. Yell louder about a profligate Congress and JP Morgan cornering COMEX. Howl about central bank manipulation, government interference, destruction of free markets to hold the attention of the client base to mitigate redemptions and defections, at least until a new viable thesis can be assembled. Paradoxically, year end redemptions forced so many hedge funds to sell gold to raise cash that they pushed gold prices into the mid $1500s, to a price where they they "should" have been buying it for their clients.

Once again, for the tenth year in a row, we bet on higher gold and Treasury bonds prices.

At the heart of our 2012 forecast are two apparently simple charts.

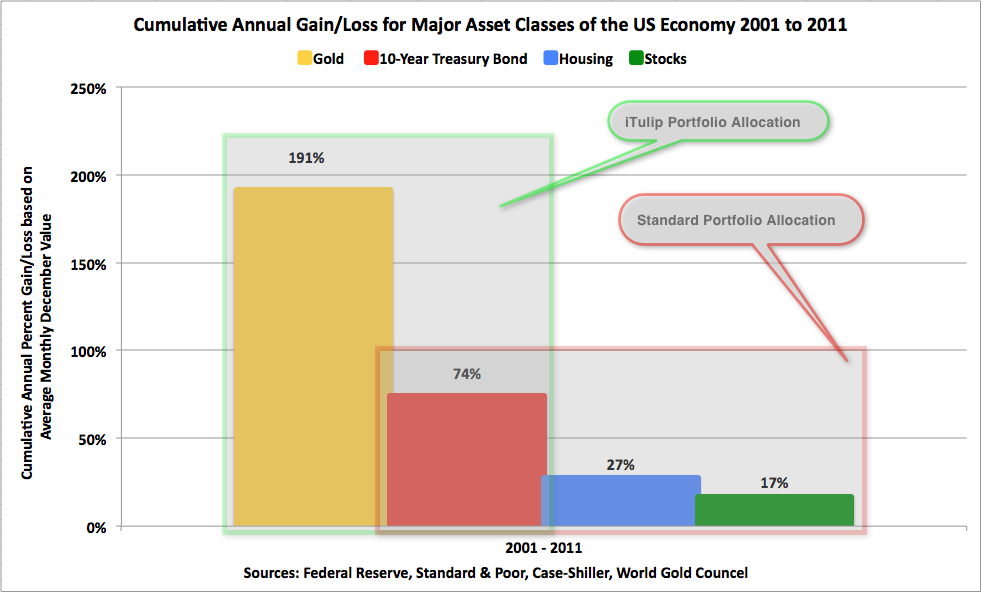

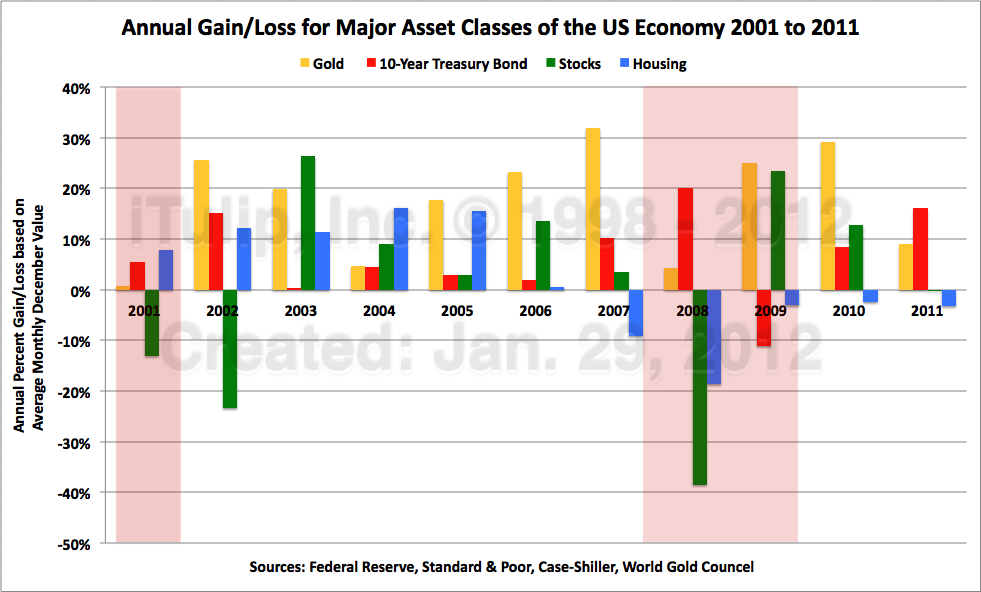

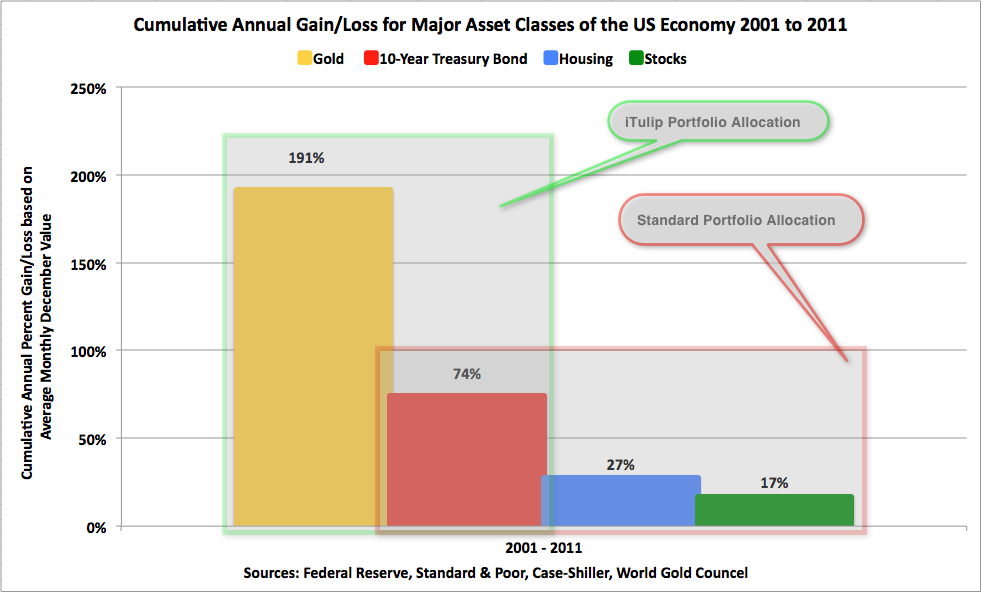

The first chart shows the cumulative annual gain/loss performance of the four asset classes -- Gold, Treasury Bonds, stocks, and Housing -- between 2001 and 2011.

Cumulatively stocks only kept up with the reported CPI rate. The iTulip Gold+Long Treasury Bonds won out over stocks as

Treasuries beat stocks and gold beat Treasuries.

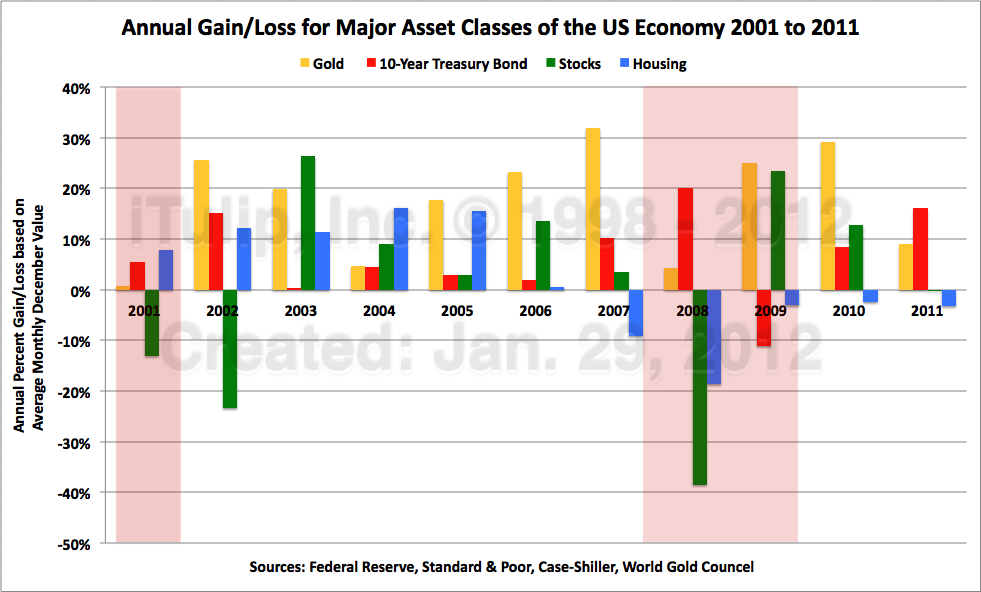

The second shows how we got there year by year.

Three out of 10 years were bad for stocks. Treasury bonds declined in only one out of 10 years.

Housing fell for the past five years. Only gold ended every year in positive territory.

Last year our friends at Twin Focus Capital Partners plugged the iTulip portfolio into a modeling tool called Zephyr StyleADVISOR and compared it to two benchmarks, the Morningstar Moderate Allocation and the Balanced Fund Index composed of 60% S&P 500 Index and 40% Barclays Capital Aggregate Bond Index.

A mythical iTulip portfolio manager running a hypothetical iTulip investment portfolio, or HIP, was allocated per the actual iTulip portfolio allocation since 2000 as follows:

The results in detail are available here.

Why question an allocation that has worked so well for us for ten years?

What about: "If it ain't broke, don't fix it"?

We re-read several dozen 2011 forecasts to see what went wrong with them. We feature Bill Gross, the world's most famous bond salesman who runs the world's largest bond fund, because my 2011 Treasury bond forecast was my worst forecast for all asset classes. more... $ubscription... (Part II: 7362 words and 40 custom charts on employment, inflation, retail sales, credit, capital inflows, stocks, bonds, gold, silver, oil, and other topics.)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

“Politics, n. A strife of interests masquerading as a contest of principles.”

― Ambrose Bierce

“Right, as the world goes, is only in question between equals in power, while the strong do what they can and the weak suffer what they must.”

― Thucydides, The Landmark Thucydides: A Comprehensive Guide to the Peloponnesian War

In a time of drastic change it is the learners who inherit the future. The learned usually find themselves equipped only to live in a world that no longer exists.

―Eric Hoffer

The year 2012 is shaping up to be the year when five decades of economic, energy, monetary, and foreign policy errors by eight successive US administrations finally catch up with us. The rise and collapse of two asset bubbles in ten years has left the US economy structurally weakened and government finances in shambles. As dwindling global oil supplies shuffle economic and political power in the Middle East, the shrinking contribution of the US and Europe to global economic output is shifting economic and political power West to East. The global political economy is reorganizing around the world's sources of oil and savings. Eastern and Middle Eastern powers are pulled together and pushed away from Western power and influence.

After decades of accumulation of risk to the steady-state political economy formed in the decades after WWII and reformed after the Cold War, in 2012 we see the potential for step function change that puts it all, or nearly all, up for grabs. On an a multi-millennial historical time line, it may happen in blink of an eye.

Call it the Year of the Jump Ball. Like a jump ball, the win goes to the quick and the strong. Who will it be and what does it mean for us as investors?

America's Five Critical Risk Factors

The US made five manageable and recoverable public policy errors in the early 1970s and 1980s. Then, as each administration failed to confront them, these once manageable and recoverable errors grew and metastasized into America's Five Critical Risk Factors. One or more of these factors may culminate in crisis in 2012 with consequences that are as difficult to predict as the timing.

The potential consequences can be traced back to the original source of each of the five risks.

Risk Factor Cause #1: Unilaterally abandoning the international gold standard to force the world onto the US Treasury dollar standard in 1971

Economist Robert Triffin and French president Charles de Gaulle warned of the consequences of currency reserve accumulation by US trade partners and of the US "going into debt for free" if global monetary system based on the currency and debt of a single sovereign nation -- the US -- persisted. The imbalances predicted by the Triffin Dilemma and the threats they pose to the international monetary system (IMS) and the global economy became apparent decades later, in the 1990s, yet Prisoner's Dilemma economics motivated all major parties in the system to perpetuate it. The cost of reform will fall largely on the IMS's main beneficiary, the United States. Major parties to the system are in no position to press the US for reform at US expense because they reply on the US for either export demand -- are dependent on the "over-consumption" growth model that Triffin warned about -- and thus domestic economic security, or military security, or both. Paradoxically, the economies of US its trade partners have over time become dependent on the global imbalances that Triffin predicted.

Triffin did not offer predictions on how re-balancing might occur if the policy of a US$ reserve currency persisted and imbalances were permitted to accumulate for decades. Readers know my theory since 1999 aka "Ka-Poom Theory" wherein a geopolitical event causes a collapse in global demand dollar liquidity that leads to spiking interest rates and a falling dollar exchange rate, which process is stopped only when the US re-opens the gold window to put up 8,000 plus tons of Treasury gold as collateral to halt the wave. While the unwinding of a reserve currency issued by an over-indebted nation will be in form unlike any previously known sovereign debt and currency crises, the catalyst for a dollar crisis will share the common element of surprise with countries like Greece (failing euro peg) or Argentina (failed dollar peg) at the periphery of their respective currency systems; a political event suddenly changes the economic relationships that underpinned the arrangement -- an election, fiscal position revelation, war. Suddenly the deal is off.

In Part II we unpack the sanitized speech "The Triffin dilemma revisited" by Lorenzo Bini Smaghi, Member of the Executive Board of the ECB, at the "Conference on the International Monetary System: sustainability and reform proposals, marking the 100th anniversary of Robert Triffin (1911-1993)" held at the Triffin International Foundation, Brussels, 3 October 2011. My conclusion: the SDR is a non-starter because, as Smaghi says without making a politically incorrect reference to the SDR directly, "A supranational currency would need to be kept strong in order not to depreciate against the other major existing currencies. Any weakening would undermine its attractiveness, and hence its function as a reserve asset. However, if the supply of a supranational currency were to be restricted, it might fail to meet demand and so fall short of its function." That leaves only gold as a backup if a multi-polar IMS cannot be developed -- which it can't, because the US economy depends on the “exorbitant privilege” to keep its economy growing and federal government operating.

Risk Factor Cause #2: Failing to reduce economic dependence on cheap oil starting in the 1970s

The 1970s oil crisis handed US policy makers a singular political opportunity to reduce the energy intensity (BTU of energy per US$ GDP) of our transportation system and US dependence on oil imports at the same time. While European countries used the crisis as political cover to raise taxes on gasoline and diesel to force consumers to conserve oil in the future after the immediate oil crisis passed, the US went the other way, subsidizing oil imports by exploiting the “exorbitant privilege” and by propping up authoritarian regimes in oil producing countries who cooperated with the US$ monetary regime.

Today the US relies on a far-flung transportation network of paved roads and little else for moving people and cargo. As a result, high oil prices have an asymmetric impact on the US economy relative to European and Asian countries. The IMF estimates that every $10-a-barrel increase in the price of oil over $80 reduces U.S. GDP growth by 0.5 percent. Small wonder that the US economy lugged through 2011 in a 7% of GDP output gap left open by the 2007 to 2009 American Financial Crisis and Housing Bust Recession. Once the Bureau of Economic Analysis completes a third revision to the Q3 and Q4 GDP data, we will find that the economy grew by only 1.4% in real terms in 2011.

The US economy needs cheap oil, as well as a FIRE Economy era debt write-off, to get back on a growth track. Unfortunately, cheap oil depends on US-friendly regimes in the Middle East and the balance of power to resume cheap oil flows westward is tipping decidedly in the opposite direction.

Risk Factor Cause #3: Making alliances with repressive political regimes in Middle East countries

"I don't remember a period in my life where the ratio of questions and answers in the Middle East was anything like it is today. All of this political uncertainty … raises many, many more questions than answers."

- Brandeis University Professor Shai Feldman

We forecast in 2007 that the American Financial Crisis that would hand us a 40% decline in the S&P 500 in 2008. The development of that insight required dozens of interviews with companies that manufactured CDOs for hedge funds and investment banks, with banking experts like Martin Mayer, the reading of hundreds of books and papers on the history of financial and banking crises, and crunching megabytes of data, all starting in 2002. To get our heads around the next crisis has required a widely broadened scope of research and primary sourcing, new tools, and new ways of thinking about the processes of change that are shaping the global political economy. - Brandeis University Professor Shai Feldman

One area of the world we know that we knew nothing about and now, after two years of work, know only slightly more than nothing about, is the Middle East. Friends we know who live there, who are close enough to be considered truly expert, are often too close to it to be objective.

The complexity of political inter-dependencies makes for a wide range of predictions, from optimistic to dire. The optimists dominated in the early innings of the ongoing power shift a year ago when they labeled the first uprisings an Arab Spring. As dust is settles in Egypt a year after the start of the uprising there the Muslim Brotherhood emerges, predictably, as the only well organized political party able to get out the vote. Combined with more radical factions, the Muslim Brotherhood are in line to control more than 75% of the legislature, leaving slightly more than 15% to moderate non-sectarian groups, and less than 10% to the groups that led the actual revolt. While Egypt is not a major oil producer, our sources explain that the governance model of an Islamic state developing in Egypt now may over time come to pass in countries like Libya that are.

One might reasonably ask, So what? No matter who is in charge, Middle Eastern oil producing states will always sell oil to the West. It is the oil itself, I have argued, that promotes corrupt dictatorships as the dominant form of political organization in the region rather than cultural, historical, and institutional antecedents. A government that can dig its tax revenues out of the ground has no motive to develop human capital. Lack of motivation to develop human capital for economic development reinforces cultural and religious factors. The question going forward is whether Arab oil producing states can overcome the curse of oil after they evolve into quasi-democratic Islamic states and become more liberalized and aligned with Western ideas of social and economic progress from which mutual economic interests arise versus the previous repression-assistance-for-oil arrangement.

Speaking at a conference last year I was asked by an audience member if I didn't worry that democratically elected Arab leaders are likely to "charge us more for our oil."

I hear this phrase "our oil" all the time. The idea that tens of millions of Arab and Persian people are obligated to sell oil to the US at a price that works for our Eisenhower era transportation system is deeply lodged in the American psyche. It may be dislodged as early as by year end as " democratically elected" Islamic dominated governments determine to sell the US oil at prices that force the US populace to change how we think about consuming a disproportionate share of the planet's oil endowment relative to our population. I expect that over time this change will be achieved by the expedient of the US paying for oil in a currency other than an irredeemable dollar the US can print at will. Consider the recent decision by staunch US ally the UAE to conduct future oil transactions in yuan.

I'm not worried about US$ oil prices eventually reflecting the loss of America's "exorbitant privilege" in oil trade. I'm not worried about the governments of oil producing countries demanding payment for oil in a redeemable currency and at a price that reflects the reality of constrained supply as demonstrated by a flattening of global oil production since 2005.

I'm counting on it. It is a key part of our gold buy-and-hold thesis since 2001.

Crude Oil price log scale with (solid line, actual) and without (dotted line, projected theoretical) the American Financial Crisis and global recession

Risk Factor Cause #4: Allowing the US economy to develop around the Finance, Insurance, and Real Estate Industries at the expense of all but the most productive industries (high tech) since the early 1980s

After a decade of erratic and high inflation, the Fed pushed short-term interest rates up into double digits, all the way to a full 6% above a double digit rate of inflation in the early 1980s. In the decades that followed, as inflation plummeted, wholesale interest rates fell but retail rates remained high creating a "fat spread" that motivated US producers to chase earnings from lending over profits from production. Why kill yourself to eek out a 5% margin on sales when 10% margins on lending are there for the taking? As the head of the credit arm of a major US auto maker told me at a conference in 2005, "We used to be a car maker that lent money. Now we're a bank that makes cars." The FIRE Economy was born.

Starting in the early 1980s, the FIRE Economy extended itself into every aspect of American life, into education and health care as transactions previously done in cash were replaced with credit. Household sector debt ballooned from 45% to 100% of GDP where it topped out in 2007.

The FIRE Economy starts to bury US households in debt in 1983 but debt peaks and starts to deflate in 2008

The FIRE Economy runs out of housing bubble fuel with the collapse of the ASB market in 2007. All the government

housing programs in the world won't make up for the loss of cheap, low risk credit that the ASB bonanza

temporarily created, compliments of the ratings agencies and a captured regulatory regime.

The self-limiting factor of the FIRE Economy is that it ran not only on credit but on an accelerating rate of private sector credit growth. As private sector debt deflates, the Federal government is obliged to step in to make up the loss lest debt deflation spill over into the real economy to produce wage and commodity price deflation and a deadly deflation spiral.

In the early 1980s, the FIRE Economy turns the US economy from unleveraged to leveraged. Total Debt plateaus in 2008.

Pundits fret about government debt but it pales beside the mountain of private debt that grew in the decades of the FIRE Economy.

When the stock market bubble caused a recession, government spending surged to compensate for lost demand, then surged

again in 2009 after the housing bubble collapse caused the so-called Great Recession. The government balance sheet

has since 2003 served as a back-stop for the recessions created by asset bubbles spawned by the FIRE Economy.

A Transitional Economy, as I describe it, with government compensating for demand that was lost to two post-bubble recessions, is a bridge from the FIRE Economy to a New American economy. However, as a good friend once said, a bridge without an end is a pier. The Transitional Economy, based on extension of private credit via government borrowing to reflate housing, among a myriad uneconomical activities, is a politically motivated attempt to prolong the inevitable -- the end of the FIRE Economy. As I warned in my 2008 Harper's Magazine article, if our politicians try to maintain the FIRE Economy by use of the federal government's balance sheet, the country will run out of foreign credit before a new, sustainable FIRE-free, production-focused private sector economy can be established.

Risk Factor Cause #5: Mortgaging American Economic Independence

The US is dependent on China as the "swing" lender when other sources of foreign lending the US needs to maintain positive net capital inflows dry up.

The global 2012 power shift will include a political transition in China that decides China's future economic and political course in the Year of the Dragon.

This year younger, more liberal, American and European educated Chinese leaders face off against the conservative old guard that rose to power after Mao. In the balance is the future of China's economic model based as it is on a combination of mercantilism, central planning, and finance-economics within the repressive political cauldron of totalitarianism. China's form of state-directed capitalism unique in history except perhaps for Nazi Germany in the 1930s. The rapid recovery of Germany under Nazi rule far outpaced the US in the 1930s. The relatively swift recovery motivated US and British industrialists to pour capital into Germany, much as US and European investors giddily shovel capital into communist China. They chose to compartmentalize Hitler's promise of radical social reform along racial lines as an awkward atom in an otherwise promising political and economic molecule. They ignored the historical fact that the internal logic of political systems produce outcomes as inevitably as sulfur, charcoal, and potassium nitrate when lit by a match. Had the Nazis not been murderous, racist megalomaniacs then perhaps a kinder, gentler form of Germany's state-directed capitalism could, in theory, have evolved to unite Europe and out-compete the US decades before the European Union.

China's economy as evolved from communism is neither expansionist or militarist, but it is decidedly not a free-market economy. From the outside it seems to operate as a kind of economic perpetual motion machine that has given China 35 years of continuous growth without one recession. No one asks how such a system might eventually run into trouble, and when it does how domestic economic difficulties might be externalized by an unelected leadership that owes its right to govern to the miracle of continuous economic growth. The attitude of US leadership is that China's repression of China's people on Chinese soil is China's business. If that's how China's elites want to run their country, that's fine with ours. But economic conflict that are the seeds of greater tensions in the future are inherent to China's mercantile, centrally planned FIRE Economy. It is predicated on government subsidies that eliminate competitive risk across the part of the private sector that competes with the rest of the world, which private sector builds products the designs of which were purchased under contracts that are frequently broken or outright stolen.

A book on China's economy could simply titled "China: Theft and Subsidy" as that sums up China's so-called economic miracle in its entirety. How long can an economy operate on the principle of labor exploitation and property theft left over from the Communist era, institutionalized intellectual property theft, and government subsidies paid for via finance capitalism?

The labor exploitation and property theft has created a social time bomb of anger and resentment, while government subsidies create a time bomb of trade partner animosity, while finance capitalism creates a time bomb of domestic debt. When they eventually go off, more or less at once, trust that the political leadership that created the circumstances for the calamity that will follow will not stand up and take the blame any more than ours did for allowing the conditions for the American Financial Crisis to develop under their noses as we and a dozen other sights offered warning after warning since early 2006.

China is not going to stop making low quality products and transition to high quality products the way Japan did 20 years ago. Japanese culture is about iterating on design and production to "refine and refine to get it done the best way possible" whereas Chinese culture is about "get it done in the shortest time with the least effort possible, then move on to the next thing." China's cultural determinism applies across the ideological spectrum. China is not going to develop institutions of property rights protection, or institutions to protect the rights of individuals and individual property rights. China is not going to hold elections. China is on an ideological and economic collision course with itself and the US. The conflict will be over oil and commodities via proxies in the Middle East, Africa, and Latin America.

This is why the Pentagon is worried about China. They are not concerned about China's current military capability today but about the future capacity that China could develop in a matter of two years by turning the nation's industrial capacity from peace time to war time production.

All of the above Five Critical Risk Factors figure into our 2012 forecast. Before we go into that forecast in Part II, we review the performance of our January 2011 forecast last year.

2011 Performance Summary

In January 2011 I forecast gold, the S&P500, the 10-yr Treasury Bond, and housing for the year. First the good news, then the bad news.

Gold, stocks, 10-Year Treasury, and Housing forecast for 2011 dated January 2011

Silver price forecast dated April 28, 2011

Both gold and silver cooperated with my 2011 end of year forecasts of $1500 for gold and $25 for silver. But while I can claim to have correctly estimated how silver was to arrive at $25 I cannot claim the same regarding gold.

Gold never fell as far to the $1100 to $1200 range as I forecast, and reached well above $1600 to $1900.

Actual gold price range for 2011 versus forecast

Setting aside gold's route to $1550, the price end of year conformed well to the forecast.

Actual gold end of year price for 2011 versus forecast

Actual S&P500 range for 2011 versus forecast

Housing fell as expected. As of Q3 by 5% versus the 10% I forecast, but I still expect that once the Q4 data are reported that the final decline for the year will be closer to 10% than 5%.

Unfortunately, my forecast for the S&P500 to end the year at its 1100 low was way off.

With respect to my 10-Year Treasury Bond forecast my forecast was way off.

Rather than prices falling and yields rising, the yield was at its nadir at the start of the year and declined in fits all year.

On the theory there is more to be learned from mistakes than from the forecasts we get right, in Part II we devote more attention to stocks and bonds than usual.

Year of the Jump Ball - Part II: Random

Next we survey a panorama of potential outcomes of Five Critical Risk Factors for 2012. The results will be difficult to distinguish from randomness. In Part II we nonetheless identify scenarios that are more likely than others.

2012 Forecast: A strife of FIRE Economy interests masquerading as a contest of principles

With January arrives a smorgasbord of annual forecasts on the economy and markets penned by every pro with money under management. Each portrays economic developments as precipitous for the asset class they manage: inflation and currency depreciation for the hard assets guys, deflation and QE for the bond guys, currency volatility for the long-short currency guys, and the perennial promise by the long equity guys on a return to robust growth and multi-year bull market. Never mind that the bull market in equities has failed to materialize after more than a decade of similar calls.

Denial springs eternal.

Among the prognosticators, hedge funds and family practices tend to most truly report the figures they spy in the crystal ball without passing them through an asset class based bias filter. Although these managers have greater editorial flexibility than their mono-asset class management brethren they are still bound by the mindset of the clients they have attracted with a storyline of ideologically oriented analysis, an editorial style of financial analysis that came into fashion in the wake of the American Financial Crisis (AFC) that caught so many believers in Wall Street's game flat footed.

The AFC caught most funds flat-footed. Who to blame for missing an event that loomed large enough to inspire us to call in December 2007 for a 40% decline in the stock indexes in 2008? How to deflect the ire of clients for neglecting to point them to gold and lowly Treasury bonds, two seemingly antithetical assets that live on opposite ends of the ideological spectrum, one a short government position and the other long, while perfectly balancing the bi-polar political economy dominated by FIRE interests and failed monetary policy?

Funds embellished client letters thereafter with heavy doses of contempt for panoply of miscreants, from the Fed to the ratings agencies to bankers as a group, one and all accused of causing the Who-Could-Have-Known? cheap oil and cheap credit bust debacle.

Big government and fiscal irresponsibility is a popular theme among the ideologically conservative long commodities crowd -- and the short bonds crowd, too, albeit on different time-lines. Stifling regulation resonates with conservative long equities fund investors to explain the decade-old lackluster performance of stock indexes while liberal oriented long equity funds prefer to blackball Wall Street in toto and, paradoxically, the corporations whose stocks comprise the indexes themselves. They are frequently heard speaking the mantra that greedy corporations instead of creating jobs are hoarding trillions in cash, neglecting the fact that net of new debt taken on since 2009 US corporations as a group have no cash whatsoever.

Misdiagnosis

These diagnoses of our economic troubles confuse the symptoms of the malady for the malady itself.

How to talk about federal deficits without talking about the cause, the collapse of two asset bubbles in ten years that created two massive recessions and historic deficits in the aftermath?

How to talk about the beneficiaries of said asset price inflation, both political parties?

How to choose between a Speaker of the House who presided over a budget surplus financed with equity bubble capital gains taxes and a governor who made his fortune levering up corporations and selling them with debt-laden balance sheets that later caused many of the firms to fail?

The FIRE Economy divides the polity into creditors and debtors but the public policy debate remains framed as rich versus poor. One goes off the fight in foreign wars, the other doesn't. One is afforded full protection under the law, the other isn't. One gets sick and receives treatment without going bankrupt, the other doesn't. One attends universities that open doors to a lifetime of power and wealth, the other doesn't. The FIRE Economy is antithetical to meritocracy. But if the inequities produced by the FIRE Economy were widely known the public policy debate might shift off its axis from liberal versus conservative, left versus right, small government versus large, and every other fabricated dichotomy that has been invented to obfuscate the strife of rent seeking interests as a contest of capitalist versus socialist principles, ironically at the expense of producers.

The illness is the FIRE Economy, and it is structurally in-curable within the confines of the American political economy. The internal logic of the FIRE Economy propels it inexorably forward to a binary conclusion. This fact "should" figure into any serious investment thesis as it has ours since 2001. On the day the FIRE Economy and its federal government backstop finally reach a breaking point, hardly anyone except a few retail investors who are still watching Jim Cramer will own anything except Treasury bonds and gold, the two weights on either end of the the dollar holder's purchasing power risk barbell.

The most insidious feature of the FIRE Economy that gives it its political intractability is the manner in which we are all made accomplices to it. We all, to a greater or lesser extent, owe our livelihoods and economic fortunes over the past 30 years to a system of asset price inflation and accelerating debt expansion. The FIRE Economy is a system of government subsidies to finance-based industries. FIRE Economy economic policy subsidizes mortgages, stock and bond prices, and asset prices generally. Who does not benefit directly or indirectly, by owning a mortgage, stocks, bonds, or any other subsidized asset? We are as residents of a nation-wide company town owned by a steel maker that has slowly and imperceptibly diversified the company's operations into drug trafficking and slavery. We might like to see it reformed but for the inconvenient fact that these lines of business now give us half of the living standard to which we have become accustomed.

Nobody wants to hear this or say it, least of all those at the top of the FIRE pyramid on Wall Street where the big FIRE money is made. The top beneficiaries finance the political campaigns of leaders selected by the campaign finance machine. Who out of this self-selected group will step up to untangle the perverse dependencies that 30 years of reliance on asset price inflation, debt expansion, and oil subsidies have produced?

Rhetorical deflection preserved many of us through 2010 and even a few months into 2011 when shell-shocked investors still had their eyes on the show and until the results came in. As time goes on, entertainingly expressed and ideologically flavored theories of the political economy give way to the weight of facts. Investor eyes turned to the quarterly statement and soon the feet followed; hedge fund redemptions picked up to near post-Lehman 2008 levels by summer.

The Hazard of "Should"

Reading back over last year's fund managers' forecasts, virtually nothing went the way it was supposed to. Once again 2011 revealed "should" as the most dangerous word in the investment lexicon.

How many managers lost their shirts in 2011 betting on a Treasury Bond bear market because the bond vigilantes "should" punish the over-indebted federal government with lower bond prices? Or betting on silver going to $100 before going to $30 because JP Morgan and other market players "should" be wiped out in a short squeeze? Or betting on a collapse of the euro because the currency union, in practical terms a glorified currency peg in my view, "should" dissolve as European bureaucrats fuss and fiddle while Rome burns, and Athens, Madrid, and Lisbon, too? Or betting that the yen that should crash as Japan's aging population shrinks the pool of domestic purchasers of sovereign debt issuance, forcing the government onto global debt markets to finance the nation's now more than 200% of GDP budget deficit?

Betting and losing on "should" does not spell immediate disaster for the fund manager who can talk a good game. If things don't go your way, double down on rhetoric. Yell louder about a profligate Congress and JP Morgan cornering COMEX. Howl about central bank manipulation, government interference, destruction of free markets to hold the attention of the client base to mitigate redemptions and defections, at least until a new viable thesis can be assembled. Paradoxically, year end redemptions forced so many hedge funds to sell gold to raise cash that they pushed gold prices into the mid $1500s, to a price where they they "should" have been buying it for their clients.

Once again, for the tenth year in a row, we bet on higher gold and Treasury bonds prices.

At the heart of our 2012 forecast are two apparently simple charts.

The first chart shows the cumulative annual gain/loss performance of the four asset classes -- Gold, Treasury Bonds, stocks, and Housing -- between 2001 and 2011.

Cumulatively stocks only kept up with the reported CPI rate. The iTulip Gold+Long Treasury Bonds won out over stocks as

Treasuries beat stocks and gold beat Treasuries.

The second shows how we got there year by year.

Three out of 10 years were bad for stocks. Treasury bonds declined in only one out of 10 years.

Housing fell for the past five years. Only gold ended every year in positive territory.

Last year our friends at Twin Focus Capital Partners plugged the iTulip portfolio into a modeling tool called Zephyr StyleADVISOR and compared it to two benchmarks, the Morningstar Moderate Allocation and the Balanced Fund Index composed of 60% S&P 500 Index and 40% Barclays Capital Aggregate Bond Index.

A mythical iTulip portfolio manager running a hypothetical iTulip investment portfolio, or HIP, was allocated per the actual iTulip portfolio allocation since 2000 as follows:

- From 2000 to 2001, 25% cash, 75% 10-year Treasury bonds

- From 2001 to Aug. 2010, 10% cash, 15% gold, 65% 10-year Treasury bonds

Why question an allocation that has worked so well for us for ten years?

What about: "If it ain't broke, don't fix it"?

We re-read several dozen 2011 forecasts to see what went wrong with them. We feature Bill Gross, the world's most famous bond salesman who runs the world's largest bond fund, because my 2011 Treasury bond forecast was my worst forecast for all asset classes. more... $ubscription... (Part II: 7362 words and 40 custom charts on employment, inflation, retail sales, credit, capital inflows, stocks, bonds, gold, silver, oil, and other topics.)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment