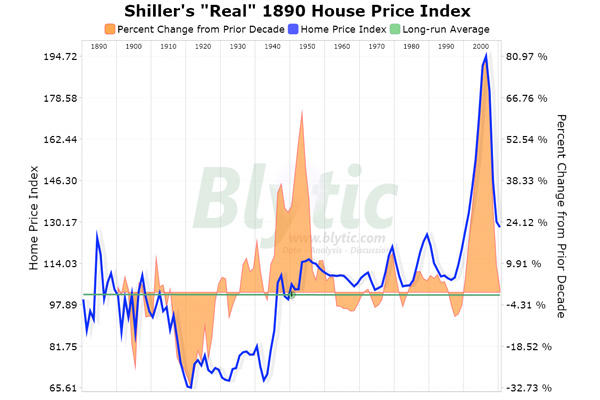

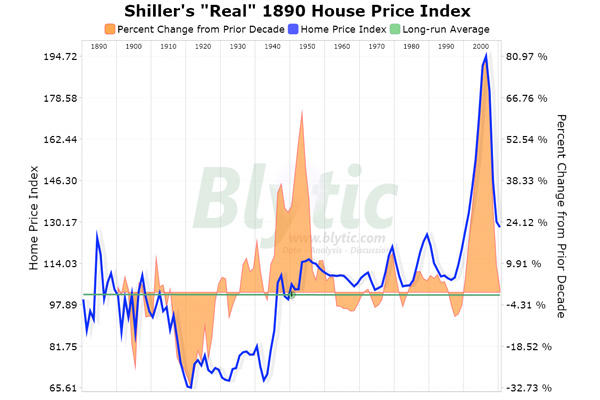

Check out the great 1890 RE equity chart. Long run average is below flatline- negative 4.31% Take away the productive economy and housing collapses. Who knew? And is cash king? (You're never underwater  )

)

We are naturally programmed to look ahead. It is wired in our DNA and financial blips like lost decades seem to run counter to this idea. I was talking with someone about real estate and they seem to believe that California has yet to face any sort of correction. Curious to hear his explanation he responded, “my neighbors house sold for the same price they paid at the peak.” As it turns out this person is in a rather select community like many that we cover here. The fact of the matter is that home prices in California are now back to levels not seen since 2002 or 2003 depending on what county you look at. A lost decade is already here if we factor in inflation. A lost decade is virtually etched in stone even on the nominal front. But can home prices remain stagnant for another decade? This question would have seemed downright preposterous back in 2006 or even 2007 but has a lot of merit today given demographic shifts in our country and the massive amount of distressed homes on the market. We don’t have to look overseas for two lost decades when we can simply look at Detroit real estate. California cash investors seem to think this is the bottom in select markets. Are they right?

Home prices stagnant until 2020?

Home prices even on a national level are still inflated even after the massive correction. Looking back to 1890 with carefully gathered Case Shiller data we can see this trend more clearly:

Housing for nearly 100 years was a rather bland investment aside from regional housing bubbles. Nationwide housing seemed to track inflation. Then in the late 1990s a mania set in fueled by toxic mortgages and prices went to the moon. The crash has rippled so deep into our economy that many think, “how can things get worse?” Many have never lived through a deep recession so this is new territory for many and given our 24 hour news media solutions are demanded instantly. There is no quick solution to this. Home prices nationally are back to 2003 price levels on a nominal basis. Inflation adjusted we have already reached a lost decade.

A decade long stagnant housing market is pretty much what we have if we sand out the massive peaks and valleys of the last decade. Many in the mainstream press are now openly talking about 15 to 20 percent price cuts on national housing values:

Local economics drive real estate markets – Case of Detroit

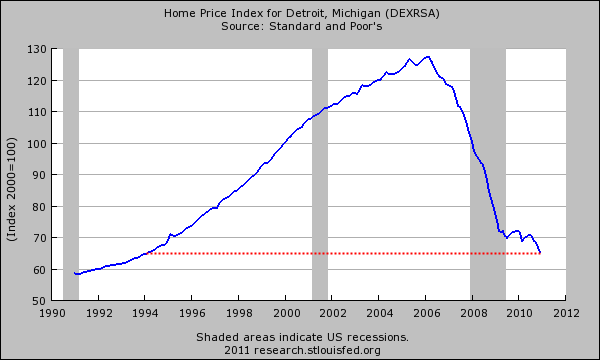

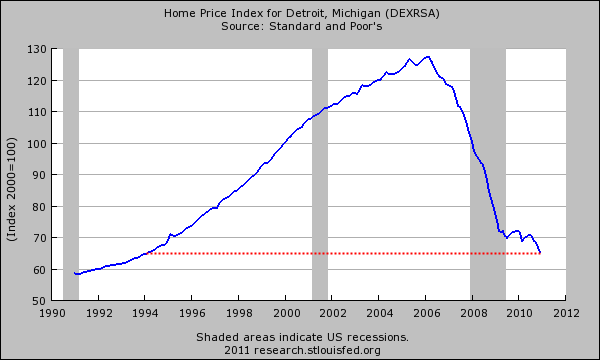

People seem to think that decade long declines are things only foreign nations experience like Japan. This is not true. We can look at Detroit to see a market that has lived through nearly two lost decades in housing:

Home prices in Detroit are back to 1993 levels. In less than two years it will be two lost decades for a mighty city that once had 2,000,000 residents and is home to the American automakers. Detroit currently has 951,000 residents and a sky high unemployment rate:

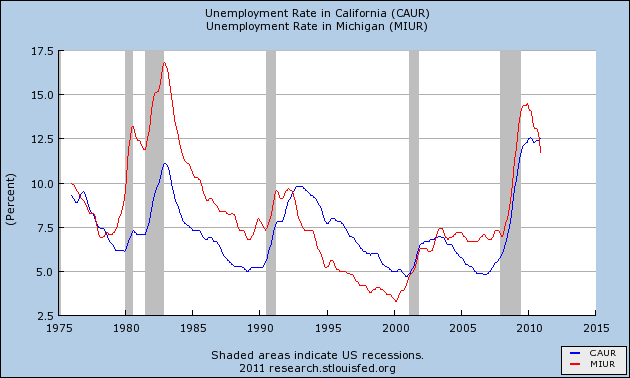

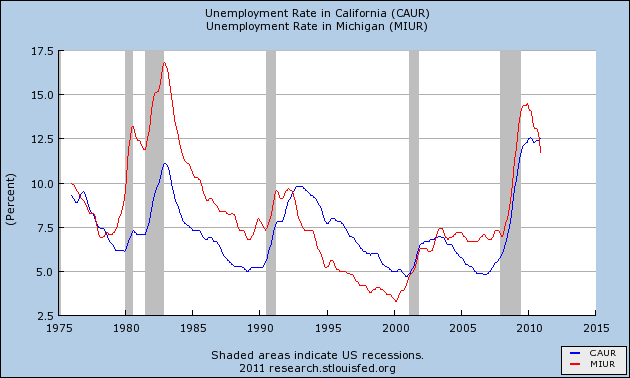

You are seeing the above chart correctly. Currently California has a higher unemployment rate than Michigan. Why? California as diverse of an economy as it is relied heavily on housing to drive growth. Clearly the economy has an impact on real estate and having one of the highest unemployment rates in the nation does not bring confidence to growing housing prices.

Out of curiosity I pulled a state with a low unemployment rate, Nebraska at 4.3 and took a look at their largest metro area for their median home price:

All cash buyers in California

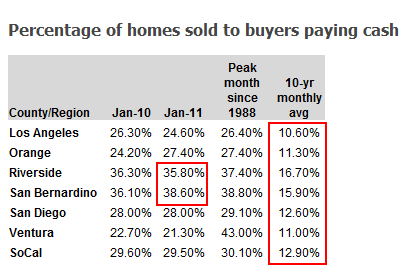

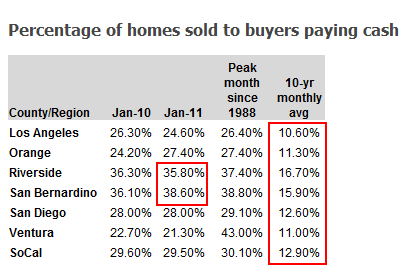

We already know that many investors are buying homes in distressed markets. But in California January 2011 was a record:

Source: DQ News

30.9 percent of homes purchased in January were from all cash buyers. This is the highest percent on record for California. Before you say these are people buying homes to move into 51 percent were absentee buyers. In other words the tax bill will be sent to another address and these are likely investment properties. It is highly unlikely that these are vacation homes since they are occurring in depressed markets. Take a look at SoCal for example:

Almost 40 percent of all sales in San Bernardino were all cash last month and 35 percent in Riverside. For Southern California the 10 year monthly average is closer to 13 percent so clearly this is way above that average. The median price paid for these all cash purchases was $160,000 signifying a thirst for cheap properties. But places like the Inland Empire were built during times of cheap oil. These areas are sustained by a cheap energy infrastructure. Lower incomes mean higher gas prices are felt deeper here. This isn’t something an investor would want to hear if they are out for the long-term because what happens if oil hits $150 a barrel or higher and stays there? Can families even afford to rent out in these markets? Who will they flip to? I’ve talked to a few folks who are buying out in these markets and they are looking for cash flow. Today things might look decent but with the volatility in oil these markets are shaky at best and this goes for Nevada and Arizona as well. People tend to forget that not everyone lives on the beach.

The all cash buyer is likely to be part of the pent up demand from the decade long bubble. These prices do seem fantastic in contrast to the bubble days but does the price warrant a purchase? Only time will tell but many thought the same thing in Detroit. Unless the local economies of the Inland Empire or for example Sacramento (37 percent all cash buyers in January) grow then these areas will continue to see price declines. I am certain that right now you are seeing a short-term feeding frenzy where some are buying for say $140,000 and flipping them for say $170,000 since money is definitely moving off the sidelines. Yet this is unsustainable and is another round of musical chairs. Cash flow is good today but what if the place sits vacant? Taxes? Repairs? Today the Antelope Valley was seeing wind gusts of 70 miles per hour. Long-term investors in challenging climates realize the costs associated with owning property in these areas. I wonder how many of these all cash investors realize the long-term costs today? The good news is they will never be underwater and won’t need a bailout no matter what the market does.

http://www.doctorhousingbubble.com/3...t-record-high/

)

)We are naturally programmed to look ahead. It is wired in our DNA and financial blips like lost decades seem to run counter to this idea. I was talking with someone about real estate and they seem to believe that California has yet to face any sort of correction. Curious to hear his explanation he responded, “my neighbors house sold for the same price they paid at the peak.” As it turns out this person is in a rather select community like many that we cover here. The fact of the matter is that home prices in California are now back to levels not seen since 2002 or 2003 depending on what county you look at. A lost decade is already here if we factor in inflation. A lost decade is virtually etched in stone even on the nominal front. But can home prices remain stagnant for another decade? This question would have seemed downright preposterous back in 2006 or even 2007 but has a lot of merit today given demographic shifts in our country and the massive amount of distressed homes on the market. We don’t have to look overseas for two lost decades when we can simply look at Detroit real estate. California cash investors seem to think this is the bottom in select markets. Are they right?

Home prices stagnant until 2020?

Home prices even on a national level are still inflated even after the massive correction. Looking back to 1890 with carefully gathered Case Shiller data we can see this trend more clearly:

Housing for nearly 100 years was a rather bland investment aside from regional housing bubbles. Nationwide housing seemed to track inflation. Then in the late 1990s a mania set in fueled by toxic mortgages and prices went to the moon. The crash has rippled so deep into our economy that many think, “how can things get worse?” Many have never lived through a deep recession so this is new territory for many and given our 24 hour news media solutions are demanded instantly. There is no quick solution to this. Home prices nationally are back to 2003 price levels on a nominal basis. Inflation adjusted we have already reached a lost decade.

A decade long stagnant housing market is pretty much what we have if we sand out the massive peaks and valleys of the last decade. Many in the mainstream press are now openly talking about 15 to 20 percent price cuts on national housing values:

“(CS Monitor) Further, while nominally (i.e. not adjusted for inflation) home prices may have gone a long way into correction territory, in real terms (i.e. inflation adjusted), national home prices are still significantly elevated (possibly by as much as 15%-20%) above long-run norms.”

It is hard to see why we won’t have this. In many still inflated markets like California the correction will be deeper. Keep in mind you have many baby boomers that will be looking to sell in the next decade. Who will they sell to? A young professional class that is deeper in debt and is earning less in wages? Are they hungry to take on more debt for their smaller family needs? The demographic winds do not favor higher home prices. With a glut of supply and large vacancies, pressure will remain on home prices to move lower. The only thing that would cause home prices to move up in the coming decade is sizeable wage gains for workers. Simply adding low paying service sector jobs is not going to support home prices in certain markets.Local economics drive real estate markets – Case of Detroit

People seem to think that decade long declines are things only foreign nations experience like Japan. This is not true. We can look at Detroit to see a market that has lived through nearly two lost decades in housing:

Home prices in Detroit are back to 1993 levels. In less than two years it will be two lost decades for a mighty city that once had 2,000,000 residents and is home to the American automakers. Detroit currently has 951,000 residents and a sky high unemployment rate:

You are seeing the above chart correctly. Currently California has a higher unemployment rate than Michigan. Why? California as diverse of an economy as it is relied heavily on housing to drive growth. Clearly the economy has an impact on real estate and having one of the highest unemployment rates in the nation does not bring confidence to growing housing prices.

Out of curiosity I pulled a state with a low unemployment rate, Nebraska at 4.3 and took a look at their largest metro area for their median home price:

Omaha Nebraska median home price: $115,000

Median family income is at $56,000. Compare this to places like Los Angeles where the median home price is $300,000 and the median household income is roughly $65,000. Ultimately local area families need to afford the homes in their immediate vicinity. Sure toxic mortgages can sustain a bubble for years but eventually things return to the mean.All cash buyers in California

We already know that many investors are buying homes in distressed markets. But in California January 2011 was a record:

Source: DQ News

30.9 percent of homes purchased in January were from all cash buyers. This is the highest percent on record for California. Before you say these are people buying homes to move into 51 percent were absentee buyers. In other words the tax bill will be sent to another address and these are likely investment properties. It is highly unlikely that these are vacation homes since they are occurring in depressed markets. Take a look at SoCal for example:

Almost 40 percent of all sales in San Bernardino were all cash last month and 35 percent in Riverside. For Southern California the 10 year monthly average is closer to 13 percent so clearly this is way above that average. The median price paid for these all cash purchases was $160,000 signifying a thirst for cheap properties. But places like the Inland Empire were built during times of cheap oil. These areas are sustained by a cheap energy infrastructure. Lower incomes mean higher gas prices are felt deeper here. This isn’t something an investor would want to hear if they are out for the long-term because what happens if oil hits $150 a barrel or higher and stays there? Can families even afford to rent out in these markets? Who will they flip to? I’ve talked to a few folks who are buying out in these markets and they are looking for cash flow. Today things might look decent but with the volatility in oil these markets are shaky at best and this goes for Nevada and Arizona as well. People tend to forget that not everyone lives on the beach.

The all cash buyer is likely to be part of the pent up demand from the decade long bubble. These prices do seem fantastic in contrast to the bubble days but does the price warrant a purchase? Only time will tell but many thought the same thing in Detroit. Unless the local economies of the Inland Empire or for example Sacramento (37 percent all cash buyers in January) grow then these areas will continue to see price declines. I am certain that right now you are seeing a short-term feeding frenzy where some are buying for say $140,000 and flipping them for say $170,000 since money is definitely moving off the sidelines. Yet this is unsustainable and is another round of musical chairs. Cash flow is good today but what if the place sits vacant? Taxes? Repairs? Today the Antelope Valley was seeing wind gusts of 70 miles per hour. Long-term investors in challenging climates realize the costs associated with owning property in these areas. I wonder how many of these all cash investors realize the long-term costs today? The good news is they will never be underwater and won’t need a bailout no matter what the market does.

http://www.doctorhousingbubble.com/3...t-record-high/

Comment