|

The loan value of foreclosed homes returned to lender at auction, the measure of foreclosure activity that we have been tracking with FR since September 2006, increased from $420 million per month in September 2006 to over $2 billion in March 2007. After leveling off in April at just above $2 billion per month, it picked up again in May, reaching $2.8 billion. Foreclosure activity is accelerating, not "leveling off" as some in the real estate industry have reported. More than $12 billion in loan value in total has been returned over the past ten months.

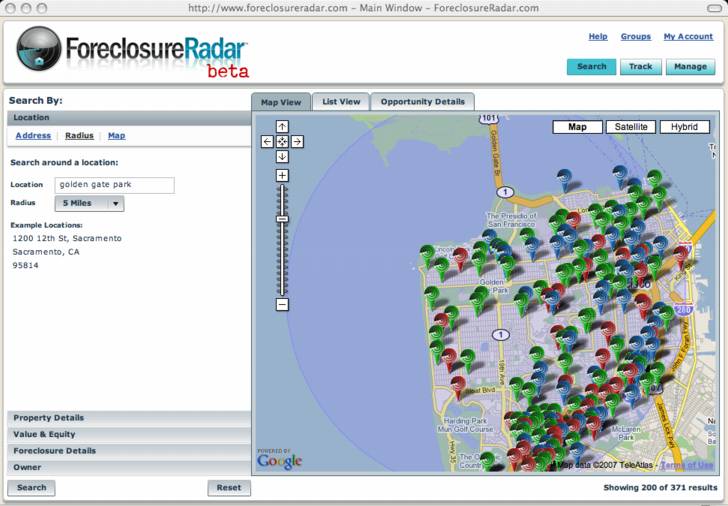

How does this look pictorially? As a non-subscriber you can see up to 20 properties in a FR search. As a subscriber, you see them all. As subscribers, we did a search for all foreclosures within five miles of Golden Gate Park to get an idea of how many foreclosures there are in an area where foreclosure activity is light–the results, below.

Above are 200 of 371 results from the search. Green indicates homes in pre-foreclosure, blue at auction, red bank owned, updated daily.

Given a booming northern CA economy, these results surprised us. We would have expected less foreclosure activity based on our prediction of only modest housing market pain in markets where employment remained strong.

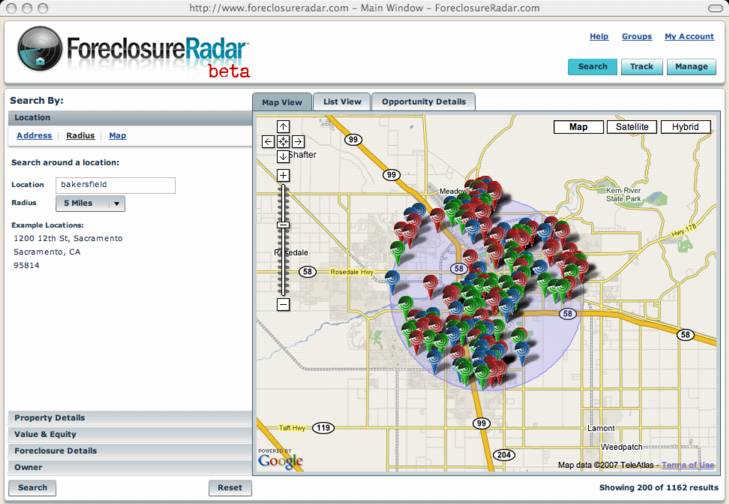

Our outside-in market contraction model anticipates a higher rate of housing market contraction in outlying areas away from major cities before housing markets contract in populated areas. How about an area where foreclosure activity is heavy, such as Bakersfield, CA?

As you can see, there are 1162 properties in foreclosure within a 5 mile radius of downtown Bakersfield, more than three times as many as within a five mile radius of Golden Gate Park. A sampling of several areas far from populated areas confirms our theory that these will tend to see price declines first.

Lack of access to accurate data can lead to mis-reporting, such as this:

Foreclosure Activity Dips 1 Percent in April According to RealtyTrac(TM) U.S. Foreclosure Market Report

IRVINE, Calif., May 15 /PRNewswire/ -- RealtyTrac(R) (http://www.realtytrac.com/), the leading online marketplace for foreclosure properties, today released its April 2007 U.S. Foreclosure Market Report, which shows a total of 147,708 foreclosure filings -- default notices, auction sale notices and bank repossessions -- were reported during the month, down about 1 percent from the previous month but up 62 percent from April 2006. The report also shows a national foreclosure rate of one foreclosure filing for every 783 U.S. households during the month.

"After hitting a two-year high in March, U.S. foreclosure activity slipped slightly lower in April," said James J. Saccacio, chief executive officer of RealtyTrac. "Last year foreclosure activity subsided somewhat during the spring and summer months, thanks in part to increased interest from buyers. Whether the decrease in April is the beginning of a similar trend this year remains to be seen, but we expect foreclosure activity to at least stay above last year's levels for the remainder of 2007, fueled by a combustible mix of risky loans taken out in the last few years -- many in the subprime market -- and slowing home price appreciation."

To see how FR works, watch our video here.IRVINE, Calif., May 15 /PRNewswire/ -- RealtyTrac(R) (http://www.realtytrac.com/), the leading online marketplace for foreclosure properties, today released its April 2007 U.S. Foreclosure Market Report, which shows a total of 147,708 foreclosure filings -- default notices, auction sale notices and bank repossessions -- were reported during the month, down about 1 percent from the previous month but up 62 percent from April 2006. The report also shows a national foreclosure rate of one foreclosure filing for every 783 U.S. households during the month.

"After hitting a two-year high in March, U.S. foreclosure activity slipped slightly lower in April," said James J. Saccacio, chief executive officer of RealtyTrac. "Last year foreclosure activity subsided somewhat during the spring and summer months, thanks in part to increased interest from buyers. Whether the decrease in April is the beginning of a similar trend this year remains to be seen, but we expect foreclosure activity to at least stay above last year's levels for the remainder of 2007, fueled by a combustible mix of risky loans taken out in the last few years -- many in the subprime market -- and slowing home price appreciation."

And now for some housing bubble crash porn...

Comment