Re: The Elusive Canadian Housing Bubble

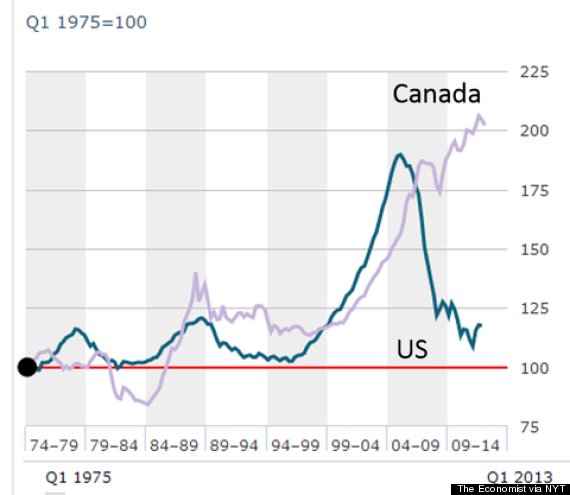

This chart probably looked quite different in circa-2006

A study by the OECD, which compared prices with local wages and rents, suggests Belgium, Norway and Canada are the most expensive markets compared with their own long-term averages, followed by New Zealand, France and Australia...

This chart probably looked quite different in circa-2006

A study by the OECD, which compared prices with local wages and rents, suggests Belgium, Norway and Canada are the most expensive markets compared with their own long-term averages, followed by New Zealand, France and Australia...

Comment