Courtesy of the Wall Street Journal,

And from later in the same article,

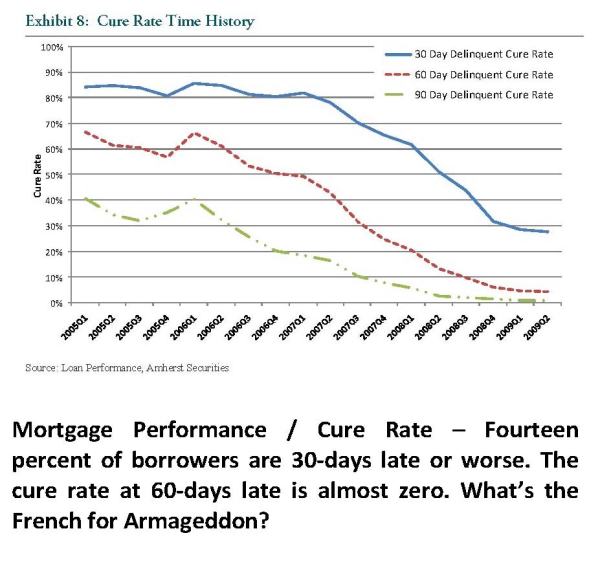

And the money shot,

But remember people, in today's housing market when a metric boatload of foreclosed homes gets "liquidated" you're not going to experience a "foreclosure-induced freefall" because that's just not how supply and demand works.

Thankfully, we're only talking about four million ADDITIONAL homes that will probably have to be foreclosed on - as in, added to the already healthy shadow inventory.

"The speed at which house prices fall over the next few months could depend less on mortgage rates and Americans' appetite for home buying than on how banks decide to manage the huge number of foreclosed homes they own or may take from delinquent borrowers in the near future. Unlike home owners, banks often are much quicker to slash prices to unload properties quickly."

"We see the perfect storm brewing with rising supply and falling demand," said Ivy Zelman, chief executive of research firm Zelman & Associates and one of the first to warn of trouble five years ago. She estimated that distressed sales could account for half of the market by year-end if traditional sales didn't rebound.

The next leg down in prices "isn't going to be the foreclosure-induced freefall where you just had inventory coming out the wazoo, and it was going to be sold one way or the other," said Glenn Kelman, chief executive of Redfin Corp., a real-estate brokerage.

Analysts at Barclays Capital estimate that some four million loans are in some stage of foreclosure or are at least 90 days past due, down slightly from a January peak.

Comment